This was the final full union budget of the Modi 2.0 government before the 2024 general election. And, in this Union budget 2023-24, the government attempted to please the common man by providing more cash in hand to the middle class while maintaining a strong sense of fiscal prudence to achieve higher GDP growth.

Let’s look at the budget proposals and assess the impact of the union budget 2023-24 on the Indian economy.

Top 10 Key Announcements in Union Budget 2023-24

- Aims to achieve fiscal deficit target of 5.9% in FY24, compared to 6.4% in FY23

- Expecting GDP growth of 6-6.8% in FY24, slightly lower than the projected 7% GDP growth in FY23.

- Increases capital expenditure by 37% to ₹10 lakh crores in FY24.

- Proposes ₹2.4 lakh crores capital outlay for the railways in FY24

- Raised education budget to ₹1.13 lakh crores and health budget to ₹89,000 crores in FY24

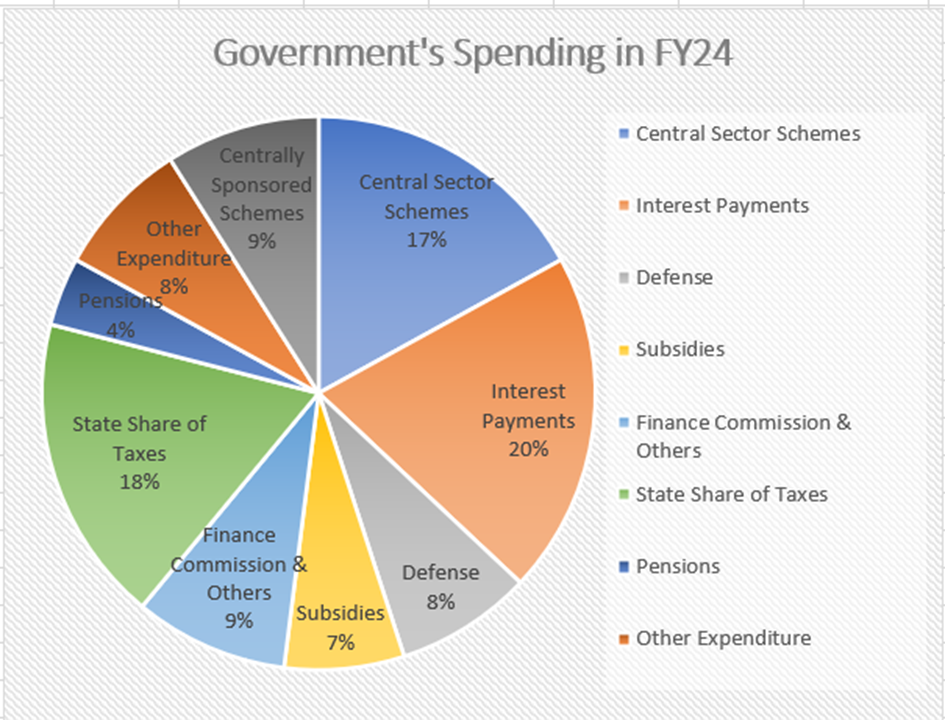

- The defense budget rose 13% over the previous year to ₹5.94 lakh crores.

- Affordable housing gets boost of ₹79,000 crores in FY24, 66% higher than previous year

- To revive 50 additional airports, heliports, aerodromes, and advanced landing grounds to boost regional air connectivity

- The new tax regime would eventually be the default tax option. The FM rationalized the income tax slabs. Income tax rebate on income extended to ₹7 lakhs in the new tax regime.

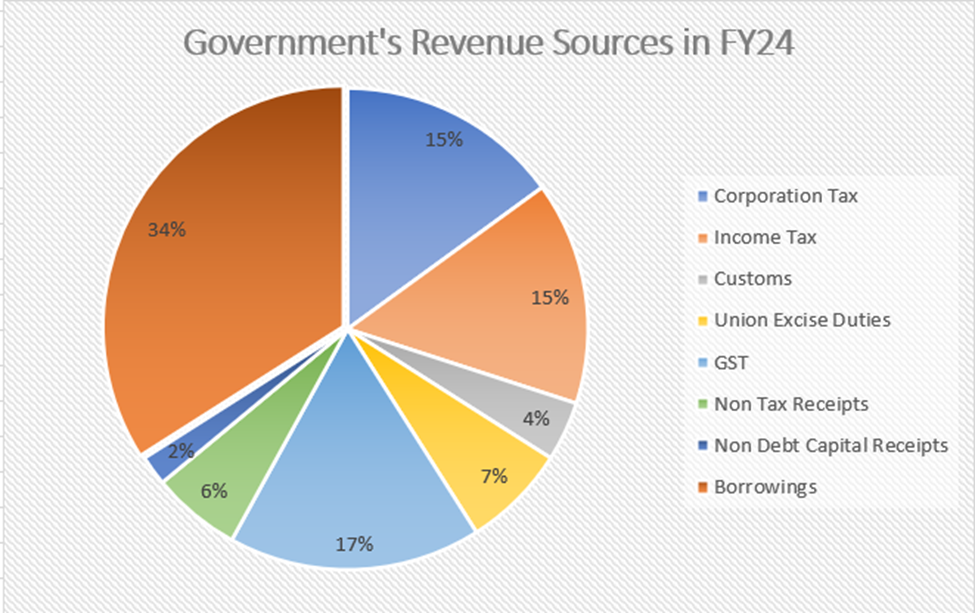

- Total revenue receipts is expected at ₹26.13 lakh crores in FY24, versus ₹23.48 lakh crores in FY23

Impact of Union Budget 2023-24 on the Indian Economy

This is an important year for the Modi 2.0 government as it is trying hard to keep the Indian economy insulated from global shocks and growth momentum intact.

Through proposals made in the union budget 2023-24, the government is focusing heavily on capital-based investment instead of consumption-based economic activities to keep the growth momentum intact for a longer time.

Capex outlay of ₹10 lakh crores

The government is spending 3.3% of its GDP in FY24, which has increased from ₹2.5 lakh crores in FY16. The massive jump in the government’s CAPEX outlay in infrastructure, clean energy, and agriculture will multiplier the economy and push for more private investments. It will help create jobs, scale up industries, and create new business opportunities.

Railway’s ₹2.4 lakh crore capital outlay

This is the government’s largest-ever capital outlay for railways, nine times larger than the outlay provided in 2013-14. The funds will be used to increase the production of Vande Bharat coach sets, modernize railway tracks, and renovate key stations nationwide. The increased investment will increase business opportunities for EPC and railway consulting firms such as RITES, IRFC, L&T, KEC, and others.

Defense got an allocation of ₹5.94 lakh-crores

The allocation is 1.5% higher than the FY23 revised estimate of 13% compared to the budgeted estimate. As per the budget paper, ₹1.62 lakh crores have been set aside for capital expenditure, including purchasing new weapon systems, arms, and other military hardware. Coupled with the “Make in India” initiative, increased defense spending will likely benefit companies BEL, Bharat Forge, Solar Industries, and other defense stocks.

Changes in Income Tax Slab Rates

The government rationalized income tax rates under the new regime to ₹7 lakhs from ₹5 lakhs. Also, it introduced a standard deduction of ₹50,000 under the new tax regime, meaning an income of up to ₹7.5 lakhs is tax-free under the new regime. And, for people earning more than ₹5 crores, the highest surcharge rate under the new tax regime was reduced to 25% from 37%, effectively bringing down the tax rate to 39% from 42.4%. The revision will impact government finances by up to ₹35,000 crores, likely to support consumption demand and personal savings.

Impact on Core Sectors of the Economy

Coal, crude oil, natural gas, refinery products, fertilizers, steel, cement, and electricity are from the core sectors and account for 40.27% of the weight of items included in the Industrial Production Index (IIP). Therefore, the quarterly performance of these sectors assists the government and rating agencies in estimating GDP in advance.

Cement: The increased level of capital expenditure, a 36% increase in allocation to road transport and highways to ₹2.7 lakh crores, and spending in the affordable housing segment in FY24 are all positive for the infrastructure sector. It will increase demand for all cement companies, including Shree Cement, Ultratech Cement, ACC, Ambuja, and others.

Steel: Although no specific announcements for the steel industry were made in the Union Budget 2023-24, the increase in CAPEX will directly benefit the steel industry. Massive investments in infrastructure, railways, airports, and ports will boost domestic consumption. In the short term, the increased allocation for Jal Jeevan Mission to ₹70,000 crores benefits pipe manufacturing companies.

Electricity: In the union budget 2023-24, the government has prioritized investments in the renewable energy sector, providing support of ₹35,000 crores towards net zero emissions and energy transition and ₹20,700 crores for the construction of a transmission line for evacuating 13 GW renewable energy from Ladakh. The move will directly benefit energy transmission and green energy companies.

Agriculture: With ₹1.25 lakh crores allocated to the Department of Agriculture and Farmers Welfare in this union budget, the agriculture sector received a significant boost. Furthermore, the fertilizer subsidy bill is estimated to be ₹1.75 lakh crores, which is expected to benefit fertilizer stocks such as Rashtriya Chemical and Fertilizers, National Fertilizers, and others. Furthermore, with the government’s increased emphasis on incorporating technology into farming processes, Mahindra & Mahindra, Escorts are expected to be among the primary beneficiaries.

Conclusion

With the union budget 2023-24 focusing on increased infrastructure spending, the Make in India initiative, and sustainable growth themes, India will likely remain a bright spot on the global map. In addition, the budget demonstrated the government’s remarkable maturity in handling finances and moving ahead on fiscal consolidation by making all efforts to woo the common man in India before the next general election without doling out freebies.

FAQs

What is the size of the Union Budget 2023-24?

The total size of the Union Budget 2023-24 is ₹45.03 lakh crores.

How much is the government borrowing in FY24?

As per Union Budget 2023-24 document, the government is borrowing ₹17.87 lakh crores from the market.

Is the government discontinuing the old income tax regime?

No, the government is continuing the old tax regime (with deductions) but is making the new tax regime a default option for income taxpayers.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.