A company’s “Economic Moats” are critical long-term profits and market share indicators. As investors, you can use this tool as a qualitative yardstick to shortlist companies that can compete for an extended period.

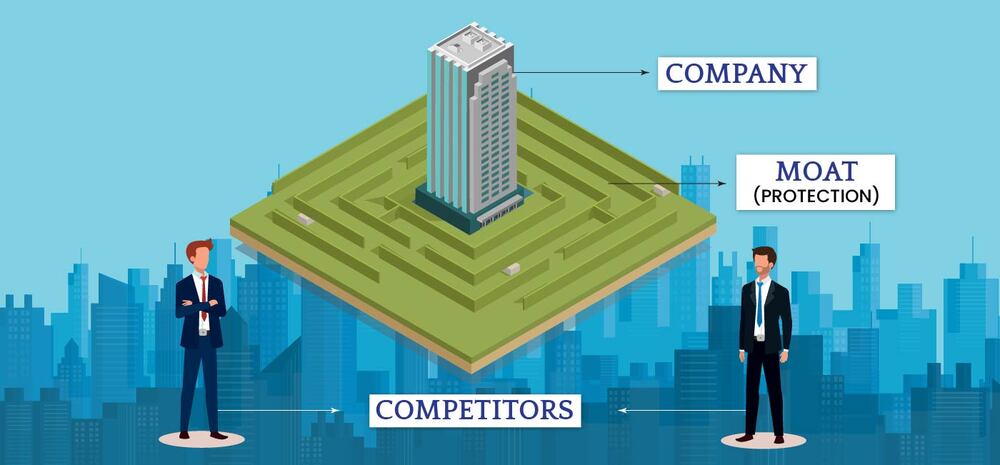

The term “Economic Moats” became popular in the business lexicon after Warren Buffet, the legendary investor, used it. In simpler terms, Economic Moat is any competitive advantage that provides a company with sustained profits over its competitors in the long term. The moats that surrounded medieval castles are an easy analogy. They protected the court and its valuables from any foreign invasion.

Economic Moats in the context of a company refer to creating an unrivaled advantage over your competitors that they cannot replicate in the short or long term.

Economic Moats Definition

Economic moats are differentiating factors that allow a company to keep competitors at bay while generating long-term profits. In addition, the company gains a market share that is hard to duplicate. Once a company has gained a substantial market share, its focus shifts to profit protection from new competitors and other outsiders.

A company is always at risk of losing its market share without enduring economic moats. When an investment is made in a company with “Economic Moats,” investors can protect their excellent returns on the capital invested.

Let us understand the economic moats definition with the help of an example-

Assume you own a juice bar. You invented a juicing technology that allows you to extract 25% more juice from an average fruit. You patent that technology. You can now drive more customers if you lower the price of juice.

This eventually results in large profits. In this case, the “Patent” gives you a competitive advantage over other juice vendors. In addition, if your juice company is listed on the stock exchange, investors can quickly generate consistently high returns due to your proprietary technology, which is challenging to duplicate.

Moats can be broadly classified into – Narrow Moats and Wide Moats

| Type of Moat | Period of sustaining a competitive edge |

| Narrow Moat | At least 10 years |

| Wide Moat | At least 20 years |

How a Company Can have Economic Moats?

We will learn how moats can shield a company from losing its market share to rival companies.

Access to Low-Cost Capital

A publicly traded company enjoys relatively low-cost capital compared to a privately owned business. As a result, the company gains leverage to efficiently raise capital to support the company’s research and development efforts. You can stay ahead of the pack for long periods if you conduct better research.

Intangible Moats

A company can create economic moats by developing intangible assets such as brand equity, patents, trademarks, etc. These assets pay off when it comes to charging higher prices for its products.

Economies of Scale

The company size is one of the economic moats to look for. A big-size company will be less volatile to fluctuations in the stock market. In addition, with low-input costs, the company can produce more units and achieve economies of scale.

High Costs of Switching

Consumers are discouraged from switching companies due to the risk of losing historical data and important contacts. In most cases, the lack of interoperability is a company’s Economic Moat because it demotivates customers from switching and offers ground for expansion.

Cost Advantage Moat

The cost advantage moat is one of the most potent moats of a company. The more you reduce your costs, the larger and deeper the moat. As a low-cost producer, your products are complex for others to compete with.

Data-Driven Moats

Some businesses provide a personalized experience by displaying results relevant to the user’s interests. Customers benefit from cutting-edge artificial intelligence and data analytics technology receiving improved offerings. Data Propriety is one of the most influential economic moats to capture more users and drive consistent profits over long periods.

How Economic Moats Help Investors Make Good Returns

Investors can select the best company to invest in by shortlisting companies with distinct moats. A company’s moat can be built in various ways, including building stickiness with customers, economies of scale, government grants, or monopoly in a specific product or area.

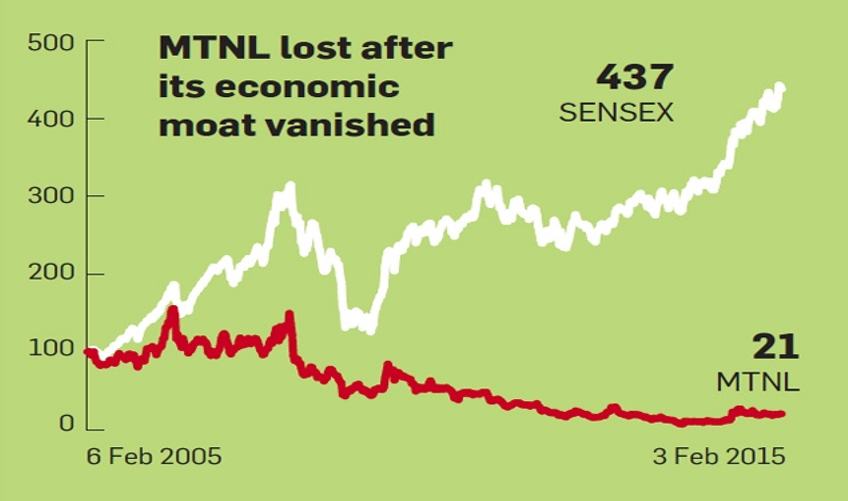

Changes in government policies or loss of monopoly can result in massive wealth losses for companies that rely solely on their monopoly for survival. For instance, MTNL, which had a monopoly in the market as its economic moat, crashed when it lost its MOAT.

As a prudent investor, you can invest in a wide-moat stock at an underpriced value for long-term profitability. Before making your investment decisions based on durable economic moats and potential threats, also check the following-

- Study the growth in Sales, Revenue, and Profit of the companies with economic moats over a prolonged period.

- Return on equity (ROE) and Return on capital employed (ROCE) are financial ratios that quantify a company’s profitability in terms of money invested.

- Put the stocks on your watchlist and monitor their financial reports to learn about their sensitivity to market fluctuations.

- Company’s brand image.

Key Takeaways

In the dynamic world of economic moats, an investor must find a company with unique, durable, and sustainable competitive edges, primarily qualitative instead of quantitative. Huge returns can be made if an investor holds the investment patiently for an extended period.

The fact remains that the economic principle also says that no moat is everlasting. Therefore, an investor must look for a company that does not become complacent about its economic moats. Companies continuously evolving to align with changing market scenarios will ultimately win and generate substantial long-term returns.

FAQs

What is the significance of economic moats?

Investing in companies with economic moats reduces both capital and market risk. As Warren Buffet has also suggested, investing in a company with a strong moat increases your chances of making long-term profits exponentially. A qualitative advantage gives the company a competitive advantage to withstand market volatility and defend against market share loss.

How Can I find Economic Moats Companies?

To find economically viable and MOAT-based companies, do a screening of companies on the following parameters-

● Size and profitability of the company

● Financial Reports to assess the profitability of the company

● Market Cap and Sales Revenue

● The uniqueness of its product/technology

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.