Have you ever heard of “Coffee Can Investing?” If not, I’m sure you’re considering consulting an economic glossary or hiring an economist to help you understand this jargon.

Let us simplify the term Coffee Can Investing for you. Did you know that even an animal as strong as a mountain Lion hoards food under dried leaves and debris for future use? Or you must have seen your mother hiding money in rice containers to meet possible contingencies?

You might be surprised that we have been practicing the Coffee Can Investing strategy for ages. But we were unaware of its implication in growing our wealth.

Brief History of Coffee Can Investing

Coffee can investing is a popular investment strategy in the United States. In 1984, American investment manager Robert G. Kirby coined the term. He was inspired by a common practice in Old West America before the advent of banking.

For decades, coffee cans were used to store valuables and cash hidden under mattresses. The underlying thought was to be future-ready. The reserves would aid people in traversing turbulent economic times.

Another intriguing story surrounds the origins of the Coffee Can Investing strategy. One day his client’s widow approached Robert Kirby, requesting to add her late husband’s shares to her portfolio; her husband was an ardent follower of Robert Kirby’s financial advice to buy and hold stocks.

The returns on shares of Xerox Corporation, then Haloid Photographic Co., astounded Robert. Despite being managed by a top investment manager, his client’s wife’s portfolio was valued at $8,00,000 less than his. It prompted Robert to conclude that buying and then patiently holding stocks for considerably extended periods is the key to massive wealth generation. His Coffee Can Investing technique was based on his hypothesis.

What is Coffee Can Investing?

Are you someone who puts off buying groceries till the last item finishes? If yes, then coffee can Investing can be your best investment strategy!

So the Coffee Can Investing strategy works like this. You purchase shares and leave them untouched for an extended time. There is no need to keep track of their market performance regularly. After a significant period, say 10-12 years, you can expect massive returns.

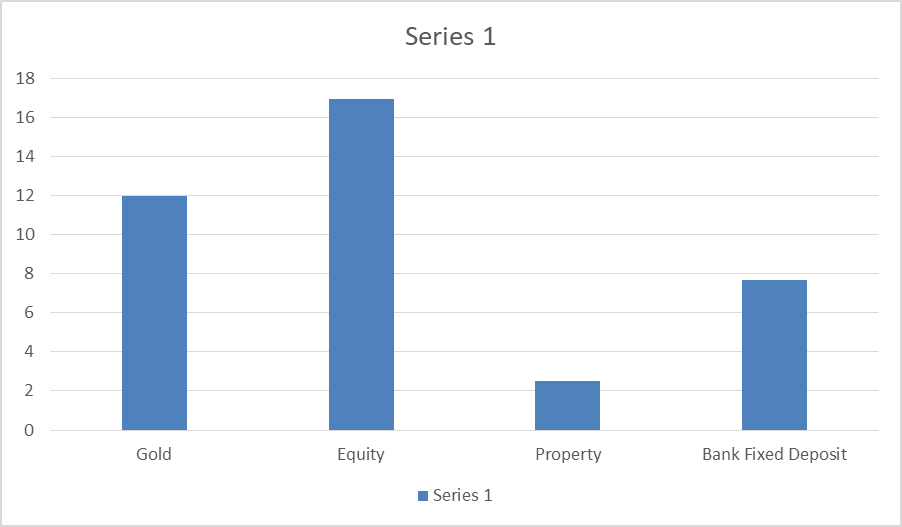

Coffee can investing is comparable to long-term investment that uses a buy-and-forget methodology. In India, we prefer long-term investments in tangible assets, such as gold or real estate. Given the rapidly changing economic scenarios, the momentum for this investment strategy in the equity market is also increasing.

Saurabh Mukherjea, in his book “Coffee Can Investing: the low-risk road to stupendous wealth,” reinvented the strategy for Indian markets. He is the founder and Chief Investment Officer of Marcellus Investment Managers and has invested more than 15 years in equity markets. But is Coffee Can Investing just buying and long-term holding any stock? No, you must apply a few checks to filter the right stocks.

What Pre-Checks to be Applied When Choosing Stocks For Coffee Can Investing?

You have to keep 10-15 stocks on your radar that qualifies the following parameters-

Market Capitalization

The Market Capitalization of any company refers to the company’s market value. It is calculated by multiplying the number of outstanding shares by the price per share. Let us consider a case where – the cost of a company’s share is Rs. 20. No. of Outstanding shares as 100. Then, the Market Cap of the company would be Rs. 2,000/-

Companies with larger market capitalizations are considered safer because it is easier to gather reliable information on large-cap companies. So, the first filter for choosing your stocks for Coffee Can Investing is a minimum Rs. 100 Crore market cap. There are approximately 1500 companies listed in stock markets with a market cap of more than Rs. 100 Cr.

List of 5 Companies with a market cap of more than 100 Crore

| Company | Market Cap (crore) |

| EKI Energy | 3906.75 |

| Nestle India | 192017.23 |

| Tips Industries | 2371.63 |

| Indian Energy Exchange | 13349.74 |

Return On Capital Employed (ROCE)

ROCE is a financial yardstick to measure the company’s return on investment. This financial indicator tells you about a company’s profitability and capital efficiency. In simple terms, ROCE tells you the gain earned by the company per Re.1 of capital invested (Equity + Debt). Higher the ROCE, the stronger the profitability of the company. Then, we must look for companies consistently generating a Return on Capital Invested (Pre-Tax) of 15%.

List of Top 5 companies with the highest ROCE

| Company | ROCE | Industry |

| Colgate-Palmolive(India) | 126.5 | FMCG |

| Hindustan Unilever | 119.2 | FMCG |

| Castrol India | 107.1 | Oil and Gas |

| Britannia Industries | 59.7 | FMCG |

| Tata Consultancy Services | 55.9 | Infotech |

If you are wondering why the 15% ROCE criteria is vital for the Coffee Can Investing strategy. Because it is the least needed to beat inflation. It is calculated by adding the risk-free return (conservatively set at 8%) and the equity risk premium (set at 6.5 – 7%). If the company is in the banking industry, a loan growth rate of 15% is required, in addition to a ROCE of 15%. It reflects the institution’s ability to lend throughout the business cycle.

Goodwill of the Company

The company must be in business for at least 10 years with a healthy state of financials. This indicator of shortlisting stocks for Coffee Can Investing gives you a positive sentiment that the company is resilient even during a downturn.

Year-on-Year Revenue Growth

Here, you must filter companies that have registered at least 10 % revenue growth over the past 10 years. Now, the obvious question is, why 10%?

The 10% revenue growth benchmark in the “Coffee Can Investing strategy” is calculated on the inflation-adjusted 10-year average nominal GDP growth rate (i.e., 13.8%). Because many companies failed to meet this criterion, a conservative growth rate of 10% has been set.

Strong Moats/ Competitive Edge

According to the Coffee Can Investing Strategy, you should try investing your money in companies with solid economic MOATS. Doing so will ensure long-term viability and profitability when you sell your shares.

Rewards of Coffee Can Investing Strategy

Save Transaction Costs

You save a lot of transaction and brokerage costs when you use the concept of Coffee Can Investing. When you churn your portfolio in equity investing, trading transaction costs consume a large portion of your return.

| Stock Exchanges | Transaction/Turnover Fee |

| National Stock Exchange (NSE) | 0.00325% of the total traded amount |

| Bombay Stock Exchange (BSE) | 0.00275% of the total traded amount |

| SEBI | 0.0002% of the total traded amount |

No Rebalancing of your Portfolio Required

When you are an active investor, you must stay involved and updated with the events in the equity market. Depending on the market trends and potential future threats, you may keep rebalancing or realigning your investments with your financial goals.

However, with coffee can investing, you can enjoy your morning coffee without worrying about market indices or the country’s economic growth. Works great for busy professionals and no finance experts.

Low-Risk Investment

In Coffee Can Investing, if you invest for at least 10 years, your probability of beating the Nifty returns is relatively high. The capital risk is proportionately reduced as the market volatility over a long period is low.

Risks of Coffee Can Investing Strategy

Lack of Patience in Investor

Not every investor has the mental strength to watch his investments plummet in a bear market. It is critical in Coffee Can Investing that the investor has the patience to see the investment through for 10-15 years. Most investors end up panic selling and losing their entire investment.

Lack of Expertise in choosing the Right Stocks

If you believe making significant returns from Coffee Can Investing requires luck, you should reconsider your strategy. Building the right portfolio requires a scientific approach and in-depth market analysis. When you lack the required skill, the chances of making a loss get higher.

The potential threat of losing the competitive edge

The company you trusted to survive market volatility based on its MOAT may become obsolete after a long period. You can never overcome the uncertainties and the inherent risks of investing in the equity market.

Key Takeaways

Coffee Can Investing is an effective wealth-building tool if you know how to pick the winning stocks and then forget about them. You can even outperform the benchmarks with disciplined investing and stock selection.

When you invest your funds in the long term, the power of compounding plays a magical role in multiplying your returns manifold.

Disclaimer Note: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold from Research & Ranking. The company shall not be liable for any losses that occur.

Read more: About Research and Ranking

FAQs

What is better, Coffee Can Investing or Index Funds?

Even though the fees are low, index funds require more active management than Coffee Can Investing funds. As a result, index funds are more expensive.

What is better, Coffee Can Investing or Mutual Funds?

Your time horizon and market knowledge will determine the answer. Choose mutual funds if you want fund managers to bear the burden of profit generation and don’t have time to wait. Be prepared to pay exorbitant fees, however.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.