Private Banks have created much wealth for their shareholders in the last two decades. HDFC Bank, in particular, has been a consistent compounder, multiplying shareholder wealth by 478 times in the previous 25 years. However, over the last 2-3 years, HDFC Bank share price performance has languished. It has underperformed (3-year CAGR of 22%) compared to its peers, with private sector ICICI Bank giving a 3-year CAGR of 37% p.a. and Public sector State Bank of India returning a CAGR of 42% p.a. for the same 3-year period.

We will analyze HDFC Bank’s share price and the recently announced merger with its parent company HDFC Ltd.

HDFC Bank Overview

The history of HDFC Bank can be traced back to the early 1990s when India was undergoing economic liberalization. HDFC Limited, which was primarily a housing finance company, decided to set up a banking subsidiary to cater to the growing demand for banking services in India.

HDFC Bank was among the early private-sector banks to enter the Indian banking sector. Its entry into the banking sector was a significant development as it was the first bank set up by a housing finance company in India. In addition, it brought a fresh perspective to the banking industry with its customer-centric approach and focus on retail banking.

HDFC Bank Journey

Initially, the bank focused on wholesale banking, catering to corporate clients and high-net-worth individuals. However, in 1996, HDFC Bank launched its first retail banking branch in Worli, Mumbai. Over the years, the bank expanded its operations and gradually became a full-service bank, offering individuals and businesses a wide range of banking and financial services.

In 1999, HDFC Bank became India’s first private sector bank approved by the Reserve Bank of India (RBI) to issue credit cards. In addition, in 2001, it became the first bank in India to launch an international debit card in association with MasterCard.

HDFC Bank’s growth trajectory has been impressive, becoming one of India’s fastest-growing banks. It has received several awards for its performance and service excellence, including being ranked as the best private sector bank in India by Asiamoney for several years.

As of December 31, 2022, the Bank’s distribution network was at 7,183 branches and 19,007 ATMs / Cash Deposit & Withdrawal Machines (CDMs) across 3,552 cities/towns as against 5,779 branches and 17,238 ATMs / CDMs across 2,956 cities/ towns as of December 31, 2021. 51% of the branches are in semi-urban and rural areas.

HDFC Bank Management profile

Mr Aditya Puri has been associated with HDFC Bank since its inception in 1994 and has served as the Managing Director and CEO for over 25 years until his retirement in October 2020. He was instrumental in building HDFC Bank into one of India’s leading banks, and under his leadership, the bank has won several awards and accolades.

After Aditya Puri’s retirement, Mr Sashidhar Jagdishan is the bank’s current Managing Director and CEO. He has been with HDFC Bank since 1996 and has held several senior positions in the bank, including Group Head of Finance, HR, and Legal.

Mr Keki Mistry is the Non-Executive Chairman of HDFC Bank and the Vice-Chairman and CEO of HDFC Limited, the parent company of HDFC Bank.

Mr Jimmy Tata is the Group’s Chief Risk Officer. He is responsible for overseeing the risk management function of HDFC. He has been associated with the bank since 2000 and has over 30 years of experience in the banking and financial services industry.

Mr Kaizad Bharucha is the Executive Director and is responsible for overseeing the wholesale banking business of HDFC Bank. He has been with HDFC Bank since 1996 and has held several senior positions there.

Mr Rakesh Singh is the Group Executive and Head of Investment Banking. He is responsible for the investment banking business of HDFC Bank. He has been associated with HDFC Bank since 2003 and has over 25 years of experience in investment banking and capital markets.

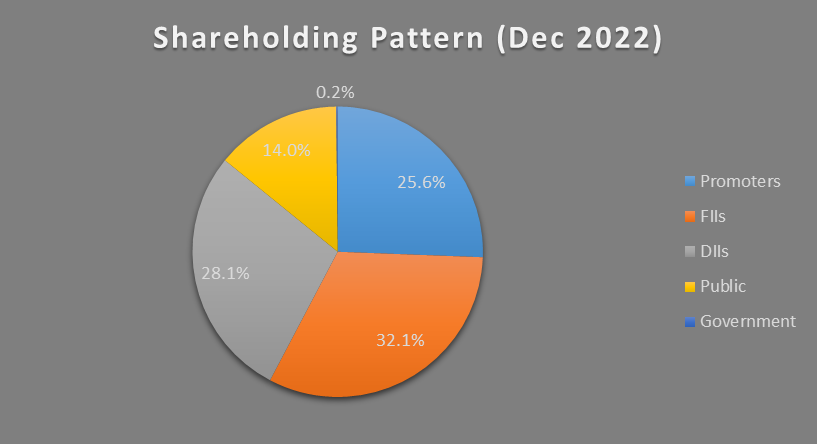

HDFC Bank Shareholding Pattern

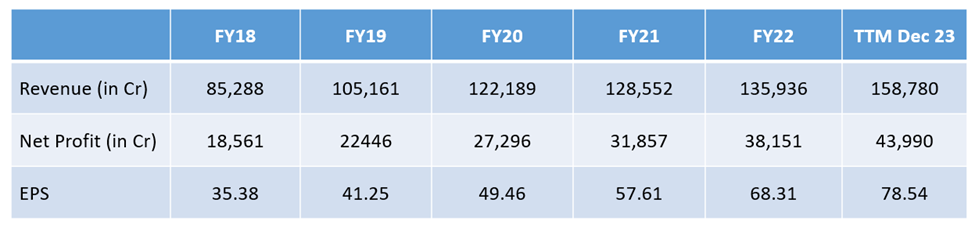

HDFC Bank Financials

Revenue & Profit

For the nine months ended December 31, 2022, the Bank earned a total income of INR 138,949.8 crore as against INR 116,177.2 crore in the corresponding period of the previous year, an impressive increase of 19.6%.

Net profit for the nine months ended December 31, 2022, was INR 32,061.3 crore, up by 19.2% over the corresponding nine months ended December 31, 2021.

Net Interest Income

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

In the recently ended December 2022 quarter, HDFC Bank reported an NII of INR 22,987.90 crore, around 24.60% higher than its NII of INR 18,443.50 crore in Q3FY22.

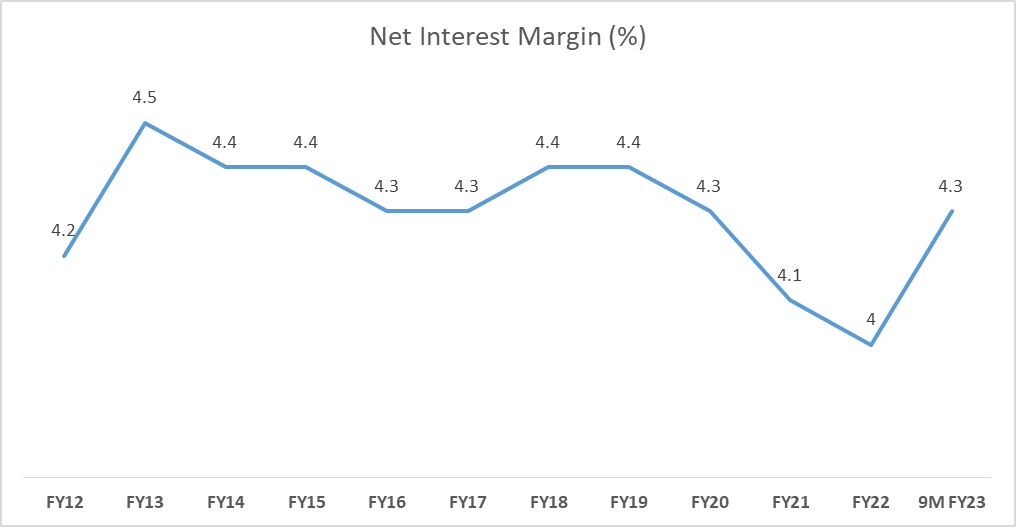

Net Interest Margin

Net Interest Margin (NIM) is a percentage that represents the difference between the interest income earned by a bank and the interest expenses incurred to generate that income. It is calculated by dividing the NII by the average interest-earning assets.

The core net interest margin was 4.1% on total assets and 4.3% based on interest-earning assets for the December 2022 quarter. NIM has stayed above 4% consistently for HDFC Bank over the last ten years.

Asset Quality

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more. Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

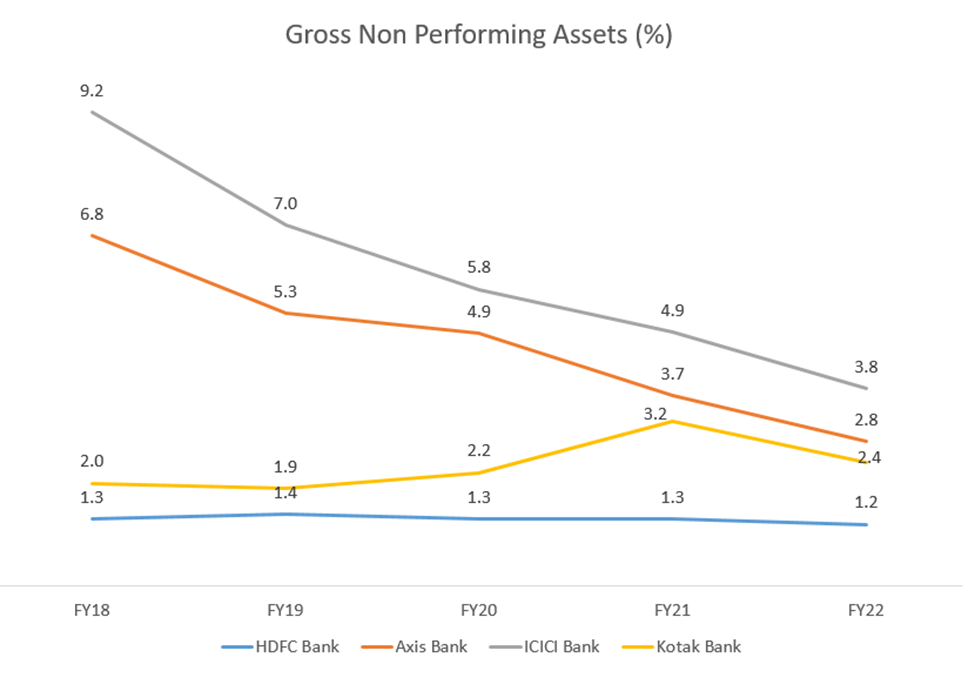

HDFC Bank has been an outperformer in terms of asset quality. Gross non-performing assets (GNPA) were at 1.23% of Gross Advances on December 31, 2022, as against 1.26% on December 31, 2021. Net non-performing assets were only at 0.33% of Net advances as on December 31, 2022, the lowest among large private sector banks.

HDFC Bank Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans. Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers.

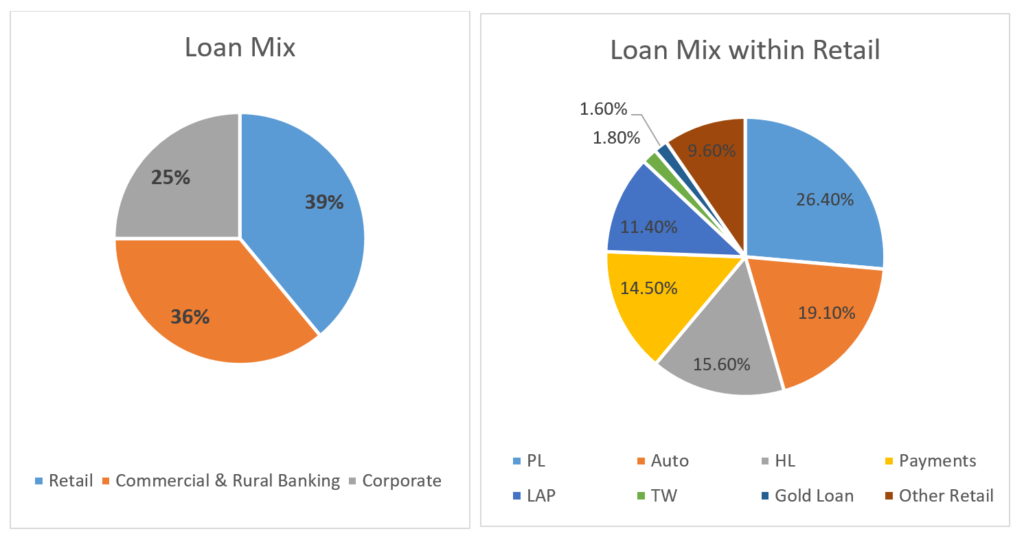

As of December 31, 2022, total advances were INR 1,506,809 crore, an increase of 19.5% over December 31, 2021. Domestic retail loans grew by 21.4%, commercial and rural banking loans by 30.2%, and corporate and other wholesale loans by 20.3%. Overseas advances constituted 2.8% of total loans.

Total Deposits showed healthy growth at INR 1,733,204 crore as of December 31, 2022, an increase of 19.9% over December 31, 2021. CASA (Current Account and Savings Account) deposits grew by 12.0%, with savings account deposits at INR 535,206 crore and current account deposits at INR 227,745 crore. CASA deposits comprise 44.0% of total deposits as of December 31, 2022, as against 47.1% a year ago.

[Jargon Simplified]

What is ROA?

ROA stands for Return on Assets and it is a term used in banking to understand how profitable the bank is in relation to its total assets

HDFC Bank Loan Book Breakup

HDFC Bank has a well-diversified loan mix between wholesale and retail segments. Even within the retail loan book, the bank has fairly diversified exposure across Personal Loans (PL), Auto Loans (AL), Payments – Credit Cards, Mortgages including home loans, Two-wheelers (TW) etc.

HDFC Bank Company Analysis

- Largest Private sector lender:

HDFC Bank is the leader among private banks and has historically maintained pristine asset quality through multiple credit cycles. ICICI Bank had the larger balance sheet; however, HDFC Bank has emerged as the clear leader over the past decade.

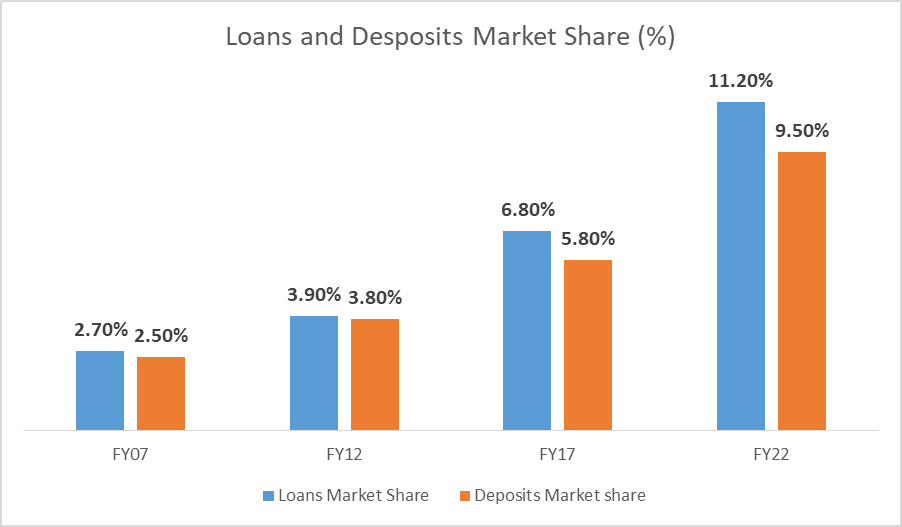

- Consistent market share gains on assets & liabilities:

HDFC Bank has consistently gained market share on both sides of the balance sheet. Advances market share has increased from 6.8% as of Mar-17 to 11.2% as of FY 22. Similarly, deposits market share has improved from 5.8% as of Mar-17 to 9.5% as of FY22.

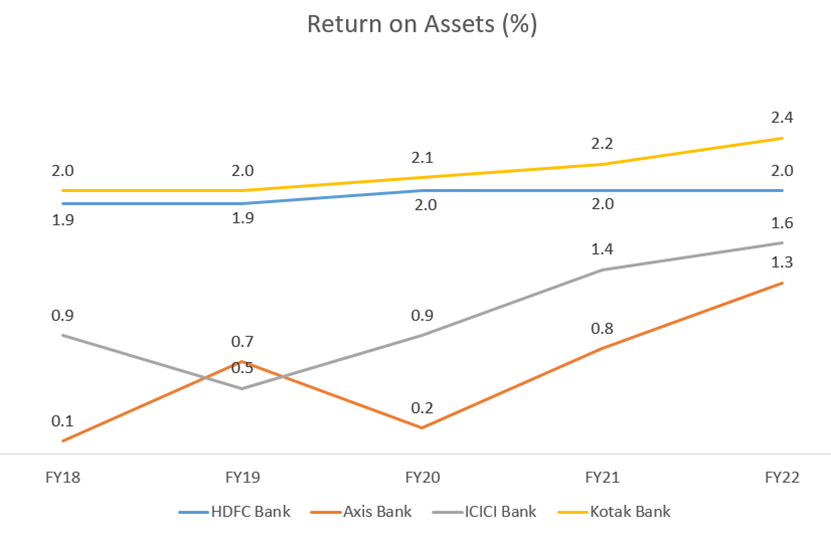

- Best-in-class return ratios:

The bank has consistently posted healthy RoAs. (A higher RoA suggests that a bank is more efficient in generating profits from its assets) in the range of 1.8%-2.0% and ROEs of 16%-18%, respectively, during the past five years despite facing various macro headwinds.

- Best asset quality and low credit cost among top private banks:

HDFC Bank has maintained healthy asset quality and the lowest credit cost (amount set aside for bad loans) among the leading private banks.

The Merger of HDFC Ltd and HDFC Bank:

HDFC Limited is a non-bank financial corporation (“NBFC”) specializing in home mortgages and is the parent company of HDFC Bank. Besides using the HDFC name and an exclusive agreement to originate mortgages for its parent, HDFC Bank has always operated independently.

The merger of HDFC with HDFC Bank will create a financial juggernaut. It has already received NCLT approval and will probably be completed by June 2023. The merger will lead to many synergies between both entities but also come with some challenges.

Synergies from the merger include the following:

- Access to Low-Cost Funds:

Data suggests competitive intensity from banks in the prime mortgage has increased materially – banks’ market share in retail home loans has increased from ~58% in FY18 to ~62% in March 2022. In addition, Prime mortgage is a price-sensitive market, and the lender with the lowest cost of funds will likely underwrite the best-in-class customers at the lowest rates. Hence, given that banks will continue to have a cost-of-funds advantage, HDFC Ltd. shareholders are better off merging with an entity with one of the country’s lowest costs of funds.

- Removal of regulatory arbitrage:

In recent years, RBI has plugged various regulatory arbitrages available to NBFCs. However, over time, larger NBFCs are expected to be closely regulated; hence, some of the advantages of the NBFC structure are likely to go away. Hence this merger is a timely exercise in light of the tighter regulatory regime.

- Ability to cross-sell to a broader set of customers:

As per the HDFC Bank management, ~70% of the customers of HDFC Ltd. and its subsidiaries do not bank with HDFC Bank, and ~8% of the HDFC Bank customers have mortgage products from other mortgage providers. Therefore, post the merger, the bank will access a large pool of untapped customers who can be cross-sold mortgages and other products manufactured within the HDFC empire.

Challenges from the merger include the following

- The merged entity will have to raise deposits to meet regulatory requirements:

Financial institutions in India must hold a certain percentage of their deposit liabilities with the central bank as cash (the Cash Reserve Ratio requirement) and another percentage in lower-yielding liquid securities instead of higher-yielding loans (the Statutory Liquidity Ratio requirement). For banks, the combined CRR and SLR are currently 22.5%. However, for NBFCs like HDFC Limited, it is 13.0%. So, the merged bank will have to raise even more deposits to make up this eight-and-a-half percentage shortfall.

- Future growth on the combined loan book will also be a challenge:

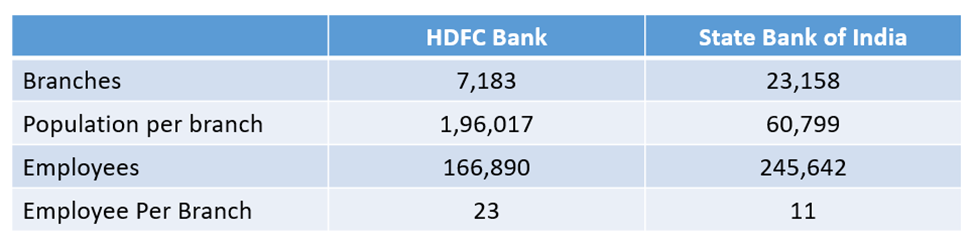

HDFC Bank grew its deposits by 19% year-on-year in 3Q FY23 and 17% y-o-y in FY22. The merged bank must do even better, accelerating deposit growth off a much larger base. Management plans to double the bank’s branch network within three years to almost thirteen thousand outlets. However, it will still be less than half of the State Bank of India’s branches even at that level.

HDFC Bank Share Price History

HDFC Bank share price has been an under-performer over the last two years. However, the stock has grown 18% CAGR during the previous ten years. HDFC completed 25 years since its IPO in May 1995. Without dividends reinvested, the CAGR has been 25%. With dividends, reinvested CAGR is 30%. A 1 crore investment in its IPO is worth 800 cr today, an incredible 800 times. However, this was possible if you have the patience to hold it for 25 years.

The bank continues to perform better than its peers and is expected to keep growing well into the future. It thus continues to be an excellent long-term investment for investors.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

Is it a good time to invest in HDFC Bank?

HDFC Bank has been a consistent compounder since its IPO. Moreover, it continues outperforming its peers in business performance and excels in all financial metrics. As a result, the outlook for the bank is excellent, and it makes sense to keep adding HDFC Bank from a long-term investment perspective.

Is HDFC Bank share going to split?

HDFC Bank last split the face value of shares from INR 2 to 1 in September 2019. There is no news of any split in the immediate future.

What is the future of HDFC Ltd shares?

Post the merger with HDFC Bank, shareholders of HDFC Ltd will receive shares of HDFC Bank. As a result, the merger ratio is 42 shares of HDFC Bank for 25 shares of HDFC Ltd.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 6

No votes so far! Be the first to rate this post.