Looking for top FMCG stocks in India? FMCG is the most significant industry not only globally but also in India. It accounts for about 5% of all factory employment in India and makes up the fourth largest economic sector in the country, contributing close to 10% of GDP.

It is one of the most important economic sectors because it serves as a barometer, revealing the state of the overall economy and its demand and consumption patterns. The FMCG sector is usually the first to feel the effects of economic stress because consumers tend to cut back on their purchases of FMCG products first. Strong economic activity is reflected in rural and urban pockets’ robust consumption and demand patterns.

FMCG Stocks Sector in India

The Indian FMCG sector was valued at $179.94 billion in 2022 and is expected to grow at a CAGR of 27.9% by 2029, reaching nearly $1.07 trillion. Growing youth population, premiumization of existing product lineup, changing lifestyle, increasing brand awareness, rising internet users fueling online purchases, and new PLI scheme for the food processing sector are some factors contributing to the growth of the Indian FMCG sector.

There are three main segments in the Indian FMCG sector- Food & Beverages, Healthcare, and Personal and Household Care. With nearly half of the sector’s revenue coming from it, the personal and household care segment is the biggest of the three.

Top 5 FMCG Stocks in India

The Nifty FMCG Index, which comprises 15 large and mid-cap stocks, has given a CAGR return of 14.22% in the last five years, as of October 31st, 2023.

The top 5 FMCG stocks included in the Nifty FMCG index, which account for 78.7% of the total weightage, are as follows:

| Company | Nifty FMCG Index Weightage |

| ITC Ltd. | 31.46% |

| Hindustan Unilever | 22.14% |

| Nestle India Ltd. | 8.63% |

| Tata Consumer Products Ltd. | 5.85% |

| Britannia Industries Ltd. | 5.62% |

ITC Limited

| Market Cap | CMP (as of 14th Nov 2023) | All-time High Level | PE Ratio | 5 yr CAGR Return | ROCE (FY23) |

| ₹ 5,43,670 crore | ₹436 | ₹500 | 27 | 10% | 38.72% |

ITC Limited is an FMCG stock which is heavily diversified conglomerate in the FMCG sector, from cigarettes, foods, snacks, dairy products, beverages, personal care, household care, and stationery products to agarbatti segments.

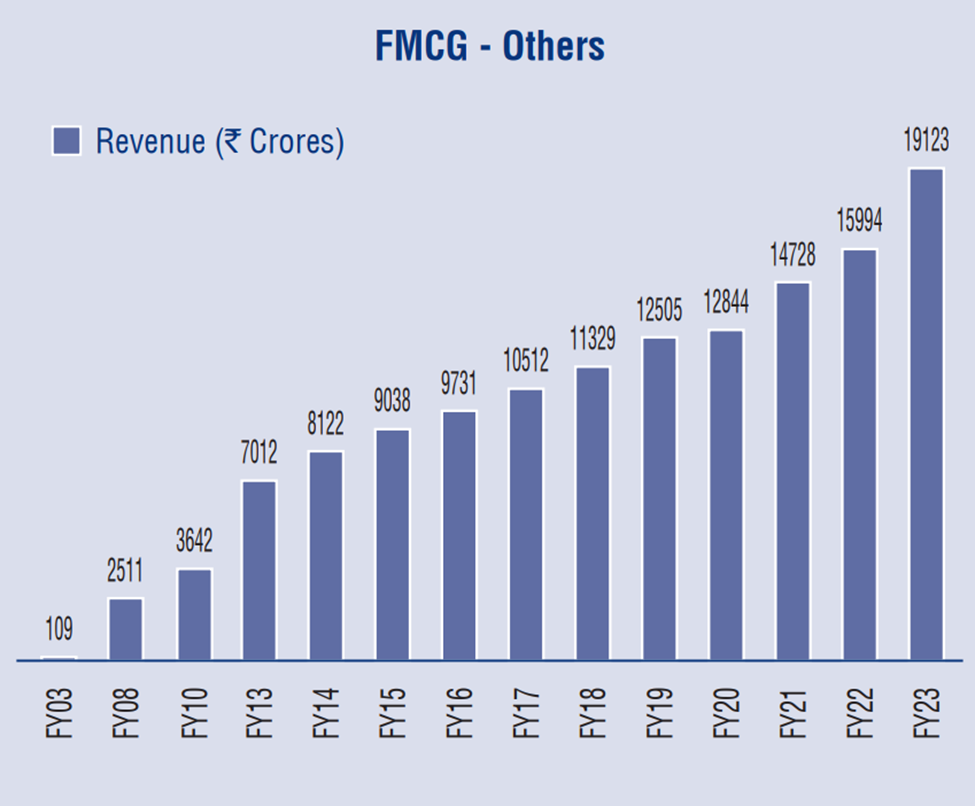

In FY23, ITC’s FMCG revenue was ₹19,239 crores, a 19.5% increase from the previous fiscal year. And, in H1FY24, the company reported total FMCG revenue of ₹27,159.8 crores, up nearly 11% from the same period in the previous fiscal year from ₹24,452.45 crores.

FMCG Revenue Breakup

| FMCG Business | FY22 (in crores) | FY23 (in crores) | H1FY23 (in crores) | H1FY24 (in crores) |

| FMCG- Cigarettes | ₹26,158.31 | ₹31,267.46 | ₹15,099.48 | ₹16,683.87 |

| FMCG- Others | ₹16,023.32 | ₹19,153.09 | ₹9,352.97 | ₹10,475.96 |

Hindustan Unilever

| Market Cap | CMP (as of 14th Nov 2023) | All-time High Levels | PE Ratio | 5 yr CAGR Return | ROCE (FY23) |

| ₹ 5,82,264 crore | ₹2,478 | ₹2,859.30 | 56.4 | 8% | 101.9% |

Hindustan Unilever is India’s largest FMCG stock company with an extensive product portfolio in the household and personal care segments. It is also present in the food segment with brands like Brooke Bond, Kwality Walls ice cream, Horlicks, Kissan, etc.

In FY23, HUL reported a total revenue growth of 16% year-on-year to ₹58,154 crores, from ₹50,336 crores in the previous fiscal. And, in H1FY24, the company’s total income increased by 5% to ₹31,485 from 30,010 crores in H1FY23.

Nestle India

| Market Cap | CMP (as of 14th Nov 2023) | All-time High-Level | PE Ratio | 5 yr CAGR Return | ROCE (FY23) |

| ₹ 2,32,225 crore | ₹24,086 | ₹24,745 | 80.3 | 8% | 122.4% (2022) |

Nestle is a Swiss multinational FMCG food & beverages company that houses popular brands like Maggi, KitKat, Munch, Nescafe, Cerelac, etc. Nestle is also one of the famous FMCG stocks in India.

In 2022, Nestle India’s total revenue from operations was ₹16,897 crores, up 14.6% to ₹14,740.5 crores in 2021. For the nine months ending on 30th September 2023, the company’s revenue from operations stood at ₹14,525.8 crores, up by nearly 15% from last year from ₹12,640.17 crores.

Tata Consumer Products Limited

| Market Cap | CMP (as of 14th Nov 2023) | All-time High-Level | PE Ratio | 5 yr CAGR Return | ROCE (FY23) |

| ₹ 85,149 crore | ₹917 | ₹930 | 68.3 | 33% | 34.3% |

Tata Consumer Products is a leading global food & beverages and largest tea company in India, which houses brands like Tata Tea, Sampann, Tata Salt, Tata Starbucks, Himalayan Natural Mineral Water, etc. The company was earlier known as Tata Global Beverages Limited.

In FY23, this FMCG stock company earned 11% more revenue than in FY22 to ₹13,783 crores from ₹12,425 crores. And, in H1FY24, TCPL reported revenue from operations at ₹7474.99 crores, nearly 12% higher than last year.

Britannia Industries Limited

| Market Cap | CMP (as of 14th Nov 2023) | All-time High-Level | PE Ratio | 5 yr CAGR Return | ROCE (FY23) |

| ₹ 1,13,120 crore | ₹4,696 | ₹5,270 | 50.8 | 10% | 47.35% |

Britannia Industries Limited, promoted by Wadia Group, is India’s oldest food company, established in 1892. It houses popular biscuit brands like Good Day, Marie Gold, Milk Bikis, Tiger, Nutri Choice, 50-50, etc.

In the last 10 years, the company’s revenue has grown by a CAGR of 10% from ₹6913 crores in FY14 to ₹16,301 crores in FY23. Compared to FY22, the revenue from operations has grown by 16.8% to ₹15,618.42 crores from ₹13,371.62 crores. And, in H1FY24, the company’s revenue from operations increased by 4.3% to ₹8,340.31 crores from 7,991.39 crores.

Conclusion

Solid companies with substantial brand equity, a diversified product portfolio, a robust distribution network, and consistent financial performance, the FMCG sector in India is one of the country’s most resilient and fastest-growing industries.

According to Nielsen’s report, the FMCG stocks sector is also witnessing a change in consumption behavior, with e-commerce platforms projected to contribute 11% of the overall FMCG sales by 2030. So, the companies with strong presence and visibility across both offline and online platforms are likely to witness growth in the coming years in terms of profitability and stock price.

FAQs on FMCG Stocks in India

What are FMCG stocks?

FMCG stocks, or Fast-Moving Consumer Goods stocks, pertain to shares in companies producing essential, quickly consumed goods such as food, personal care, and household items. These stocks are characterized by steady demand, brand recognition, low price points, and repeat purchases. Often considered defensive investments, FMCG stocks tend to remain stable even during economic downturns, offering consistent returns.

Why FMCG stocks are falling?

FMCG stocks may fall due to various reasons such as economic downturns, changes in consumer preferences, increased competition, rising input costs, or broader market trends. Economic factors, geopolitical events, and shifts in consumer behavior can impact the performance of FMCG stocks. Investors should stay informed about market dynamics, company fundamentals, and industry trends to make informed decisions in the ever-changing landscape of stock markets.

How to analyze FMCG stocks?

FMCG stocks, or Fast-Moving Consumer Goods stocks, represent shares in companies that produce everyday consumer products with a quick turnover. The fall in FMCG stocks can be attributed to various factors, including shifts in consumer preferences, economic downturns, increased competition, or disruptions in the supply chain. Investors should monitor market trends, company financials, and industry developments to understand the reasons behind the decline. Analyzing FMCG stocks involves assessing financial performance, brand strength, market share, distribution networks, consumer trends, competitor positioning, regulatory impacts, global influences, innovation strategies, and traditional valuation metrics like P/E ratio and dividend yield. A holistic approach to analysis is essential for making well-informed investment decisions in the FMCG sector.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 16

No votes so far! Be the first to rate this post.