ESG and ESG Funds – The Latest Trend in Investing. Latest top ESG funds by performance in India

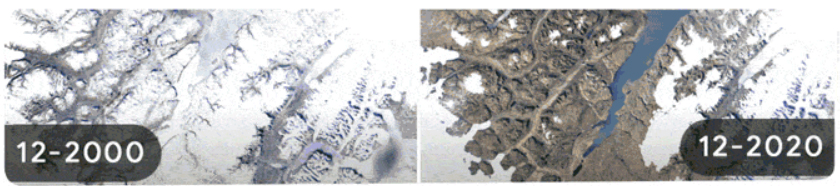

Did you see the Google Doodle on Earth Day? It was the simplest wake-up call we’ve seen in some time. The image showed the physical changes on Earth. But the timeline is terrifying – in just two decades, the Earth has become worse.

In case you missed it –

Are you wondering what connection Google Doodle has to Investing? We want you to know more about investing in sustainable businesses. That image indicates the rapid changes Earth has undergone due to rampant deforestation, increase in global temperatures, shrinking waterways, and more. It is the cost we may pay for economic growth and welfare. But don’t you want to invest responsibly?

Well, the blog is about sustainable profit through ESG investing and SEBI’s new ESG Investing Categories.

E.S.G. investment is the latest investing methodology investors are betting on these days. E.S.G. full form is Environmental Social and Governance. Although E.S.G. investing has become a topic for discussion now, you will be surprised to know that its principles aren’t new. And these are not even difficult to understand.

In this article, you will understand more about ESG. investing, how investments work, what led to E.S.G. investing in India and globally, how you can build an ESG-compliant portfolio, and a list of the latest top-performing ESG funds in India.

What are E.S.G. Investing and its history?

E.S.G. Investing and E.S.G. Funds are a way to invest “sustainably” – where investments are made considering their impact on the environment, human well-being, and the economy.

Hundreds of years ago, religious and ethical beliefs influenced investment decisions. For instance, Muslims established investments that complied with the Sharia law, prohibiting investing in businesses dealing with weapons, lending, etc.

The rising importance of corporate social responsibility (C.S.R.) and social sustainability has increased investor awareness about ethical participation in the market. In 2006, the United Nations released a set of guidelines called Principles of Responsible Investments (P.R.I.) for incorporating ESG factors into business policy and strategy.

Many investors believe P.R.I. may have marked the entry of E.S.G. into mainstream investing today. P.R.I. has over 2000 signatories and is widely considered the official point of reference for all things ESG

What is The E.S.G. Investment Component?

ESG investing is also known as socially responsible investing, impact investing, or sustainable investing. As the name suggests, investing in assets with a focus on environmental, social, and governance-related factors. As an investor, you look at the financial performance of the company. However, ESG factors have more importance and higher weightage. Such a style of identifying potential businesses, which weighs better on the ESG parameters, is known as the ESG. Investing methodology.

What Are ESG Funds?

ESG funds are those funds whose asset allocation primarily includes companies’ areas and/or bonds that are evaluated based on Environmental, Social, and Governance factors. While Europe accounts for half the global E.S.G. assets, the U.S. has the most robust expansion this year and may hold the center stage in the category starting in 2022. However, the next wave of growth could come from Asia with a significant focus on Japan.

The boom in E.S.G. Investing and E.S.G. Funds

Recent times have seen a remarkable expansion of E.S.G. investing and E.S.G. Funds in India and Global economies. In addition, the COVID-19 pandemic brought more attention to the interdependencies between social, environmental, and economic factors for the growth of a business.

When coronavirus first appeared in late 2019, market disruptions and uncertainties caused many investors to turn to E.S.G. funds. In the first three months of 2020, investors globally invested $54.6 Billion in E.S.G. funds. Between 2020 and 2021, investments in global E.S.G. funds more than doubled.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

According to ADEC Innovations, $30.7 trillion (more than Rs. 24 thousand crores) currently sit in sustainable investment funds worldwide, and it is expected to grow to ~$50 trillion in the next two decades. While Environmental, Social, and Governance investing entered the corporate boardrooms globally in 2004, no specific date marks the beginning of E.S.G. investing in India. Scores of developments and policy reforms took place over the last decade to guide E.S.G. investing in India.

Mutual fund houses have launched Environmental, Social, and Governance funds in India. Among the popular E.S.G. funds, S.B.I. Magnum Equity E.S.G. Fund, with an asset under management (AUM) of Rs. 4,509 crore i,s the oldest E.S.G. fund in India.

Significant Developments that Built the Foundation of E.S.G. Investing in India

2008 – CRISIL, Standard and Poor, K.L.D. Research & Analytics launched the S&P E.S.G India Index. It was the first investible index of Indian enterprises whose business strategies and performance demonstrate a high commitment to meeting E.S.G. standards.

2009 – The Ministry of Corporate Affairs (M.C.A.) issued Corporate Social Guidelines. It recommended all businesses must develop C.S.R. policies centered around six core elements – care for stakeholders, proper functioning, respect for workers’ rights and welfare, respect for human rights, respect for the environment, and activities for social and inclusive development.

2012 – The Securities Exchange Board of India (SEBI) issued a circular mandating that almost 100 listed companies publish an annual business responsibility report.

2014 – The government passed a landmark law mandating companies of a particular scale and profitability to spend 2% of their average profits of preceding years on C.S.R. activities.

2015 – SEBI extended the 2% C.S.R. requirement to the 500 companies in the SEBI Listing Obligations and Disclosure Requirements Regulations.

2016 – SEBI issued its green bond guidelines, making India the second country after China to provide national-level guidelines.

Why Is E.S.G. Investing an Evolving Concept in India?

E.S.G. investing is commonplace around the world. But it is still an evolving concept in India. Despite its decade-old history, the country is yet to show significant growth in E.S.G. investing.

Today, around 88% of Indian public corporates have implemented E.S.G. initiatives. However, E.S.G. teams and employees lack confidence that their companies can deliver against their promised goals. Only 50% believe their firm performs very effectively against environmental metrics. 39% feel the same way about governance. And only 37% are satisfied with social progress.

Despite this, Inflows in E.S.G. funds in India leapfrogged close to 95% to Rs. 4,844 crores in FY21 from Rs. 2,490 crores in FY20. However, these funds recorded a net outflow of Rs. 315 crores in FY22. India has fewer E.S.G. funds focused on E.S.G. investing than other top 10 economies. Interestingly, Taiwan has more funds focused on Environmental, Social, and Governance metrics than India.

India has 10 E.S.G. funds, whereas the U.S. and the U.K. have over 500 E.S.G. funds each.

The reason for such under-penetration is simple. Indian investors are still relatively new to sustainable or E.S.G. investing. Hence, they are a little reluctant to put cash into E.S.G. funds as most funds in the sector are unique and do not have a track record of outperformance. Moreover, some institutional investors and distribution partners often have policies that do not allow them to invest in E.S.G. funds with less than three or five years in the market.

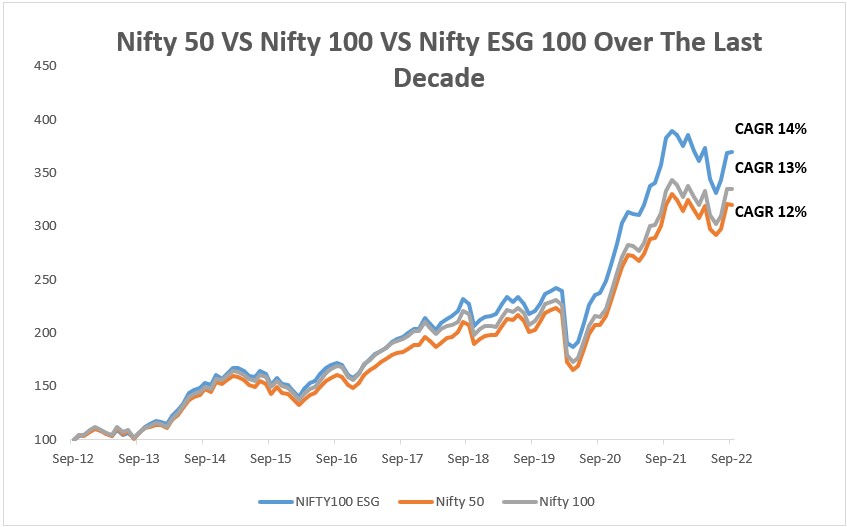

Comparison between Nifty 50, Nifty 100, and Nifty E.S.G. 100

The thematic index NIFTY ESG 100 has outperformed Nifty 100 and NIFTY 50 by 1.3% and 1.8%, respectively.

What is a Thematic Index?

An index that tracks performance of a list of companies on the stock market that follow a particular investment theme. Examples of other thematic index are Nifty50 Shariah Index, Nifty SME Emerge, Nifty Housing, Nifty India Defense etc. You can track these indices on Niftyindices.com.

2022 List of E.S.G. Funds in India and their performance

| E.S.G. Fund | Asset Under Management (Rs. Cr.) | % 1 Year Returns | % CAGR Till Date |

| Quant E.S.G Equity Fund | 90 | 21.9 | 52.9 |

| Quantum India E.S.G Equity Fund | 61 | -1 | 17.9 |

| Axis E.S.G. Equity Fund | 1806 | -9.3 | 16.9 |

| Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund | 136 | -0.8 | 16.6 |

| ICICI Prudential E.S.G Fund | 1412 | -6 | 15.1 |

| Invesco India E.S.G Equity Fund | 750 | -2.7 | 14.3 |

| Adity Birla Sun Life ESG Fund | 1001 | -5.1 | 12.5 |

| SBI Magnum Equity E.S.G. Fund | 4509 | 1.6 | 12 |

| Kotak E.S.G. Opportunities Fund | 1452 | -6.7 | 8.8 |

| HDFC Housing Opportunities | 1209 | 3.5 | 5.9 |

Rise of E.S.G. Around the World

In January 2004, former U.N. Secretary-General Kofi Annan invited 50+ C.E.O.s of major financial institutions to participate in a joint initiative under the guidance of the U.N. Global Impact with the support of the International Finance Corporation (IFC) and the Swiss Government. That’s when Environmental Governance and Investing were first discussed.

The goal of that initiative was to facilitate the incorporation of E.S.G. into capital markets. E.S.G. Investing was first used a year later in a landmark report titled “Who Cares Wins.”

At the same time, the United Nations Environment Programme (UNEP) produced the “Freshfield Report,” which portrayed E.S.G. issues as unrelated to financial valuation. These two reports formed the base for introducing the Principles for Responsible Investment (P.R.I.). Its role is to forward the integration of E.S.G. investing into analysis and decision-making through thought leadership.

Today, many exchanges worldwide have made E.S.G. disclosures mandatory for listed companies.

2013 – A Tipping Point for E.S.G. investing

The growth of E.S.G. investing has been everything but smooth and steady. On the contrary, it has had a fair share of struggles in the initial days. Institutional investors were initially reluctant to accept the concept, arguing that their primary duty was limited to maximizing shareholders’ values irrespective of environment, social impacts, and broader governance issues such as corruption.

Another excellent barrier has been a lack of data and the necessary tools to get complete information. However, corporate disclosure on E.S.G. issues has routinely improved since the Global Reporting Initiative (G.R.I.) launch in 2000.

Over 80% of the world’s largest corporations use G.R.I. standards. The adoption of E.S.G. investing and E.S.G. funds picked pace in 2013-14 when studies showed that good corporate sustainability performance is associated with good financial results. In addition, when coronavirus first appeared in late 2019, market disruptions and uncertainties caused many investors to turn to E.S.G. funds.

Largest E.S.G. Funds by AUM

As of December 31, 2020, the 20 Largest E.S.G. funds held more than $150 Bn in assets combined. These 20 funds collectively represent ~13% of the total assets under management (AUM) globally in E.S.G. equity funds.

Largest ESG Funds by AUM Globally

| Name | AUM ($Bn) | Inception | Origin Country | Fund Type |

| Parnassus Core Equity Fund | 22.94 | 1992 | U.S. | Active Fund |

| iShares ESG Aware MSCI USA ETF | 13.03 | 2016 | U.S. | Index-based ETF |

| Vanguard FTSE Social Index Fund | 10.87 | 2000 | U.S. | Index-based Fund |

| Stewart Investors Asia Pacific Leaders Sustainability Fund | 9.87 | 2003 | U.K. | Active Fund |

| Vontonobel Fund – mtx Sustainable Emerging Markets Leaders | 9.58 | 2011 | Luxembourg | Active Fund |

| Northern Trust World Custom ESG Equity Index | 8.69 | 2013 | Ireland | Index-based Fund |

| Pictet – Global Environmental Opportunities | 8.31 | 2010 | Luxembourg | Active Fund |

| Pictet – Water | 8.02 | 2000 | Luxembourg | Active Fund |

| KLP AksjeGlobal Indeks I | 7.69 | 2004 | Norway | Index-based Fund |

| Nordea 1 – Global Climate and Environment | 7.37 | 2008 | Luxembourg | Active Fund |

| Parnassus Mid-Cap Fund | 6.9 | 2005 | U.S. | Active Fund |

| iShares ESG Aware MSCI EM ETF | 6.83 | 2016 | U.S. | Index-based ETF |

| iShares Global Clean Energy UCITS ETF | 6.52 | 2007 | Ireland | Index-based ETF |

| iShares Global Clean Energy ETF | 6.51 | 2008 | U.S. | Index-based ETF |

| Nordea 1 – Emerging Stars Equity Fund | 6.41 | 2011 | Luxembourg | Active Fund |

| TIAA-CREF Social Choice Equity Fund | 6.32 | 1999 | U.S. | Index-based ETF |

| Handelsbanken Hallbar Energi | 5.85 | 2014 | Sweden | Active Fund |

| Putnam Sustainable Leaders Fund | 5.81 | 1990 | U.S. | Active Fund |

| iShares MSCI USA SRI UCITS ETF | 5.63 | 2016 | Ireland | Index-based ETF |

| Calvert Equity Fund | 5.37 | 1987 | U.S. | Active Fund |

Sector Exposure of E.S.G. Funds by AUM

Sector Exposure (%) of 10 ESG Funds

| Fund | Communication services | Consumer discretionary | Consumer Staples | Energy | Financials | Healthcare | Industrials | IT | Materials | Real Estate | Utilities |

| Parnassus Core Equity Fund | 11.32 | 7.88 | 8.52 | 0 | 6.17 | 10.61 | 18.17 | 32.48 | 3.38 | 1.47 | 0 |

| iShares ESG Aware MSCI USA ETF | 10.1 | 11.99 | 6.05 | 2.15 | 10.06 | 13.43 | 9.13 | 28.79 | 2.36 | 2.79 | 2.54 |

| Vanguard FTSE Social Index Fund | 12.56 | 13.82 | 5.66 | 0.05 | 10.56 | 14.45 | 5.31 | 32.9 | 2.48 | 2.79 | 0.77 |

| Stewart Investors Asia Pacific Leaders Sustainability Fund | 2.64 | 4.59 | 20.96 | 0 | 13.23 | 18.93 | 6.66 | 29.15 | 4.11 | 0 | 0 |

| Vontonobel Fund – mtx Sustainable Emerging Markets Leaders | 13.18 | 17.05 | 4.19 | 4.59 | 21.57 | 1.88 | 2.37 | 19.84 | 5.97 | 4.23 | 5.13 |

| Northern Trust World Custom ESG Equity Index | 8.77 | 10.52 | 5.49 | 0.99 | 10.93 | 12.79 | 5.07 | 22.28 | 2.52 | 2.66 | 1.24 |

| Pictet – Global Environmental Opportunities | 0 | 0 | 0 | 0 | 0 | 8.97 | 25.17 | 37.53 | 12.86 | 4.05 | 9.27 |

| Pictet – Water | 0 | 4.38 | 0 | 0 | 0 | 12.87 | 43.75 | 3.47 | 4.41 | 0 | 30.25 |

| KLP AksjeGlobal Indeks I | 10.74 | 12.25 | 6.23 | 2.02 | 9.99 | 13.52 | 8.21 | 28.88 | 2.53 | 2.52 | 2.78 |

| Nordea 1 – Global Climate and Environment | 0 | 0 | 4 | 0 | 0 | 4.42 | 36.94 | 32.31 | 15.16 | 1.52 | 5.64 |

Why Is E.S.G. Investing Gaining Popularity?

The younger generation demands an E.S.G. stance.

The millennials are highly active and vocal about environmental issues and climate change. They want to see if the companies they invest in are ethical and support global causes. For example – The Save the Planet campaign raised the issue of single-use plastic overuse.

Many companies using plastic or disposing of plastic as part of their manufacturing process or product offering took a beating in the stock market. These companies had to use alternative products to plastic to be relevant in the eyes of the investors (e.g., Moving from plastic bags to paper bags at supermarkets) or face the heat from all the company’s stakeholders.

Shock absorbers

After being thoughtful about world problems and investing in a sustainable environment, there is another aspect you must consider -E.S.G. stocks performing better. The historical performance suggests that E.S.G. themes have performed much better than non-E.S.G.-based portfolios. These E.S.G. portfolios also do well during global events like the Covid-19 pandemic.

E.S.G. Trends Are For Long-Term

Many investing themes stay for 5-10-15 years, and then they fade away. On the other hand, E.S.G. trends are here to stay for an exceptionally long time and maybe a few decades. For example, the most noticeable long-term themes can move from fossil fuels to renewable energy sources. If you believe in such trends and decide to be on this journey, you may benefit as it develops and these companies grow. You may be able to future-proof your portfolio through E.S.G. investments.

Factors To Consider While Selecting E.S.G. Stocks

Most E.S.G. funds use a rigorous review process to pick the stocks. They look at quantitative E.S.G. metrics that match the ideology and vision of the funds. Moreover, they consider parameters such as greenhouse gas and carbon emissions.

So, companies with higher carbon footprints, like coal miners, tobacco manufacturers, and oil and gas companies, lose points and do not feature as E.S.G-relevant companies. On the other hand, companies in the renewable energy industry, FMCG, technology, and healthcare typically feature in the E.S.G. portfolios.

The E.S.G. rating or score – is a must for investors to evaluate. An E.S.G. rating is a way to measure a company’s level of sustainability. External agencies calculate the score based on environmental impact, employee engagement working conditions, and best practices. An E.S.G. score can range from 0 to 100.

How To Build an E.S.G. Portfolio?

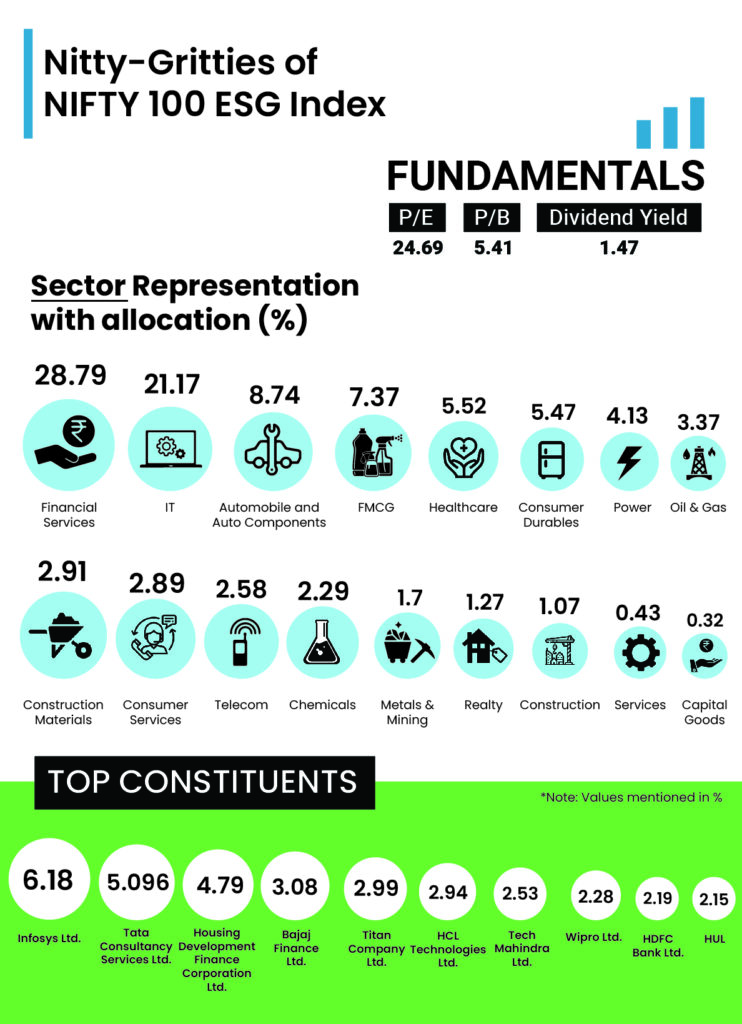

Now that you have a comprehensive idea about E.S.G. investing, the Best E.S.G. Funds in India and worldwide are the best ways to build your E.S.G.-compliant portfolio. First, look at the NIFTY 100 E.S.G. Index to learn how to identify E.S.G. businesses. Then, you can refer to the NIFTY100 E.S.G. Index to build a portfolio of companies that comply with E.S.G. guidelines in India.

Know NIFTY100 E.S.G Index

NIFTY100 E.S.G. is a thematic index designed to reflect the performance of companies within the NIFTY 100 index based on their E.S.G. scores. Please note that it’s not an E.S.G Fund. The NIFTY100 ESG index was launched on March 27, 2018, with a base date of April 01, 2011. Since its inception, Nifty100 E.S.G. Index has grown 246%.

While the movement of NIFTY100 E.S.G. has been steady for the most part, disruptions and market uncertainties during COVID-19 made the investors bet on E.S.G. investing heavily. This implies investors have started focusing on the company’s ability to sustain its businesses through social and environmental risk management.

Risks Of E.S.G. Investing

- Lack of universal global E.S.G. standards

E.S.G. investing is a new concept that does not have a recognized global standard. There are global benchmarks for investors to check, analyze, compare, and make decisions. There are no agreed-upon standards to evaluate the performance of E.S.G. applications and implementation for any company. Such inconsistencies create confusion when comparing two different E.S.G. funds, as the application of funds may be drastically different from theirs. One of the E.S.G. funds holds tobacco stocks as the definition for that fund, which meets the criteria. - Lack of enough historical data

There is hardly any data available for investors to analyze. Long-term data does not suggest ESG funds as a financially viable option. Such untrue inferences may drive the investors away from these funds. - No mandated E.S.G. reporting governance

Today, SEBI has not mandated a reporting structure for listed companies about their efforts on E.S.G. initiatives. The E.S.G. companies voluntarily issue regular reports and commentary, which may be inconsistent with any other company – hence, not comparable. E.S.G. reporting is not a priority for the board members of all the companies yet.

Sebi Proposes Five New ESG Categories

The Securities and Exchange Board of India (SEBI) published a consultation paper on ESG Disclosures, Ratings, and Investing.

SEBI aims to seek public comments on proposals related to ESG (Environmental, Social, and Governance) disclosures and ratings, introducing five new categories for ESG funds in India. These categories are intended to increase the focus on ESG investing and align the interests of investors with broader sustainability goals.

The consultation paper proposes various measures to enhance ESG disclosures, such as mandating companies to disclose their ESG-related risks and opportunities, providing industry-specific ESG guidelines, and requiring companies to disclose their ESG performance in annual reports.

Let’s understand these categories.

The capital markets regulator SEBI has suggested that mutual funds be allowed to adopt five new categories under the ESG scheme: exclusions, integration, best-in-class, and positive screening,

impact investing, and sustainable aims.

Mutual funds can currently place only one ESG scheme within thematic funds. It is mandated that every scheme category should invest a minimum of 80% of the total funds per a specific theme. At the same time, the remainder should align with the more comprehensive ESG philosophy. However, SEBI has proposed that each asset management company be allowed to set up one ESG scheme within each of the five segments.

The Exclusion Scheme: The regulator has suggested that mutual funds exclude securities based on certain ESG-related activities, business practices, or business segments for the ESG exclusions scheme.

The ESG integration scheme: considers ESG-related variables that are material to the investment’s risk and return, in addition to traditional financial factors.

ESG best-in-class and positive screening strategies: must invest in companies that beat their peers in ESG indicators.

ESG impact investment: should pursue a non-financial (real-world) impact and determine whether that impact is quantifiable and trackable.

ESG sustainable aims: should attempt to invest in sectors, industries, or firms projected to profit from long-term macro or structural ESG-related developments. SEBI has voluntarily compelled the top 1000 listed businesses (by market capitalization) to provide ESG disclosures under the Business Responsibility and Sustainability Reporting (BRSR) since the fiscal year 2021-22, making it mandatory in FY23.

SEBI is establishing a regulatory framework for ESG Rating Providers in response to public comments (ERPs). Through AMFI, SEBI has mandated disclosures for ESG-labeled mutual funds.

To simplify the regulatory framework for ESG Disclosures, ESG Ratings, and ESG Investment, SEBI established the ESG Advisory Committee in May 2022. Shri led the Committee. Members from corporations, investors, rating providers, Mutual Funds, industry groups, academicians, technology experts, and other stakeholders were present, led by Navneet Munot, MD and CEO of HDFC AMC.

In addition to proposing the new categories under the ESG scheme, SEBI has also recommended increasing transparency by requiring AMCs to include the name of the specific ESG approach in the name of the fund or scheme. Moreover, the regulator has proposed that ESG plans disclose the name of the ESG rating provider in monthly portfolio disclosures, along with the score disclosures.

The annual commentary of the fund managers on the implementation of the ESG strategy, the yearly monitoring of changes in the ESG rating of investee businesses, and other disclosures will all be included. At least 65% of the assets under management (AUM) of the ESG program should be invested in businesses with thorough BRSR. The remaining investments must be made in companies that report on BRSR.

The consultation paper also proposes measures to improve ESG ratings, such as establishing a standard ESG rating methodology, creating a registry of ESG rating agencies, and establishing a framework for the accreditation of ESG rating agencies.

Impact on Investors

The proposal suggests that mutual funds in India should disclose their ESG-related investments and activities to their investors. This move will help investors understand the ESG exposure of their assets and allow them to make informed investment decisions.

The ESG framework is taking the investment world by storm, with investors increasingly focused on sustainability and responsible investing. SEBI’s new proposal for five ESG categories aims to align investors’ interests with broader sustainability goals and enhance transparency and accountability. The rule is set to become mandatory from April 1, 2023, according to SEBI, who requested public feedback on the plans through March 6.

FAQs

How are ESG trends evolving?

ESG trends are evolving to include more emphasis on social issues such as diversity and inclusion and an increased focus on climate change and sustainability. Regulators are also more active in setting ESG standards and guidelines.

What is the role of regulators in ESG investing?

Regulators are essential in setting standards and guidelines for ESG disclosures and reporting. They also work to ensure that ESG investments are appropriately managed and meet the needs of investors.

What are the benefits of ESG investing?

ESG investing can provide benefits such as reduced risks, improved long-term financial performance, and the ability to invest in companies that align with an investor’s values and beliefs.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 4.9 / 5. Vote count: 10

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/