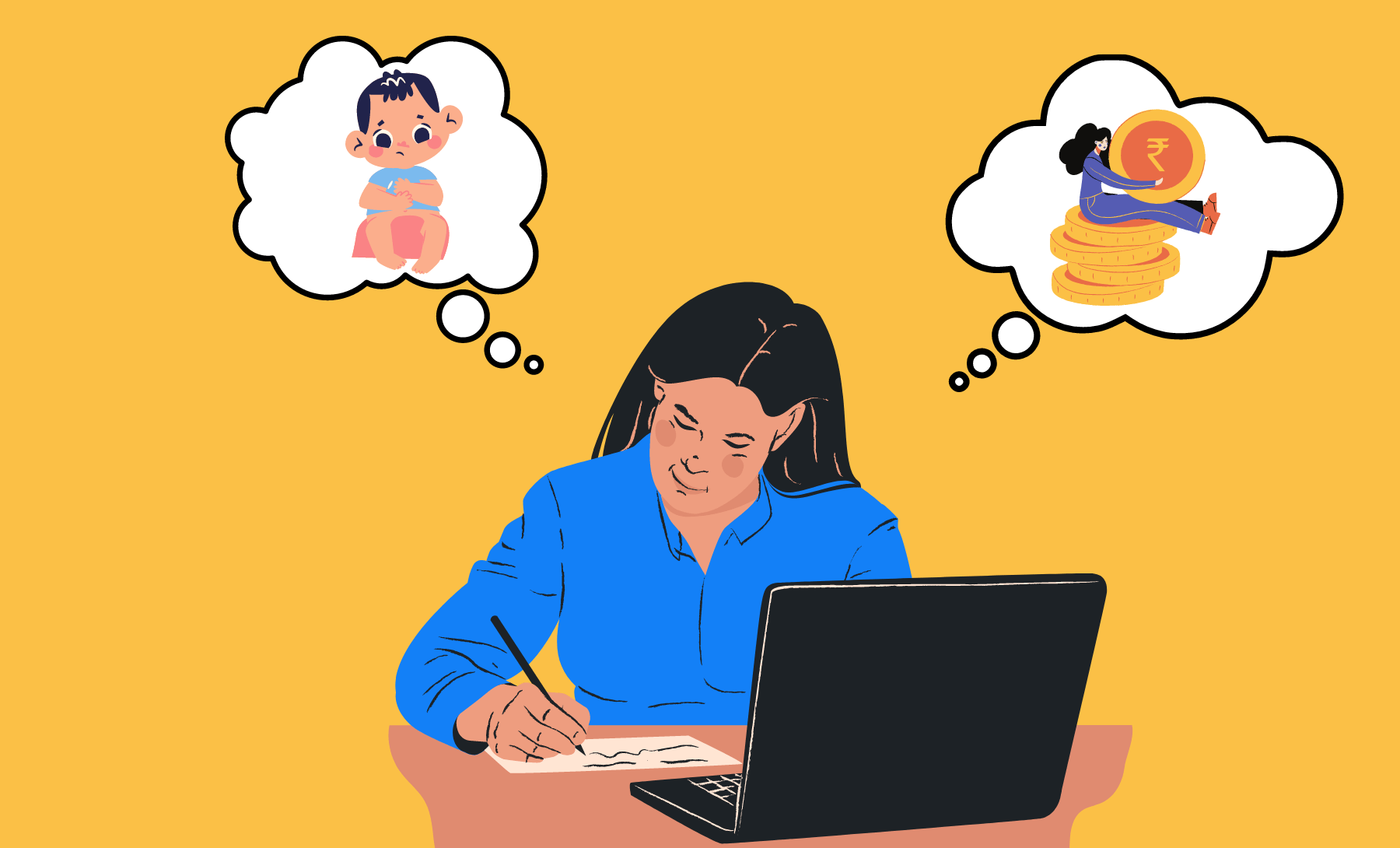

We’ve spoken of first-time investors, working professionals, and working women too. Today’s article focuses on working mothers and how they can invest to make their money grow. Working mothers are busier as they must do justice both at work and at home.

You will probably be a man reading this blog. But you can definitely share the insights learned with your wife, mother, sister, a friend, or a colleague who’s a mother. Remember, sharing is caring.

Mothers with young children feel they don’t have enough time to get things done, and long-term financial goals like wealth creation and investing get overlooked. Often other mundane activities take precedence over savings and long-term investing for the future.

Whether you’re planning for a family trip around the world, or want enough money to retire comfortably, there is an investment you can make to help your money grow.

One of the most vital priorities for parents is ensuring they meet the financial needs of their family. It is especially true for working mothers. No mother wants her children to go without.

You’ve probably heard that investing in the stock market is a fantastic way to create wealth, and you’d love to start investing, but don’t know how.

Our team got the financial experts at Research & Ranking to help us explain and direct you on your road to financial freedom through investing for the long term.

1. Stop making excuses

Mothers who are first-time investors often feel like they don’t have enough time to research the kind of investments that make the most sense. However, that is not the right mindset when they want to begin investing. Making excuses for not starting your investment journey must stop. If you can make time for your salon appointments or business meetings then, you can make time for investing.

2. Get your funds and saving habits in order

Before you start investing, ensure paying your other bills like credit card bills, school fees for children, rent, water, etc., on time becomes a habit. Have an emergency fund in place. Check if you have excess money for your investment capital. If you don’t, then, examine your spending habits and check what’s burning a hole in your pocket. Invest only when you have the extra money to do so.

3. Decide on your goals and time horizon

Do you want to travel the world, need money for education, or want to buy a house? Decide on the most important goals for your family and you. Once you do, then your sacrifice of setting money aside becomes meaningful. Next, ask yourself, how long do you want to invest for each goal? Answers to this question will help you understand the kind of investment suitable for each financial goal. Remember, the earlier you start, the better your chances of achieving your goal.

4. Research, research, and some more research

If you are afraid to invest, then you may lack the knowledge needed to invest successfully. But that is easy to resolve. Not investing when you could be something you must fear more than your desire to invest. If you learn the basics of how investing works and seek the help of an advisor who can help you invest better, then you are good to go. Start your investing journey with an end goal in mind.

Go online, research, and spend time reading the information. Get a better idea of what kind of businesses you prefer investing in. To begin with look at the products you use in your home. We are sure there are several multibaggers right in front of you. You invest, only if you have the knowledge, time, and money.

5. Decide on one hour every month to check on your investments

If you’re only investing and not looking to start short-term investing, then you can pick an hour every month to check on your investments. Use this hour to research investment strategies that work best for your goals, put some money in a fantastic stock with excellent fundamentals, and check your monthly budget to know how much you can invest each month.

6. Automate your investments

One of the best things moms you can do for your investments is to set it and forget it. Technology has made investing simpler and faster. You can choose from the dozens of investing apps that help you put money in the market with various levels of supervision, especially for first-time investors.

7. Talk with your spouse or friend about your progress

You may have forgotten about your investments in the humdrum of routine work. That is when you need someone who can remind and push you to invest regularly. Talking to your best friend or spouse about your progress can motivate you to invest and track your investments regularly.

Investing in the stock market is no longer daunting when you know enough to get your investing journey rolling. Remember, always research, get your finances in order, and in time you will find yourself diversifying your portfolio too.

What do you think of this article? Please share this article for sure.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.