Introduction

2022 may be the year of Mergers & Acquisitions (M&A) if the amalgamation activities continue simultaneously. On Monday, 5th April 2022, the investor community woke up to a blissfully surprising announcement – the merger of HDFC Ltd. (NBFC) and HDFC Bank Ltd. (private lender).

In March, two merger activities occurred: Axis Bank’s acquisition of Citi Bank’s consumer business and PVR – Inox from the entertainment space. We have covered these two mergers in detail in our investors’ education initiative, “Informed InvestoRR.” To get insights into these mergers, long-term investments, and more, subscribe to the 5 in 5 Wealth Creation Strategy.

This article explores the World’s largest Banking Deal in the last 15 years and the biggest merger in Indian corporate history.

Marriage of two equals

In the words of HDFC bank Chair Deepak Parekh, the merger between HDFC and HDFC Bank is a merger of two equals. It comes at the right time, as the Reserve Bank of India (RBI) regulations have slimmed the operational arbitrage for non-banking entities. Arbitrage is taking advantage of price differences in two or more markets.

Moreover, he highlighted that the regulatory amendments for NBFCs and banks over the last few years eased the merger. The lenders have been in talks for the last three weeks for the merger.

RBI issued guidelines to harmonize regulations between Banks and NBFCs in the last three years. In our opinion, the marriage of two equals makes sense. RBI has urged large non-banking financial corporations to become banks for better regulations and apply the same banking laws. The amalgamation will involve HDFC and its wholly-owned subsidiaries – HDFC Holdings and HDFC Investments.

Benefits On The Cards

According to HDFC Bank CEO Sashidhar Jagdishan, “The biggest motivation for the deal is creating demand in the housing market as our penetration in this segment is very low”. The proposed merger will enable HDFC Bank to bolster its housing loan portfolio. This, in turn, will inflate the balance sheet of the merged entity, allowing it to underwrite large ticket-size loans.

For HDFC, the primary gain will be quick and easy access to well-diversified low-cost funding and a vast customer base of HDFC Bank. Following the merger, HDFC will hold 41% of transactions in the bank. The proposed entity will complete a product suite with HDFC Life, HDFC MF, etc., coming under one roof. This will help the leadership strengthen the distribution and cross-selling of a complete suite of products.

In addition to the merging entities, the Indian economy is expected to benefit from the merger too. According to Parekh, the pressing need for the Indian economy is access to credit. The merged entity will enable a greater flow of credit into priority sectors like agriculture.

Treat to shareholders

HDFC is the promoter of HDFC with a 21% stake. However, following the merger, HDFC Bank will own all the subsidiaries and associate companies of HDFC Ltd, eliminating HDFCs shareholding in the bank. Post-merger, the public shareholders will own 100% of HDFC Bank, and existing shareholders of HDFC will own 41%. A treat to shareholders is that HDFC shareholders will receive shares in the ratio of 1:1.68. If you hold 25 shares of HDFC, you will receive 42 shares of HDFC Bank.

2nd Largest Company by Market Cap

The merger announcement of the two financial giants pleased traders and investors. On 5th April, HDFC rose ~14%, achieving a market cap of Rs. 5,05,725.10 crore, and HDFC Bank jumped ~10% to top the market cap of Rs. 9,16,927.47 crore. The sum of the market capitalization of the twin came to Rs. 14,22,652.57 crore.

If we put this into context, the market cap of the second-largest company TCS was Rs. 13 73, 882.31 crore. The merged entity can potentially become India’s second-largest company by market cap. Moreover, if the merger falls in place, HDFC Bank will be the World’s fifth most-valued bank and the 63rd most-valued company with a combined valuation of $190 Bn.

Headroom for FPIs

The HDFC Bank is not included in the MSCI index, a gauge for foreign fund managers to compare Indian equities with other emerging market peers. Foreign Portfolio Investors (FPIs) have less room to raise their stakes in the bank.

Following the mega-merger, the FPI holding in the amalgamated entity would be 66%. This means foreign investors will have additional 10% headroom in the merged entity. A stock requires a 15% stake scope for foreign investors to be part of the MSCI index. Inclusion in the MSCI index is expected to bring 5 Billion dollars for the counter with over 10% weight. Counter means stock in investing parlance.

Will the merger be a smooth sail?

The simple answer to this is No. Although RBI has issued many guidelines to ease acquiring a Banking license for large NBFCs, the merger will not be as smooth as expected for HDFC and HDFC Bank.

RBI wants banks to limit ownership stakes in insurance companies. HDFC Bank’s acquisition of HDFC will boost the bank’s balance sheets and bring in the insurance business. HDFC Life and HDFC Ergo are among the top private players in life and general insurance. Analysts say the RBI will not be comfortable with the insurance exposure the bank will get from the deal.

Nonetheless, the bank’s management has asked RBI for clarity on complying with the rules.

A win-win situation for all

While there may be hurdles in the way of the merger, the $40 Billion deal is a win-win situation for all. HDFC, which has helped many buy homes, finds a home in the family company.

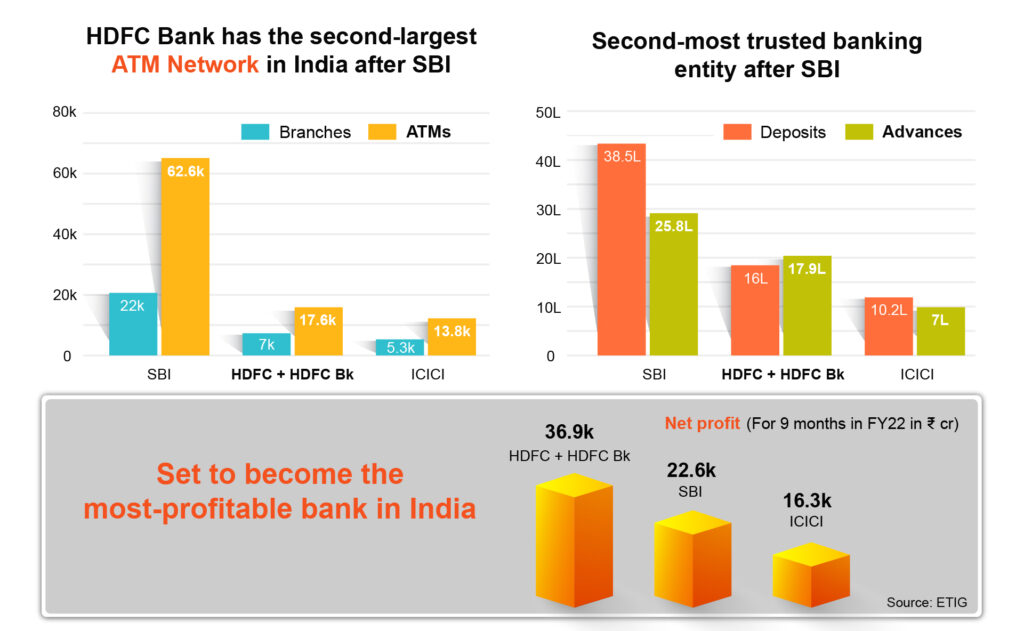

The bank gets to spread its wings in the housing market. Priority sectors like agriculture in the Indian economy are expected to receive greater credit flow. The merged entity will emerge as the most profitable finance company in the country. HDFC shareholders will receive additional HDFC Bank shares at no extra cost.

All in all, the merger, once it falls in place, will be a win-win situation for each stakeholder involved. However, we must wait and watch how things turn out for everyone.

Well, the wait is over, and we have the latest deets on the merger. Let’s take a look

HDFC and HDFC Bank Merger

In a recent press conference on June 27, HDFC’s chairman, Deepak Parekh, announced that the merger between India’s largest housing finance company, Housing Development Finance Corporation (HDFC), and the largest lender by market cap, HDFC Bank, would be finalized during the board meeting on June 30. The merger is set to take effect on July 1. This merger marks a significant milestone. Let us understand the changes that are due to the merger.

Merger details

- The merger between HDFC and HDFC Bank will be effective from July 1, following the board meeting on June 30.

- Shares of HDFC will be delisted on July 13, symbolizing a crucial step in this 45-year-long journey.

- HDFC Bank employees over 60 years will be absorbed with no effect on their salaries.

Final Projections After The HDFC Bank Merger

- Gross Non-Performing Assets (GNPA) ratio is estimated to be 1.16 percent (up from 1.12 percent), and Net Non-Performing Assets (NNPA) ratio is projected to be 0.37 percent (up from 0.27 percent) post-merger.

- Advances may reach Rs 22.2 lakh crore after excluding intra-company lending, representing a 38.85% increase from HDFC Bank’s FY23 loan book.

- Deposits are projected to grow by 8.1% to Rs 18.8 lakh crore.

- The merged entity is expected to benefit from HDFC Ltd’s lower cost of funds, potentially improving HDFC Bank’s Net Interest Margin (NIM).

- The cost-to-income ratio is expected to improve, with the merged entity’s ratio at 35.2 percent for FY23 compared to HDFC Bank’s 40.4 percent.

- HDFC Bank and HDFC Ltd have a quarterly ROA of over 2%. The Return on Assets (ROA) is expected to increase for HDFC Bank and HDFC Ltd.

- Reserves are anticipated to increase by approximately 48 percent to Rs 4.1 lakh crore, reducing the need for additional capital in the medium to long term.

- Taking into account the swap ratio and excluding HDFC Ltd’s holdings, HDFC Bank’s equity is projected to increase by 34.34 percent post-merger.

Asset Quality and Risk

- Gross Non-Performing Assets (GNPA) are expected to rise by 49.7 percent to Rs 26,791 crore, and Net Non-Performing Assets (NNPA) are projected to increase by 96 percent to Rs 8,561.4 crore.

- The provision coverage ratio (PCR) may decline to 68.3 percent from the current 75.8 percent.

- Risk-weighted assets (RWA) to loans are expected to decrease to 92.8 percent from the current 99.1 percent.

- The restructured book is projected to increase to 0.42 percent from the current 0.31 percent.

Branches and Employees

- The number of branches is set to increase by 6.7 percent to 8,344.

- The employee base is expected to grow by 2.4 percent to 1,74,017. (Source: CNBC)

Conclusion: The merger between HDFC and HDFC Bank is a significant event for both entities, set to reshape the landscape of India’s financial sector.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What will happen to HDFC shares after the merger?

After the merger is finalized on July 1st, HDFC Ltd shareholders will have a 41% stake in HDFC Bank. The bank has established a Swap Ratio of 25:42, meaning that for every 25 shares of HDFC Ltd, shareholders will receive 42 shares of HDFC Bank.

How big will HDFC be after the merger?

The merger is expected to give rise to a dominant player in the financial services sector. The newly-formed entity will have a consolidated asset base of about Rs 18 lakh crore upon completion of the merger.

What happens to the share price after the merger?

After a company is acquired, its stock prices tend to rise as the acquiring company pays a premium on the target shares, resulting in higher valuation and increased attractiveness to potential investors.

Who will benefit from the HDFC merger?

After the merger, HDFC’s current shareholders will receive 42 shares of HDFC Bank for every 25 shares of HDFC they own. As a result, existing HDFC shareholders will retain 41% ownership of HDFC Bank. Additionally, HDFC Bank will become a fully publicly owned bank.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/