Fab India, founded in 1960 by John Bissell, is a leading consumer lifestyle platform that offers sustainable handcrafted garments, furnishings, fabrics, and ethnic products. The company offering the Fab India IPO has a business model involving a network of vendors working with artisans and farmers across India.

The Indian traditional lifestyle products company has filed its Draft Red Herring Prospectus (DRHP) with SEBI to raise 4000 crores through the Fab India IPO, This article looks at the upcoming Fab India IPO, which will soon debut in the stock markets.

Fab India IPO details

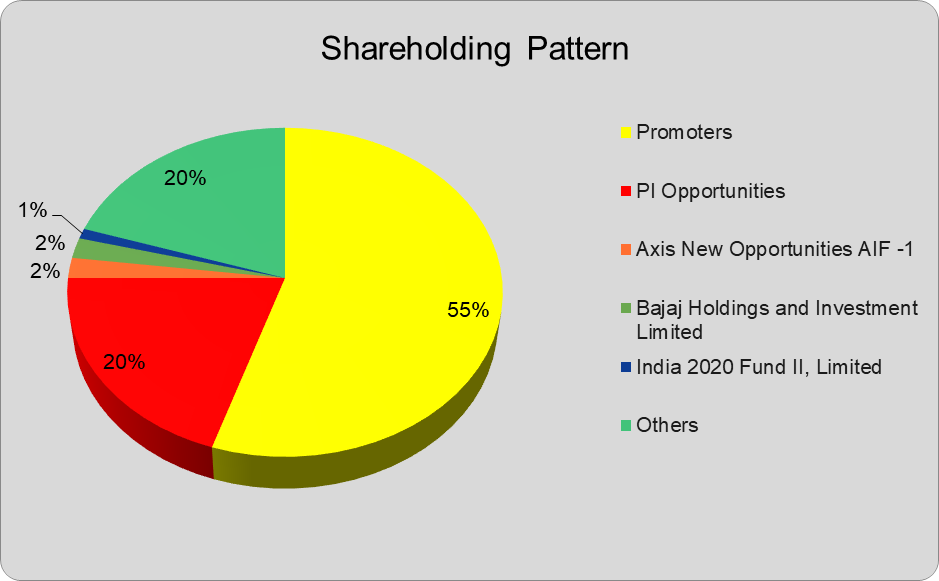

Fab India Ltd, headquartered in New Delhi, filed its DRHP with market regulators to obtain approval to float the Fab India IPO designed to raise funds by selling equity of existing shareholders/investors.

Details of the proposed Fab India IPO are as below-

| IPO Status | Not Announced |

| IPO Date | Not Announced |

| Total IPO Size | Fresh issue – Rs. 500 Crores and Offer For Sale – Rs. 3500 Cr |

| No. of Shares for IPO | Not Announced |

| Issue Type | Book Built |

| Issue Price Band | Not Announced |

| IPO listing at | BSE and NSE |

| Face Value per Equity Share | Rs. 1/- |

Category-wise Shares Offered

| Category | % of Offer |

| Institutional Investors | 75% |

| Non-Institutional Investors | 15% |

| Retail Investors | 10% |

About the Ethnic Wear Brand Planning the IPO

Fab India Ltd is a multi-category store brand with a distinct ethnic, artisanal positioning in fashion, lifestyle, home décor, and personal care. Fab India and Organic India are leading brands that work on the core tenets of “Celebrating India” and “Healthy Conscious Living,” respectively.

As of September 30, 2021, Fab India Ltd had 309 retail outlets spread across 123 cities in 26 Indian states and union territories, including 185 COCOs (Company-owned-and-operated stores including one flagship store), 28 Experience Centers, and 96 FOFOs (Franchise-owned-and-operated stores). Outside of India, the company operates 11 retail stores.

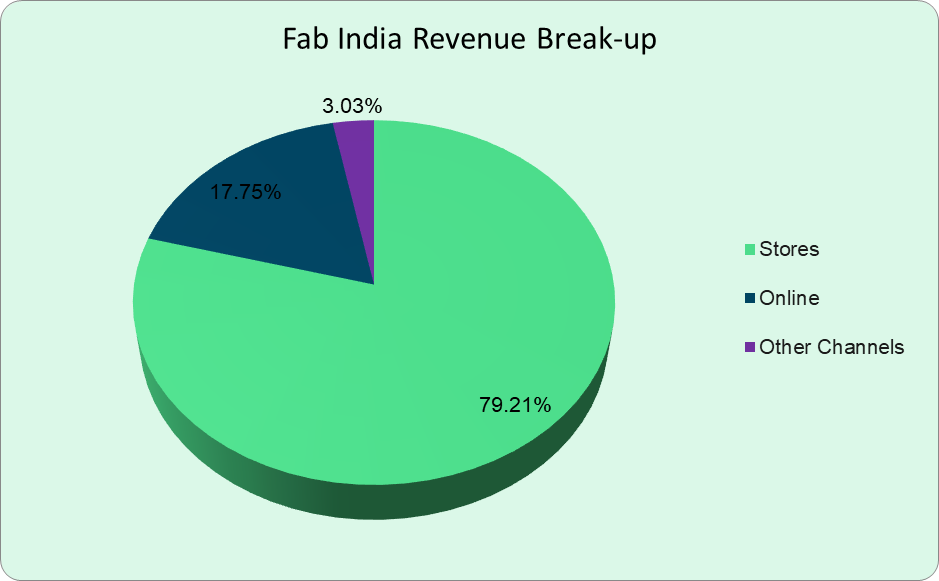

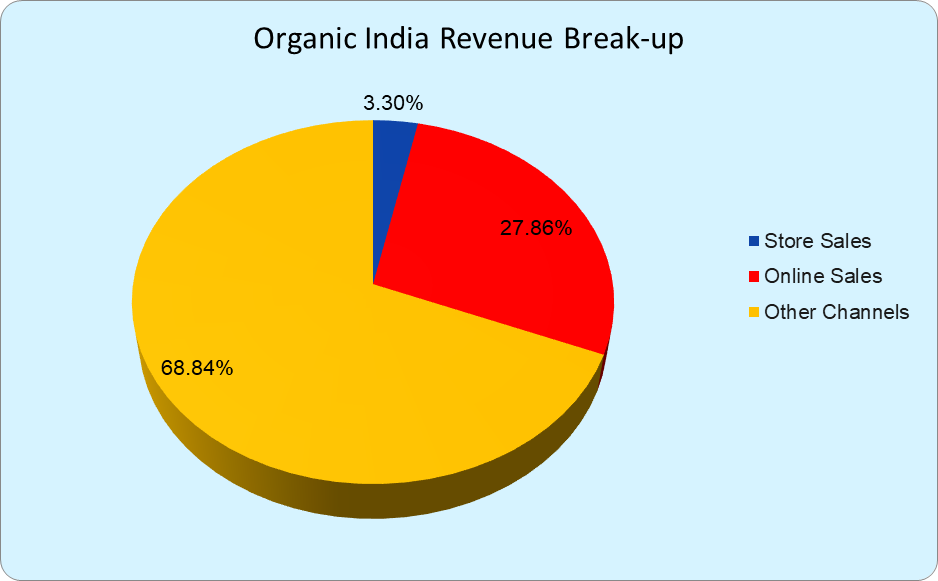

Revenue Break-up (during the six months ended 30 September 2021)

Percentage The Company Holds in its Subsidiaries

FABINDIA LIMITED has

- (a) three direct Indian Subsidiaries: (1) Organic India Private Limited, (2) Fabcafe Foods Private Limited; and (3) Biome Life Sciences India Private Limited;

- (b) one direct foreign Subsidiary: Fabindia International Pte. Limited; and

- (c) three indirect foreign Subsidiaries: (1) Indigo Origins Pte. Limited (2) Organic India USA, LLC and (3) The Clean Program Corp, USA, while filing the DRHP.

The table below shows the share the company holds in its direct subsidiaries.

| Subsidiaries | Shareholding % |

| Organic India Private Limited (OIPL) | 63.79% |

| Biome Life Sciences Pvt Ltd | 50.01% |

| FabCafe Foods Pvt Ltd (FFPL) | 68.46% |

| Fab India Pte International Ltd | 100% |

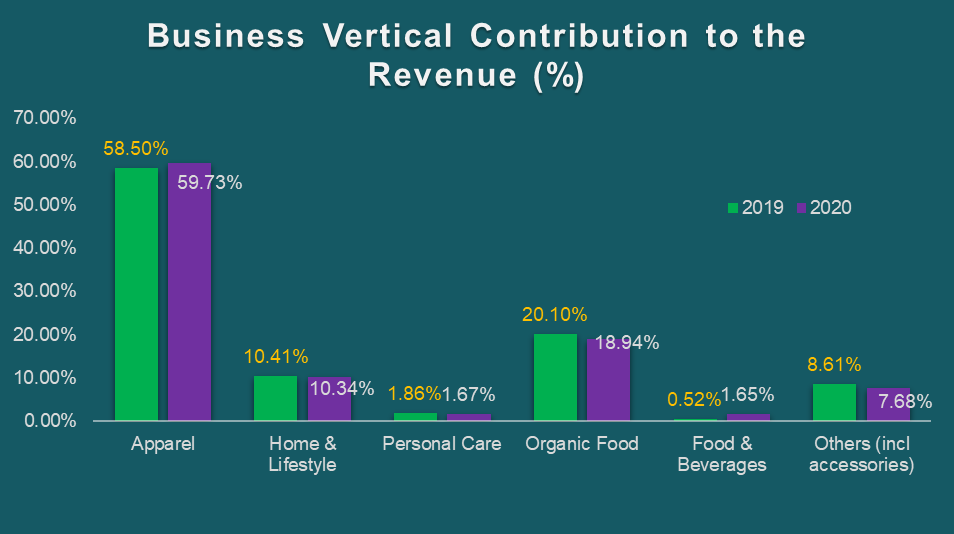

Key Business Offerings of Fab India

- Apparel and Accessories

It offers a wide range of daily and occasional wear, ethnic and western footwear, handcrafted apparel, and accessories to meet every customer’s wardrobe needs.

- Home & Lifestyle

Covers furniture, soft home furnishings, home décor, giftware, and an interior design studio feature focusing on natural fiber.

- Personal Care

Encompasses a broad range of skin and hair care products and fragrances made with naturally inspired ingredients.

- Organic Food

The company offers various Infusions, teas, staples, healthy snacks, detox kits, preserves, agri-products, Ayurveda supplements, and organic personal care products. Also serves healthy dining with regionally inspired foods and beverages.

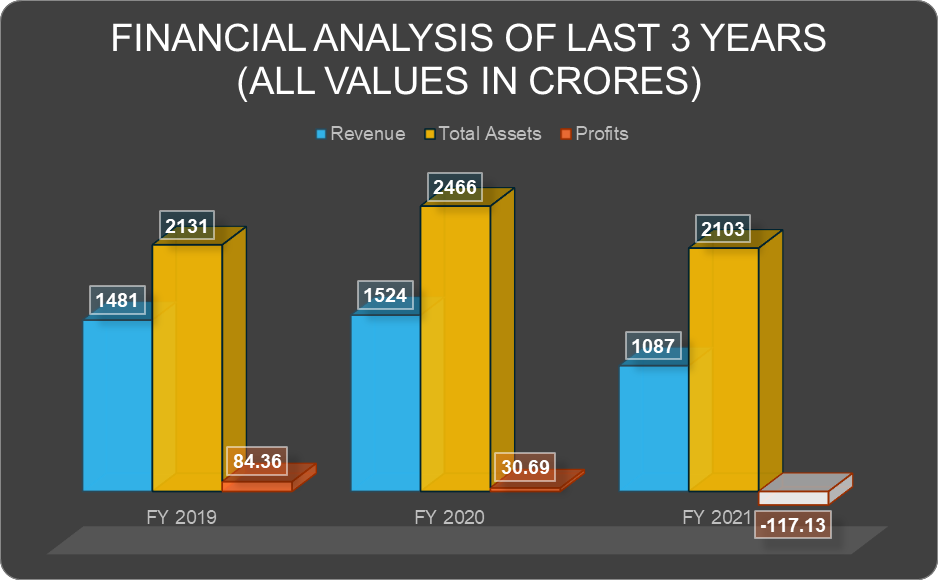

Financial Analysis of the Company

- Revenue increased from 1481 crores in FY2019 to 1524 crores in FY20. However, it fell to 1087 crores in FY21 due to the pandemic-led restrictions that forced the retailer to shut shop during the lockdown. Restricted timings throughout the year added to their woes. It was the first time the 60-year-old ethnic retailer, known for selling products sourced chiefly from rural areas, posted a loss and sales decline in over two decades.

- Net Profit has fallen from Rs. 84.36 crores on March 19 to Rs. 30.69 crores on March 20 and then to Rs. -117.13 crore on March 21.

- Adjusted EPS has slumped from Rs. 0.81 on March 19 to Rs. 0.37 on March 20 to Rs. -0.76 in March 2021.

- The EBITDA Margin% has slumped from 23.77% in March 2019 to 18.06% in March 2020 and 9.05% in March 2021.

| Particulars | Mar 2019 | Mar 2020 | Mar 2021 |

| Net Sales (in Cr) | 1139 | 1161 | 659 |

| Total Expenditure (in Cr) | 919.10 | 910.53 | 604.78 |

| Net Profit (in Cr) | 84.36 | 30.69 | -117.13 |

| Adjusted EPS (in Rs.) | 0.81 | 0.37 | -0.76 |

| Total Assets (in Cr) | 2131 | 2466 | 2103 |

| EBITDA Margin (in %) | 23.77% | 18.06% | 9.05% |

The Strengths and Weaknesses of the Company Offering Fab India IPO

- Leading consumer lifestyle platform focusing on genuine handcrafted and organic products blending indigenous craft techniques with contemporary designs. With consumers becoming more aware of products that address environmental concerns and social integration, the company has an advantage over its competitors.

- With a customer base of over 4.32 million, Fab India is distinctively positioned to leverage emerging trends in the lifestyle, food, and wellness segments thanks to the strength of its organic, sustainable, and natural products.

- Fab India has an extensive supplier community and supply chain infrastructure to gain a competitive advantage. As of March 2021, the team consisted of 50,000 artisans from 109 districts spread across 21 states, direct access to over 2200 farmers, and indirect access to 10,300 farmers via associates from 11 districts spread across 5 states.

- Omni-channel retail network of 311 stores across 118 cities in India, 14 international stores, and 74 Organic India stores to provide customers with personalized service and the best digital experience.

Risks

- In the event of a COVID-19 pandemic outbreak or resurgence, Fab India’s business, operating results, cash flows, and even the performance of the upcoming Fab India IPO could suffer. As evidenced in the past, due to the pandemic’s disruptions, revenue from operations fell by 29.73% year on year in FY 2021.

- Fab India had net cash outflows from operating activities in the past. It may continue to have net cash outflows in the future due to uncertainties such as inflation, regulatory changes, or the recurrence of a crisis. In 2021, net cash outflow (in Rs. Crores) was -6.13; in 2021, it was -111.71 due to the impact of Covid-19.

- Certain products are highly susceptible to seasonal variations in demand and pricing, which may result in stocking too much inventory, resulting in lower margins than expected.

- Fab India and Organic India sell small amounts of their products to countries like Myanmar, Turkey, Russia, and Ukraine, specifically targeted by US sanctions. Any change in US laws can jeopardize the company’s business.

The Objective of Offering Fab India IPO

The company has proposed three primary goals for offering Fab India IPO-

- For voluntary redemption of Non-Convertible Debentures (NCD) aggregating to Rs. 250 Crores along with the accrued interest.

- Prepayment or scheduled repayment of a portion of Fab India outstanding borrowing aggregating to Rs. 125 crores and the accrued interest thereon.

- General Corporate purposes

Should You Invest in Fab India IPO or let it pass?

Suppose you are considering investing in Fab India IPO. In that case, you must first evaluate the factors affecting its performance, like the company’s financial status, growth opportunities, sectoral performance, and market dynamics.

Fab India Ltd has a strong market position and a well-known brand with a large customer base. It employs a fully integrated supply chain model, working with contract manufacturers directly engaged with artisans and managing the entire value chain. This integrated supply chain model offers superior visibility and agility, making it easier for the company to be nimble and respond quickly to changing designs and trends.

However, we must not overlook how the pandemic has impacted its profits, revenue, and cash flows. It will be interesting to see how the company plans to fix its valuation and issue a price band once the final prospectus/ Red Herring prospectus of Fab India IPO is made public.

2022 was bittersweet for IPOs, as markets experienced a sharp correction and several companies reached new milestones. Given the geopolitical tensions, rising inflationary fears, and less-than-impressive IPO performance in the past, predicting how the Fab India IPO will fare is difficult.

Disclaimer*: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

What are the Fab India IPO allotment dates?

The company has yet to announce the exact allotment dates for the Fab India IPO once its DRHP has been approved by SEBI.

Who is the Fab India IPO’s registrar?

Link IntiIPO’sdia Pvt. Ltd is the registrar of Fab India IPO.

When will my order be placed if I pre-apply for Fab India IPO?

Pre-applying lets you apply for the Fab India IPO two days before the subscription period begins. Your order will be processed as soon as the Fab India IPO bidding begins. You will also receive the UPI request within 24 hours of the bidding period starting.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.