The Economic Survey is an annual report published by the Government of India that reviews the country’s financial developments over the previous fiscal year. It also examines trends in various sectors of the economy, such as agriculture, industrial production, export, import infrastructure, and fiscal deficit, among many others.

Overview of the Economic Survey

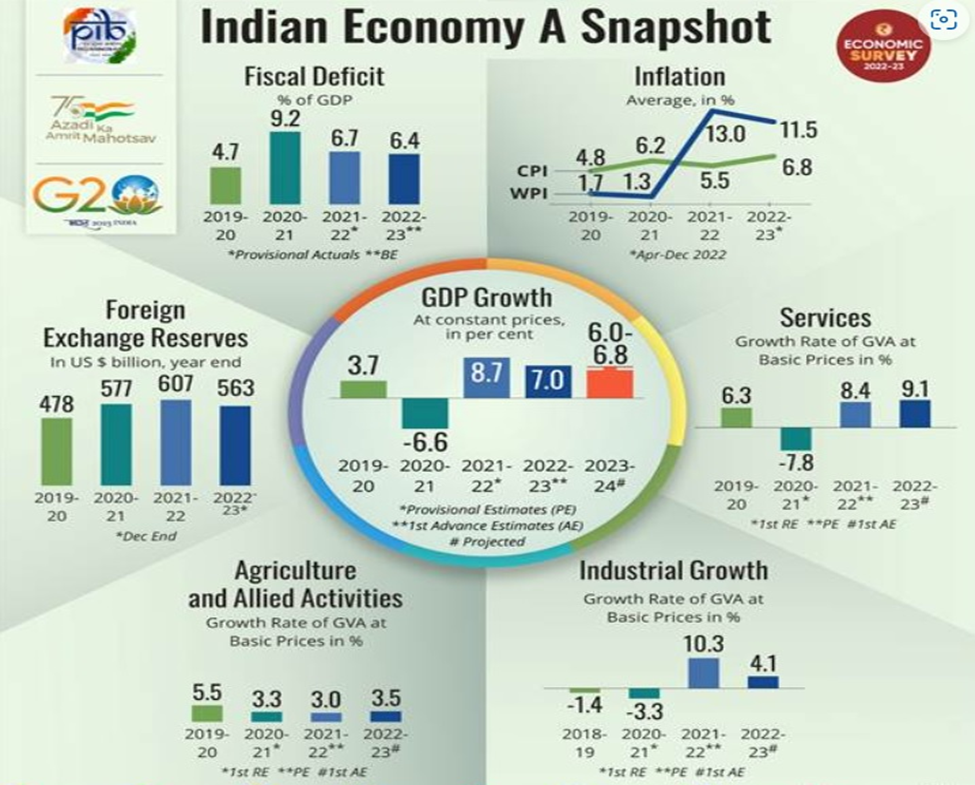

According to the Economic Survey 2022-23, the year 2022 has been particularly intriguing, with India completing its full recovery from the pandemic ahead of many other countries, despite the challenges of a depreciating rupee, rising global commodity prices, and surging inflation.

The Economic Survey presented by Finance Minister Smt Nirmala Sitaraman forecasts 6.5% real GDP growth in FY 2024. These projections correspond to statistics provided by multilateral agencies such as the World Bank and the IMF and domestic agencies such as the RBI and ADB.

Let us take a bird’s view of the Economic Survey 2022-23, which discusses the six key highlights driving future economic growth.

Credit Growth

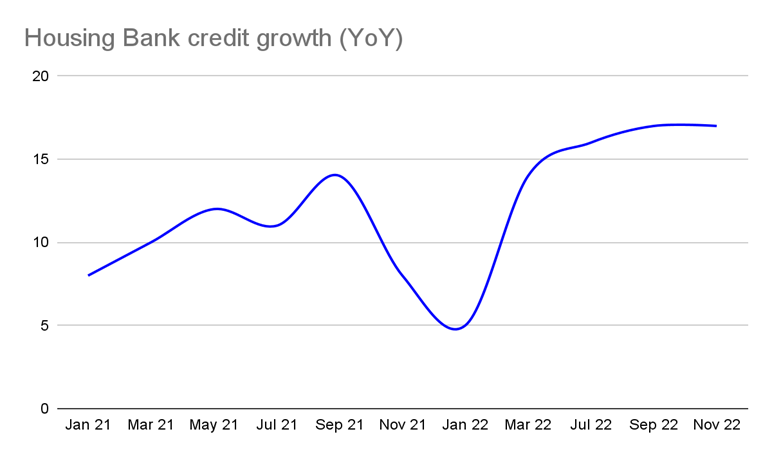

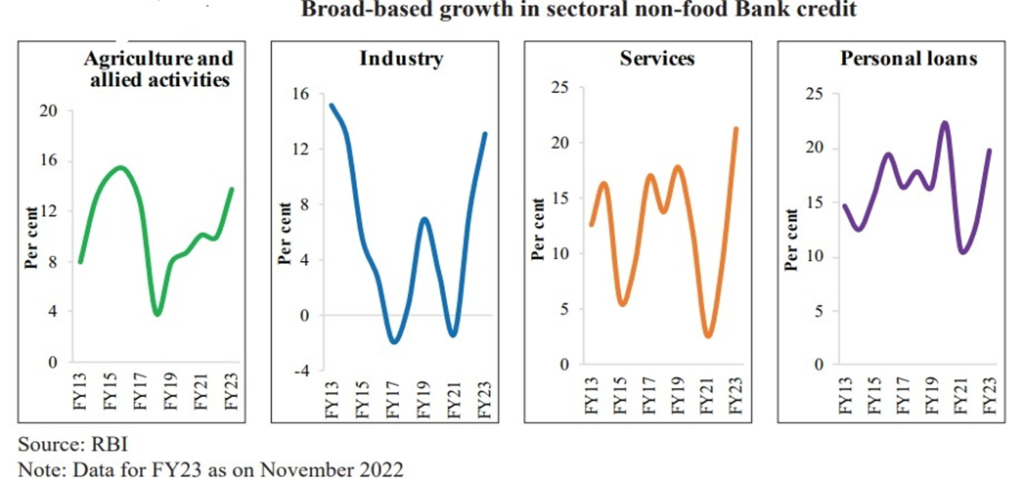

Credit growth has been wide-ranging across sectors, with retail credit primarily driving growth due to rising demand for home loans.

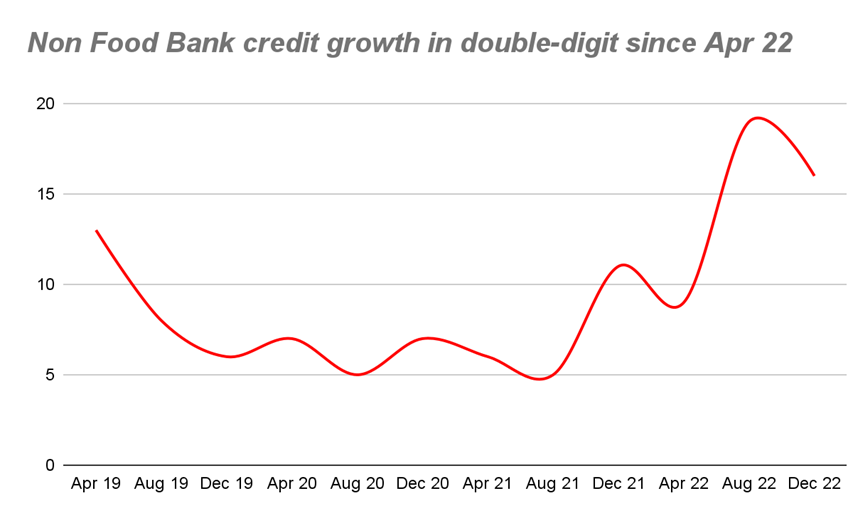

According to the Economic Survey, the Non-food bank credit growth accelerated to 15.3% year on year in December 2022. It indicates an acceleration in current economic activity growth with an expectation of momentum continued in the future.

According to the Economic Survey 2022-23, the credit growth in the Micro, Small, and Medium Enterprises (MSME) sector has been remarkably high, at more than 30.6% on average between January and November 2022. Thanks to the Union government’s extended Emergency Credit Linked Guarantee Scheme (ECLGS), Production-linked incentive scheme, and improvement in capacity utilization.

A rebound in credit-fueled growth in the services sector to NBFCs, commercial real estate, and trade industries. Increasing credit disbursal to Non-Banking Financial Corporations (NBFCs) was primarily attributed to improved asset quality and increased profitability.

The dramatic industrial credit growth implies brighter prospects for CAPEX investments. The PLI schemes are intended to increase manufacturing capacity, boost exports, reduce reliance on imports, and create skilled and unskilled labor jobs. Despite the global headwinds, the credit growth in India should continue to grow, supported by resilient demand conditions.

Current Account Deficit (CAD)

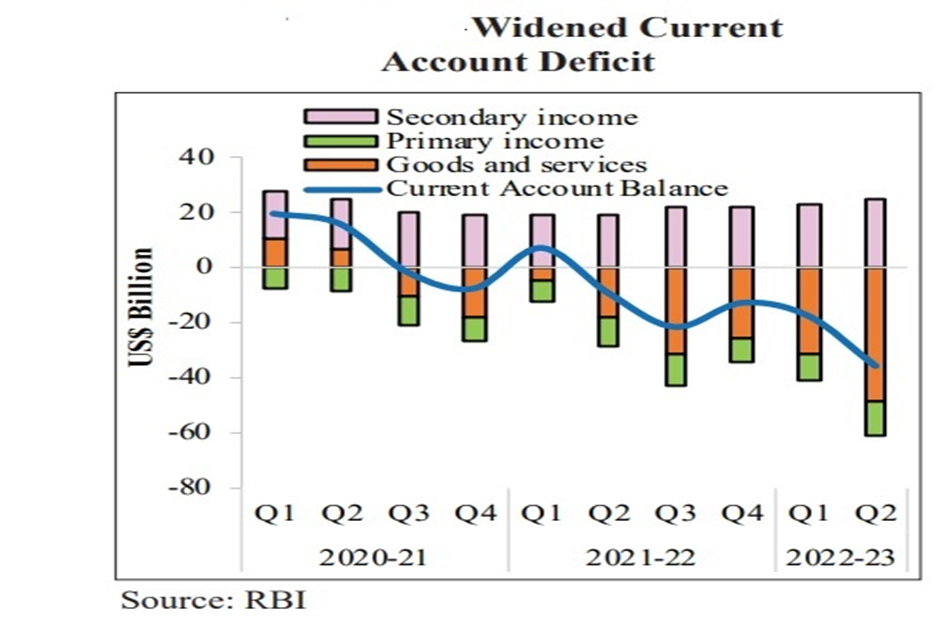

Per the Economic Survey, India recorded a Current Account Deficit (CAD) of 3.3 % of GDP in H1FY23 compared to 0.2% in H1FY22. This increase is triggered by an uptick in the merchandise trade deficit and higher net investment income outgoing.

The reason for the widening of CAD and the high inflationary pressures in net importing countries like India is the pandemic-induced shrinkage in production worldwide and the inflation the Russian-Ukraine conflict fuelled. It led Central Banks around the World, influenced by the Federal Reserve, to hike their interest rates to fight inflation.

The US Fed’s rate hike drew capital into US markets, causing the US Dollar to rise against most currencies. It led to the widening of CAD. If the current account deficit grows, the rupee could depreciate.

A domestic shipping and shipbuilding industry can help reduce freight costs and forex outflows, lowering the current account deficit.

Export Outlook

According to the Economic Survey, exports stood at a record high of $422 billion in FY 22. In a global slowdown marked by slowing international trade, a downturn in Indian exports is unavoidable. Significant measures to evolve the whole eco-system in an export-friendly direction over time would include-

- The National Logistics Policy would reduce the cost of internal logistics to encourage Indian exports.

- In 2022, India signed several Free Trade Agreements with the countries such as UAE and Australia that would create opportunities for exports at concessional tariffs or no tariffs barriers on goods and services.

- In July 2022, RBI allowed invoicing, payment, and settlement of exports in Indian Rupees (INR), thereby reducing the currency risk for Indian businessmen. Safeguarding the currency volatility not only lowers the cost of doing business but also allows for better business growth, increasing the chances of Indian businesses growing globally.

Because of the rise in global crude oil prices, petroleum products remained the most exported commodity in FY22 and April-December 2022, followed by gems and jewelry, organic and inorganic chemicals, and drugs and pharmaceuticals.

Digital Infrastructure Roadmap

In the wake of COVID-19, when physical interactions have been restricted, the role of Digital Infrastructure has been significant in the country’s socioeconomic development. The economic Survey 2022-23 outlines a few significant developments in the sphere of digital infrastructure-

- Under the ambitious flagship program Digital India launched in 2015, the rural and Urban teledensity gap has significantly improved.

- The government has introduced Account Aggregator, a global techno-legal framework that gives individuals complete access to essential services such as finance, health, education, and skills. Allows you to securely share the data with any regulated third-party financial institution of your choice with due consent.

- Low-cost accessibility, the success of citizen-centric services such as the Unified Payments Interface (UPI), massive adoption and reach (DigiLocker, MyGov), and the vaccine journey via Co-Win are all significant and powerful milestones in India’s digital infrastructure journey.

To summarize, the convergence of physical and digital infrastructure will be a dominant attribute of India’s future growth story.

Agri and Allied industries

According to the Economic Survey, the agriculture sector in India has grown at a 4.6% annual rate over the last six years. The key highlights of the survey related to agriculture and allied industries include the following-

- The sturdy performance can be credited to the government’s efforts to promote farmer-producer organizations, encourage crop diversification, and boost agricultural productivity through mechanization assistance and the establishment of the Agriculture Infrastructure Fund.

- Providing financial assistance to farmers to improve their weather resilience through programs such as the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN). The government also promotes allied agricultural activities to allow the farmers to diversify their income.

- India is rapidly emerging as a net exporter of agricultural products, and agricultural exports reached an all-time high of $50.2 billion in 2021-22.

The agricultural sector remains critical to India’s growth and employment trajectory and therefore needs to be encouraged through an affordable, inclusive, and timely approach to providing income support and adequate insurance coverage.

Recovery from COVID-19

Economic Survey 2022-23 says that the last three years have been extremely difficult for the real estate market. Due to the increasing uncertainty, health concerns, and stay-at-home orders, people delayed purchases.

However, thanks to government initiatives such as lowering home loan interest rates and bestowing subsidies and incentives, the housing sector has recovered from the pandemic’s impact.

- In 2020, the government launched the Atmanirbhar Bharat Rozgar Yojna (ABRY) to stimulate the economy and increase employment generation in the post-Covid-19 recovery phase. It also incentivized the creation of new jobs, social security benefits, and restoring jobs lost during the pandemic.

- The Economic survey describes how the government guided the economy through financial stress, repairing and restoring corporate, banking, and non-banking balance sheets.

Key Takeaways

According to the Economic Survey 2022-23, India, like the rest of the World, faced numerous challenges, such as the pandemic, geopolitical conflicts, soaring commodity prices, etc. However, India has fared better than many other countries in dealing with these challenges.

You can expect lower macroeconomic volatility in 2023 than in the previous fiscal year because the inflation risks from global commodity prices in advanced countries are likely lower.

Economic Survey states that we live in a new normal in which the global economy is still recovering from the effects of the pandemic and persisting geopolitical conflicts. Because of the dedicated support for infrastructure creation through increased capital expenditure and strong macroeconomic fundamentals, India could effectively navigate the situation.

FAQs

What is Economic Survey?

The Economic Survey of India is a comprehensive report on the country’s economic performance during the previous fiscal year. It contains information on all major government initiatives, key policies, and outcomes.

Who prepares the economic survey, and when is it presented?

The Department of Economic Affairs (DEA) prepares the Economic Survey under the watchful eye of the Chief Economic Advisor (CEA). It is presented a day before the actual budget is presented.

Does the Economic Survey affect the Union Budget?

Although the economic survey results are kept in the background while drafting the Union Budget, they do not necessarily affect each other. The government is not required to present the Economic Survey or to implement its recommendations. If it desires, it can even reject all of the suggestions in the document.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.