Amidst the uncertain economic environment and volatile market conditions, the rising trend in the global wealth level is surprising, and so is the distribution of wealth across individuals and regions.

The global wealth was estimated at $463.6 trillion at the end of 2021, an increase of 9.8% compared to 2020 global wealth surpassing the annual average of +6.6% since the beginning of the century. Credit Suisse’s Global Wealth Report 2022 shows that global wealth may increase by $169 trillion or 36% by 2026, while the wealth per adult could pass $100,000 by 2024.

The report gives essential insights into global wealth growth and helps to understand the wealth distribution across regions and different income classes, which we will cover in this blog article.

Global Wealth Report 2022

Credit Suisse’s Global Wealth Report 2022 provides a detailed outlook on the available global household wealth, the impact of the coronavirus pandemic, and the Ukraine war on global wealth creation.

Credit Suisse’s report is divided into four segments- global wealth level, wealth distribution, wealth outlook, and country experiences.

Let’s look at the key trends in each segment.

Global wealth levels

- The global wealth level at the end of 2021 totaled $463.6 trillion, a growth of 9.8% or $41.4 trillion compared to the previous year. In 2020, despite the pandemic wreaking havoc on global economic growth, global household wealth rose by 7.4%.

- Average wealth per adult rose 8.4% or $6,800 during 2021 to reach $87,489. It is nearly three times the level recorded at the turn of the century.

- Region-wise, only North America, China, and India recorded double-digit growth in average wealth per adult in 2021. India recorded a 10.1% growth in average wealth per adult to $15,535, while China’s average wealth per adult is $76,639.

- In 2021, financial assets contributed most to the increase in total global wealth. In addition, millennials and Gen X added the most wealth to their portfolio between 2019 and 2022.

Global wealth distribution

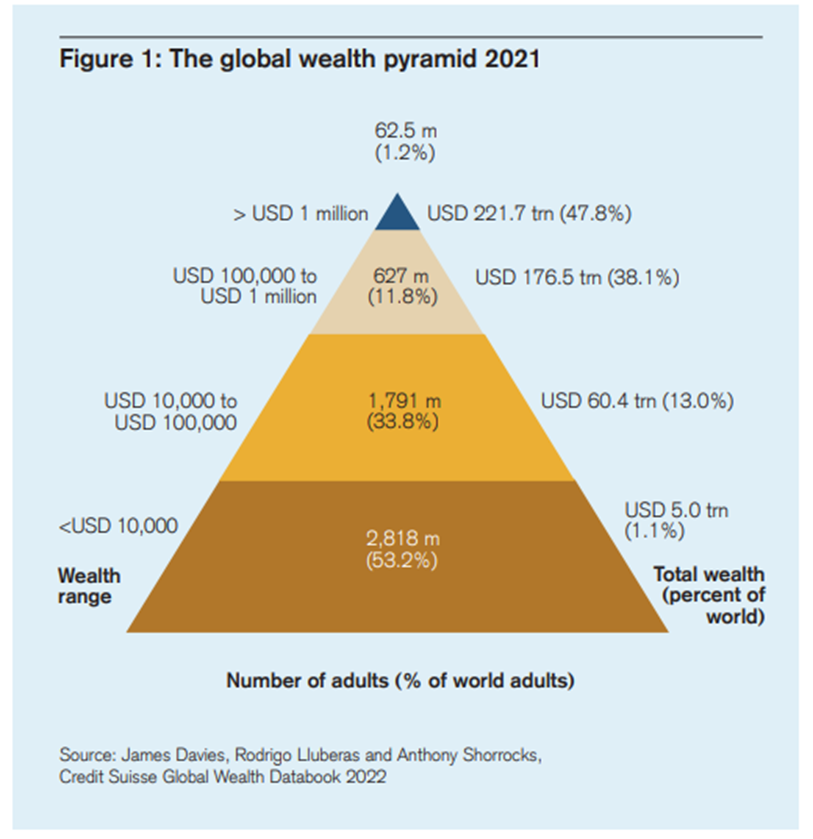

- Rising inequality in wealth distribution is the key highlight in this segment. The wealth share of the top 1% rose to 45.6% in 2021 from 43.9% in 2019.

- 53% of the world’s population, roughly 2.8 billion individuals, will have wealth below $10,000 in 2021. The next segment- the middle segment with wealth ranging from $10,000- $100,000 witnessed the most significant rise in this century, with total size going up from 504 million in 2000 to 1.8 billion at the end of 2021.

- The upper middle segment, with wealth ranging from $100,000- $1 million too, witnessed a rise in size this century, from 208 million 627 million. In the middle and upper-middle segments, China and India dominate with 38% and 9% in total membership.

- India’s median wealth from 2000-2021 went up from $1,005 to $3,295, showing an average annual growth rate of 7.3%, the second-highest among all countries. On the other hand, China recorded a 12% average annual growth rate.

Wealth Outlook

- The Russia-Ukraine war and global inflation paint a grim picture of wealth creation over the next few years, and expect a nominal increase of 36% or $169 trillion by 2026.

- Low and middle-income countries are expected to contribute the most to global wealth growth over the next five years, with 42% growth.

- The share of global adults having wealth less than $10,000 is likely to fall to 46% in 2026 from the current 53%. And the middle-income segment is expected to expand by 4% to 38%.

- Over the next five years, India is expected to double the count of millionaires to 1,632, narrowing the gap with other leading economies.

Country experiences

- In the US-Canada region, the global financial crisis, subdued recovery of economic activity, the coronavirus pandemic, and inflation resulted in uneven wealth growth during the last decade. While US citizens have the highest share of financial assets in their portfolios, people in Canada prefer non-financial assets.

- Covid-19 and lockdown factors affected the China-India region the most but were quick to recover from losses. While China is reaching the average global wealth level, India is far below the global mean. The composition of financial assets differs significantly between the two countries, with the average Chinese having a 44.7% share of financial assets in their portfolio. At the same time, the figure is 23.2% in India.

- The mean wealth growth per adult in France and the UK slowed during the last decade. However, between 2000 and 2021, wealth growth in both countries averaged around 3.9% per year. Every region provides a mixed trend due to the economy, population mix, and other factors.

How will most adults become millionaires by 2026?

Some striking features recorded in the global wealth report by Credit Suisse are the higher share of financial assets like stocks and mutual funds in the composition of wealth per adult in all developed economies and the contribution of financial markets in wealth creation.

According to a McKinsey study, the global balance sheet and net worth have tripled since the start of this century. And assets grew from $440 trillion to $1,540 trillion. Yet, during this period, higher asset prices accounted for about two-thirds of the growth in net worth, with savings and investments making up only 28%.

The Credit Suisse report shows different factors and asset mixes for wealth creation for other economic regions, but in the case of India, the expanding capital base and a high savings rate are responsible for higher wealth creation in the last two decades. And the trend is likely to continue moving forward. And as history suggest, the best way to take advantage of the global balance sheet and asset growth is by investing in growth stocks that capture the economic rise.

FAQs

Which countries added the most household wealth in 2021?

In 2021, the United States added the most household wealth, followed by China, Canada, India, and Australia.

Which country ranks first in terms of highest wealth per adult in 2021?

Switzerland ranks the highest in wealth per adult in 2021 at USD 696,600, followed by the United States, Hong Kong SAR, and Australia.

Which countries added the most millionaires in 2021?

The United States added the most millionaires in 2021, 2,491, followed by China and Canada. India added 107 millionaires, while Japan’s millionaire count was reduced by 395.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.