As retirement sets in, your regular income stops, but the expenses keep rolling. When inflation skyrockets, so will everyday expenses.

An evolving demographics, a boost in life expectancy, a surge in nuclear families, and possibly a desire to retire early are other credible reasons retirement planning is a must. Working hard to generate wealth is a given. But that is not enough. You must have solid financial planning as a support system to let you reach your future goals as you start your retired life.

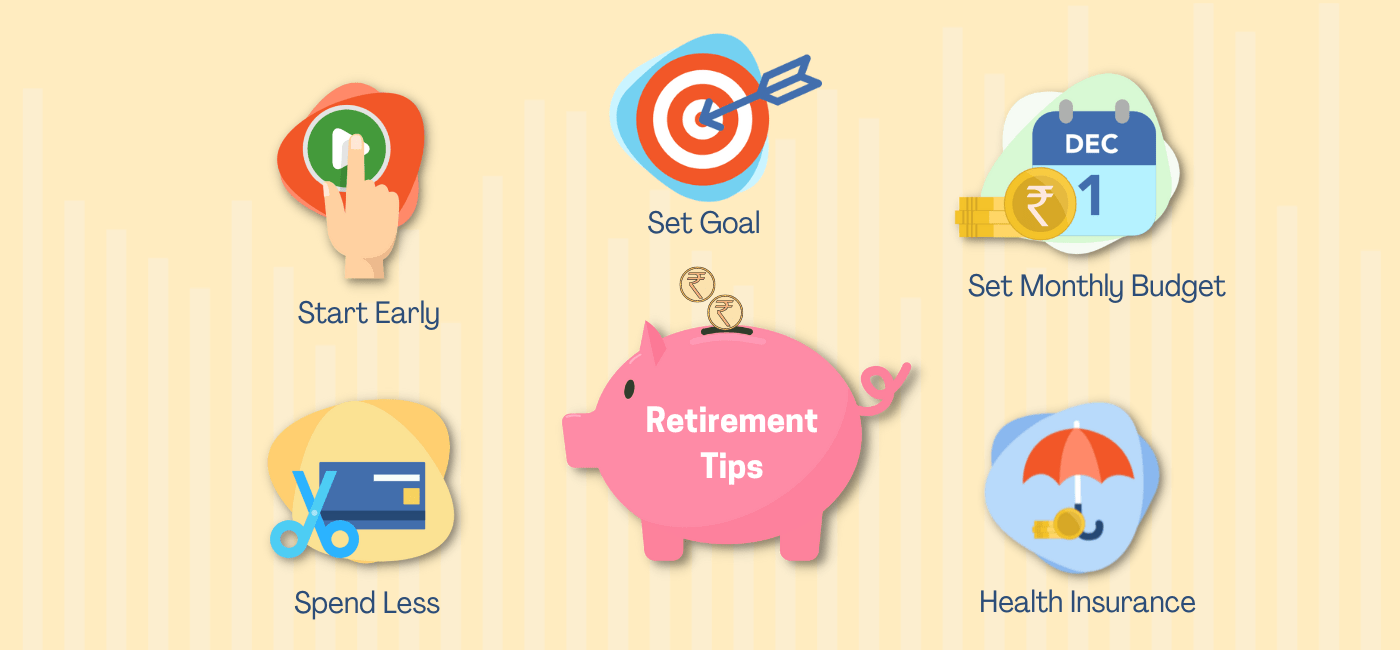

Here are our top 7 retirement tips for 2022 in India.

1. Estimate Your Retirement Corpus

It is essential to have a clear sight of your future goals. You must apply the same philosophy to your retirement planning. It helps to ensure that you retain your lifestyle in your sunset years.

You must estimate and calculate the corpus amount you will need to maintain your current lifestyle after you retire. Considering the factors mentioned below will help:

- Your retirement age

- Your life expectancy

- Your average monthly expenses

- An estimated rate of inflation

- The rate of return on expected investment pre- and post-retirement

2. Manage Your Debt Smartly

One of the top retirement tips from retirees includes managing your debt wisely before starting your second innings in life. Prioritize expenses according to value. Therefore, home or mortgage loans come first, followed by student debt, car loans, personal loans, and credit card debt should be dealt with innovatively and efficiently.

If you plan to retire within 12 months, you must ensure that you pay off all existing debts and refrain from taking on any new debt of a significant value.

3. Prepare a Health Insurance Strategy

With inflation rising and better quality of life, healthcare will become a significant expense when you mature. Therefore, you must invest in a solid medical plan that covers your partner and you for all health-related concerns until the end of life.

If there is a history of critical conditions like cancer in the family, make sure you purchase adequate riders that will cover major critical illnesses. Mediclaims come in packages, and every package suits a specific need of the beneficiary. So, choosing the right mediclaim policy is essential.

4. Monitor Your Income Sources

You may not be able to maintain your current lifestyle because you consider retirement planning when you had the chance. Working with a financial expert can help you understand the income that you will need to generate post-retirement to keep up with the lifestyle that you are accustomed to.

It will involve carefully determining your current income sources, letting you save and invest early to achieve your retirement targets.

You can liquidate an emergency fund to meet healthcare expenses or for anything else.

5. Imbibe A Disciplined Habit to Invest

Accumulating enough wealth to tide over your post-retirement expenses demands a disciplined approach to smart investing. An intelligent investment plan ensures you have enough saved to reward yourself with a stress-free retirement with financial freedom. In addition, a systematic approach allows your fund to grow over time, making it possible to achieve your life goals.

With the power of compounding, you can counter the effects of inflation, tackle unforeseen expenses, maintain your current lifestyle by investing in a pension plan from an early age, and build a significant corpus.

6. Diversify Your Asset Allocation

Never make the mistake of building your nest egg with a single asset allocation. Instead, it should be a mix of high, medium, and low-risk financial instruments, be it stocks, bonds, mutual funds, gold, or other asset classes.

The perfect retirement plan enables you to start investing early and roll it over 30 and 40 years. You can also explore pension schemes that usually give investors a wide range of options on how you want to build your investment portfolio by selecting the asset class that will provide you with maximum exposure and comes with a guaranteed income in the future.

You must carefully assess your risk appetite and the years remaining for your goal realization.

7. Take Inflation into Consideration

In the long-term scenario, inflation can negatively impact the accumulated value of your investments geared towards your retirement corpus. Hence, the focus should consider a competitive inflation rate and invest in channels that can deliver returns.

Several insurance providers offer pension and retirement plans that provide value to your investment more significantly than the rate of inflation, along with sufficient coverage with a sum assured post-retirement.

The best of retirement tips and tricks says that you should aim to build a corpus that should be sufficient to cater to your financial and lifestyle needs after your retirement, not just for you but for your dependents as well.

Final Takeaways

You get absolute peace of mind when you know that you have a solid corpus readily accessible in the form of a retirement plan that can manage your financial expenses satisfactorily in your golden years.,,,

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.