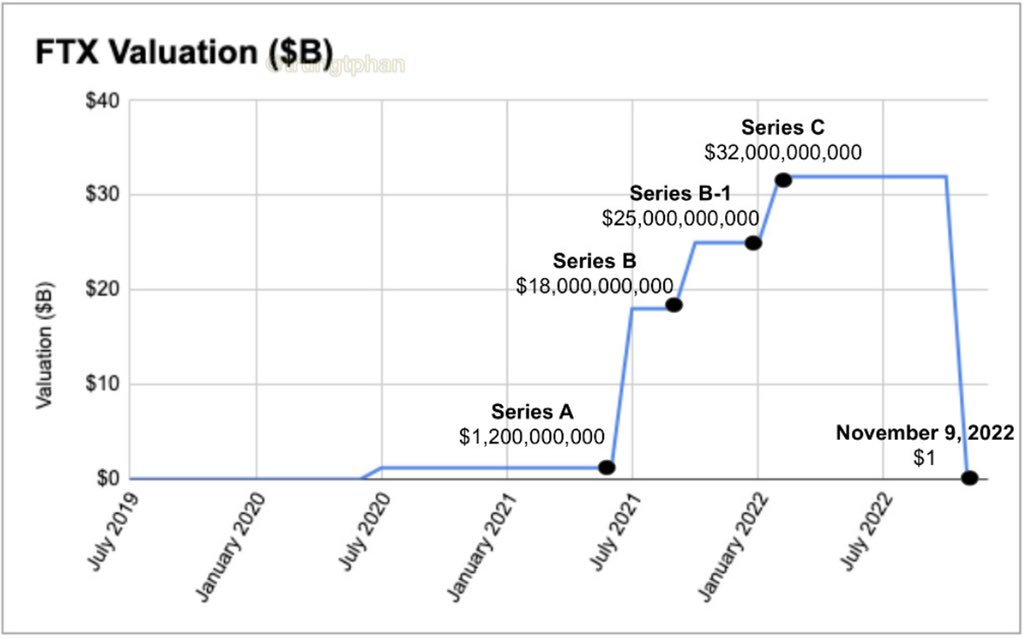

The volatile crypto market has been shaken by the recent collapse of FTX – the once leading cryptocurrency exchange valued at US$ 32 billion.

The FTX crash will undoubtedly impact the future of cryptocurrencies going forward and may even have some influence over broader markets such as equities. Unfortunately, customers and investors lost billions in this crash, where the likelihood of complete recovery is minimal.

Let’s explore what went wrong with FTX that led to its collapse.

What is FTX?

FTX stands for “Futures Exchange.” It is a Bahamas-based company that was founded by Sam Bankman-Fried in 2019. The company multiplied over the last three years by trading in digital assets, raising millions of dollars in venture capital funding. It resulted in Future Exchange becoming one of the largest cryptocurrency exchanges in the world.

The crypto exchange reached a US$ 18 billion valuation in July 2021. Later, the company valuation reached US$ 25 billion in October 2021 when the company raised funds from Temasek, a Singapore state investment firm, and the US-based Tiger Global. Finally, with Softbank’s US$ 400 million influx of funds, the valuation of FTX soared to a staggering US$ 32 billion in January 2022.

Most importantly, the Futures Exchange commanded credibility in the market, and market analysts and regulators lauded it as one of the most transparent crypto operations globally.

What Happened to FTX?

Until July 2022, the exchange was seemingly on a roll. With a history of solid growth, it even offered to purchase the bankrupt crypto lender Voyager Digital getting approval to operate a Dubai-based exchange. However, things started to go awry for crypto exchange in August 2022. A US bank regulator instructed FTX to stop its misleading and false claims made on their funds that the government insured the company.

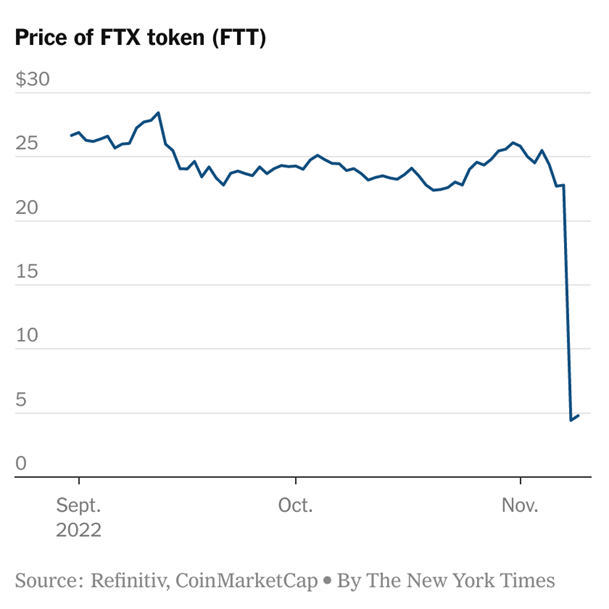

The problems started to compound in November, and everything for the company practically unraveled over 10 days. A CoinDesk scoop was the last straw that led the pyramid to collapse. The scandal brought to the forefront that Sam Bankman-Fried, CEO of FTX, ran a quant trading firm called Alameda Research that held a position worth US$ 5 billion in FTT, the native token of FTX.

The report mentioned that the investment foundation in FTT by Alameda Research was not a fiat currency or other cryptocurrency. It raised many eyebrows about Bankman-Fried’s companies’ undisclosed leverage and solvency.

What Led to the Spectacular Freefall of the Futures Exchange?

Following this scoop about FTX’s potential involvement with Alameda Research led to the company’s insolvency issues and liquidity crisis. Here are some of the reasons why:

1. Binance Announces Sale of FTT Tokens:

The world’s biggest crypto exchange, Binance, announced that it will sell its entire FTT tokens equivalent to US$ 529 million on November 6th, 2022. Changpeng “CZ” Zhao, CEO of Binance, said that the reason for liquidating their FTT position of roughly 23 million tokens was based on the potential risks. 2022 has already witnessed the collapse of the Terra (LUNA) crypto token, which contributed to this decision.

2. Futures Exchange– Binance Deal to Save the Exchange:

Sam Bankman-Fried tried hard to reassure the crypto exchange investors by trying to strike a deal with several venture capitalists. Such a deal would address the liquidity crisis that the company was facing. However, the leaked CoinDesk scoop had FTX customers demanding withdrawals of their tokens valued at US$ 6 billion. Bankman-Fried’s attempts to secure additional VC funding did not materialize, so he turned to Binance.

Futures Exchange and Binance reached a non-binding bailout agreement, with Binance agreeing to purchase the non-U.S. business of FTX for an undisclosed sum. However, in two days, the FTT value plummeted by 80%.

3. Futures Exchange –Binance Deal Falls Through:

The bailout promise by the largest crypto exchange in the world for FTX was short-lived. The deal fell through, with Binance citing reasons for significant concerns about the Futures Exchange’s mishandling of customer funds, among other issues.

4. Futures Exchange Assets Were Frozen:

Following the news of the US$ 8 billion rescue deal being sought by Bankman-Fried, the Bahamas securities regulator froze the company’s assets on November 10th, 2022. The freeze included the company’s Digital Markets and the exchange’s Bahamian subsidiary.

The final nail in the coffin came with the California Department of Financial Protection and Innovation announcing that it had initiated an investigation against the exchange on the same day.

Can the Equities Market Remain Strong Despite the Collapse?

The spectacular crash of the FTX, the third largest exchange globally by volume, sent a series of shock waves in the crypto universe. However, the significant impact of this fall will take some time to emerge to the surface.

The crypto exchange collapse did not create significant repercussions in the traditional markets, including equities, in the short term. It means that the impact of this crypto freefall and mainly been restricted within the crypto ecosystem. However, the long-term effect on other asset classes is yet to be determined, given the fallout magnitude.

FAQs

What exactly is the FTX lawsuit?

US crypto investors filed a lawsuit against FTX creator and CEO Sam Bankman-Fried and several celebrities who promoted this crypto exchange. Their claim against the CEO and the promoters are participation in misleading and fraudulent activities offering FTX yield-bearing digital currency accounts.

Did FTX get hacked?

FTX was hacked within hours of declaring and filing for bankruptcy. The company noticed illegal or unauthorized transactions of roughly US$ 500 million in assets. This was spotted by Elliptic, which offers blockchain analytics for crypto asset compliance. The hacker went on a wallet-draining spree for many days and has reportedly invested these funds in Ether.

What happened to Sam Bankman-Fried?

Sam Bankman-Fried was arrested in the Bahamas at the request of the US government on December 12th, 2022. The government has requested extradition for Bankman-Fried against 8 criminal charges, including wire fraud and conspiracy to defraud investors.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.