Someone has perfectly described inflation as the silent killer of money. So often, at dining table conversations, the discussion regarding inflation is restricted chiefly to how the cost of daily essential items and food has gone up, with little or no discussions around how it impacts our ability to save.

In this article, we will dig deeper to understand inflation, its impact on personal finance, and ways to manage it.

What is Rising Inflation?

Inflation is simply the rising cost of goods and services over time in the country. For example, goods worth Rs 100 today may rise to Rs 105 next year. The 5% increase in the value of goods is called inflation.

Inflation always results in reducing your purchasing power. It is because you need more financial resources to buy precisely the same amount of goods and services that you had bought earlier. The inflation rate is not fixed, differs each year, and is an important economic indicator. A country with a high inflation rate indicates its poor state of fiscal management and wrong government policies.

Why is inflation both good and bad?

Inflation is a highly debated economic metric in any country, and governments globally prefer having a moderate inflation rate to drive consumption and growth.

For instance, during a deflationary situation, the price of goods and services consistently decreases over time, resulting in delayed consumption. It means that people tend to wait further for a fall in the price of goods and services. Doing so hurts consumption, so producers don’t have an incentive to produce goods and services, thus impacting economic growth.

On the other hand, a moderate inflation rate helps the economy to increase production, as more spending results in greater demand for goods and services, resulting in economic growth. On the other hand, a high inflationary situation significantly reduces the purchasing power of people. It kills demand for goods and services as people prioritize spending only on essential items and reduce discretionary spending.

How is inflation calculated?

In India, two metrics are used to measure inflation, wholesale price index (WPI) and consumer price index (CPI). However, for retail consumers, CPI is mainly focused on and widely referred to as the inflation rate in India.

CPI measures the change in the retail price of goods and services of 260 commodities. The index or basket is divided into three categories- primary articles- food (22.62%), fuel and power (13.15%), and manufactured goods (64.23%).

When is inflation considered high?

Every year, the Reserve Bank of India outlines the target inflation range in their monetary policy, which they intend to maintain using different monetary policy initiatives. When the CPI number breaches the upper range or the acceptable range of the target inflation, it is officially a period of high inflation rate in India.

How does inflation impact savings?

Whether the inflation is moderate or high, it directly impacts your savings rate. For instance, if the annual inflation rate in the country is 7% and the return on one-year FD is 7.5%, your net return on your fixed deposit is only 0.5%. In contrast, in case of high inflation, your net FD return can become negative, meaning you will lose money on the fixed deposit.

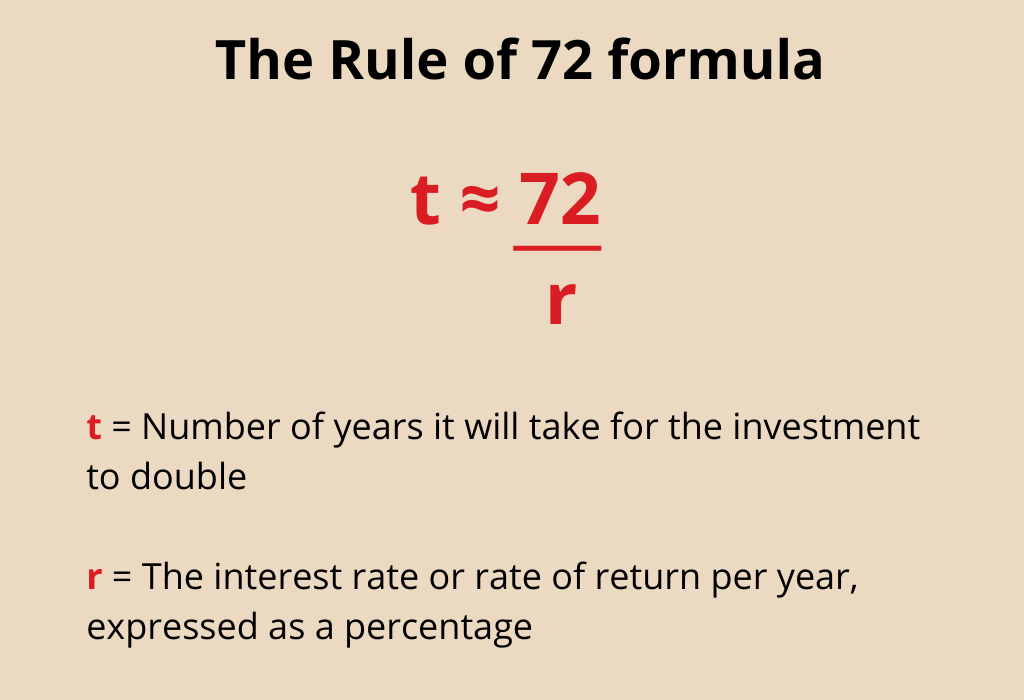

Rule of 72

The rule of 72 is mainly used to calculate the years it would take to double your investment at the prevailing interest rate.

For example, at a 6% annual interest rate, it would take almost 12 years to double your investment. So, to calculate, you need to divide 72 by the annual interest rate, i.e., 72/6 = 12.

Similarly, using the rule of 72, you can also calculate the impact of inflation on your purchasing power over the long term. For instance, at an 8% annual inflation rate, the value of your money would halve every nine years. Therefore, you must increase the savings rate to match the inflation rate so you can save adequately to meet future goals.

How to manage Rising inflation?

Inflation is hard to ignore, and managing it is a continuous process to reduce its impact on your finances. Some of the top ways to manage inflation include:

Avoid investing a large part of your income in low-risk or risk-free saving options: Risk-free saving options include bank fixed deposits, recurring deposits, post-office saving schemes etc. However, in the long term, you tend to lose money from investing in such saving schemes due to a lower return rate than the inflation rate.

You should consider investing in equities and equity-related securities, as, during high inflation periods, they tend to perform better than low-risk savings and investment options. For example, index funds having Nifty as their underlying index have given an annualized return of 12.18% and 13.50%, respectively, in the last 5 and 10 years. It not only helps to beat inflation but also assists in wealth creation.

Diversifying your investment: You should diversify your investments across multiple asset classes, financial instruments, and other categories. It helps to build a stable income source over the long term, reduce investment risks, and reduce the impact of inflation.

Conclusion

Rising costs impact all households; however, if managed properly, the impact on finances can be minimal. It depends on how you prioritize your savings, investments and the financial discipline that helps you stay on course and overcome difficult financial situations. Finally, managing inflation is not a short-term game. It requires patience, planning and persistence.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.