Overview of the Asian Paints Share Price

Asian Paints Limited is an international paint manufacturer with Indian roots headquartered in Mumbai, Maharashtra. The firm manufactures, sells, and distributes paints, coatings, home décor goods, bathroom fixtures, etc. Since 1967, the business has held the top position in the paint market. It has grown twice as big as any other paint business in India. Asian Paints produces a large selection of paints for both ornamental and industrial purposes.

Asian Paints, with a total sales of Rs 25,002 crores, is the largest paint manufacturer in India. In the fiscal year 2021–2022, the firm brought in ₹25640.40 crores in sales and made ₹4194.14 crores in profit. The organization enjoys an exceptional reputation for professionalism, rapid expansion, and creating shareholder wealth in the business sector. Asian Paints has 26 paint production plants worldwide and operates in 15, serving customers in more than 60 nations.

Asian Paints Business

In addition to Asian Paints, the group also conducts business internationally through its affiliates Asian Paints Berger, Apco Coatings, SCIB Paints, Taubmans, Causeway Paints, and Kadisco Asian Paints. Asian Paints produces a large selection of decorative and industrial paints. Asian Paints is a player in the decorative paints market’s four subsectors: interior wall finishes, exterior wall finishes, enamels, and wood finishes. Its product line also includes wall coverings, adhesives, and waterproofing.

To meet the expanding demands of the Indian automobile coatings industry, Asian Paints also does business through “PPG Asian Paints Pvt Ltd”, a 50:50 joint venture between Asian Paints and PPG Inc., USA, one of the leading automotive coatings manufacturers in the world. The second joint venture (JV) with PPG, known as “Asian Paints PPG Pvt Ltd,” provides services for India’s protective, industrial powder, industrial containers, and light industrial coatings sectors.

Asian Paints Management

| Name | Designation |

| Ashwin Dani | Chairman (Non-Executive Director) |

| Deepak Satwalekar | Chairman & Independent Director |

| Manish Choksi | Vice Chairman & Non-Executive Director |

| Amit Syngle | Managing Director & CEO |

| R J Jeyamurugan | CFO & Company Secretary |

| Malav Dani | Non-Executive Director |

| Jigish Choksi | Non-Executive Director |

| Amrita Vakil | Non-Executive Director |

| Nehal Vakil | Non-Executive Director |

| Suresh Narayanan | Independent Director |

| R Seshasayee | Independent Director |

| Milind Sarwate | Independent Director |

| Pallavi Shroff | Independent Director |

| Vibha Paul Rishi | Independent Director |

History of Asian Paints

In 1945, The Company was incorporated as a private limited company under Asian Oil and Paint Company Pvt. Ltd. It was converted into a public limited company in 1973. Asian Paints manufactures a wide range of surface coatings catering to different end uses. It also manufactures vinyl pyridine latex used in the manufacture of rubber tires. The company expanded its product range, developed its own technology, set up a distribution network penetrating smaller towns, and plowed a large part of earnings into creating new facilities.

Here is a timeline of how Asian Paints expanded

- In 1965, the name was changed from Asian Oil and Paint Company Pvt. Ltd. to Asian Paints (India) Pvt. Ltd.

- In 1975, Bonus Equity shares were issued in the ratio: 1:2 in 1961, 1:3 in 1962, 1:1 in 1966, 1:2 in 1969, 2:3 in 1971, and 1:2 in 1975.

- In 1978, 1,00,000 Bonus Equity shares were issued in the prop. 2:3.

- In 1982, The main objectives of the public issue of capital during August were to fulfill the Stock Exchange listing requirements and provide part of the finance for the increased operations.

- In 1990, The Company also set up two more joint ventures under the names and styles of Asian Paints (Nepal) Pvt. Ltd., and Asian Paints (S.I.) Ltd., both of which are subsidiaries of the Company.

- In 1995, Pantasia Chemicals Ltd. (PCL) was merged with the Company. The assets and liabilities of the erstwhile PCL are vested with the company from 1st October 1994.

- In 1999, in its first-ever acquisition overseas, Asian Paints Ltd (APL) acquired a 76 percent equity stake in Sri Lanka-based Delmege Forsyth & Co (Paints) Ltd.

- In 2000, Asian Paints launched two variants of polyurethane (PU) wood finish under the brand name Opal. They opened a manufacturing plant in Oman in partnership with a local company. Asian Paints acquired Pacific Paints Company based in Australia for over Rs 1 crore.

- In 2001, Asian Paints introduced Utsav Enamel for the festive season.

- In 2002, Asian Paints revamped its international operations. They transferred shares in its subsidiaries in Fiji, Tonga, Solomon Island, Vanuatu, Australia, and the Sultanate of Oman to the Mauritius-based subsidiary Asian Paints International. Executed agreement for the purchase of 60% equity capital of SCIB Chemicals S.A.E., Egypt. Launched its $3 million joint venture with Bangladesh-based Confidence Cement, in which it holds a 51 percent stake. Acquired a controlling stake of 50.1 percent in Berger International, Singapore, for Rs 58 crore.

- In 2003, Asian Paints, via its Singapore-based subsidiary – Berger International – inked a technology and brand licensing agreement with PT Abadi Coatings Solusi, an Indonesian paint company. Shareholders approved the Scheme of Arrangement proposed to be made. It acquired Taubmans Paints (Fiji) Ltd. through its subsidiary in Fiji, Asian Paints (South Pacific) Ltd (APSP), acquired 9.2% shares in ICI India Ltd too and bagged the Ken Sharma award.

- In 2004, Asian Paints launched paint solutions for kids.

- In 2005, Berger International partnered with the Filipino firm Dutch Boy. The company has changed its name from Asian Paints (India) Ltd. to Asian Paints Ltd.

- In 2006, APICL’s new manufacturing plant at Baddi commenced commercial Production.

- In 2009, Asian Paints Ltd submitted the disclosure under Regulation 7(3) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations, 1997, to BSE. It appointed Shri. S Ramadorai as an Additional Director of the Company pursuant to Section 260 of the Companies Act, 1956.

- In 2010, Berger International Ltd Singapore (BIL), a subsidiary of Asian Paints Ltd, became a wholly-owned subsidiary of the Company. The company signed an MOU with Maharashtra Govt. to set up a Mega Project to manufacture Paints & Intermediate.

- In 2011, it formed a second Joint Venture with PPG Industries. The company’s subsidiary, SCIB Chemicals SAE, temporarily restarted the operations of its two plants in Egypt.

- In 2013, the company completed the acquisition of Sleek Group.

- In 2014, it entered into a binding agreement with ESS.

- In 2015, the company signed a Memorandum of Understanding (MoU) with the Government of Andhra Pradesh to set up a manufacturing facility for paints and intermediates in Vishakhapatnam District, Andhra Pradesh.

- In 2017, the paints company expanded its paint manufacturing capacity in Gujarat.

- In 2019, commercial production at the company’s Vishakhapatnam Plant commenced.

- In 2020, the company approved the Scheme of amalgamation of Reno Chemicals Pharmaceuticals & Cosmetics Private Limited (Transferor Company), a wholly-owned subsidiary of the Company, with Asian Paints Limited.

- In 2021, the company signed a Memorandum of Understanding with the Government of Gujarat, commencing the proposed expansion of the manufacturing capacity of paint from 130,000 KL to 250,000 KL and resins and emulsions from 32000 MT to 85000 MT.

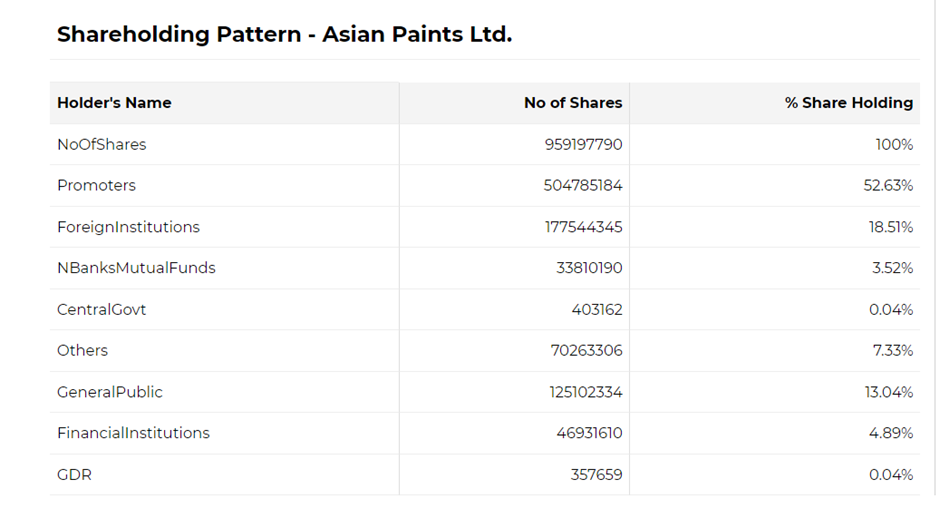

Asian Paints Shareholding Pattern

Scrutiny of the shareholding pattern of an organization is a vital piece of central examination. The shareholding pattern is a determinant of the stock’s market capitalization and is a sign regardless of whether the stock valuation is legitimate. Here, The shareholding pattern of of the company presents the Promoter’s holding, FII holding, DII’s Holding, and shareholding by the general public, central public, etc.

The Promoters hold half of the shareholding, followed by foreign institutions, General banks, financial institutions, Banks Mutual funds, central government, etc.

Asian Paints Financial Performance

Asian Paints Ltd is India’s largest, Asia’s third-largest, and the World’s ninth-largest paint organization, with a presence in 22 nations globally with 27 paint-producing offices overhauling customers in 65 nations through Berger International SCIB Paints Apco Coatings and Taubmans.

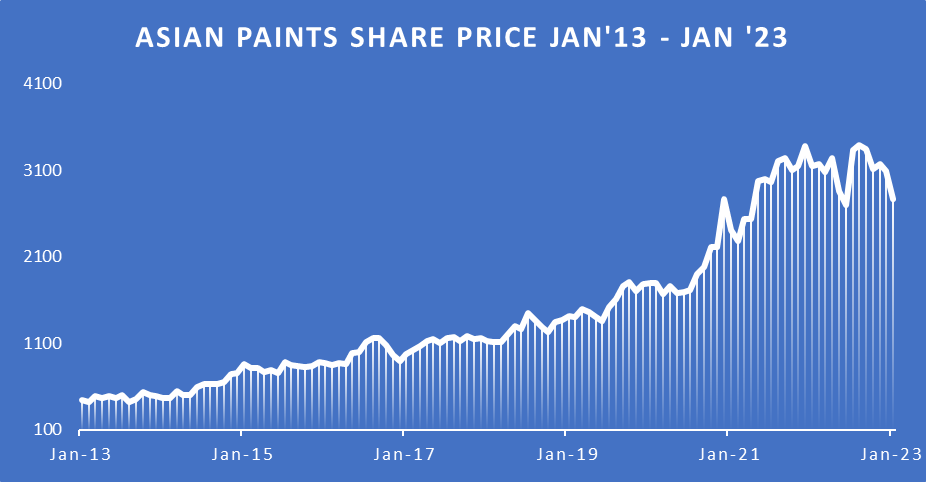

The shares of any stock are volatile and keep changing throughout the day owing to different factors ~INR. In January 2000, Asian Paints share was trading at ~INR 16. On 17 March 2021, the stock price was around INR 2,425. It means 15,056% returns over two decades, which does not include dividends. It has also been the only company to deliver a CAGR of 20% for six decades globally.

As of September 2020, the paints major held 39% of the overall industry. That’s twice the consolidated share of three of its nearest rivals Akzo Nobel, Berger Paints, and Kansai Nerolac. Its market cap in March 2021 was around INR 2.3 lakh crores. As of 10th February 2023, Asian Paints share price is ~INR 2807.15; The Market capitalization is ~INR 2.69 lakh cr.

Marketing Strategies

Asian Paints Embraced an inventive bundling that painted a brilliant future.

Paint used to get sold in tins. But, in 1945, the company dumped monster tins and began selling paint in minuscule parcels. This out-of-the-case bundling technique improved its sales speeding its distribution. Furthermore, with only 5 tones: black, white, red, blue, and yellow, the company earned ~INR 3.5 lakhs. By 1952, its yearly turnover was an incredible ~INR 23 crores.

The 73-year-old Paints brand is synonymous when you consider refurbishing or beautifying your home. Gattu RK Laxman’s incredible creation is a memorable brand mascot of its times. Then emerged with the ‘Mera Wala’ campaign. “The tagline became so popular that people would go to stores and ask for ‘mera wala blue or ‘mera wala green.’

It was the beginning of the Ogilvy & Mather and Asian Paints team, which shared unforgettable campaigns more focused on the home exteriors focusing on how the paints could keep the exteriors timeless. Their tagline, “Har Ghar Kuch Kehta Hai,” created a storm. They went from a simple paint company to a paint solution provider.

Later it launched its ‘Home Solutions’ offering painting services through a dial-in facility. With the launch of several initiatives like Delhi Beautiful Homes (The first ever ‘beauty contest for homes’) and the ‘Rethink Recycle’ campaign, The paint major found the ideal opportunity to move to luxury and superior segments.

It went through two rebranding exercises rejigging its brand portfolio, focusing on a few strong brands, neatly clubbed under verticals like exterior (Apex Ultima), interior (Tractor Emulsion, Royale, Royale Play), solutions (Ezycolour) and waterproofing (SmartCare), releasing campaigns accordingly by roping in celebrities.

From encouraging individuals to practice environmental safety to winding around brief promotion films on causing men to comprehend varieties to making intriguing and delightful narrating, such as ‘Homes Not Showroom’, to foraying into the first happy space. Throughout the long-term, Asian Paints has been making homes more joyful and invests wholeheartedly in amalgamating advancement and innovation with its item improvement program, advertising tricks, client support going past walls, and being Indian on a basic level, always.

Today, customers are familiar with ideas like outside, waterproof, etc. However, in earlier days, discussing different shades on offer was odd. Varieties, shades, and paint were far, and few, and the decision was passed on to the local home improvement shop to choose.

Conclusion

Asian Paints has forever been somewhat revolutionary. It exploited television ads to promote the brand. Its very first television ad circulated in 1984. Afterward, somewhere between 1998 and 1999, the company laid out community tasks and finished a site. Thus, it centers around being future prepared to stay aware of patterns.

The details shared above are based on the quarterly and annual reports of Asian Paints and are meant for information purposes only. However, we suggest doing your due diligence before you make investment decisions.

Disclaimer Note: The numbers mentioned in this article are just for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 24

No votes so far! Be the first to rate this post.