Over the last decade, Adani Enterprises has become synonymous with India’s growth story. The group’s spectacular rise saw the arrival of a new generation of entrepreneurs keen to expand their ventures internationally.

Led by Gautam Adani, the group is home to over half a dozen major corporations with interests ranging from infrastructure development to transportation, power, food, and more. A regular face on the Forbes billionaire list, Gautam Adani and Adani Enterprises was rocked by the release of the report by Hindenburg Research that wiped out a staggering USD 118 billion since 24th January 2023.

What Led to the Adani Empire’s Fall from Grace?

The Hindenburg Report was released by Hindenburg Research, a forensic financial research firm founded by Nathan Anderson in 2017. The organization analyses equity, credit, and derivatives. It has a proven record of exposing corporate scams and wrongdoings.

This US-based short-seller Hindenburg has alleged that the Adani Enterprise has been built on poor fundamentals, with Gautam Adani possibly pulling one of the ‘largest cons in corporate history.’ In its 100-page report, Hindenburg revived old suspicions about corporate governance at the Adani conglomerate and stated that it had the evidence to support that the company had been party to ‘brazen stock manipulation and accounting fraud scheme over the course of decades.’

The release of the Hindenburg Report set in motion a tumbling down effect that resulted in a combined loss of USD 1.7 bn (Rs 1.4 trillion) in wealth for investors in Adani Group stocks. Adani also saw a drop in his personal fortune. The second wealthiest man in the world now features at No. 21 on the Bloomberg Billionaires Index.

What Were the Main Accusations in the Hindenburg Report?

“Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure,” said the report by Hindenburg Research.

In other words, the 100-page Hindenburg report has mainly focussed on how this Indian conglomerate inflated revenues and manipulated stock prices using a web of companies in tax havens despite debt piling up on its books.

Other than this, the allegations by Hindenburg Research touched upon the following:

- The Hindenburg Report disclosed the existence of 38 shell companies in Mauritius controlled by Vinod Adani, Gautam Adani’s brother. Similar entities have been found to operate in other tax havens under the supervision of Vinod Adani and his close associates. The report stated that these offshore shell entities formed a network to manipulate the usage of the company revenue.

- The firm auditing the books of Adani Enterprises and Adani Total Gas is seemingly a small company with only 4 partners, 11 employees, and no website. This tiny firm is said to be the auditor of just one other listed company. It triggers suspicion as the complex audit work required for Adani Enterprises, which has over 156 subsidiaries and many more joint ventures, can be managed by an audit firm of this size.

- The Hindenburg report also mentioned that 8 of 22 key roles are held by the family members of Gautam Adani, Founder and Chairman of the Adani Group.

Moreover, the Hindenburg Report also shed light on the four major government investigations that were undertaken in the past relating to allegations of fraud by the company.

What were the Immediate Consequences of the Hindenburg Report?

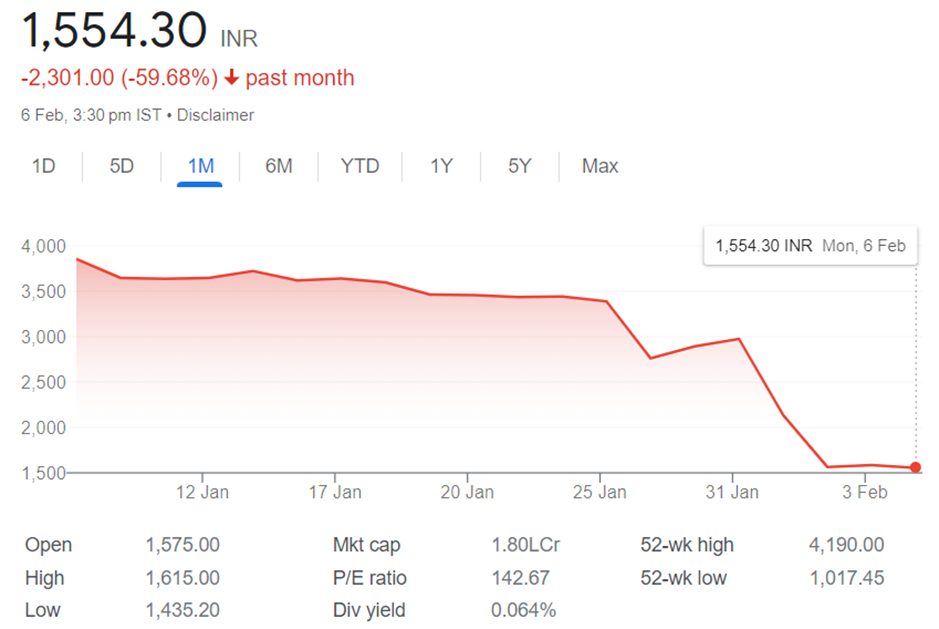

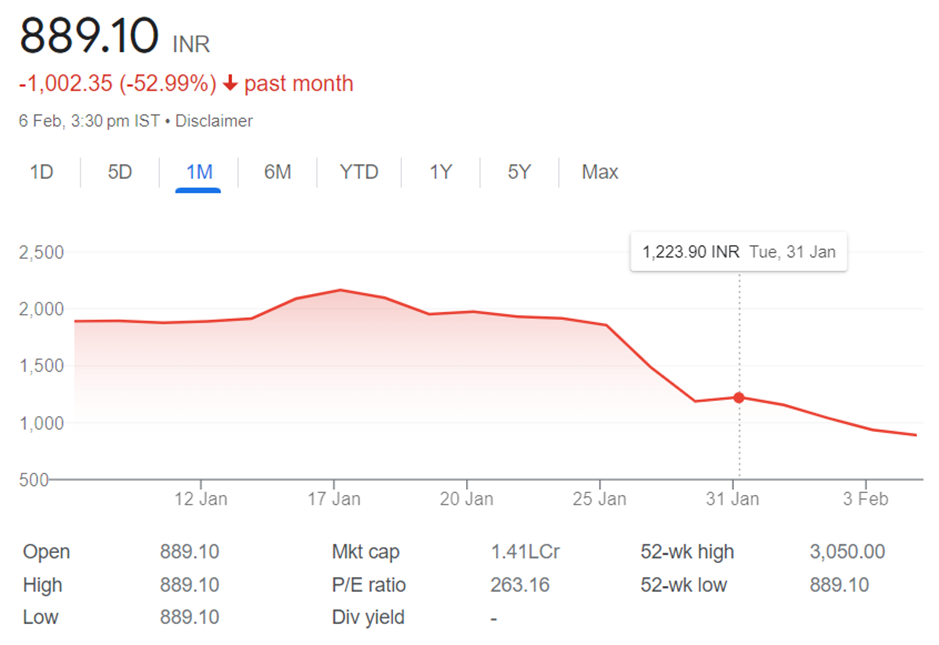

Following the release of the Hindenburg report, a massive sell-off of Adani stocks has adversely impacted market perceptions over the last week.

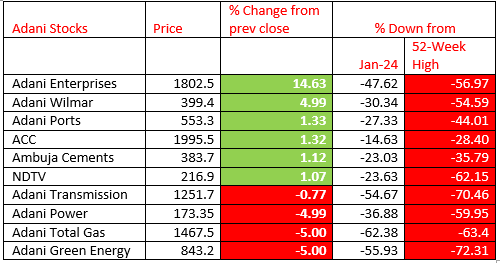

Look at how Adani group stocks performed over the last few days.

Adani Enterprises stock was down by 2.2% at the close of business on Friday, 3rd February 2023. The share price had plummeted by 50% in the last 7 days.

The shares of Adani Green Energy closed at Rs 935.90, recording a new 52-week low. Overall, the share value has experienced a fall of 30%.

A 25% fall was recorded in the share price of Adani Ports and Special Economic Zone Ltd in the NSE, with the stock closing at Rs 488.40 at the end of business on Friday.

Besides triggering the downhill journey of one the wealthiest men in corporate history, the release of the report by Hindenburg Research has seriously undermined investor confidence in India. Not just that, it has also raised critical questions about the integrity of the country’s regulatory framework.

A look at how Adani stocks fared 12 days after the report was released.

The rollover effect of the release of the Hindenburg report has led to the Reserve Bank of India launching an inquiry into ascertaining the exposure of Indian banks. Additionally, financial institutions like Credit Suisse and Citigroup have refused to accept Adani Group’s securities as collateral for loans. After the Hindenburg report was published, some rating agencies began examining the risks associated with the Adani Group’s debt and creditworthiness.

What is the Way Forward for Adani Enterprises?

Adani Group has responded with a 413-page letter rebutting the allegations put forward by the report released by Hindenburg Research as “unsubstantiated speculations.” Gautam Adani recalled the sale of the fully subscribed FPO to gain investor confidence. He clarified that the Group’s books are strong and healthy, with secure assets and an “impeccable track record of servicing their debt.”

15 days after the report was released, Adani stocks have recovered from their decline, with Adani Enterprises rising to Rs.2220 as of 8th February, which is a ~23% gain in a day. Other stocks have also gained.

FAQs

What was Gautam Adani’s net worth according to the Hindenburg report?

Gautam Adani had a net worth of USD 120 billion, of which USD 100 billion was amassed in the past 3 years.

What led to Adani Group’s rise in the past decade?

Adani Group invested in capital-intensive projects such as airports, power plants, and data centers, which aligns well with Prime Minister’s core agenda to drive India’s growth story.

Did all Adani companies experience a huge loss in share value in the last week?

Adani Transmission experienced a 10% degrowth in share price, whereas Adani Power, Adani Total Gas, and ACC Ltd. stocks witnessed a 5% decrease each over the last week.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 65

No votes so far! Be the first to rate this post.