Introduction

From being mired in multiple scams and controversies towards the end of 2018 to being recognized as the “Company of the Year” for 2022 by The Economic Times, ICICI Bank has been a successful corporate turnaround story led by Sandeep Bakshi at the top.

The bank has registered impressive growth in profits and margins over the last three to four years, supported by improved asset quality and greater contribution of deposits. This has led to ICICI Bank being projected as the poster boy for Indian banks and remains a top pick among brokerage houses. The stock has delivered a 5 Year/3 year CAGR of 26%/40% respectively.

Let us try and understand what is leading to the bank’s turnaround and growth prospects going forward.

ICICI Bank Overview

ICICI Bank is India’s second-largest private sector bank by assets, with a wide range of banking and financial products and services. Since 1955 with support from the World Bank and the Government of India, the bank has transformed itself from a development financial institution offering Project finance to a diversified financial services provider.

The bank was incorporated in 1994 as a subsidiary of ICICI (Industrial Credit and Investment Corporation of India) and later merged with its parent entity in 2001, much like what is happening today between HDFC and HDFC Bank.

The bank offers its customers a range of retail banking, corporate banking, and investment banking products and services. Its retail banking offerings include savings accounts, current accounts, fixed deposits, recurring deposits, loans, credit cards, debit cards, and digital banking services.

ICICI Bank’s corporate banking services include working capital finance, term loans, trade finance, cash management solutions, treasury and forex services, and investment banking services such as debt and equity underwriting, mergers and acquisitions advisory, and project finance.

The bank has a strong presence in India, with over 5,718 branches and 13,186 ATMs nationwide. It also has a significant international company with branches in the United States, the United Kingdom, Canada, Singapore, Hong Kong, Bahrain, Sri Lanka, Qatar, Oman, and Dubai.

ICICI Bank Journey

The timeline below depicts the Bank’s journey since inception and the most important events contributing to its growth and success.

- 1994: ICICI Bank came into being Promoter by ICICI Limited

- 1998: IPO of ICICI Bank that reduced ICICI’s shareholding in the bank to 46%

- 2000: Equity offering in the form of ADRs got listed on NYSE

- 2001: ICICI Bank acquired the Bank of Madhura

- 2002: RBI approved the merger of ICICI and two wholly-owned retail finance subsidiaries, ICICI Personal Financial Services Limited and ICICI Capital Services Limited, with ICICI Bank.

- 2003: Incorporation of ICICI Bank Canada

- 2007: Sangli Bank merged with ICICI Bank.

- 2010: Amalgamation of Bank of Rajasthan Ltd. with ICICI Bank Ltd. came into effect

- 2020: Board approved an investment of INR 10 bn in Yes Bank

ICICI Bank Management Profile

Mr Sandeep Bakhshi is the current MD and CEO of ICICI Bank. He was appointed to this position in October 2018, following the resignation of Ms Chanda Kochhar. He has been associated with ICICI Group for over 30 years. He has held various leadership positions, including MD and CEO of ICICI Prudential Life Insurance Company and Deputy MD of ICICI Bank.

Mr Anup Bagchi is an Executive Director (ED) of ICICI Bank. He has been associated with the bank for over 25 years. He has held various leadership positions in ICICI Bank, including CEO of ICICI Securities, Head of Retail Banking and Rural Banking, and COO of the bank. As an ED, Bagchi is responsible for the retail banking, technology, and digital banking businesses of ICICI Bank.

Ms Vishakha Mulye is an ED of ICICI Bank. She has been associated with the bank for over two decades, joining the ICICI Group in 1993. Mulye has held various leadership positions in the ICICI Group, including MD and CEO of ICICI Venture Funds Management Company and ED of ICICI Lombard General Insurance Company. She has also served as the CFO of ICICI Bank and played a vital role in the bank’s capital raising and M&A activities.

Mr Sandeep Batra is an Executive Director responsible for Operations and Customer Service, Human Resource Management, Technology, Legal, Corporate Communications, and Secretarial functions. He is also administratively responsible for the Risk function, Internal Audit, and Financial Crime Prevention and Compliance Groups.

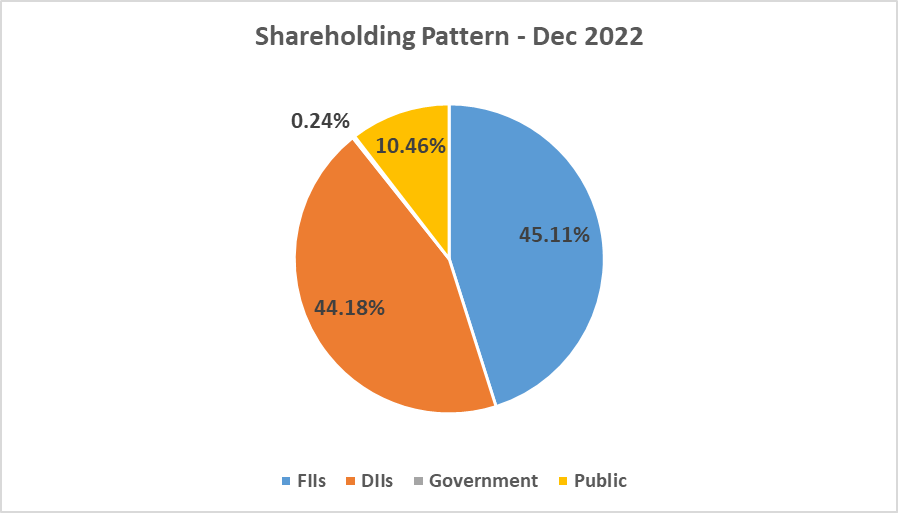

ICICI Bank Shareholding Pattern

ICICI Bank Business Company Analysis

ICICI Bank is a financial conglomerate. Through its various subsidiaries, it has a presence in insurance (life & general), asset management, broking & investment banking, private equity, and debt underwriting.

Key Subsidiaries of ICICI Banks are:

- ICICI Prudential Life Insurance

- ICICI Lombard General Insurance

- ICICI Securities

- ICICI Prudential Asset Management Company

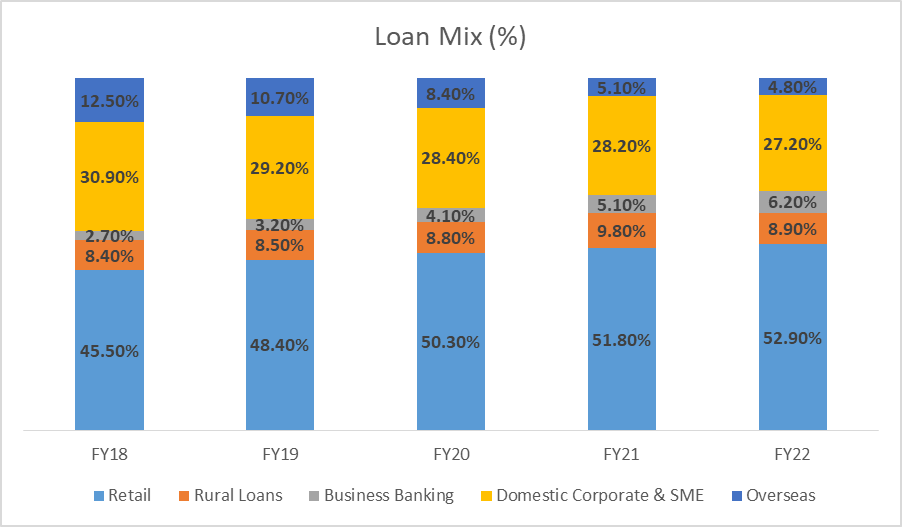

Within the bank, the loan mix has changed in favor of retail, and the corporate and SME book has come down. As a result, it has reduced NPAs and higher profitability for the bank.

ICICI Bank Financials

Core Operating Profit and Net Profit

ICICI Bank’s profitability (both at the Operating and Net Profit levels) has increased consistently over the last few years. Core operating profit (profit before provisions and tax, excluding treasury income) grew by 31.6% year-on-year to INR 13,235 Cr in the quarter ended December 31, 2022 (Q3FY23) as against INR 10,060 Cr on December 21, 2021 (Q3FY22)

Similarly, Profit after tax grew by a handsome 34.2% year-on-year to INR 8,312 Cr in Q3FY23 as against INR 6,194 Cr in Q3FY22.

| Q3 FY23 | Q3 FY22 | 9M FY23 | 9M FY22 | FY22 | |

|---|---|---|---|---|---|

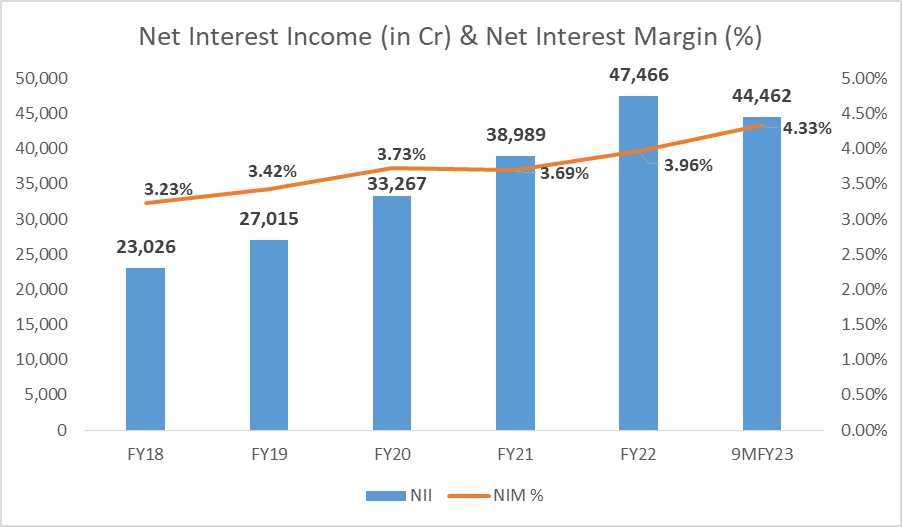

| Net Interest Income (Rs. Cr.) | 16,465 | 12,236 | 44,462 | 34,862 | 47,466 |

| Non-Interest income (Rs. Cr.) | 4,987 | 4,899 | 14,755 | 13,005 | 17,614 |

| Operating Expense (Rs. Cr.) | 8,217 | 7,075 | 23,945 | 19,684 | 26,733 |

| Core Operating Profit (excluding Treasury Income) (Rs. Cr.) | 13,235 | 10,060 | 35,272 | 28,183 | 38,347 |

| Profit After Tax (Rs. Cr.) | 8,312 | 6,194 | 22,775 | 16,321 | 23,339 |

ICICI Bank Net Interest Income

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

ICICI Bank Net Interest Margin

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets. NIM continues to witness up-tick led by re-pricing of advances (while the impact of increased deposit rate is yet to catch up on the expenses side).

Asset Quality

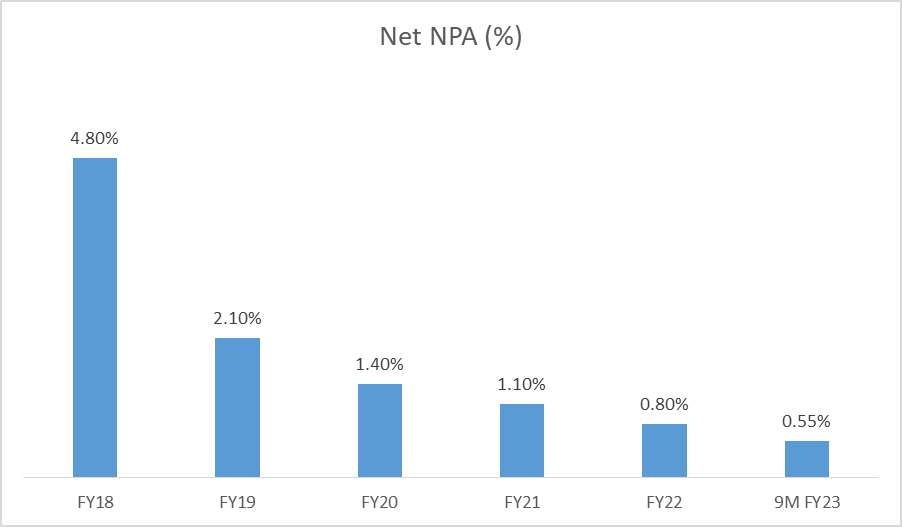

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

The gross NPA ratio declined to 3.07% on December 31, 2022, against 4.13% on December 31, 2021. The net NPA ratio fell to 0.55% on December 31, 2022, from 0.85% on December 31, 2021.

Asset quality has improved significantly over the last five years, as seen in the chart below.

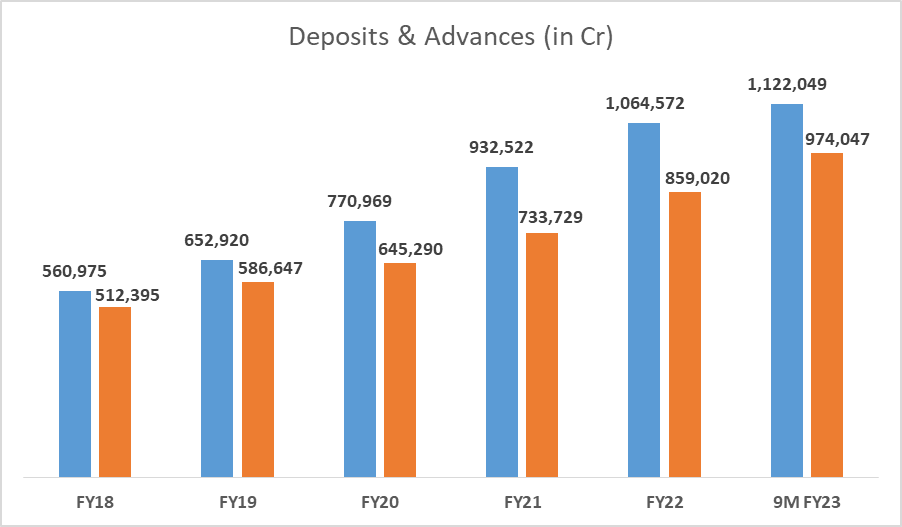

ICICI Bank Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers.

Total advances increased by 19.7% year-on-year and 3.8% sequentially to INR 974,047 Cr on December 31, 2022, and Total period-end deposits increased by 10.3% year-on-year to INR 1,122,049 Cr at December 31, 2022.

One of the reasons for the superior performance of the Bank has been the growth in the retail loan book. The retail loan portfolio grew by 23.4% year-on-year and 4.5% sequentially and comprised 54.3% of the total loan portfolio on December 31, 2022.

The average CASA (Current Account & Savings Account) deposits increased from 41.4% of total average deposits in fiscal 2021 to 44.5% in fiscal 2022. The average current and savings account (CASA) ratio was 44.6% in Q3-2023.

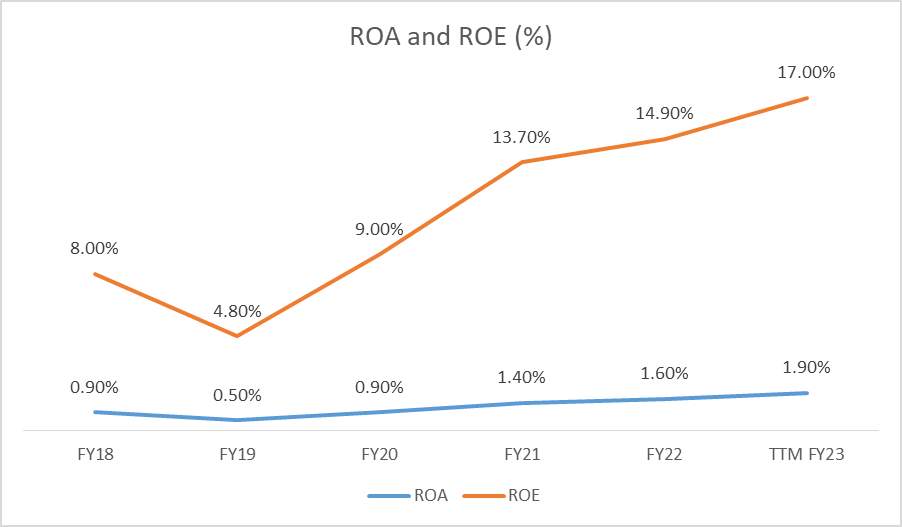

Improving Return ratios (ROA & ROE)

ICICI bank has been improving its RoA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) & ROE (the higher the ROE, the more efficient a company’s management is at generating income and growth from its equity financing) over the last few years.

ROA was inching towards 2% from a low of 0.55% in 2019, and ROE was approaching 20% from a low of 4.8% in 2019. This shows the extent of turnaround the bank has seen in the last five years.

Technology Initiatives

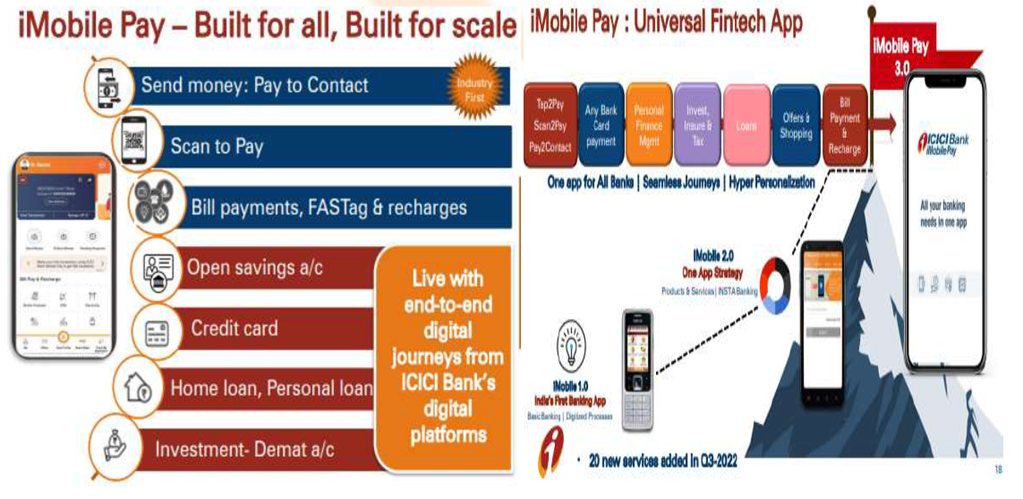

ICICI Bank is a pioneer in technological innovation in the Indian banking industry. It has been continuously upgrading and introducing innovative technology into the system. Today, it has best-in-class end-to-end seamless digital platforms that offer customers personalized solutions and value-added features, enabling more effective data-driven to cross-sell and up-sell. These platforms also allow the bank to acquire new customers.

The Bank has created over 20 industry-specific STACKs, providing bespoke and purpose-based digital solutions to corporate clients and their ecosystems. The Bank’s Trade Online and Trade Emerge platforms allow customers to digitally perform most of their trade finance and foreign exchange transactions. About 71.2% of trade transactions were done digitally in Q3 of this year. The value of transactions done through these platforms increased by 59.3% year-on-year in Q3 of this year.

ICICI Bank has introduced iMobile Pay, the bank’s universal fintech app, to provide customers with better access and service quality. The app is scalable and already has ~8.6 mn activations from non-ICICI Bank customers.

ICICI Bank Share Price Analysis

ICICI bank share price has delivered a CAGR of 16% over the last ten years despite being mired in a few scams and scandals in between. The bank’s performance has been nothing short of a turnaround after Mr Sandeep Bakshi took over as the CEO towards the end of 2018.

The bank has already delivered 40% CAGR over the last three years. Given its superior financial performance, top-management stability/credibility, and strong capital/ provision buffers, it remains a top pick in the banking space for most brokerage houses.

ICICI Bank Share Price Target Growth Potential

ICICI bank has done well reporting better-than-expected earnings, with better loan growth and margins. Some of the factors that are expected to aid ICICI Bank’s share price growth in the future are:

- Faster adoption of digital strategy: ICICI Bank has upped the ante in its digital offering to compete with Fintech firms. Acceleration on that front can lead to a fall in the cost of income and higher net profits in the future.

- Shift towards lower-risk retail loans: The focus of management has shifted to lower-risk retail loans to increase granularity in the lending book. This could lead to better fee income growth. In addition, the bank implemented several initiatives focused on improving its retail clientele to deepen the penetration of products and services, thus further strengthening its franchise.

- Continued focus on portfolio quality and strengthening of underwriting credit processes can restore the prudent growth path for the firm and result in better long-term value creation.

- Reduction in the concentration of large loans: concentration of large loans (Top-20 exposure) has also been declining from about 14.3% in FY16 to 9.6% in FY22.

After 4-5 years of hard work, the bank is regaining its lost stature. However, risks such as increased competition from Fintech firms and returning asset quality pain due to unexpected changes in the economic outlook can also derail the growth journey.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

What is the 52 Week High and Low of ICICI Bank?

The 52-week high/low is the highest and lowest price at which ICICI Bank stock traded during that period (similar to 1 year) and is considered a technical indicator. The 52-week highs and lows of ICICI Bank are INR 958.20 and INR 669.95 as of 12 Apr ’23.

What is the face value of the share of ICICI Bank Ltd.?

ICICI Bank share’s face value is INR 2.

Is ICICI Bank good for the long term?

ICICI Bank has improved on all business parameters, including profitability, NPAs, retail loan book mix, and return ratios, and is well-positioned to deliver good returns over the long term.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 7

No votes so far! Be the first to rate this post.