The power sector is the most critical sector of any economy because any country’s long-term economic development requires adequate, reliable, and affordable power supply around the clock.

Over the last two decades, India’s power sector has gradually improved, with increased private sector participation in power generation and transmission. Companies such as Adani Power, Tata Power, and Torrent Power are investing heavily in expanding their generation capacity to meet India’s rising demand for power.

This article will analyze India’s largest private thermal power producer. But first, let’s check the long-term growth potential of Adani Power share price.

Adani Power Company Journey

Unlike its peers, the footprints of Adani Power in India’s power sector are not very old, and its journey started in 2006 with the setup of the first power plant in Mundra, Gujarat. However, the company was incorporated in June 1996 by Mr Gautam Adani, Mr Rajesh Adani, and other relatives.

Over the years, Adani Power’s generation capacity has increased to 13,650 MW, making it India’s largest private-sector thermal power generation company. It is in the process of building and operationalizing an additional 3,200 MW of power plants by 2028.

With its strong project execution skills, Adani Power is now leading in setting up coal-based thermal plants based on ultra-supercritical technology, known for having low carbon footprints and higher efficiency. As a result, it became the world’s first company to set up a coal-based supercritical thermal power project under the Kyoto Protocol’s Clean Development Mechanism.

At present, Adani Power is India’s most profitable thermal power generation company and has shown excellence in operational capabilities. For example, a unit (330M MW) in its 4,620 MW Mundra power plant set a national record by running continuously for 600 days in March 2017, showcasing its might to achieve high operational efficiency. The company had a market cap of ₹79,318 crore as of 26th April 2023.

Business Overview of Adani Power

It has segregated its business into two following segments:

- Power Generation and related activities

- Trading and Investment activities

Power Generation and related activities account for over 90% of the turnover. Of the 13,650 MW of installed power generation capacity, 40 MW is the solar plant. In addition, the company built 9,620 MW of thermal capacity on its own and acquired four financially stressed thermal plants of 4,370 MW.

On April 10th 2023, Adani Power commissioned the first 800 MW unit of the 1600 MW Godda thermal plant in Jharkhand and started supplying the power to Bangladesh from this plant. The company has a 25-year-long power purchase agreement with the Bangladesh government from this plant.

It is also constructing a 1600 MW ultra-supercritical thermal plant in Singrauli, Madhya Pradesh.

Plant Load Factor (PLF)

Adani Power has the most super-efficient and modern power generation units, with 74% of the total installed capacity being supercritical or ultra-supercritical units. As a result, it helps maintain a higher plant load factor, an important metric to measure the power plant’s capacity utilization.

In FY22, the average plant load factor was 52%, which aligns with the average all-India PLF. However, due to increased fuel costs and insufficient domestic coal supply, the average PLF declined to 42.1% in Q3, FY22.

Adani Power Management Profile

Adani Power is led by Chairman Mr Gautam Adani and Director Mr Rajesh Adani, who sit on the company’s Board of Directors.

Mr Anil Sardana, the Managing Director and CEO, has over three decades of experience in power and infrastructure. He began his career with NTPC before moving on to various leadership positions with BSES and Tata Power. Before joining Adani Power, Mr Sardana was MD and CEO of Tata Power.

Mr Shersingh B. Khyalia is the Chief Executive Officer (CEO), a Chartered Accountant by profession, bringing over 32 years of experience in the power sectors. Before joining Adani Power, he was Managing Director at Gujarat Power Corporation.

Mr Shailesh Sawa is the Chief Financial Officer (CFO) and joined Adani Power in July 2020. Earlier, he was with HCC and Essar. He is a Chartered Accountant and Cost Accountant by profession.

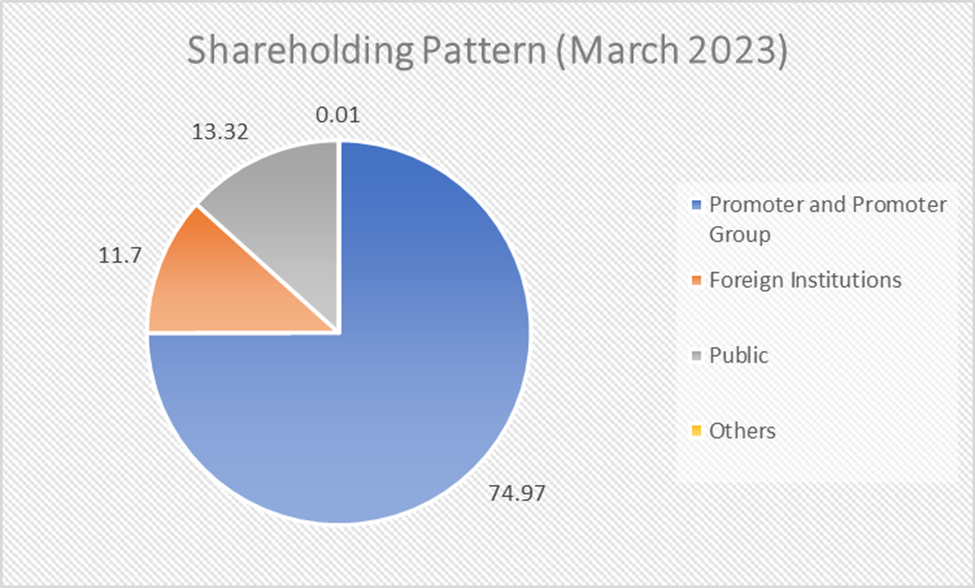

Adani Power Shareholder Profile

As of 31st March 2023, the promoter and promoter group has pledged 25.15% out of the 74.97% stake in Adani Power.

Adani Power Financials

Revenue

In FY22, Adani Power reported net consolidated revenue of ₹27,711.18 crores, up 5.6% from ₹26,221.48 crores in FY21. While, in 9MFY23, the company reported net consolidated revenue of ₹28,531 crores, up by 66.7% from ₹17,113.40 crores registered in 9MFY22.

Segment-wise Revenue Breakup

| Segments | 9MFY23 (in cr.) | 9MFY22 (in cr.) | FY22 (in cr.) | FY21 (in cr.) |

| Power Generation and Related Activities | ₹28,423.19 (+66.7%) | ₹17,042.76 | ₹27,221.79 (+5.2%) | ₹25,870.60 |

| Trading and Investment Activities | ₹108.05 (+53%) | ₹70.64 | ₹489.40 (+39.47%) | ₹350.88 |

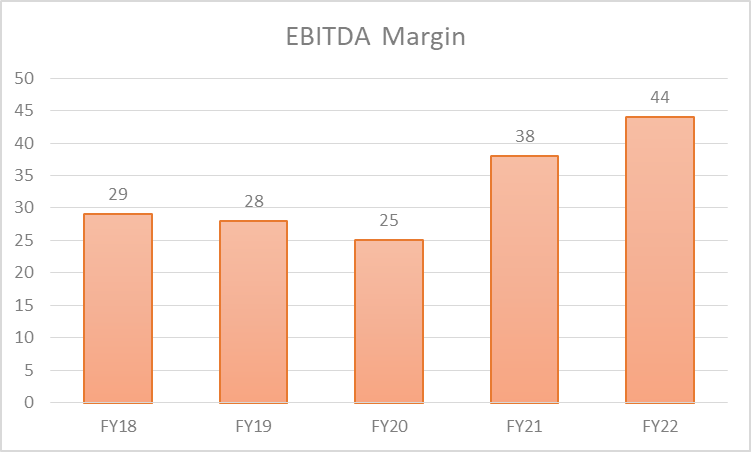

EBITDA

In FY22, consolidated EBITDA grew by 30% to ₹13,789 crore from ₹10,579 crore in FY 21. For 9MFY23, the consolidated EBITDA came in 103% higher at ₹11,851 crores compared to ₹5,847 crores in 9MFY22 because of improved tariffs and higher one-time revenue realization. However, breaking further, the Q3FY23 EBITDA stood marginally lower at ₹1,996 crores compared to ₹2,003 cores in Q3FY22, mainly due to higher fuel costs

Net Profit

In FY22, profit after tax increased by a little over four times to ₹4,912 crores, compared to ₹1,240 crores in FY21.

While in Q3FY23, consolidated profit after tax nosedived to ₹8.77 crores from ₹218.49 reported in Q3FY22 on account of higher tax expenses. Profit before tax for the period is ₹211.90 crores.

Adani Power Key Financial Metrics

Current Ratio: In FY22, the current ratio marginally improved to 0.95 times from 0.90 times in FY21.

External Debt to EBITDA: Due to higher EBITDA and lower external debt level in FY22, the External Debt to EBITDA ratio improved to 3.07 times from 4.37 times in FY21.

Debt-to-equity Ratio: During FY22, the consolidated debt-to-equity ratio improved to 8.89.22 times from 99.58 times in FY21.

Net Profit Margin: The net profit margin improved to 17.72% in FY22 from 4.84% in FY21 on account of higher realization due to increased tariffs.

Return on Net Worth: The consolidated return on net worth reduced to 89.48% in FY22 from 255.22% in FY21.

Adani Power Share Price Analysis

Adani Power’s initial public offering (IPO) was launched on July 28, 2009, and was offered to the public at a price range of ₹90-100 per equity share, raising ₹3,016.52 crores. As of April 26th, 2023, the stock was listed at a discount, and the holding period return (4,999 days) on the listing price is 101%, while on the offer price, the holding period return (5017 days) is 111%.

Adani Power share price made an all-time high of ₹432.50 on 22 August 2022, before crashing down.

The stock has never undergone a split, or the company has issued any bonus shares or paid dividends to shareholders since its listing.

Adani Power Fundamental Analysis

Adani Power is India’s most financially stable and profitable private-sector thermal power producer. The key to its financially stable operation is power-supply agreements with long-term power-purchase agreements (PPA) with buyers, including regular tariff increases.

Power Purchase Agreements

The company’s 78% of the installed and upcoming greenfield capacities are tied to PPAs, enabling revenue visibility, and 73% of domestic coal requirement is met through long-term fuel supply agreements (FSAs). Also, imported coal-based PPA includes provisions of fuel cost passthrough, thus enhancing cash flow stability.

Technologically Advanced Power Plants

The second factor plays a huge role in modern and technologically-advanced power plants. For example, 68% of the installed capacity is supercritical or ultra-supercritical power plants. And by 2027, the share of supercritical power plants will increase to 74%. These technologically advanced plants can produce electricity most efficiently with minimum pollution.

Deep Backward Integration and Geographical Advantage

Adani Power has deep backward integration with the mine-to-logistic company and dedicated teams with strong domain expertise in O&M, fuel management, power sector regulation, project management, and business development, which helps to keep costs under control.

And power plants are located closer to the demand zone, and fuel sources are helping it to reduce wastage and transportation costs.

All these factors and arrangements play a crucial role in providing visibility of revenue and profits for the next few years, helping it plan the capex and operations. However, despite favorable operational conditions, Adani Power faces multiple business risks which can affect the long-term growth potential of Adani Power share price.

Risks

Adani Power is a pure thermal power generation company; the government’s growing focus on increasing the share of renewable and sustainable energy in India’s installed capacity could limit thermal power generation.

Almost 22% of Adani Power’s installed capacity is exposed to short-term market risks due to the absence of fuel-supply agreements. Non-availability of coal from state-owned coal suppliers renders plants to operate at lower efficiency. And volatile international coal price impacts the merit order position of PPAs with coal price passthrough.

A higher debt level may hamper its ability to undertake huge capex, and high finance costs can drag the company’s profitability.

Opportunities

Over the last decade, India’s installed power capacity has increased 8.1% CAGR to 416059 MW as of March 31, 2023, with coal and lignite-based power plants accounting for nearly 51% of coal and lignite-based power plants’ installed capacity. However, despite adding capacities yearly, the country faces a power deficit in peak periods.

The power deficit increased to 0.5% in FY23 from 0.4% in FY22, indicating strong demand and increased economic activity. On the other hand, the national power deficit had decreased significantly since FY13, when it was 8.7%. Therefore, players like Adani Power will likely continue to benefit from the strong power demand outlook.

The average plant load factor at Adani Power is hovering around the 50% level. Therefore, greater domestic coal availability could result in higher PLFs and higher income.

Proven capabilities of turning around stressed power assets acquisitions like Mahan Energen Limited, acquired from Essar, and Raipur Energen Limited, acquired from GMR Chhattisgarh, helping Adani Power to diversify geographically and increase revenue while avoiding execution risks.

Adani Power Share Price Future Growth Potential

Recently, stocks of Adani Group companies, including Adani Power, witnessed a meltdown after Hindenburg Research accused the firm of severe corporate governance lapses and misuse of funds.

Keeping aside the concerns raised by Hindenburg Research, Adani Power share price long-term growth outlook looks positive. The commissioning of 2400 MW power plants in the next three years will add to the top and bottom lines.

The key triggers that will aid in the rise of Adani Power share price are the release of pledged shares by promoters and a reduction in debt level, currently making it vulnerable to increased market volatility.

Large capex plans on hold due to the evolving scenario may impact growth. Still, close monitoring of Adani Power financial performance in the coming quarters is critical to assessing the company’s financial stability.

Disclaimer Note: This article’s stocks and financials are for education only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any, are for illustration only and are not recommendatory.

FAQs

Is Adani Power a profitable company

Yes, Adani Power is a profitable company. It reported a net profit of ₹4,912 crores and a net profit margin of 16% in FY22.

How has Adani Power share price performed in the last three years?

Adani Power share price has given good returns to investors. Adani Power IPO was launched in July 2009 at an offer price of ₹100 per equity share. As of 26th April 2023, Adani Power share price is trading at ₹211, making an all-time high level of ₹432 on 22nd August 2022.

When was Adani Power established?

Adani Power was incorporated in June 1996, and it set up its first power plant at Mundra in July 2006.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 5

No votes so far! Be the first to rate this post.