Should RBI Launch Digital Rupee This Year: Cryptocurrencies have quickly become a hard-to-ignore asset class. Despite high volatility in their prices, millions of Indians are investing and trading in crypto today. And why would they not when Cryptocurrencies have outperformed every other traditional asset class by a large margin over the long term.

But it seems like the crypto market has run out of steam now. Bitcoin, the world’s biggest cryptocurrency, has dropped over 70% from its peak. And the total cryptocurrency market cap is below the $900bn level after touching a high of $2.9 trillion in Nov 2021.

So, what happened in the crypto market? And is it the right time for the RBI to push for the early launch of the digital rupee? Let’s find out.

The Story of the Cryptocurrency Market Crash

On November 8th, 2021, bitcoin touched an all-time high of $68,789. It was a dream run for the crypto market, especially after two years of crypto winter. However, starting in 2022, the market experienced some headwinds due to profit bookings, global macro developments, worsening geopolitics, and new regulations and taxes levied in India and the US.

Moreover, China’s ban on crypto trading and mining wiped out 40% of the market in a month. Furthermore, things worsened when the Terra Network, the second-largest DeFi protocol in the market, collapsed, wiping nearly $60 billion of investors’ wealth in a few days.

It led to panic selling and solvency issues in multiple leading DeFi lending protocols, resulting in the further downfall of the market.

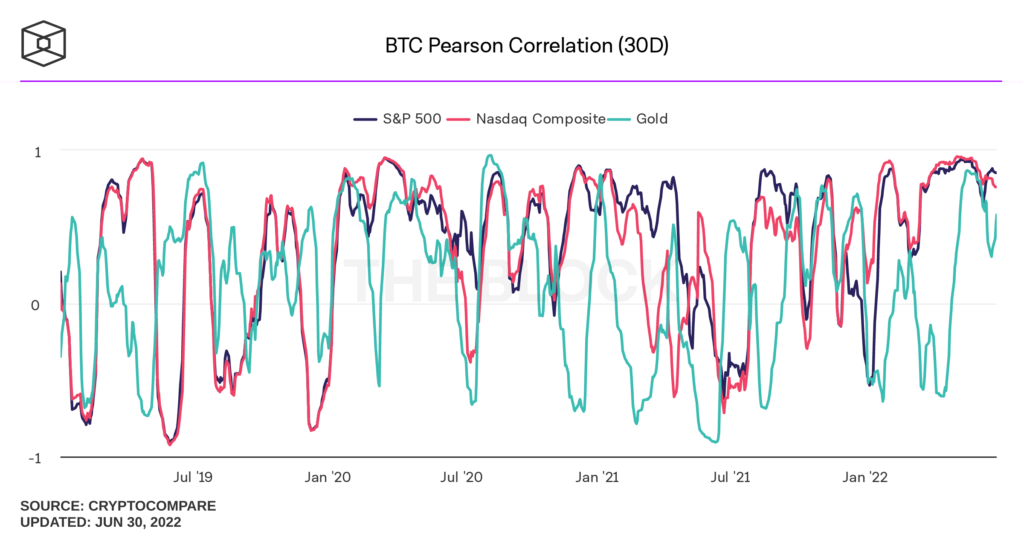

BTC- S&P 500 Correlation

Bitcoin and the crypto market may be unrelated to the global financial market, but recent trends highly correlate with major US indices. In June 2022, the BTC-S&P 500 and BTC-NASDAQ correlation remained high.

On June 30th, 2022, the 30-day BTC-S&P 500 and BTC-NASDAQ correlation stood at 0.85 and 0.76, respectively.

The daily price chart of BTC and NASDAQ above showcases similar price movements. Besides the internal shocks, global macro developments currently influence the crypto market. For example, the global liquidity scenario, the US inflation data, and US GDP data also impact the crypto market significantly.

Future of Cryptocurrency

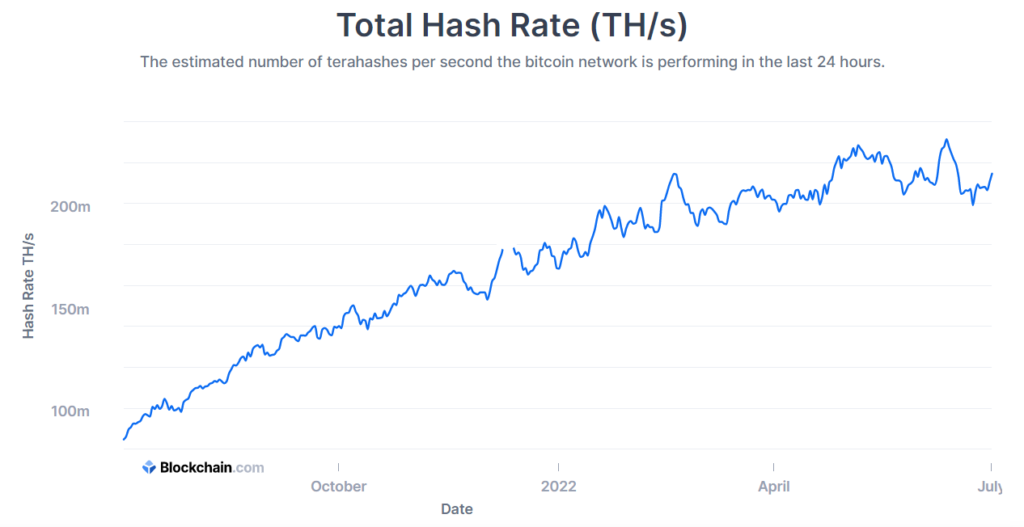

From initial rejection to getting recognized as an asset class, bitcoin has come a long way and is much stronger and decentralized.

The chart above showcases the computing power of the Bitcoin blockchain network, which is at 214.21m Tera hashes per second. To give you a perspective, the world’s fastest supercomputer, Fugaku, has a computing power of 442,010 Teraflop per second, just a fraction of the Bitcoin Network’s computing power.

The recent crash is the fifth major reset of the crypto market. In the 2018 market reset, bitcoin lost close to 80% of its value, dropping from $19,783 to $3,200.

About the future of cryptocurrency, a lot depends on the following factors:

- Government regulations;

- Tax treatment of crypto gains;

- Adoption of cryptocurrencies in payments;

- And technological innovations

The technological innovations in the blockchain-based system are driving the crypto market. For instance, Decentralized Finance (DeFi) space innovations fueled the 2020-21 market rally.

Similarly, investments and innovations in Web 3.0 could fuel the next crypto market rally. Web 3.0 is the third generation evolution of web technologies, aiming to keep the internet decentralized and make it more intelligent.

Venture Capital firms like Andreessen Horowitz (a16z) and crypto exchange Binance announced new investments in Web 3.0 startups and blockchain-based gaming platforms. You can safely say cryptocurrency will continue to exist parallel to the traditional financial system.

Digital Rupee: Should India Push for it Amid Crypto Market Meltdown?

Digital Rupee, or the Central Bank Digital Currency (CBDC), has been debated for a long time, and RBI is planning to launch it in the current financial year. But, does the present market scenario make a case for speeding up the launch.

After much deliberation and firming up the use cases, the government must launch the digital rupee. Remember that CBDC will act as legal tender and exist on a closed blockchain network. It is not a replacement cryptocurrency.

Crypto tokens are like stocks of a blockchain project. Their value increases or decreases based on utility, tokenomics, market demand, and supply. Whereas CBDC will have a fixed value, the central bank will support it.

CBDC can Disrupt Financial Intermediary Structure

The basic idea of cryptocurrency is to cut third-party intermediaries from the process and develop a peer-to-peer system. It means CBDC will also include the peer-to-peer payment function, cutting down the role of banks. As a result, it could disrupt the financial intermediation structure, credit creation process, and financial stability.

The launch of CBDCs also means a more significant role for the central bank to play in settling small payments, which banks are responsible for now.

On the other hand, there are many advantages of the digital rupee. First, it cuts down the cost of printing currency notes, ensuring payment security, cutting down fraudulent transactions, and offering a real-time settlement of transactions, which will lead to a more efficient and regulated monetary system.

However, there is plenty to discuss, about how the digital rupee will function. The launch of CBDCs will not eliminate cryptocurrencies but may be a way to embrace the revolutionary blockchain technology in the traditional monetary system to increase efficiency.

Whether the government will hasten its digital rupee launch remains to be seen. Meanwhile, subscribe to the 5 in 5 Wealth Creation Strategy if you want to start your wealth creation journey today.

Read more: How Long term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.