Yesterday we spoke of the rapid changes in the Renewable Energy sector and how Billionaire Barons in India are racing to add the best clean energy businesses to their portfolio.

Here is a deep dive into Reliance’s foray into green energy.

Reliance Industries Ltd (RIL) AGM’s have become synonymous with surprise announcements, and the 44th meeting on 25th June 2021 was no exception.

The AGM agenda had several initiatives like the JV with Google for its Android phone launch in September, the retail expansion plan, and the surprising Rs.75000cr allocation for green energy investments in the next three years.

This ambitious move to green energy from fossil fuels may have surprised Reliance shareholders. But it is in line with the Prime Minister’s vision to accelerate India’s venture into renewable energy production and use.

Experts believe Reliance foraying into green energy will spur others into taking action in this sector. The company’s ability to build cost-efficient end-to-end chains in O2C and retail may help to make their solar and energy storage businesses a success.

Mukesh Ambani unveiled his ambitious renewable energy dream. Let us understand the steps taken:

Creating the Council of nine: Mukesh Ambani has enlisted eight global technocrats to his nine-member New Energy Council. This council of advisers to governments will help the oil-to-gas business become a green energy giant.

The national research professor and independent director at RIL, R Mashelkar heads the council. Alan Finkel, special adviser to Australia on low emission technologies and national hydrogen strategy; Draper Prize winner for engineering, Rachid Yazami; Director of MIT’s energy initiative, Robert Armstrong; the father of photovoltaic, Martin Green; David Milstein, an expert at splitting water, innovative energy storage systems, and carbon capture, utilization, and storage; Professor of energy engineering, Imperial College, Geoffrey Maitland and the pioneer of modern wind industry Henrik Stiesdal make up the council with Mukesh Ambani.

The council will validate RIL’s plans for a tech-based system to make clean and affordable energy in 5-15 years. They guide on technical plans, ascertain opportunities, and counsel on partnerships worldwide.

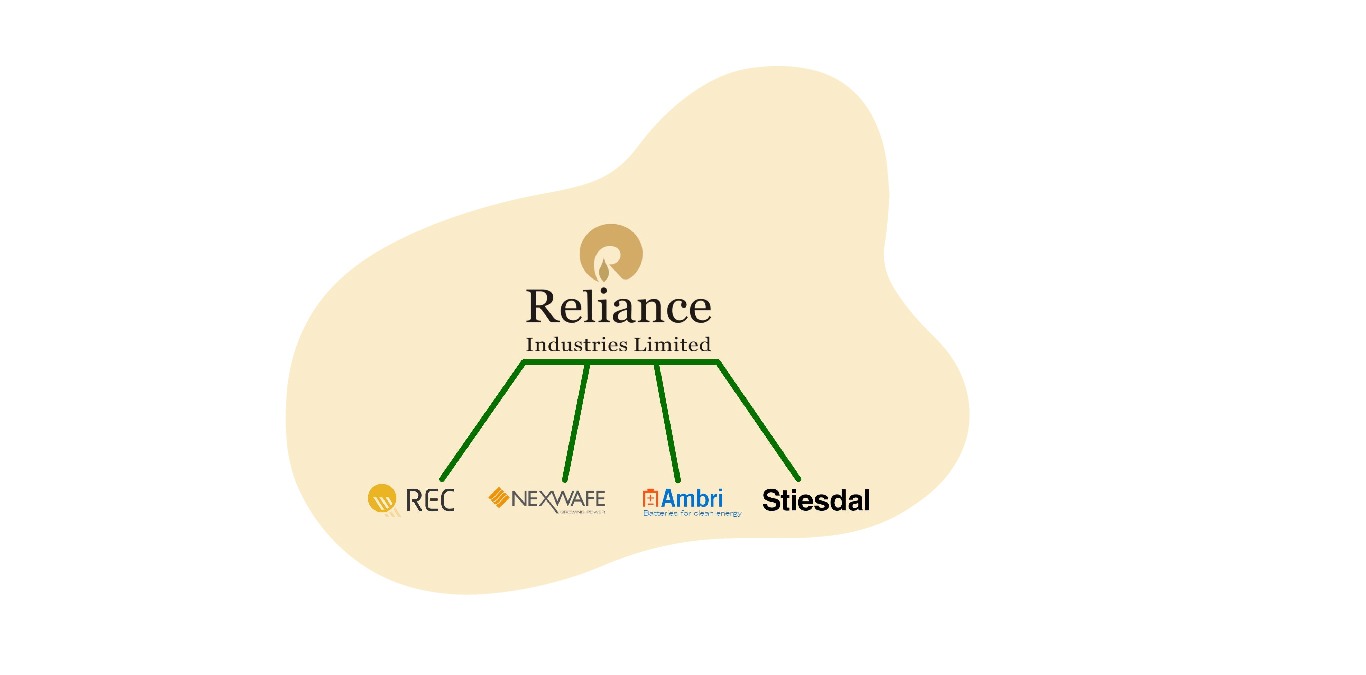

RIL’s Partnerships: Reliance has partnered with green energy businesses in solar, battery, and hydrogen, which could contribute around 10% of the company’s pre-tax profits in five years.

- REC: Reliance New Energy Solar Ltd (RNESL), the new subsidiary, acquired a stake in Norway-based REC Solar Holdings AS for 5782cr. REC manufactures polysilicon, PV cells, and modules with plants in Norway and Singapore.

- Sterling & Wilson: RIL bought a 40% stake in Sterling & Wilson Solar Ltd, a leading EPC and O&M firm in renewables for 2850cr. They provide a comprehensive range of solar energy turnkey solutions. The solutions include design, procurement, building, project supervision, processes, and administration.

- NexWafe: RNESL invested 337cr is a Germany-based firm NexWafe. It will give the Ambani’s access to NexWafe’s methods and expertise to manufacture solar wafers. RNESL will support NexWafe in completing the commercial development of its PV products on prototype lines in Freiburg. RNESL and NexWafe together will develop technologies and commercialize mono-crystalline ‘green solar wafers’ in India.

- Stiesdal A/S: RNESL signed a cooperation agreement with Denmark-based Stiesdal A/S to develop technology, manufacture HydroGen Electrolyzers. They will collaborate on the development and implementation of new climate change technologies such as offshore wind energy, next-generation fuel cells to convert hydrogen to electricity for mobile and static generation, long-duration energy storage, and carbon-negative fuels.

- Ambri: RNESL will invest around 371cr to acquire 42.3 million preference shares in Ambri, the Massachusetts-based company. The investment will help Ambri monetize and grow its liquid metal batteries for energy storage globally.

Dhirubhai Ambani Green Energy Giga Complex: RIL will develop a 5000-acre DAGEGC in Jamnagar, Gujarat. This complex will house the green energy factories manufacturing solar-grade polysilicon, solar panels, and modules, metallic silicon. These acquisitions and partnerships will help RIL expand its capacity to 10 GW from 4 GW and aid in Reliance’s goal to produce 100 GW of green energy before the end of 2030.

The commitments and steps taken will tell you RIL is building a fully-integrated end-to-end renewable energy ecosystem for customers through solar, batteries, and hydrogen. No other company is financing the complete new energy value chain like Reliance. If Ambani’s pull-of their ambitious plan for green energy then the earnings will be significant.

Of course, like all plans, there could be several issues. Fossil fuel companies across the globe have not been able to transition to renewables.

Technologies for advanced storage and fuel cells are a work-in-progress. Despite considerable investment in the development of new energy technologies, the US government had modest results. Materials science in India is under-developed, while advanced technologies like Cobalt, lithium, and nickel are not available commercially.

RIL forays into a market with a thorough study and detailed roadmap. It could mean a complete disruption in the green energy sector or a disaster in the making. We will have to wait for the results and the impact of its decisions on the industry.

If you have liked this article, please share it. Look for our next on Adani’s ambitions for green energy.

Read more: Renewable Energy – The World’s Favorite Energy Source Today!

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.