Recent events like the Russia-Ukraine war, the sustained rise in crude oil prices, and the FPI’s withdrawing investments have led to plenty of volatility in the stock markets. So it is obvious to worry about the returns you expect, the fall or rise in your portfolio value, etc.

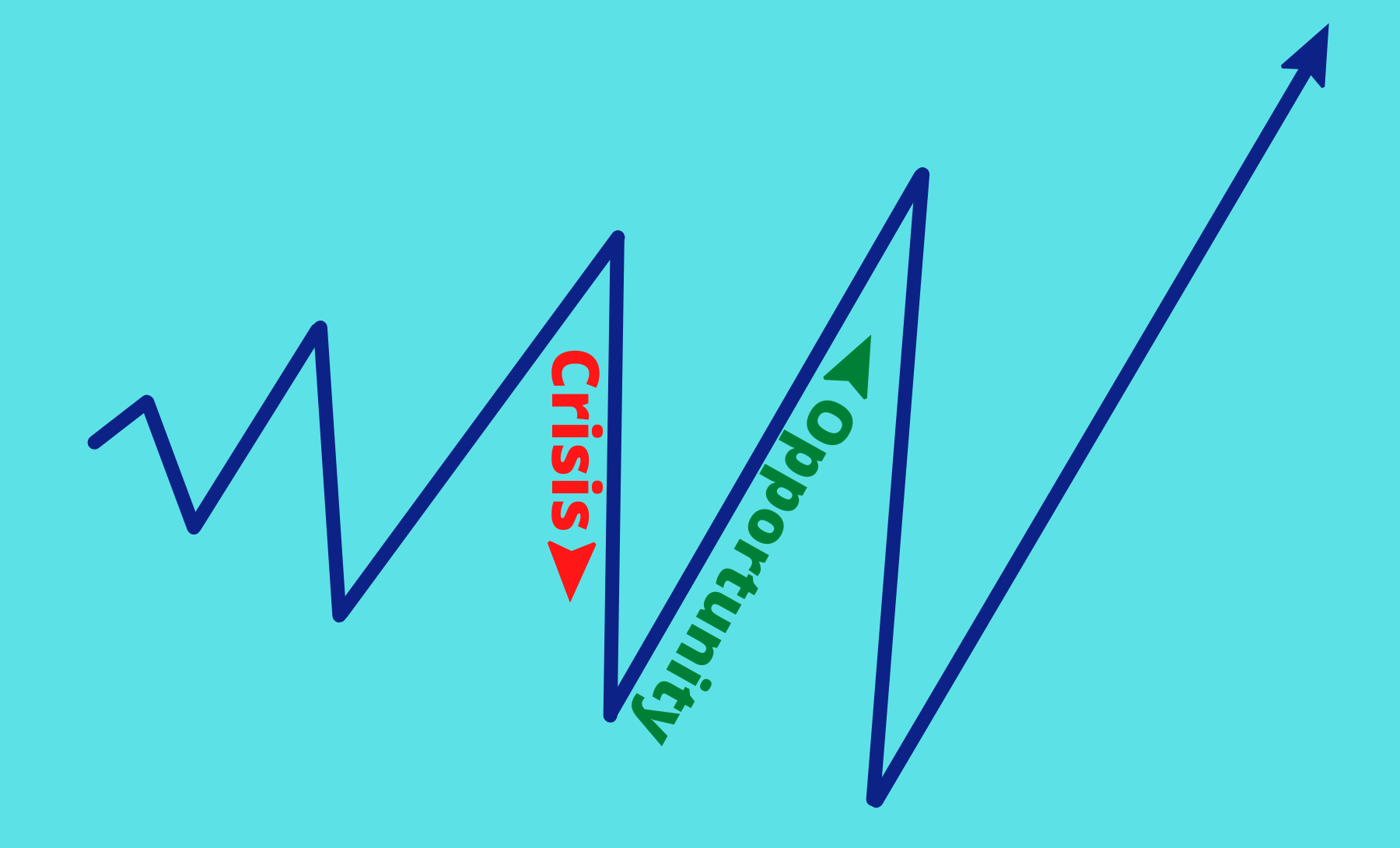

The news is full of sensational headlines that make investors panic and consider selling to mitigate losses. But can a crisis be an opportunity in disguise?

Yes, definitely. In the words of Albert Einstein –

“In the midst of every crisis lies great opportunity.”

We are sure you are wondering how a crisis can be an opportunity. Well, read on to understand

Financial markets are often forward-looking. The stock market growth during the pandemic is the best example. The markets bottomed out in March globally due to rising COVID-19 cases. However, they soon rebounded, doing exceptionally well during the year.

2020 was not the only year the markets grew during a crisis. Look at the past 25 years. Nifty returns with dividends grew at ~12.9% year on year while Gold grew at 9.3%.

Crisis during the last 25 years

Among the several events that had far-reaching effects were the Russian, Asian, global financial, dot com bubble in 2000, and the World Trade Centre attacks in 2001.

Some Indian events were US Sanctions on India in 1998 after the nuclear tests, the Kargil war in 1999, the attack on the Parliament in 2001, the Mumbai attacks in 2008, other stock market crashes, and corporate scandals over the years. Not to forget the political events that caused market crashes.

Each of these events was a cause that led to steep market crashes. However, while people were reeling under these issues, the stock market delivered stellar returns over the years. Moreover, there is strong evidence of equities outperforming other assets globally.

Three professors from the London Business School who authored Triumph of the Optimists: 101 years of Global Investment Returns found investors who optimistically invested in equities made handsome returns over the long term.

Their study of stock market returns data for 16 countries from 1900-2000 found investors in equities earned 5.6% more than investors in long-term bonds per annum.

Another author Barton Biggs in his book Wealth, War and Wisdom, analyzed market data and found that equities performed better than other assets like bonds and treasury bills, beating inflation too.

What does this trend tell us?

Whether you look at the stock market trend in a 10-year segment, 50-year segment, or 100-year segment, the most important learning is to stay invested in equities for the long term. Of course, you may sell a few stocks, add new stocks or even change your investment advisor if they don’t help you achieve your financial goals. But you must not give up on equities as an asset class because of losses during short-term volatility.

Does this mean you must invest 100% of your funds in equities? No, we don’t recommend doing it as the stock market is volatile, and you must have the capacity to handle such volatility without losing sleep. Instead, allocate a part of your assets to bonds, debt instruments and Gold too.

Investments are always subject to market risks and volatility. However, as an investor, you must commit to staying invested despite the crashes and crises.

Meanwhile, subscribe to 5 in 5 Wealth Creation Opportunities and start creating wealth.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/