Sector rotation has been in the news lately. Everyone from the economic times, business wire, and the financial express to the NASDAQ, Forbes and others have shared their opinions on sector rotation in the last three weeks. If you are like us, we are sure you would like to understand it better.

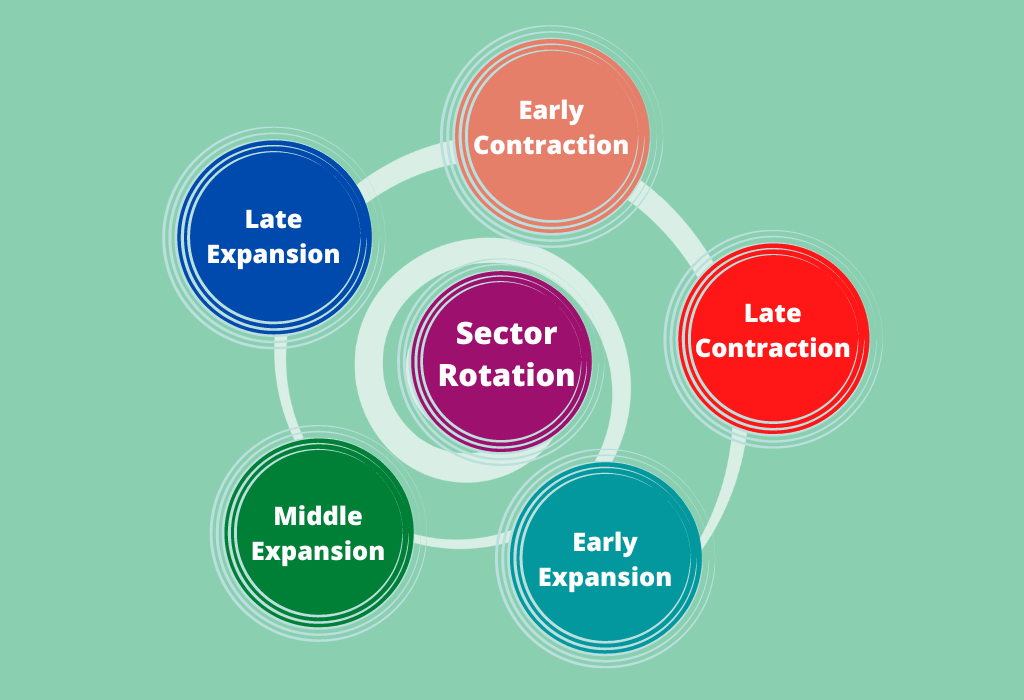

Let us understand sector rotation and its phases better

Identifying the right sectors and understanding the flow of money from one industry to another will help you swim through the stock market ocean. Sector rotation is that stock market wave that takes you happily to the shore.

Investopedia defines sector rotation as “the movement of money in stocks from one industry to another based on the next economic cycle is sector rotation.” For instance, steel industries faced turmoil in the late 2015s up to 2019, post which they saw a global boom. However, specific industries and sectors tend to outperform due to the change in long-term business cycles and the influence of economic cycles.

Business cycles reflect industrial fluctuations. Therefore, it can be a critical factor in evaluating and predicting the equity sector’s performance over a period. Any business cycle will have a period of stability, followed by extraordinary economic growth, slowdown, and recession. Typically, price stability follows a recession period, and the cycle continues.

The stock prices also reflect business cycles from peak to trough. This cycle is known as Sector rotation. The economy behaves in predictable cycles, so companies that dominate in some periods could fall in other business periods.

There are 11 sectors in the Indian stock market – Healthcare, Materials, Real Estate, Consumer Staples, Consumer Discretionary, Utilities, Energy, Industrials, Consumer Services, Financials, and Technology Sector.

Phases of a Typical Business Cycle

There are four distinct phases of a typical business cycle. Let us see what each means.

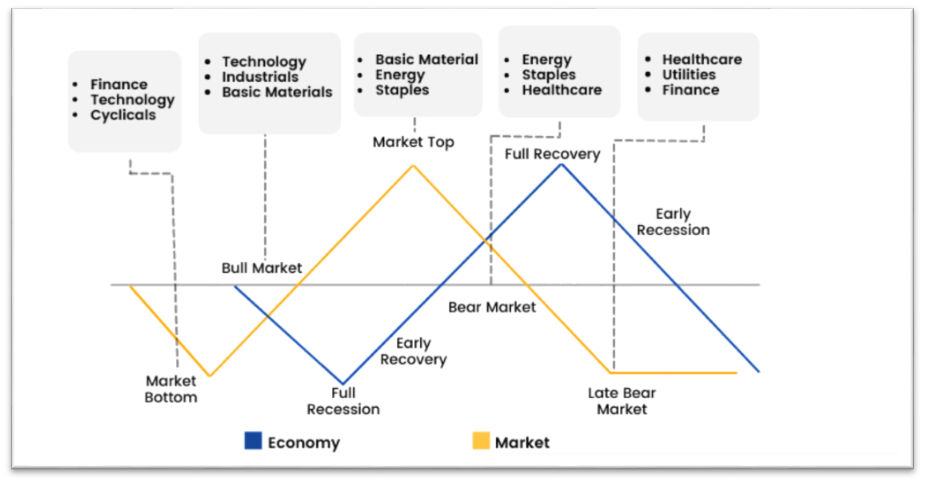

1. Early-Cycle Phase -> The Bounce from the Trough

Generally, the market finds a bottom in the short term and then recovers from those levels. It is considered a bounce-back in the market. This phase marks a change in investors’ sentiment from a negative to a positive, causing an acceleration in growth.

The central government generally manages such recessionary situations by easing the monetary policy and loosening the economy’s credit flow to improve the people’s purchasing power. As a result, it will increase the money supply circulating in the economy, boosting demand from consumer-related sectors and industries. As a result, business inventories are typically low during a recession until they see substantial sales growth.

Typically, healthcare, consumer staples, and consumer services are leading indicators in a recession recovery period as they see consumer demand before any other sector. As a result, these sectors generally outperform and are known as the most stable investment options and the least volatile, with limited downside risks in times of turmoil.

2. Mid-Cycle Phases -> The Bull Run of The Market

The Bull Run is the most prolonged phase in the stock market. The growth rates are stable and consistent, with plenty of economic credit to boost demand and increase profitability for most companies.

Such periods generally bring the best of most businesses. The growth rates are stable and consistent. The credit supply in the economy is going towards its peak. As a result, economic activity gains momentum, credit growth supports demand, and profitability for the companies is also healthy.

The high-risk companies tend to outperform the market in such a phase because the overall view of the economy is very bullish. Because of high credit flow and money supply, the consumer discretionary sector flourishes as people spend more money on things they want. Because of business expansion, industrial sectors thrive as they expand their facilities and capacities.

3. Late-Cycle Phase -> The Peak of A Bull Market

This is the phase where retail investors become greedy, and the market shifts from optimistic to euphoric. People start buying stocks without proper research as the stock market is on the run.

The emerging sectors and small and mid-cap companies suddenly start seeing inflows and participation from retail audiences, and that is where you need to stay cautious. The consumer discretionary sector generally signals to top out in the stock market.

4. Recession -> Emergence of a Bear Market

The market top is made, and we see selling pressure all around the street. The investor’s perception becomes negative as low sales mean low profits. A higher-than-average inflation rate indicates an excessive money supply in the market that needs central bank intervention. The recession-proof stock portfolio typically includes defensive sectors, such as consumer staples, utilities, and healthcare. These are essential commodities and tend to see continued demand even in recessionary conditions.

Sir John Templeton rightly said, “Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.”

Here is a snapshot of the sectors that outperform at different stages of the market sentiment

Benefits of Sector Rotation Strategy

A sector rotation strategy can help the investors reshuffle and rebalance their investments with the broader market outlook. Investors use a tactical asset allocation strategy to exploit the current market condition and shift money across sectors. As a result, they can overweigh specific outperforming sectors and under weigh underperforming sectors.

Given the stage and maturity of the bull market, you must identify the sectors and see the churn that happens through the process. Picking the right sectors at the different stages will allow you to earn alpha returns in the stock markets.

Remember, due diligence is a must before you choose an investing strategy. Want to get a customized portfolio? Subscribe to 5 in 5 Wealth Creation Strategy today and get started.

Read more: How Long term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.