Dabur India, a leading consumer packaged goods company in India, plans to become a significant player in the spices business. The company recently acquired Badshah Masala, a well-known spice brand, to increase its presence in the spices market.

Let’s learn more about the acquisition.

Dabur India’s Acquisition of Badshah Masala

Dabur India plans to acquire a 51% stake in packaged spices company Badshah Masala for ₹ 587.52 crores to expand its food business. It will acquire the remaining 49% stake in five years. Once the acquisition is complete, Badshah Masala will become a subsidiary of Dabur India. It expects to complete the purchase during the current fiscal year.

The acquisition will allow Dabur India to enter the ₹ 25,000 crores branded spices market, including national and regional players. The deal values the Badshah enterprise at ₹ 1,152 crores. The estimated financials for FY23 resulted in a revenue multiple of approximately 4.5 and an EBITDA multiple of around 19.6.

Badshah Masala, founded in 1958, has two manufacturing facilities in Gujarat and sells ground spices, blended spices, and seasonings in India and internationally. It is a dominant player in the spices and condiments industry, with a strong presence in Gujarat, Maharashtra, and Telangana.

Expectations are that the acquisition will increase Dabur India’s growth in the spices business and help the company become a national player in the market. Mohit Burman, Chairman of Dabur India, stated that the acquisition aligns with the company’s long-term growth strategy and will allow Dabur India to offer its customers a broader range of products. He recently told Business line that the company plans to dramatically grow its food business to achieve ₹500 crores over the following three years.

Dabur India’s CEO, Mohit Burman, explained that Dabur aims to take advantage of India’s market trend toward branded goods by forging ahead in new markets where they will be successful and their current margins won’t need a drastic change. The spices market is one such example, with double-digit growth.

The Indian Spice Market

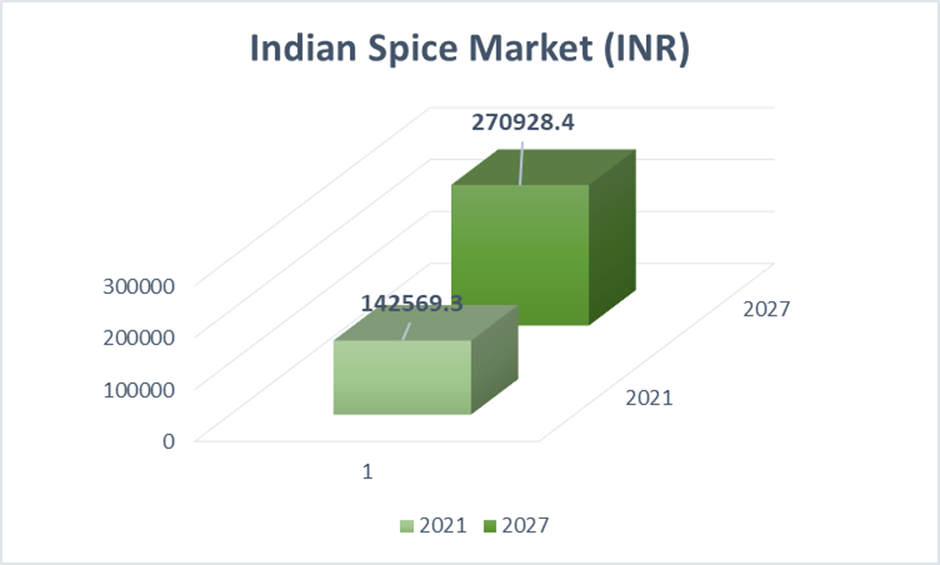

In 2021, the Indian spices market was worth ₹ 142,569.3 crores. IMARC Group predicts that the market will reach ₹ 270,928.4 Crores by 2027, with a CAGR of 11.15% from 2022 to 2027.

Indian Spice Market – Export

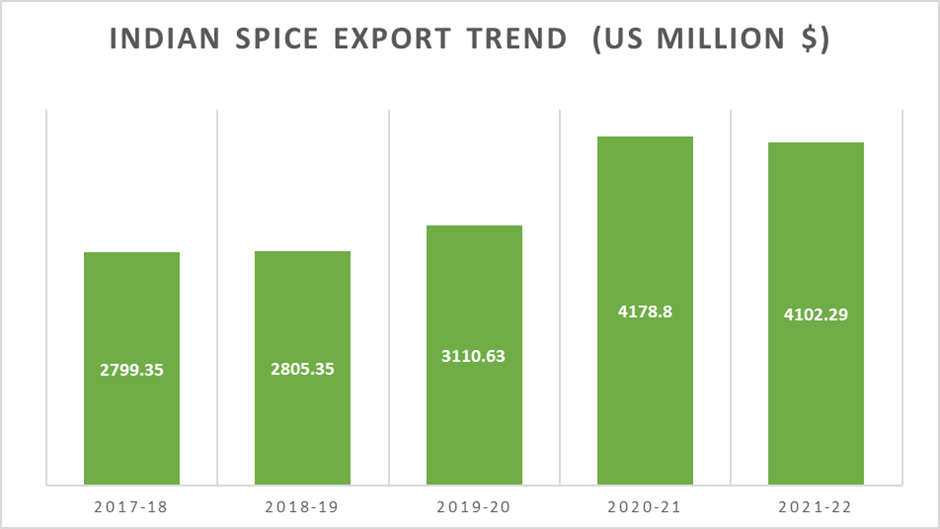

India is the leading exporter of spices, with exports worth $4,102.29 million in 2021-22. In September 2022, spice exports from India increased by 6.62% to $330.46 million. The graph below shows the trend in Indian spice exports.

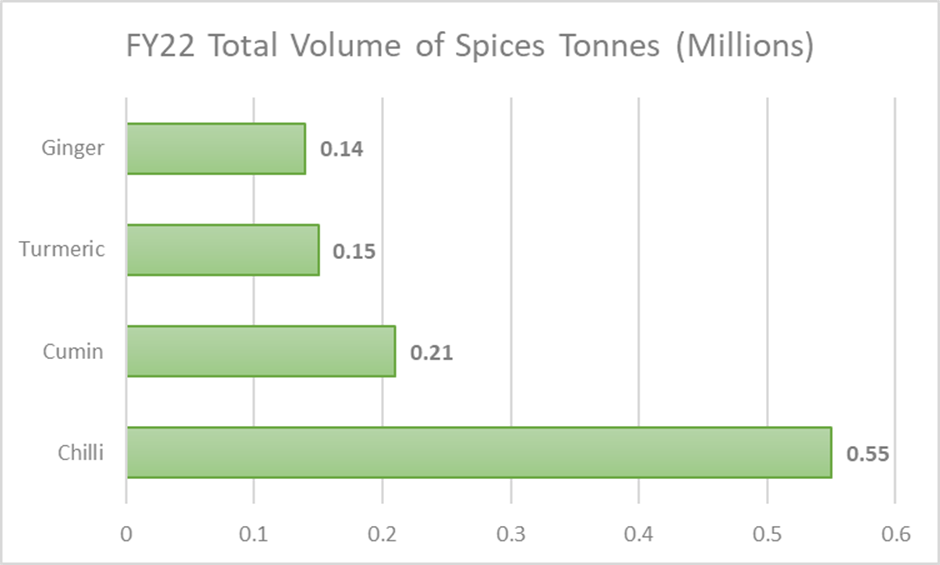

During the FY22 fiscal year, India exported 1.53 million tons of spices. From FY18 to FY22, the total quantity of spices exported from India grew at a CAGR of 10.47%. The graph below shows the total volume of top spices exported during FY22.

In 2020-21, India exported spices and spice products to 180 destinations worldwide. The top destinations were China, the United States, Bangladesh, Thailand, the United Arab Emirates, Sri Lanka, Malaysia, the United Kingdom, Indonesia, and Germany. These nine destinations comprised over 70% of the total export earnings in 2020-21.

A few of the key players have also looked at the industry’s competitive landscape of the Indian Spice Market are:

- Aachi Spices & Foods Pvt Ltd

- Badshah Masala

- Eastern Condiments Private Limited

- Everest Food Products Pvt Ltd

- Patanjali Ayurved Limited

- MTR Foods Pvt Ltd

Dabur India is seeking to take advantage of additional opportunities for growth and cooperation to maximize the benefits of acquiring Badshah Masala.

Dabur India’s Financial Performance

Dabur India reported total revenue in Q2FY23 of ₹ 2,986 crores, a marginal increase from ₹ 2,817 crores (YoY) and ₹ 2,822 crores (QoQ). However, their net profit for the quarter was ₹ 491 crores, down from ₹ 505 crores in Q2FY22.

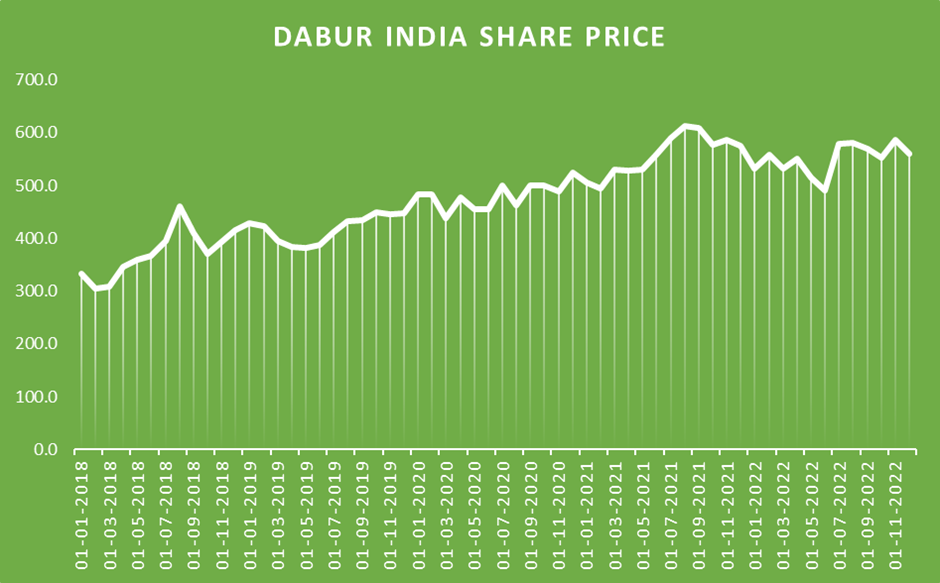

However, their profits increased from ₹ 441 crores compared to the previous quarter. As of December 30, 2022, the company has a market value of approximately ₹ 99,467 crores and a dividend yield of 0.93%. And when the market closed, the Dabur share price corrected to ₹ 561.45(0.09%).

The graph below shows Dabur’s share price movement between 2018 to 2022. Dabur’s share price is between ₹ 300 to ₹ 600.

The Outcome of Acquisition

Dabur India plans to expand its business globally by leveraging Badshah Masala’s International Market presence. The transaction is expected to have a neutral effect on cash EPS in the first year and to be accretive in subsequent years.

Badshah Masala was thrilled to announce a strategic partnership with Dabur. Dabur stands for Trust and Heritage, and partnering with Dabur will help propel Badshah’s future growth potential. In addition, this transaction will allow Badshah Masala to quickly add its products to Dabur’s diverse portfolio to meet consumers’ needs across geographic regions.

Final Words

Dabur India plans to expand its food business to ₹500 crores within the next three years by entering the spices market. The CEO, Mohit Malhotra, sees this as a promising opportunity due to the strong double-digit growth in the industry and the shift in the Indian market towards branded products. Dabur aims to enter categories complementary to its current offerings and where they have a good chance of success, hoping to become a national player in the spices business.

Disclaimer Note: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

Why do companies pursue acquisitions?

Companies may pursue acquisitions to expand their product or service offerings, enter new markets, gain access to new technologies or intellectual property, increase efficiency or scale, or diversify their operations.

How do cultural differences between the acquiring and acquired companies impact an acquisition?

Cultural differences between the acquiring and acquired companies can impact an acquisition by creating communication barriers, misunderstandings, or conflicts during the integration process, potentially leading to decreased employee morale, retention issues, and difficulties in achieving the desired outcomes of the acquisition.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 5

No votes so far! Be the first to rate this post.