Humara Kal Humara Aaj

Buland Bharat Ki Buland Tasvir

Humara Bajaj Humara Bajaj

The song that captivated the entire country in the early 1990s set the tone for the future growth of the Bajaj group of companies. From manufacturing India’s best-selling scooters to becoming the most-valued NBFCs, the Bajaj group of companies has made remarkable strides in business and customer convenience.

In this article, we will analyze Bajaj Finance share price, which is a jewel in the Indian stock market and has set a benchmark for other NBFCs in the country to achieve operational excellence and shareholder value creation.

Let’s understand how Bajaj Finance rose to the top of the segment since its listing.

Bajaj Finance Company Journey

Bajaj Finance has an interesting history of starting up and fueling Indians’ growing aspirations in the early 1990s. The opportunity for a separate financing unit in the group was realized when the group’s auto division experienced high demand for its scooters, resulting in a six-month wait period in some cases. And people then were willing to pay a premium for a short wait period.

Sensing the growing aspirations and willingness to spend more, Bajaj Auto Finance Ltd. was launched as a two-wheeler financing company in 1987 to help people with financing needs.

The financing unit was registered with the RBI as an NBFC in 1991, allowing it to diversify into other financial products and capitalize on the country’s rising consumerism. By the decade’s start, Bajaj Auto Finance was not limited to financing two-wheelers. It expanded to three-wheelers, durables, property, and other spheres of customer’s life.

Bajaj Auto Finance crossed the ₹500 crore annual disbursement in 2000, and within six years, it doubled to ₹1000 crore. On 6th September 2010, Bajaj Auto Finance Ltd. changed its name to Bajaj Finance Ltd. to reflect its growing product basket.

And, there was no looking back for the company as it grew by leaps and bounds, reporting consistent growth in asset under management (AUM) quarter after quarter. At the end of FY23, Bajaj Finance recorded the highest-ever new loans booked, and AUM grew up to ₹2.47 lakh crores.

Bajaj Finance Business Company Analysis

Bajaj Finance is a leading NBFC catering to a diverse set of customers with a strong presence in both online and offline channels. With robust risk management procedures and portfolio monitoring framework, Bajaj Finance has the industry’s lowest non-performing asset (NPA) at 0.41% at the end of Q3FY23 and capital adequacy ratio (CAR) at 23%.

With a pan-India presence, including smaller towns and villages, Bajaj Finance has the most customer touchpoints, serving diverse customer segments. It offers the following loan basket:

- Consumer Lending: consumer electronics, furniture, digital products, e-commerce purchases, and daily spending financing

- Personal Loan: Offers loans to existing customer base and salaried individual

- SME Loan: Secured and unsecured loans to both business enterprises and professionals

- Rural Lending: It includes consumer B2B lending, personal loans, gold loans, retail deposits, and others

- Commercial Lending: Loans to established businesses, including auto component manufacturers, light engineering industry, specialty businesses like pharma, financial institutions, and mid-market companies.

- Loan Against Securities: Offers short and medium-term financing options against securities like shares, bonds, insurance policies, etc.

Deposits

Bajaj Finance also accepts deposits from retail customers and corporate clients and continues to grow the retail deposit segment in a calibrated manner. At the end of Q3FY23, the company’s deposit book swelled to ₹42,984 crores, an increase of 41% year-on-year. In FY22, the company’s deposit program got the highest credit rating, FAAA/stable from CRISIL and MAAA/stable from ICRA.

Housing Finance

The company also has a presence in the housing loan segment through a wholly-owned subsidiary- Bajaj Housing Finance Ltd. registered as a housing finance company. It offers home loans, loan against property, lease rental discounting, and developer financing.

Securities and Broking

Bajaj Financial Securities Ltd., the wholly-owned subsidiary, is registered as a stockbroker and depository participant with SEBI and started its operations in August 2019. It offers investment products and services to both retail and HNI clients, including margin trade financing. It’s the profit-making unit of Bajaj Finance and has generated ₹124 crores in revenue in FY22 and profit after tax of ₹17 crores.

Bajaj Finance Management Profile

Bajaj Finance Ltd. is led by Mr Rajeev Jain, the Managing Director, who has played a key role in transforming the captive auto financing company into a highly diversified NBFC in India. He joined the company in 2007 as a CEO and has since led the company. He has stellar experience managing consumer lending businesses and was associated with American Express and AIG.

Mr Sandeep Jain is the Chief Financial Officer who joined the company in 2008 to set up management accounting practices and has also played a key role in the company’s transformation journey. He is a Chartered Accountant from ICAI.

Mr. Fakhari Sarjan is the Chief Risk Officer responsible for overseeing the corporate governance and strategy for the entire risk management. Earlier, Fakhari managed multi-cultural and cross-functional teams at Barclays, USA. He is a management graduate from IIM Lucknow with a career spanning over 25 years.

Other key members in the management include Deepak Bagati (President of Debt Management Services), Deepak Reddy (President- Rural Business, Fixed Deposits and Investments, Insurance), and MM Murlidharan (Treasurer).

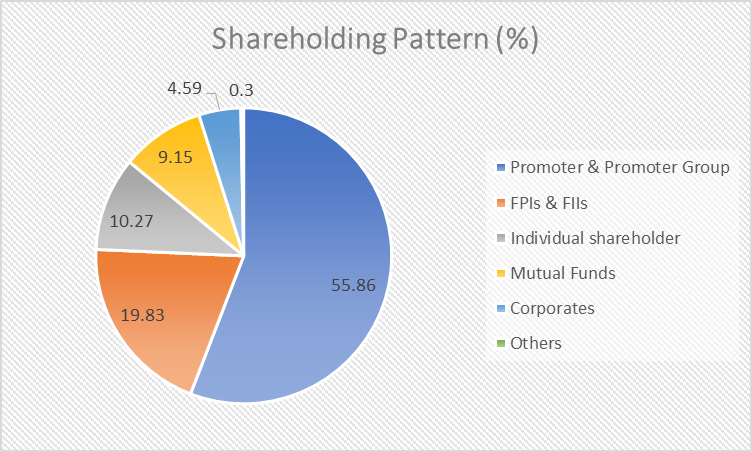

Bajaj Finance Shareholding Pattern

Bajaj Finance Financials

Revenue

In FY22, Bajaj Finance reported a total income of ₹31,640 crores, which is 19% higher compared to ₹26,683 crores in FY21. And, 9MFY23 total income for the company is ₹30,043 crores, which is 30.5% higher over the previous year’s corresponding period at ₹23,019 crores.

The company’s income from operations has grown at a CAGR of 34% in the last 15 years.

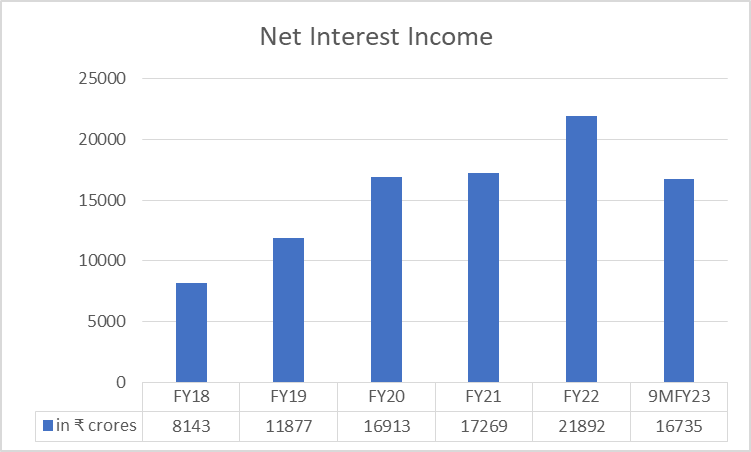

Net Interest Income (NII)

NII is an important metric for companies involved in the lending business, which is arrived at after deducting interest paid to depositors from interest income earned from borrowers.

Bajaj Finance’s NII in FY22 came in at ₹21,892 crores, which is 27% higher compared to ₹17,269 crores reported in FY21. In Q3FY23, the NII rose by 24% to ₹7,435 crores from ₹6,005 crores.

And, in 9MFY23, the NII of the company increased by 33.11% to ₹21,075 crores. In the last 15 years, NII has grown at a CAGR of 35%, indicating the strong operational performance of the business.

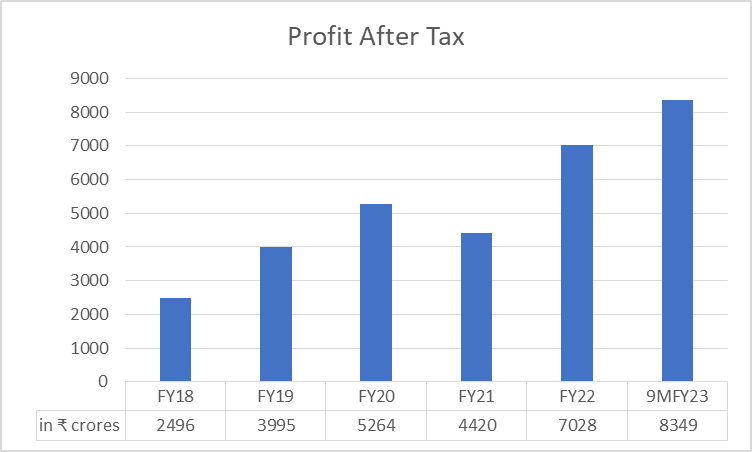

Profit After Tax (PAT)

In FY22, the company reported a PAT of ₹7,028 crores, higher by 59% compared to the previous fiscal at ₹4,420 crores. And, in 9MFY23, PAT increased by a whopping 82.51% to ₹7,452 crores from ₹4083 crores reported in the same period last year.

Bajaj Finance Key Financial Ratios

Non-Performing Asset

In FY22, the net NPA ratio improved by 7 bps to 0.68%. And in Q3FY23, it further improved to 0.41% from 0.78% reported in Q3FY22.

Capital Adequacy Ratio (CAR)

CAR represents the bank’s available capital against the risk-weighted credit exposure expressed as a percentage.

Bajaj Finance’s CAR is 23% as of 31 Dec 2022, against the minimum regulatory requirement of 15%. Higher CAR indicates that the lending institution could absorb any shock due to loan default without deteriorating the fundamentals.

Provision Coverage Ratio (PCR)

PCR represents the percentage of bad assets the bank or financial institution can provide from their funds. Bajaj Finance has a PCR of 64% as on Q3FY23.

Cost of Funds

For any company involved in the lending business, the cost of funds is the most tracked metric by investors to gauge future growth potential.

In Q3FY23, the cost of funds for Bajaj Finance was 7.14%, and the liquidity buffer stood at ₹12,758 crores. A high liquidity buffer will ensure the reduced impact of recent interest rate hikes on the cost of funds.

Operation Expenditure to NII

Bajaj Finance, through many industry-first steps and innovation in products, the offering has managed to reduce operational expenditure. In Q3FY23, operation expenditure to NII stood at 34.7%.

Bajaj Finance Share Price History

Bajaj Finance is the biggest wealth creator of the decade in the Indian stock market, delivering a return of 80% annually in the last 10 years until 2022. In 2010, its market capitalization was just over ₹1,100 crores, which has now grown to over ₹3.5 lakh crores as of 11th April 2023.

In the last 10 years, Bajaj Finance has issued a 1:1 bonus share once and has done a split in the 10:2 ratio. The company also pays annual dividends to its shareholders. In the last three years, Bajaj Finance paid ₹10 in 2020, ₹10 in 2021, and ₹20 in 2022 as dividends to its shareholders.

Bajaj Finance share price traded at around ₹60 levels in 2012 and touched an all-time high level of ₹7,862 on 11th Oct 2021.

Bajaj Finance Fundamental Analysis

Robust Balance Sheet

Despite the challenging macroeconomic scenario and rise in interest rates, Bajaj Finance has maintained its profitability metrics. In Q3FY23, NII grew robustly by 24%, driven by healthy growth asset under management (AUM). The company appears to be on track to meet guidance and deliver ₹52-53,000 crore of core AUM growth in FY23.

The profit after tax in the first nine months of FY23 surpassed FY22 levels. And the company has well managed to keep costs under control, and despite the growing business size, it has kept operational expenditure to NII close to 30% for the last few years.

Strong asset quality

Bajaj Finance has a remarkable asset quality with an NPA of 0.41% on that huge loan book. Also, Bajaj Finance is well capitalized (CAR) and above the prescribed limit of RBI, enabling it to absorb any shock in the balance sheet without deterioration.

This has helped Bajaj Finance to get the highest credit ratings for its deposits and debt papers by Indian credit rating agencies.

Strong growth momentum across all product channels

The omnipresence strategy has helped Bajaj Finance to spread faster compared to its peers and has recorded the highest-ever new customer addition and loans booked in Q3FY23. As it plans to go fully digital across products and services, it will help in wider reach and new businesses from the existing user base.

As of 31 December 2022, the AUM mix consists of Consumer (44%), Rural (14%), SME (18%), Commercial (16%), and Mortgage (8%). In Q3FY23, it added 3.14 million new customers, and the customer franchises stood at 66.05 million.

The housing finance segment is witnessing accelerated growth. As of 31st December 2022, AUM increased by 33% to ₹65,581 crores as against ₹49,203 crores on 31st December 2021.

The deposit book grew by ₹3562 crores in Q3FY23 to ₹42,984 crores, and the company aims to deliver 25% of the borrowings from deposits in the medium term.

Long Range Strategy (LRS)

Bajaj Finance is guided by its LRS framework, in which they have set its priorities and objectives. The framework includes the following:

- Ambition: To be a leading payments and financial services company in India. Dominate with 100 million customers with a market share of 3% of payments GMV, 3-4% of total credit, and 4-5% of retail credit in India.

- Strategy: To be an omnipresent financial services company dominant across all consumer platforms.

- Approach: To acquire customers and cross-sell across all consumer platforms.

Bajaj Finance Strategy To Grow

Bajaj Finance has set its objectives very clearly- to be among the top 20 profit-making companies in India and among the top 5 profit-making financial services companies in India. To achieve them, the company is focusing on the 5 blocks strategy.

- Products– Launching new product lines (CV, Agri, Auto, MFI, Emerging Corporates), new product innovations, and following megatrends.

- Geography– Launch all products in all locations and win UP, Bihar, and Northeast markets.

- Platforms- Dominate all platforms of consumer presence and generate 50% revenue from digital channels.

- Horizontal functions– Pursue operational excellence and deliver robust controls and compliance

- Subsidiaries: Leverage existing channels to ramp up businesses for subsidiaries and dominate respective industries.

Bajaj Finance has a lot of grounds to cover and capture the unexplored market. India’s total credit market is forecasted to grow from ₹149 lakh crores in FY23 to ₹237 lakh crores through 2027 at a CAGR of 12.4%.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Bajaj Finance established?

Bajaj Finance was established as Bajaj Auto Finance Ltd. in 1987 as a two-wheeler financing company.

How Bajaj Finance share price has performed in the last 10 years?

As on 11th April 2023, Bajaj Finance share price has grown at a CAGR of 49% in the last 10 years.

Is Bajaj Finance and Bajaj Finserv different?

Bajaj Finserv is the parent company of Bajaj Finance Ltd. and is focused on lending, wealth management, insurance, and asset management.

Read more: About Research and Ranking

How Long-term investing helps create life-changing Wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 9

No votes so far! Be the first to rate this post.