NASDAQ-listed Ebix Inc’s Indian arm has applied for an IPO. This article will thoroughly analyze EBIXCash, including its business, operations, promoters, and financial standing. This analysis may help you decide whether to subscribe or not.

About EBIXCash

Ebix Inc, a US-based company headquartered in Atlanta, has grown over the years into a diverse corporation with operations in multiple countries and continents. Originally incorporated as Delphi Information Systems in 1976, the company went public under that name in 1987.

The company struggled financially until Indian-American businessman Robin Raina became involved as VP in 1997 and was later promoted to President and CEO in 1999. Under Raina’s leadership, the company has seen tremendous growth in revenue and profit, and he now owns 13.9% of the company.

EbixCash is a sister company of Ebix, a leading fintech company that provides a wide range of financial services, including money transfer, foreign exchange, travel, insurance, and e-commerce. The company has a strong presence in over 60+ countries across the globe.

EbixCash leverages technology to provide fast, reliable, and convenient financial services to individuals, small businesses, and corporations. With a focus on innovation and customer satisfaction, EbixCash is constantly expanding its offerings and exploring new opportunities to serve its customers better.

EBIX IPO Details

EbixCash Limited is a fintech company that offers a range of digital products and services, including payment solutions, financial technologies, travel, and business processing outsourcing services.

The company leverages its integrated business model and technology to provide a comprehensive platform for its customers, combining the advantages of B2B, B2C, and B2B2C models.

It utilizes a “phygital” strategy combining physical distribution outlets with a digital platform for a smooth customer experience.

EBIXCash, which has its headquarters in Delhi, India, filed a DRHP with SEBI on March 9, 2022, for new issuance of 6,000 crores.

| IPO Details | |

| IPO Status | Draft Offer Documents filed with SEBI |

| IPO Date | March 2023 |

| IPO Size | 6,000 Crore |

| Lot Size | Not disclosed yet |

| IPO Price Band | Not disclosed yet |

| Issue Type | Book Building |

| IPO Listing at | BSE & NSE |

| Face Value | Rs. 5/Equity Share |

| Listing Date | March 2023 |

| Fresh Issue | 6,000 Crore |

| Sitertar subs | 0 |

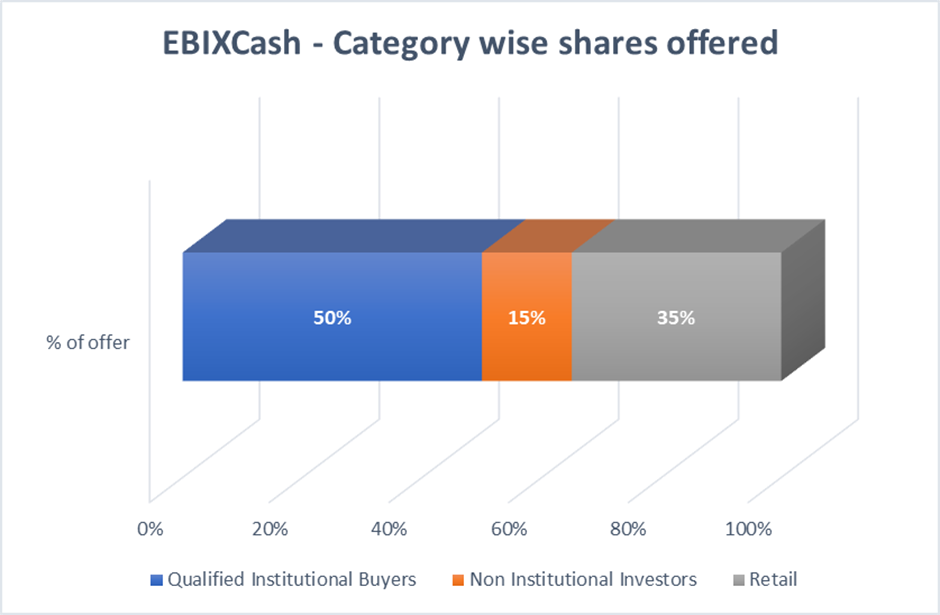

Category-wise Percentage of shares offered

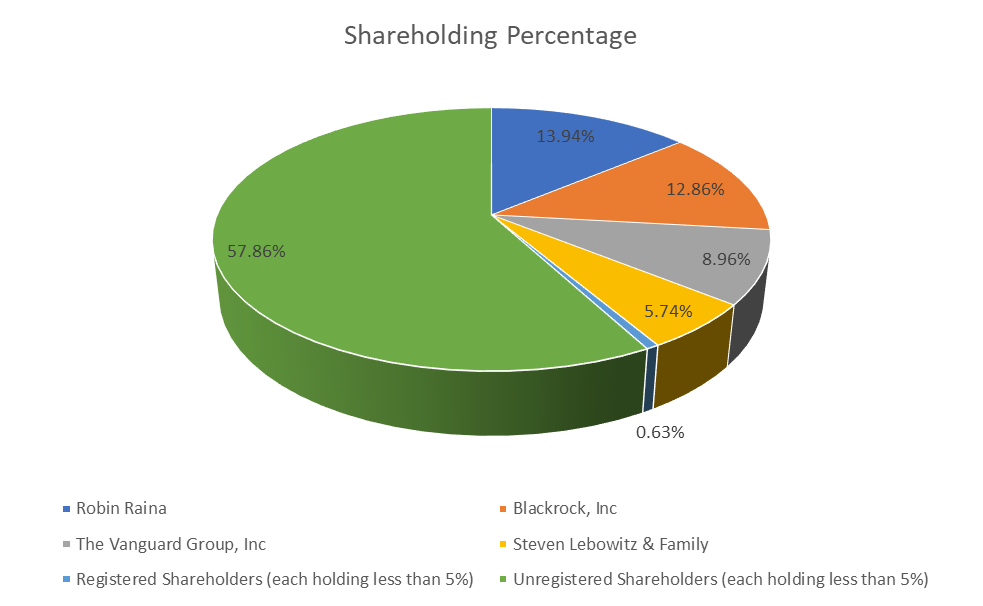

Shareholding Pattern

Mr. Robin Raina is the Chairman and Non-Executive Director, holding a 14% stake in the holding company, with major investors like Blackrock and Vanguard also holding a stake.

What does EbixCash do?

EbixCash Limited offers various payment solutions, including domestic and international money transfers, foreign exchange, and prepaid/gift cards. The company mainly generates revenue from commissions and transaction fees. Although COVID-19 affected one quarter of the financial year 2020 negatively, the remaining three quarters were relatively unaffected.

The firm offers various travel-related services, both B2B and B2C. These include corporate travel services, bookings through VIA.com, MICE, and luxury travel services and products. The company has over 2,200 employees, a network of 212,450 agents, 25 branches, and over 10,000 corporate clients.

Products & Services

The company provides financial technology products and services through EbixCash Financial Technologies. It offers on-demand software technology services for clients in wealth, insurance, asset and lending management, travel, and bus exchange channels. It has adopted a backward integration approach to offer end-to-end technology services that allow them to retain clients and cross-sell other services and products.

They also provide BPO services to clients across India, offering customer retention and customer experience services such as inbound/outbound contact call centers, email, chat, and social media contact centers, feet on the street, and last-mile delivery services, hiring, onboarding, payroll, and human resources helpdesk services, and IT, digital transformation services like knowledge management, application development, and infrastructure management.

It has a list of key clients, including HDFC Bank. The company serves over 25 large companies in India, with an average tenure of more than nine years.

Additionally, it actively evaluates small businesses and start-ups for acquisition or partnership opportunities, which has previously provided opportunities for the company to invest in start-ups such as AHA Taxis to invest in asset-light technology start-ups that offer a strategic position in emerging sectors such as agritech, fintech, health tech, insuretech, and wealth tech.

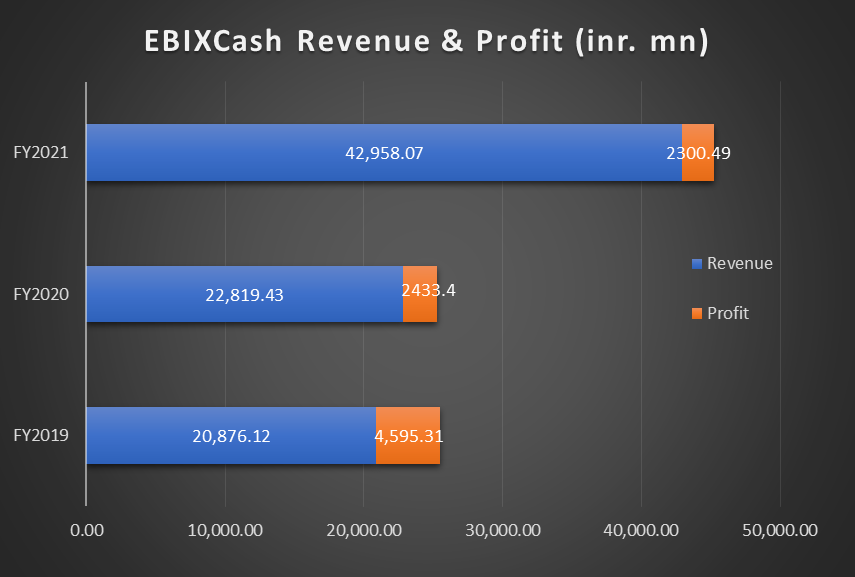

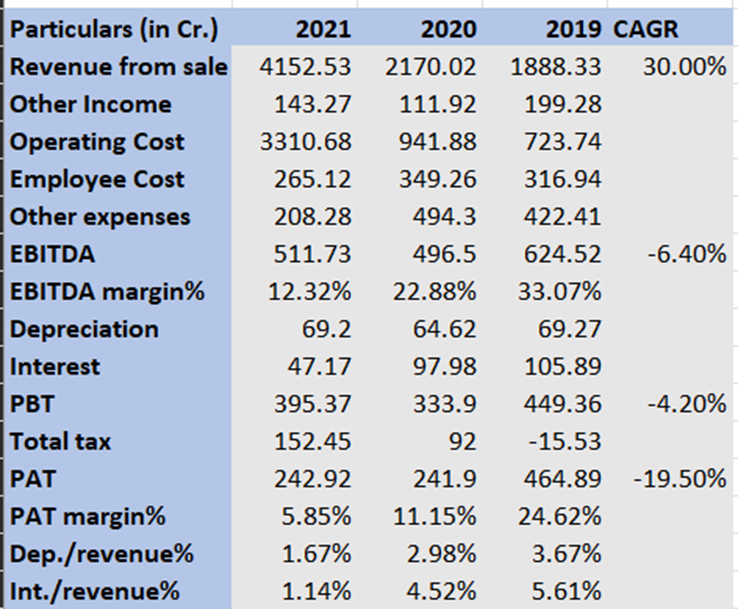

Financial Health

The largest segment is Payments which includes Domestic Remittance, Forex, International Remittance, and Pre-paid Cards. It largely generates revenue based on commissions and transaction fees in each case. Payments account for 77% of the business as of H1FY22 compared to just 12% in FY19.

Strengths of ECL

EbixCash Limited (ECL) is a technology-enabled provider of digital products and services that serves customers’ needs across their entire digital journeys. The company’s integrated business model combines the advantages of B2B, B2C, and B2B2C models within a single platform.

The company uses an Omni channel approach through online and offline distribution networks to provide a broad range of services to clients, corporates, and end-users.

It develops, deploys, and typically has end-to-end control over all the aspects of its products, including technology and customer experience, resulting in many touchpoints for consumers and back-end entities, ensuring high customer stickiness.

The company operates in regulated industries such as payment solutions, forex, remittance, bill payments, insurance, and travel and is required to obtain and maintain certain licenses. As of December 31, 2021, it had licenses to operate in payment solutions, forex, remittance, and bill payments.

ECL has a history of acquiring complementary businesses and integrating them into its ecosystem. It leverages its approach to centralize costs, compliance, and internal systems to achieve growth and improved performance of the newly acquired business.

The company’s highly reputed Board includes members such as former US SEC Chief Economist and Padma Shri Awardee (2020) Sriprakash Kothari, former BSE’s Chairman and current Tourism Finance Corporation of India chairman Sethurathnam Ravi, former deputy managing director of the Corporate Accounts Group at SBI, Sunil Srivastav, former RBI’s executive director Uma Shankar, and former Alight Solutions LLC India managing director Pavan Bhalla.

Opportunities ECL Has

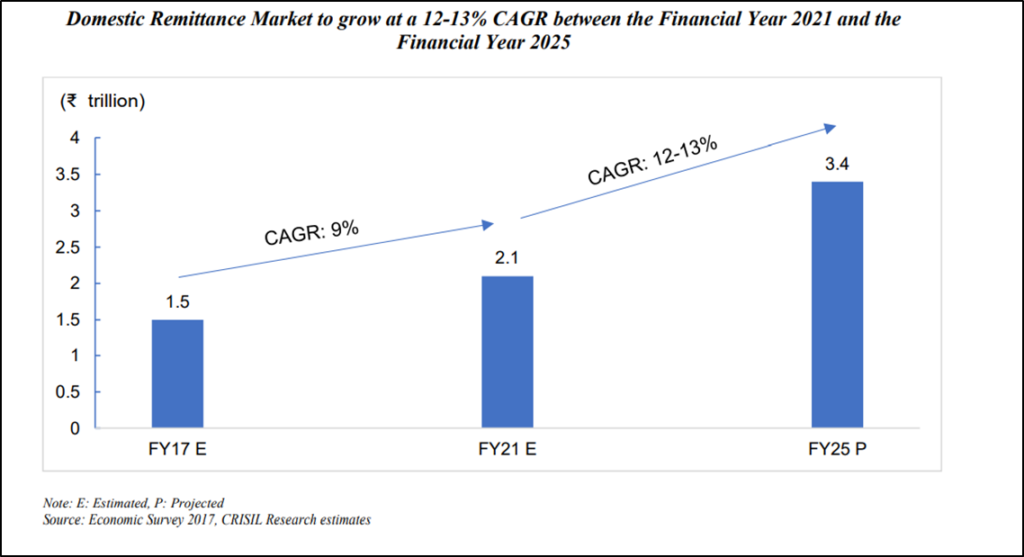

Key segments like Prepaid cards and domestic remittance are expected to grow 12-13%, and pre-paid cards market has grown significantly post covid.

COVID-19 resulted in a reduction in the demand for forex and remittance services. But, over FY20-21, it experienced significant growth in pre-paid cards business in retail and corporate segments leading to remarkable revenue growth in the last 2 years.

Threats EBIXCash Faces

EbixCash Limited operates in highly competitive industries and faces challenges in staying ahead of the curve by introducing new products and services. As the company has limited experience in offering these new products and services, it cannot guarantee that they will be profitable.

Additionally, the company may not be able to successfully diversify its product and service offerings or enter into new lines of business, which could impact its prospects and financial performance. EbixCash Limited may also struggle to keep up with rapid technological changes by developing new products and services that meet the needs of its customers.

The industries in which EbixCash Limited operates are highly competitive, and its ability to compete effectively is vital to its growth strategy. The company operates in a market sensitive to price and is subject to pressure from customers to lower its services and solutions fees. It could decrease margins and impact the company’s operating results.

Acquiring other businesses may disrupt ECL’s current operations, divert its resources, and require significant management attention that would otherwise be devoted to the ongoing development of its current business.

It may need to make additional capital investments or undertake remediation efforts to ensure the success of the acquisitions, which could reduce the benefits of such acquisitions.

ECL may need to use a substantial amount of cash or issue debt or equity securities to complete an acquisition or realize the potential of an alliance. Doing so could deplete its cash reserves and/or dilute the existing stockholders. All these risks could significantly impact the company’s financial performance.

The company plans to use the net proceeds from this offering to undertake inorganic growth, but the target for this growth has not been identified yet. The company may seek alternative funding if the net proceeds are insufficient to fund the proposed acquisitions and other strategic initiatives.

The IPO cash will be used for the following:

- A share of the money will help the subsidiaries Ebix Travels Private Limited and EbixCash World Money Limited satisfy their working capital needs.

- ECL will compulsorily buy convertible bonds from Ebix Asia Holdings Inc. in Mauritius with the money from the IPO.

- They plan to use the funds to finance strategic purchases, investments, and corporate activities.

Should You Subscribe to EBIX IPO or Not?

IPO investments are subject to market risks. You must research the company and understand your risk tolerance before investing.

Final Words

Ebix IPO presents an opportunity for investors to gain exposure to the company’s diverse operations and strong growth potential, but it also carries risks such as competition and acquisition execution.

Disclaimer*: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

When is the EbixCash IPO taking place?

The exact date of the EbixCash IPO has not been announced yet. The company is expected to go public around March 2023.

What is the price of the EbixCash IPO?

The price of the EbixCash IPO has not been announced.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 4

No votes so far! Be the first to rate this post.