Dividends are one of the best sources of passive income you can have. Businesses give their shareholders a share of the profits as payouts of their returns. When these companies generate profits, they reward their shareholders through dividends.

Dividend companies are those that generally pay regular dividends to their shareholders. These stocks are well-established and mature organizations with a proven history of distributing profits among their shareholders.

Companies pay dividends to shareholders after deducting all the expenses. One part of the final net profit is paid as dividends, and the rest is re-invested in the organization for future growth and expansion.

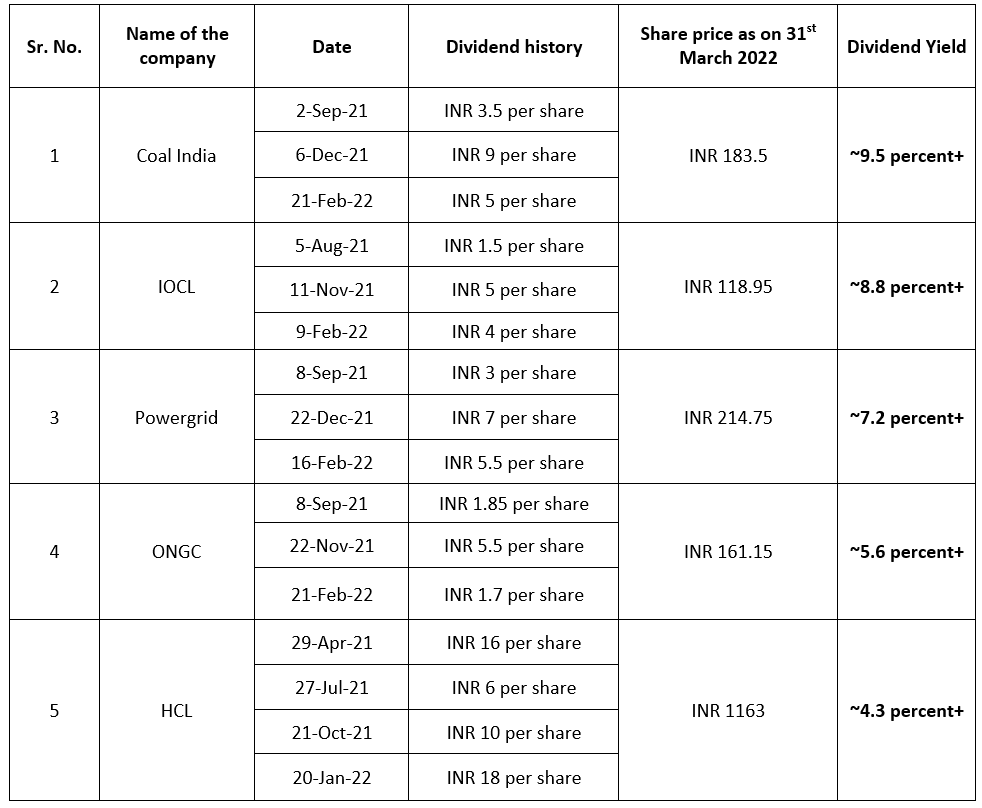

Here are five stocks that have given the highest dividend yield so far

Coal India:

Coal India Limited is an Indian coal mining (government-owned) and refining company. It is headquartered in Kolkata and is the largest coal producer globally. Historically, the company has an annual dividend yield of more than ~10 percent.

An interesting fact about Coal India Limited is its slogan – “We Survive if Nature Lives”.

Coal India Limited sells its offering through the fuel supply agreements (FSA) and the e-auctions. FSAs are longer-term arrangements with limited provisions for price variations and adoptions, whereas e-auctions most likely reflect the dynamic of increasing global prices quickly.

Indian Oil Corporation Limited (IOCL):

The IOCL is a government-owned company under the Ministry of Petroleum and Natural Gas. It is an Indian flagship oil company, so it is called the Energy of India. The company is into natural gas, petrochemicals, exploration, production, and renewable energy.

Indian Oil is the highest-ranked Indian Energy Public Sector Undertaking (PSU) in Fortune’s “Global 500” (Rank 212). The company wishes to be “A Globally Admired Company.”

Indian Oil expanded overseas through global subsidiaries in Sri Lanka, Mauritius, and the UAE. It aims to explore and expand further to become a global leader in the integrated energy business.

Hindustan Computers Limited:

The company was set up in 1976. The HCL group has 3 group companies; HCL Technologies, HCL Healthcare, and HCL Infosystems.

One of India’s first IT garage start-ups. Today, it is a global conglomerate with a long and exciting journey.

HCL is ranked #1 in India on Edelweiss ESG Scorecard for the year 2021. The company has strategically set high business standards by serving the client requirements in the most feasible and convenient method.

ONGC:

ONGC stands for Oil and Natural Gas Corporation Limited. The company began in the year 1955 and has grown ever since. It is owned by the Government of India and the Ministry of Petroleum & Natural Gas. One unique feature of ONGC is that it is fully integrated; to explore, and produce oil, gas, and other related oil-field services.

ONGC is considered one of the largest energy companies in India. The company provides almost 71% of the Indian domestic production surpassing many milestones over 60 years of its journey to fulfill the energy aspirations of India.

Power Grid:

Power Grid Corporation of India Ltd (PGCIL) is an electric power transmission company in the electric utility sector. Power Grid is the Principal Indian Company in this business.

Power Grid, a public sector undertaking, under the Ministry of Power. The company is into telecom, transmission, and consultancy. The company covers 90% of India’s interstate and inter-regional electric power transmission system.

The stock market exposes you to numerous stocks as an investor allowing you to invest and grow your money. Some stocks help you create wealth for the long-term, while others let you earn regular income as dividends. Your investment portfolio and its allocation depend on your financial goals.

We have just picked five stocks that have given high returns so far. These companies are investor favorites for those who want a steady passive income. Investing in dividend stocks allows you to add an extra income stream. Don’t forget to do your research before investing in financial markets, as they are always subject to market risks.

Disclaimer: Information mentioned in this article is for educational purposes. Please do not consider it a recommendation to buy/sell/hold from Research & Ranking.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.