The earlier chapter concluded on the lines of ETFs’ popularity surpassing that of MFs. Yes, it’s true. However, retail investor participation is still minuscule when investing in ETFs. Before you understand more about this, look at a brief history of ETFs in India.

The First ETF

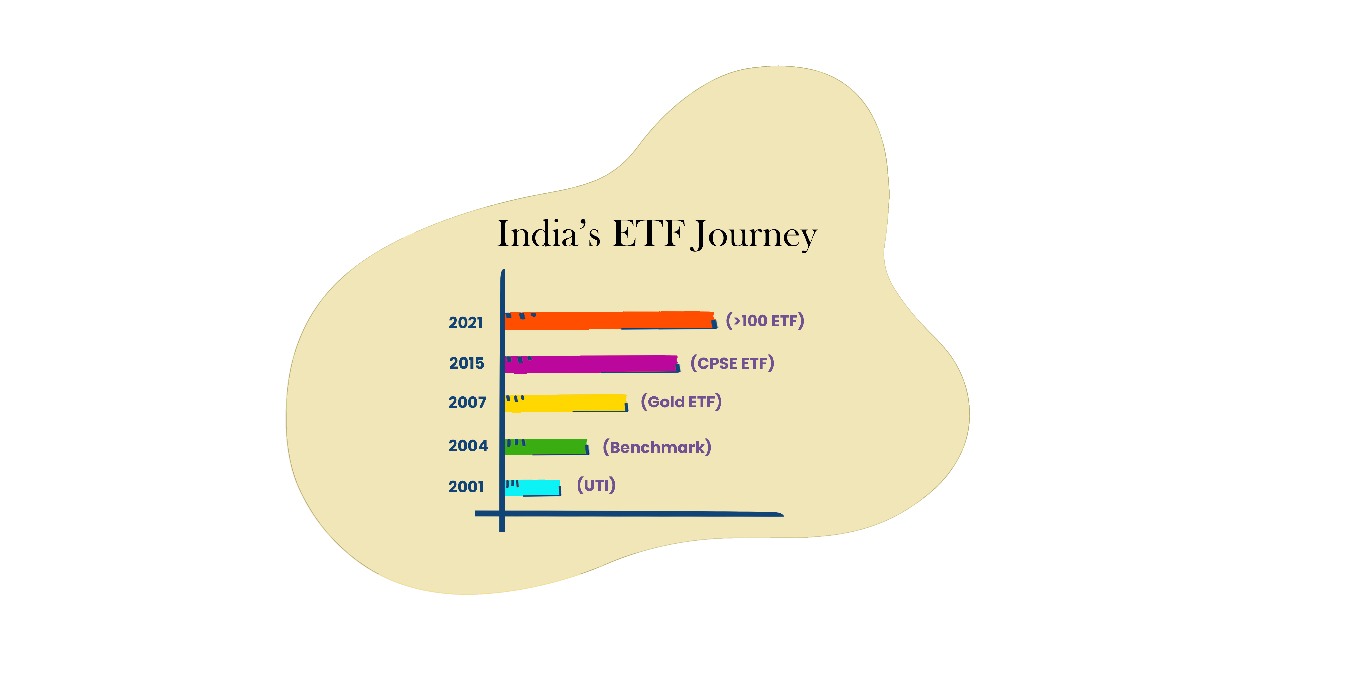

Benchmark Mutual Fund launched the first ETF in India in 2001 to track the performance of the NIFTY50 index.

Benchmark continued to be an innovator of ETF in India as it launched two more ETFs – the first Fixed Income ETF (Liquid BeEs) in 2004 and the first Gold ETF (Gold BeEs) in 2007.

Major fillips

Despite the launch of ETFs in the early 2000s, they received very little attention from retail investors. These ETFs had stable growth in the next few years. ETFs received their first push in 2013 when the center included ETFs as an eligible asset in the pension fund universe. Moreover, the securities transaction taxes were reduced to align them with Mutual Funds.

A significant fillip came when the Government chose ETFs to disinvest in Public Sector Undertakings (PSUs) and raise money in 2015. The Central Public Sector Enterprises (CPSE) ETF comprised 10 quality PSUs back then.

A year later, Employee Provident Fund Organization (EPFO) announced that it would take equity exposure only through ETFs.

Liquidity concerns

Coming back to how ETFs’ don’t find favor with retail investors. We understand what stops retail investors like you from investing in ETFs. The Relative illiquid nature of ETFs often concerns retail investors.

Exchange-traded funds have seen over 30 times volume growth in the last five years, with 2019 being a spectacular year, thanks to pension funds, and the rising awareness among investors.

However, the current liquidity of ETFs is still a fraction of overall liquidity in direct equities. Per CFA institute’s one report on Indian Exchange Traded Funds Industry, institutions own ~90% of Indian ETFs mainly the Employee Provident Fund Organizations (EPFO).

“The dominance of one-way flows results in poor liquidity”, the report notes.

The most liquid ETF in India when we wrote this article, PSUBANKBEES had a total daily volume of 90, 98,120 units traded on Nifty. Whereas, the most traded stock, ICICIBANK, had a volume of 3, 34, 31,141 shares traded on the same exchange.

Though the daily trading volume is not a sole factor to judge ETFs or Stocks, it shows the Indian market is far from mature.

The industry has grown considerably in the past two decades, in terms of assets, product launches, or adoption by institutional and high net-worth investors. The industry has benefited from several tailwinds from the market and regulations.

Yet, in the aspects of investor awareness, liquidity, and market structures, the industry is still nascent.

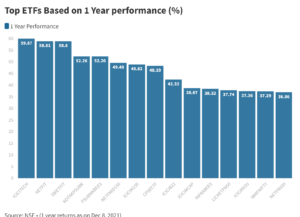

While we conclude this chapter, here is a list of top ETFs in India-

Need sound advice on where to invest, how much to invest, and for how long to invest in stock market? Subscribe to our 5 in 5 Wealth Creation Strategy and get a portfolio of 20-25 fundamentally strong stocks tailored for your goals and risk-taking ability.

*Disclaimer: The information mentioned in this email is for educational purposes. Please do not consider it a recommendation to buy/sell/hold from Research & Ranking.

Read more:

Exchange-Traded Funds – What Are They?

Three Financial Crises Through History Reinvented Investment. Find Out Now

ETFs Or Stocks – Find Out Which One To Invest In Now

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/