Have you seen the web series Scam 1992? Do you recall how Harshad Mehta’s association with Pranav Seth began? It is when Harshad Mehta asked him to join him as a partner to make a fortune trading penny stocks.

The world of penny stocks may seem like fun. You may have a chance to make big money in a short period by trading in them; however, there are higher chances you may lose all your money quickly without getting out of the investment too. This blog will focus on what penny stocks are, a few in India, and the risks of investing in penny stocks.

What are Penny Stocks?

Penny stocks are classified as those that trade below ₹10 in India. The stocks have a very low market capitalization and are from companies with poor fundamentals.

The stocks are speculative and primarily illiquid, barring the few big names. For example, shares of Vodafone Idea are trading at less than ten and are classified as penny stocks; however, because it was once a household name in the Indian telecom industry, it has a healthy trading volume.

Investing in penny stocks can be risky due to wild price swings and getting locked in upper and lower circuit limits, making it difficult to exit the investment.

Can Penny Stocks be Considered Small Caps?

Shares with a market capitalization of less than ₹5,000 crores are classified as small-cap stocks. But, barring Vodafone Idea and Suzlon, most of the penny stocks in India have a market capitalization of a few hundred crores to less than a hundred crore. So, they can be classified as microcaps and nanocaps.

Microcap firms have a market capitalization of ₹100-500 crores, while nanocap firms have a market capitalization of less than ₹100 crores.

Penny Stocks in India

Investing in the right stocks is always rewarding in the long term, and this even stands with penny stocks. The following are the best multibagger penny stocks of the last few years and are no longer considered penny stocks.

Penny Stocks in India – That Grew

- Morepen Laboratories

- Eros International Media Ltd

- Indian Overseas Bank

- South Indian Bank

- Shree Renuka Sugars Ltd

Morepen Laboratories

The makers of Burnol, the stock of Morepen Laboratories, used to trade around ₹3 in 2013 and have rebounded since then. It touched an all-time high of ₹75 in July 2021. As of 17th May, Morepen Laboratories is trading at ₹26.2 and has had a CAGR return of 25% in the last ten years.

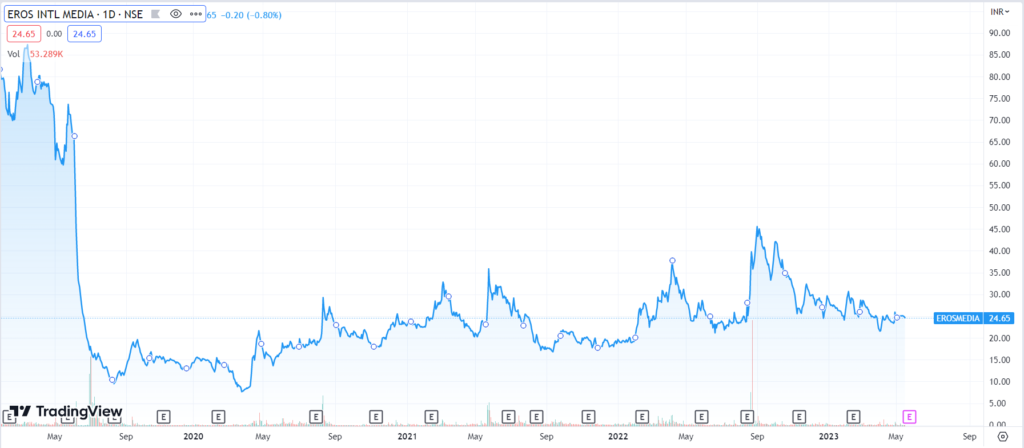

Eros International Media Ltd.

The stock of the well-known Indian motion picture production and distribution company, Eros International, is trading at ₹24.6 as of 17th May 2023. It was one of the leading stocks in the entertainment space, but sustained losses in operations resulted in a slide in stock prices. From a high of ₹643 recorded on 20th July 2015, the stock reached a low of ₹7 on 24th March 2020. Since then, the stock’s price has remained volatile and made a high of ₹47.80.

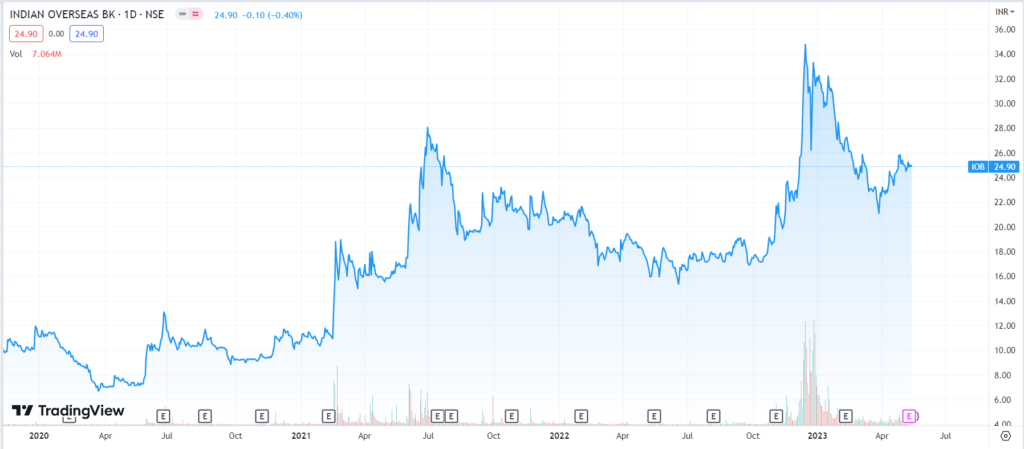

Indian Overseas Bank

Plagued by high NPA ratios and losses, the public sector bank was once one of the worst-performing stocks in the Indian banking sector. On 18th March 2020, the stock of IOB hit its lowest level at ₹6.05.

Following the government’s capital infusion and book cleaning, the bank’s financial performance improved, increasing the price of IOB stock. The stock of IOB is currently trading at ₹24.9 as of 17th May 2023. Its 52-week high level is ₹37.6. The last three-year CAGR return is 52%.

South Indian Bank Ltd

Delayed financial recovery, higher slippages, and weak coverage ratio resulted in the South Indian Bank stock nosedive, reaching a low of ₹4.80 in March 2020 and continuing to trade below ₹10 for over two years.

Improvement in financial performance resulted in the stock of South Indian Bank recovering and is currently trading at ₹16.90 as of 17th May 2023. It made a 52-week high of ₹21.8 on 15th December 2022. In the last three years, the stock price CAGR is 49%.

Shree Renuka Sugars Ltd

Shree Renuka Sugars Ltd.’s stock is one of the penny stocks that turned multibagger. The Shree Renuka Sugar Ltd stock climbed higher due to the Government of India’s favorable Ethanol policy, improved sugar exports, and a financial performance turnaround.

The stock reached an all-time low of ₹3.25 on March 24, 2020. It is trading at ₹42.85 as of May 17th, 2023, with a 52-week high of ₹68.8. The three-year CAGR return on the price of stocks is 112%.

Understanding the Risks: Exploring Downsides of Investing in Penny Stocks

As a small retail investor, if you are considering some penny stocks to buy, you should be aware of the following risks:

Extreme Price Volatility

Penny stocks, known for their speculative trades, are prone to wild price swings and rapid, significant fluctuations. When such stocks get locked in upper or lower circuit limits, it can pose difficulties in exiting the investment.

Lack of Liquidity

Barring a few big names, penny stocks are primarily illiquid, meaning there are few buyers or sellers or traded in much less quantity in the market due to their low price and poor fundamentals. As a result, often, it gets difficult to sell penny stocks in the market due to a lack of buyers.

Lack of Historical Data

Penny stocks inherently carry higher risks due to limited historical data and information available in the market. In addition, these companies often have dubious pasts, need proper financial record-keeping, and operate without a well-established management team. As a result, investing in penny stocks exposes investors to the risk of sudden bankruptcies or abrupt termination of trading activities.

Price Manipulation

The low price of penny stocks often invites manipulative practices, with operators artificially manipulating the stock price through high trading volumes, attracting small retail investors. However, once the price reaches a certain threshold, these operators dump their entire holdings, causing an abrupt crash in the stock price. It leaves small retail investors with little to no time to exit their investments, making them vulnerable to significant losses.

One example is the Gamestop stock, whose prices were driven unnaturally high, attracting investors. However, once it reached a threshold, the buyers turned sellers. It led to a price crash, leaving smaller investors suffering massive losses.

Factors to Check While Considering Buying Penny Stocks

You must know that not all penny stocks turn into multibaggers. However, predicting which stock will grow is impossible. However, if you are looking to invest in such stocks, then you must check the following factors:

Price Behaviour

You must check whether the stock is operator-driven or has healthy trading volume during market time. In addition, you should be cautious if the stock price is often locked in upper or lower circuit limits. Also, check if the price momentum is becoming stronger or not.

Changes in the Business

It would be best to look for the business’s revenue sources. How much the company earns from its business operations, whether there are any changes in the company management, what it is, its future goals, etc.

Shareholding Pattern

Check out the shareholding pattern of the company. Understand who the promoters and investors are in the company and whether the promoter is increasing or decreasing their stake. Understand if their shares are pledged or not.

Other factors like the company’s website, profitability ratios, competitor analysis, and the market it operates in should be checked before investing in penny stocks.

Should You Invest in Penny Stocks?

Penny stocks are considered high-risk investments. Therefore, investing in penny stocks should be done only after thoroughly researching the company and its financials. When considering investing in a penny, allocate a tiny portion of the portfolio towards penny stocks. It must be an amount you can afford to lose while considering the risk-reward ratio.

However, always select a company that has a proven business record and opt for long-term investment rather than eyeing to make quick money from short-term price fluctuations. It helps to mitigate the losses and increases the chances of getting the best multibagger penny stocks in India.

(The opinion expressed in the Article is the author’s opinion and shall not be considered as the opinion of Equentis Wealth Advisory Services Private Limited.)

Disclaimers:

1. The securities quoted are for illustration purposes only and are not recommendatory.

2. This Article is for education/information/knowledge purposes only and shall not be considered a recommendation or investment advice.

3. Investments in securities markets are subject to market risks. Read all the related documents carefully before investing

4. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are penny stocks?

Penny stocks are low-priced, have a low market capitalization, and trade for less than ten rupees in India.

Is investing in penny stocks risky?

Investing in penny stocks is risky due to extreme price volatility, lack of liquidity and historical data, and higher risk of price manipulation.

How to find good stocks in India?

Companies with an economic moat, sustained revenue from operations, and an exemplary management team may have a higher chance of growing large enough to grow in India in the long term.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 11

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/