If we were to describe Prashant Jain, the former fund manager at HDFC AMC, in two words, it would be courageous and inquisitive. It is no easy task to survive in this market for so long, run three funds successfully, and outperform the benchmark index consistently for 17 years. And this is from a person who had no background in equity research or experience in the financial market before entering this space. So, yes, we are talking about the dynamic Prashant Jain.

Prashant Jain education

He has a BTech from IIT Kanpur with an MBA from IIM Bengaluru.

Prashant Jain’s Journey

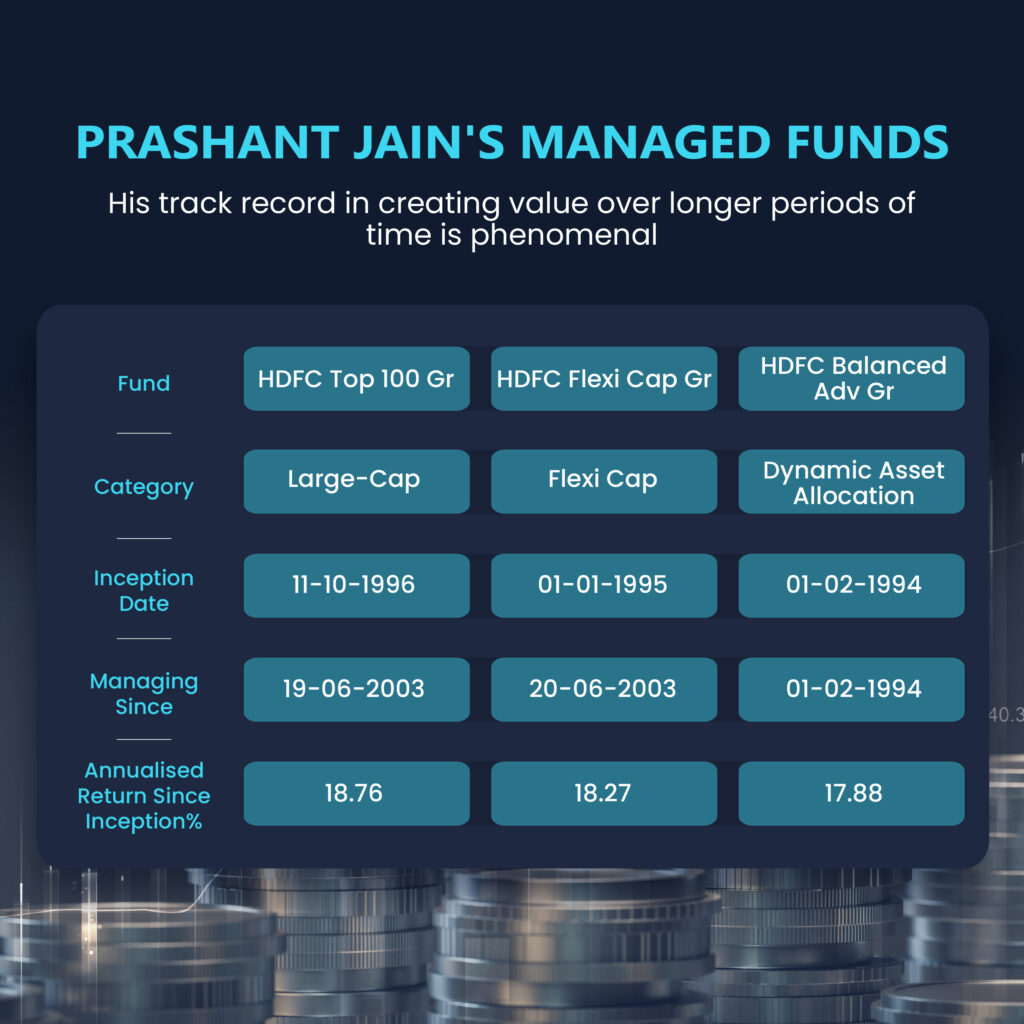

He recently called it quits as a Chief Investment Officer at HDFC Mutual Funds, closing his 30-year illustrious career on a high note. His resignation came just four days after HDFC celebrated the 20th anniversary of its pioneering index fund. He is the only fund manager in India who managed cumulative assets worth Rs. 1 lakh crore. A look at the funds he managed will tell you the kind of fund manager he was. Few of his peers believe his legacy is unbeatable, while others believe he is the true polestar among fund managers.

Jain looked for value in growth stocks and diligently followed the keep-it-simple approach to bottom-up investing. He had a three-pronged focus: a) focus on business sustainability, b) preferred management of a certain quality, and c) growth and value stocks.

In his farewell letter, titled “सार,” meaning essence, he listed his hits and misses and how situations pushed him into the world of equities.

Persistence in Learning

No one can say his career started on the right note. After being unable to find a suitable job in sought-after roles in merchant banking, project appraisal, and marketing, Prashant Jain started his career as a member of the equity research team in SBI Mutual Fund in 1991. That is how he entered the world of equity investing. Later he was handed an added responsibility at the money market desk.

If anyone remembers, both the equity and money markets were on the boil during that time. As a result, thousands lost their savings, and securities fraud hit the market badly. But things worked in Prashant Jain’s favor.

His discipline in starting early and discomfort in handling large deals due to lack of experience helped him avoid the market madness at that time. And it pushed him deeper into the world of equities, accelerating his learning in the market.

The Bold Step

Choice, not chance, determines your destiny

Greek philosopher, Aristotle

Prashant Jain left SBIMF to join 20th Century Mutual Fund in 1993, and his journey to becoming one of India’s most celebrated fund managers began. Although it was an immature decision to leave an established fund house for a new one, it was the wisest decision he ever made.

The fund house witnessed multiple changes of hands in the next decade, finally ending with HDFC Mutual Fund in 2003.

During the period, Prashant Jain managed three funds. All three became the most successful mutual fund schemes in India. His deep understanding of the market and stock choices helped him turn Rs 100 to Rs 10,940 in one of the funds he managed for over 25 years. He was appointed Chief Investment Officer (CIO) at HDFC AMC in 2004, a year after joining the fund house.

Excellence

His deep understanding of the market and self-belief made Prashant Jain genuinely remarkable in equity investing. In his career spanning 30 years, he credited his success to the 6-8 critical decisions he made. For instance, taking advantage of the different market cycles to the fullest, like the IT cycle of the mid to late 90s, the capital goods and manufacturing cycle towards the end of 1999, FMCG and pharma rally.

He also believed that it’s exceedingly difficult to time the market over the short to medium period; therefore, any attempt to do this is futile. And as emotions and herd behavior drive the market, it occasionally throws up opportunities.

Also, it is evident in the investments made in three funds he managed. Out of the 465 stocks he invested in as a fund manager, one in four resulted in a loss. And of those 465 stocks, only 55 stocks gave him 85% of the total gains. Therefore, he believed that rightsizing as a portfolio would have its share of gainers and losers.

Tryst with PSU Stocks

Investors who followed the market very closely in the last few years may recall Prashant Jain’s bullish stance on PSU stocks and the criticism he received for it. Yet, his stance proved right eventually. Despite the underperformance in PSU stocks in CY18-20, he doubled down his exposure to PSU stocks. As a result, holding onto his self-belief, the PSU index generated a CAGR of 44.5% from Oct 20 to Aug 22, more than Sensex’s CAGR of 24.2%.

Learnings

Prashant Jain has shown how things work if done using the right approach and maintaining discipline, from being a member of the equity research team to becoming a celebrated fund manager in India managing assets worth Rs 1 lakh crore. Humble in acknowledging his mistakes, what worked, what did not, and his gratitude towards his gurus makes him a great fund manager.

Here are Prashant Jain’s key learnings from the market

- Investing is more about emotional quotient (EQ) than about IQ- the ability to take the right decisions at the wrong time

- Portfolio sizing is essential. It’s difficult to pinpoint the winners and losers on the first attempt.

- Markets are efficient over the longer term. So stay on the course and follow the correct process. Don’t let volatility and mispricing in the short term move you.

- Equities are a great asset class. Patience and perseverance are Key.

- Lastly, self-belief is what matters at the end of the day.

Well, he quit his position to go on his own. Whether he will make waves once again depends on his new solo journey. We are sure you’ve realized the importance of long-term investments and will start now if you haven’t yet.

Want us to help? Subscribe to the 5-in-5 Wealth Creation Strategy to get your customized portfolio of 20-25 potential multibaggers.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.