We often hear about the bull run or the bear run in the stock market, and news channels speak of the same trend, so most investors are aware of it.

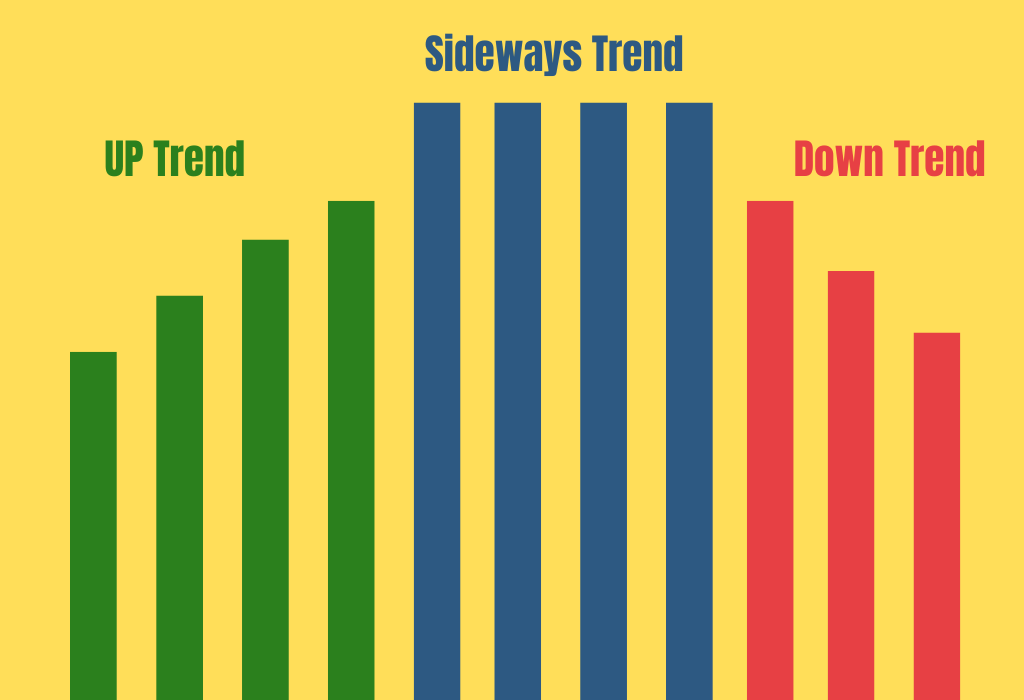

The bull market structure forms when the prices make higher highs and higher lows on the charts over a while, forming an uptrend pattern. A bear market structure forms when the stock price forms lower lows and lower highs on the charts creating a downward trend. However, these trends are for the long term, but there are short-term and mid-term trends that form within that market. One such trend is the sideways market.

Wondering what a sideways market could be?

Investopedia defines a sideways market as, “the horizontal price movement that occurs when the supply and demand for a stock are almost equal. It typically occurs when the stock is in the consolidation phase before the price continues a previous trend or reverses into a new trend.”

A sideways market or a consolidating market does not form new highs or new lows over a period and trades in a very tight range between the swing high and swing low of the stock in the last few trading sessions.

After a sharp run-up for any stock, the stock then consolidates in a broad range for a period. Such movement is often known as the sideways market, which makes investment decisions difficult. Such market structures confuse investors as they do not understand what to do with their portfolios. There is a lack of clarity in such moves.

Why are sideways markets more difficult than the usual Bull or Bear markets?

The sideways market that lasts for 6 months to 1 year would mean no return for the investors. The chief reason investors invest in stock markets would be to beat inflation. If the stock market stays sideways for a time, investors may feel irritated as they face the impact of inflation and lose capital value too.

Also, no returns for 6 months would mean a loss of time in the stock market, when they could have earned a coupon payment in a debt instrument. During such times investors must sail the boat and not decide to sell because there is no movement. The question is what can you do to earn in a sideways market?

Here are four things that you can do, to make money in a sideways market.

1. Sector rotation

We typically see sideways markets at an index level where the broader markets are trading in a tight range. However, there is a substantial change of hands across sectors, keeping the overall index afloat at a similar level.

For example, Nifty Index in India has a heavyweight in banking, financials, IT, and metals.

The rupee depreciates against the dollar due to higher inflation, the global metal prices go up, and banking is affected, but IT does well because its revenue is in dollars. However, the overall net impact on the Nifty index may be negligible and the price of the Nifty index may not even move an inch. But there is a substantial flow of funds from banking to IT and Metal stocks due to macro-economic changes. It means sector rotation can help you maintain your portfolio.

2. Have a stock-specific approach

Like identifying sectors that outperform and underperform, even in a sideways market, few stocks show strength and others show weakness. A sideways market shows the true potential value of any company as it consolidates over large periods to its correct price points. Having a strict plan to buy and sell a stock based on the right valuations, will allow you to rebalance your portfolio in a sideways drift.

3. Focus on dividend-yielding stocks

Dividends are one of the finest sources of passive income. If you can identify high dividend-yielding stocks with a consistent dividend payout history, you will benefit immensely during the sideways market. Sideways markets are not known for sharp movements in stock prices. However, the dividends a company pays depend on the historical performance of the company. Dividend becomes an income for investors even in a sideways market. With the interest rates still low, dividend income from stocks becomes an attractive investment opportunity.

4. Global investments

There are instances of the Indian economy running in tandem with its counterparts across the globe. However, certain macro-economic events result in funds flowing from developing economies to developed economies. For example, the dollar strengthening globally against all currencies will mean fund flow from India to the United States as the US economy is stronger and more stable than the other developing economies. Shifting money to global investments during a sideways market will let you earn more than the domestic market.

There are limitations to a sideways market too. Such a market trend can be difficult to deal with. Especially, for investors, as the traditional buy and hold strategy may not give the alpha returns, they expect.

Does this mean you sit on the sidelines? No. Proactively checking your portfolio and tweaking it if necessary is what you can do when the market is drifting sideways.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.