It’s pouring across the nation, but it feels like winter is here for the Indian EdTech start-ups, including a few unicorns. As you are aware, when the pandemic struck, nationwide shutdowns followed. It forced malls, schools, roads, restaurants, offices, etc., to close doors.

Just like commerce and offices found options online like Zomato, Amazon, Microsoft Teams, Zoom etc., the budding EdTech industry saw an opportunity to capture a pie of the education industry in India.

The pandemic boosted the Indian EdTech space by coining four unicorns, Vedantu, Eruditus, upGrad and Unacademy. Since everybody was stuck at home, including office goers, the industry witnessed 300%-400% customer growth over the last two years.

Know the meaning

Unicorn: It is a term a venture capitalist Aileen Lee popularized to distinguish a private company (business) with the valuation of $1Bn. In the Indian currency, a start-up must have a valuation of Rs. 79,10,10,00,000 (more than seventy-nine hundred crore) to achieve the Unicorn status.

However, as they say, “all good things come to an end”, and the frenzy around online learning and upskilling from home seems to have ended. This article will cover what is troubling the EdTech Industry in India, the reasons for the mass layoff, and the way forward.

What’s Wrong with Indian EdTech start-ups?

Many believed that the EdTech space would have a hard time in India. Although the word EdTech has become commonplace now, you can trace the first reference to technology in education (as we remember) over a decade ago.

EdTech: In simple words, it’s an amalgamation of education and technology – teaching performed using the technological means like smartphones, tablets, interactive projection screens etc.

You may remember those e-class pen drives advertised behind Sundaram notebooks. But unfortunately, the business model failed due to a lack of innovation.

But EdTech start-ups that emerged recently, such as Vedantu, BYJU’s, upGrad, and FrontRow, for instance, brought innovations never thought of. Yet they struggle to remain profitable while managing their marketing and tech expenses.

Earlier, the reason behind EdTech start-ups’ failure was the talent gap in India, low internet and smartphone penetration, lack of funding and belief, and inability to find the right business and revenue models, among a few others.

But the reasons are slightly different today.

- Toxic Environment Pushes Educators to Quit

The talent gap is almost nil. Still, this time online educators do not feel like teaching at an EdTech firm because of their highly toxic culture.

- Change in the mindset of parents

With schools, colleges, and offline classrooms reopening, parents’ mindset is also shifting. Many believe their child’s confidence and social skills will not improve if they continue taking lessons online. In addition, some are worried about not knowing what their child watches or reads on the screen during online lectures. Because of this, parents are re-enrolling their children in local offline tuition centers.

- Finding Winter

In the last two years, along with the pandemic, the Indian EdTech industry grew exponentially on the back of one more contributor – VC Funding.

According to reports, the country’s EdTech start-ups saw a total investment of $2.22Bn against $553 million received in 2019.

But in 2022, the VC money flow has slowed down. The reasons are the global headwinds like the Fed interest rate hikes, the geopolitical crisis between Russia and Ukraine, rising crude prices, and the tumbling of tech stocks in major financial markets.

Please note that it’s not only EdTech companies but the entire start-up community struggling to attract VC money this year. Because of the reasons above, many EdTech companies are on a mass layoff drive.

Layoff, Layoff, and More Layoffs

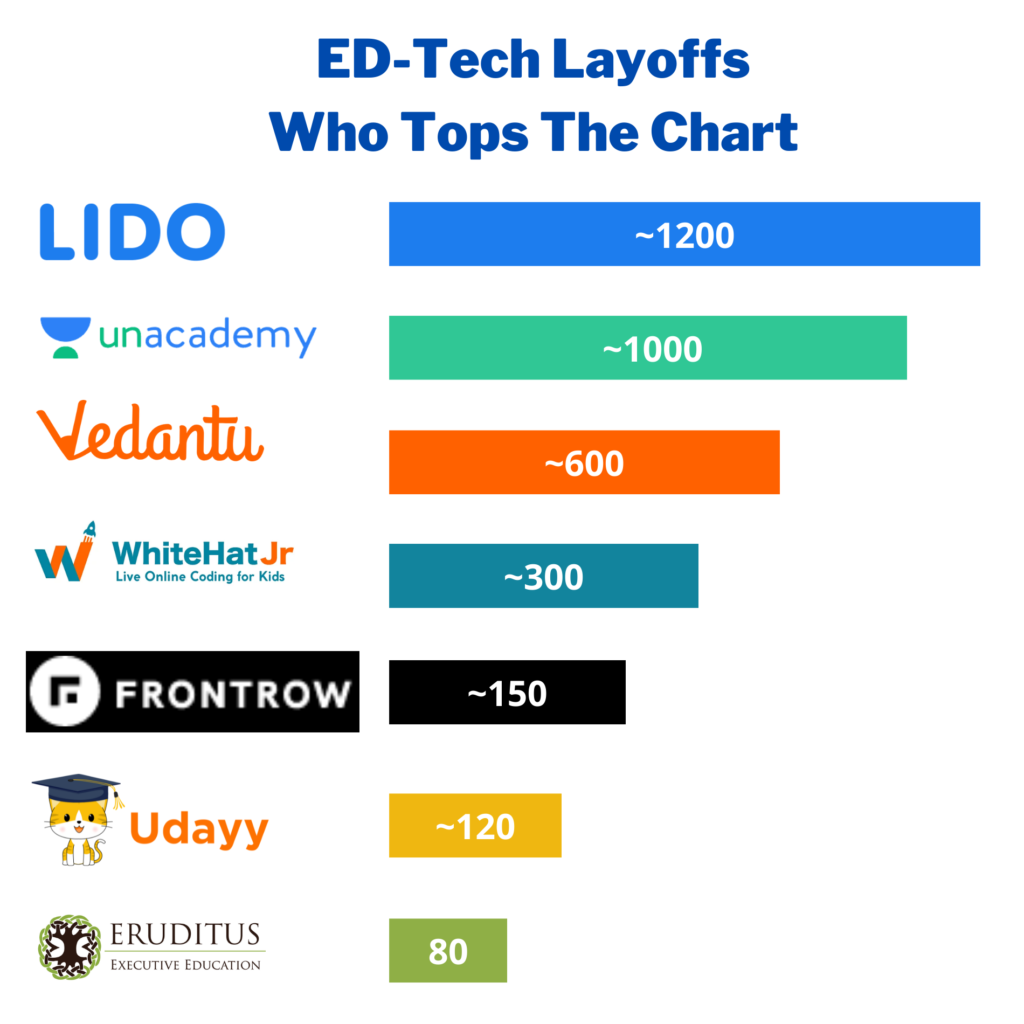

The Indian EdTech space has laid off over 3000 employees this year alone. Moreover, the number of employees asked to leave or forced to resign has increased monthly.

It started with Lido Learning, a LIVE online class’s platform for Grades KG-10 (Kindergarten to 10) students, asking more than 1200 employees to resign over an online town hall meeting in February. The company founder, Sahil Sheth, admitted before all employees that the company was in a financial crisis. As a result, most employees asked to leave were from the sales and marketing departments.

A month later, Softbank-funded unicorn, Unacademy fired around 100 employees. The start-up laid off a few educators and some from Prep Ladder’s marketing & sales team. Unacademy called it a restructuring exercise.

In April, it asked another 600 employees to leave, tallying up to 10% of the start-up’s workforce. Following the trend are Vedantu, a specialized platform for competitive exam preparation; WhiteHat Jr, a code-teaching platform for kids; FrontRow, a platform that helps master passion, Udayy, and Eruditus.

Udayy’s Suryast – Shutting down of Udayy

Udayy, an online platform for Grades K-12 (Kindergarten to 12) students founded in 2019, not only fired its staff but also shut down operations. The start-up’s co-founder, Saumya Yadav, announced the winding up of functions and promised to return the remaining capital of around $8.5Mn to its investors.

The reason for Udayy’s shutdown is relatively straightforward. It operated in the K-12 segment. Doing business in this space has become challenging after the schools and colleges reopened. Parents’ priorities for children and spending capacity in this segment are changing.

The founders considered selling the business to a more prominent player before deciding to shut shop. But none of the discussions materialized.

But Not Every EdTech is facing a Hard Time.

Though major EdTech players, including the biggest Indian Unicorn Byju, are facing a tough time, a particular EdTech player is not much affected.

Scaler, an online code-teaching platform for adults, is looking to invest $50Mn for mergers and acquisitions this year. The start-up’s founders, Abhimanyu Saxena and Anshuman Singh, believe there is an opportunity for consolidation thanks to the recent decrease in valuations of tech companies. In addition, the company expects to spend on marketing and growth projects this year.

upGrad’s chairman Ronnie Screwvala stated that the company plans to hire 3,000 people in the next three months.

Joining these two EdTechs is a recently turned Unicorn, Physics Wallah. It is looking to expand aggressively. The start-up’s founder Alakh Pandey wants to grow its presence in the segments it does not operate in yet. They are also hiring 150 people every month for several roles.

What next for Indian EdTechs?

The next step most EdTech players are thinking of is to go offline. Byju’s and Unacademy have set up offline training centres. They have also made a provision for a hybrid learning model.

Several upskilling players like Stoa School, Scaler, and Imarticus Learning have introduced elements of offline learning in their course models. For example, Stoa School has started organizing city-wide meetups and three-day residency programs. It conducted the first offline meetup in Bangalore last month. However, its teaching sessions remain online.

Scaler has associated with co-living start-ups to provide customized living space called Scalerverse (Scalers’ universe) to its learners. But their classes continue to happen virtually.

EdTechs entering the offline market have their pros and cons. Industry experts believe that the customer acquisition cost (CAC) will go up as they must invest in physical classes and related infrastructure.

Some also believe there is a scope for a rise in the revenue per user. For example, offline classes can push EdTechs to charge a higher fee because users get access to physical classes, doubt-solving sessions and more.

Final Words

There is no doubt that the EdTech players are struggling, but as we mentioned, not all are stressed. A segment that is struggling the most caters to students from kindergarten, schools, and colleges. However, upskilling or higher education players are standing firm in the game.

Three Unicorn EdTechs planning to go public may postpone their plans because of the current industry slowdown. Unacademy and Vedantu founders had plans to make public debuts in the next two years. Byju’s, on the other hand, is reportedly looking for an overseas listing at a valuation of $40Bn. About the offline model, we believe it is too early to comment. We’ll have to wait and see how things turn out for EdTech players. In the meantime, do let us know your take on the story.

Read More:

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/