When most Indians hear the term “IT sector,” they immediately think of two companies: TCS and Infosys. And why do they not? Both companies have worked hard and changed how the world looks at India. But, the journey of Infosys is quite unusual and inspiring in many ways.

Unlike TCS, which had a strong parentage, Infosys had a very humble beginning in 1981 and is now the second-largest IT exporter in India, with revenue of ₹1,46,767 crores in FY23. Infosys also announced a final dividend of Rs. 17.50 per equity share for the previous financial share, with a record date set for 2nd June 2023. The news of its weak Q4 performance led to a fall in the share prices on 17th April 2023 to Rs. 1240.

So let’s analyze Infosys share price and check its growth potential.

Infosys The Company Journey

Ideation and Incorporation

It was the year 1980, the time when most people had no idea what computers were or had never heard of the terms information technology or software. But, something was brewing in the minds of Narayan Murthy and six other young software engineers at Patni Computers. They were discussing how they could start a company and write software for clients, but the journey was not easy.

None of them had any business experience or even the necessary funds to launch the company. They were, however, full of passion, and Murthy always dreamed big and wanted to accomplish something big in life.

After much discussion, Murthy finally decided to start Infosys with his six colleagues in 1981 in Pune, with a meagre initial capital of ₹10,000 provided by Sudha Murthy (Narayan Murthy’s wife), which she saved without his husband’s knowledge. And so the journey to build a world-class software company began.

Nurturing the Plant

As Infosys was signing up new clients, Infosys relocated to a new corporate headquarters in Bangalore in 1983 and opens first international office in Boston, US, in 1987.

1993 turned out to be a very important year for Infosys as it made its initial public offering in Feb, and shares were listed on the Indian stock market on June 14th.

It slowly started expanding its presence in other countries like the UK, several European countries, Canada, Hong Kong, UAE, Japan, Singapore, etc. Simultaneously, it introduced new solutions like e-Business practice, Enterprise Solutions, Business Consulting Services, Universal Banking Solutions (Finacle), BPO services, etc.

In 1999, Infosys listed ADS (American Depositary Shares) on the Nasdaq National Market to mark the 25th anniversary of the company.

Growth Phase

Years of hard work began to pay off handsomely as the company reported record turnover and profits. Total revenue exceeded $100 million for the first time in 1999, and it surpassed $1 billion in the next five years. And, in 2007, quarterly revenue surpassed $1 billion for the first time.

Despite many challenges, like the founder member quitting in the early days and the leadership crisis in 2017- Infosys continued to grow and set benchmarks in the industry in terms of achieving operational excellence and high standards of corporate governance.

Infosys closed the financial year FY23 with a revenue of ₹1,46,767 crores ($17.4 billion), with more than 346,000 employees in the talent pool.

Infosys Company Analysis

Over the years, Infosys added many services and products to its offerings as per the emerging market trends and demand from enterprises. And it has divided the company’s operations into eight different segments:

- Financial Services

- Retail

- Communication

- Energy, Utilities, Resources, and Services

- Manufacturing

- Hi-Tech

- Life Sciences

- All other segments

Infosys earns over 60% of its revenue from digital services, and 95% of its revenue comes from international markets. It has a presence in over 54 countries. The company has a very strong balance sheet with a free cash flow of ₹20,443 crores at the end of Q3FY23.

Infosys Finacle -The Banking Suite

Over decades of operation, Infosys had built many world-class products, but its core banking suite- Finacle, became the most popular product from its stable. It was launched in 1999 to automate banking processes.

Finacle has been the product of choice of over 200 banks in over 100 countries and is used by almost all Indian banks serving more than a billion accounts. It offers core banking, e-banking, mobile banking, CRM, payments, treasury, liquidity management, wealth management, analytics, and every other vertical of banking.

It has helped banks to achieve a higher return on assets, return on capital, and less cost to income compared to other banking suites.

Infosys Management Profile

Infosys is led by Mr Salil Parekh as CEO and Managing Director, who was appointed to the position in December 2017. He has over three decades of experience in the global IT services industry and held many leadership positions in companies like Capgemini, Ernst & Young, etc.

He holds a Master of Engineering degree in Computer Science and Mechanical Engineering from Cornell University and a B.Tech degree in Aeronautical Engineering from IIT, Bombay.

Nilanjan Roy is the Chief Financial Officer (CFO) and joined on 1st March 2019. Earlier, he served as a Global CFO at Bharti Airtel and has held many leadership positions there, and has also worked with Unilever for almost 15 years. Nilanjan is a Chartered Accountant and has rich global experience in ESG, corporate governance, M&A, cost management, taxation, and accounting.

Shaji Mathew is the Group Head of Human Resource Development. He is responsible for drawing up a roadmap for HR, driving strategies, and implementing operational priorities aligned with the overall organization mandate. He has been with Infosys for more than 30 years and has held a diverse leadership role. Shaji is a rank holder from NIT Calicut and has done Global Leadership Program at Stanford University.

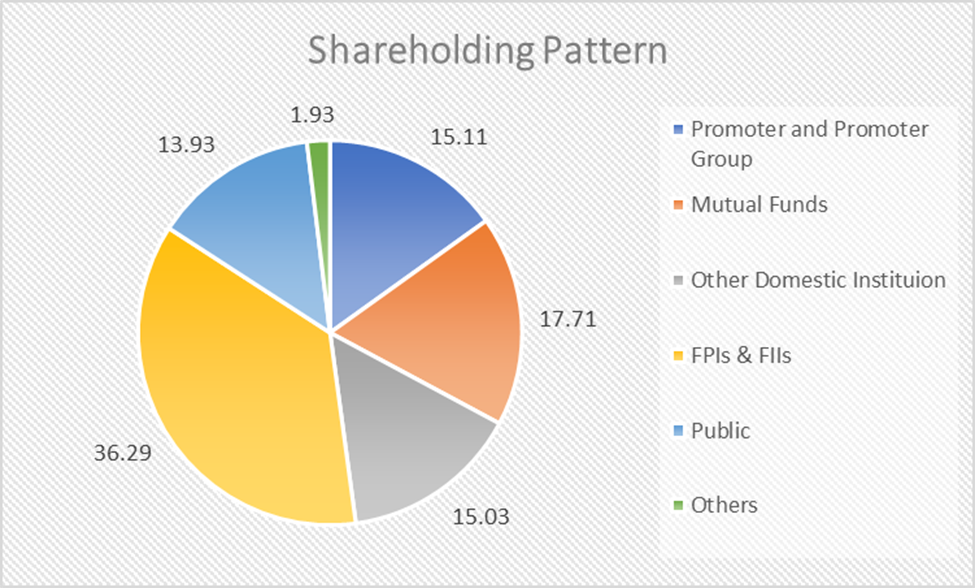

Infosys Shareholding Pattern

Infosys Financials

Revenue

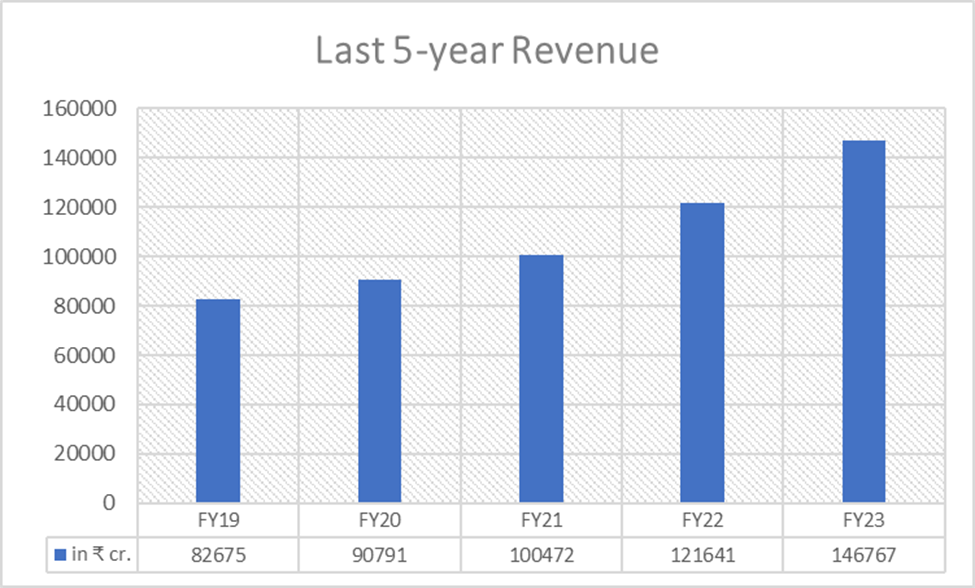

In FY23, Infosys’s consolidated revenue from operations came in at ₹1,46,767 crores, a 20.7% increase over the previous fiscal year’s figure of ₹1,21,641 crores.

Quarter-wise, Infosys reported a 2.3% decline in revenue at ₹37,441 crores in Q4FY23, compared to ₹38,318 crores in Q3FY23. North America is the key market for Infosys, contributing 61% of the revenue, Europe contributed 27%, the rest of the world contributed 9.4%, and India contributed 2.6% to total revenue in Q4FY23.

Segment-wise Revenue Breakup

| Segments | FY23 (in ₹ cr) | FY22 (in ₹ cr.) | % Change |

|---|---|---|---|

| Financial Services | 43,763 | 38,902 | 12.49 |

| Retail | 21,204 | 17,734 | 19.56 |

| Communication | 18,086 | 15,182 | 19.12 |

| Energy, Utilities, Resources, and Services | 18,539 | 14,484 | 27.99 |

| Manufacturing | 19,035 | 13,336 | 42.73 |

| Hi-Tech | 11,867 | 10,036 | 18.24 |

| Life Sciences | 10,085 | 8,517 | 18.41 |

| All other segments | 4,188 | 3,450 | 21.39 |

Last 5-year Revenue Growth

In the last 5-years, Infosys revenue had grown at a CAGR of 12.15%, despite the pandemic shock and worsening inflation conditions in the European and North American markets.

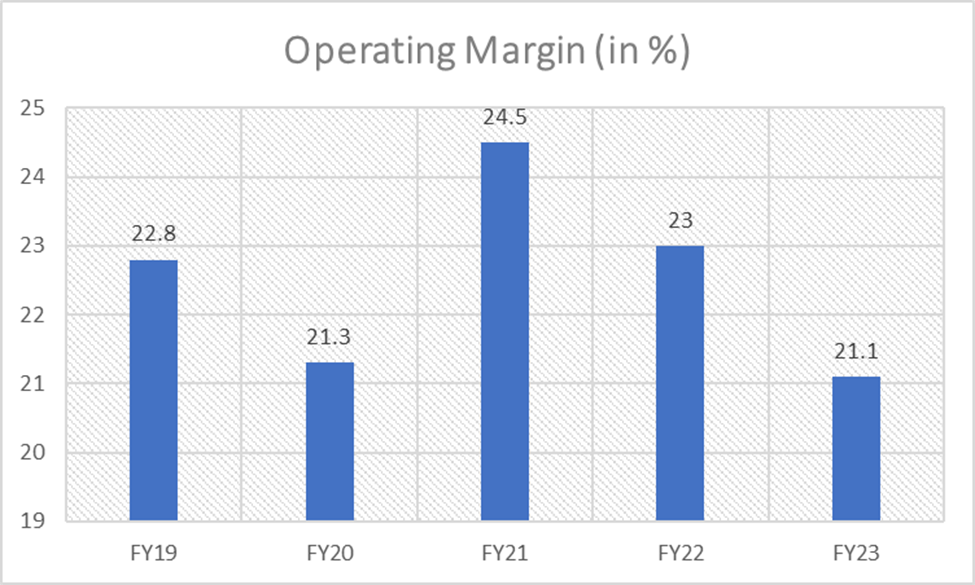

Operating Margin

Infosys reported an operating margin of 21% in FY23, a 1.9% decrease from the previous year. In Q4FY23, the operating margin came in at 21%, compared to 21.6% in Q4FY22.

Last 5-year Operating Margin

Net Profit

Infosys reported a net profit of ₹24,095 crores in FY23, up 9% from the previous year’s net profit of ₹22,110 crores.

In Q4FY23, the company reported in net profit of ₹6,128 crores, a 7% decrease from Q4FY22 at ₹5,686 crores.

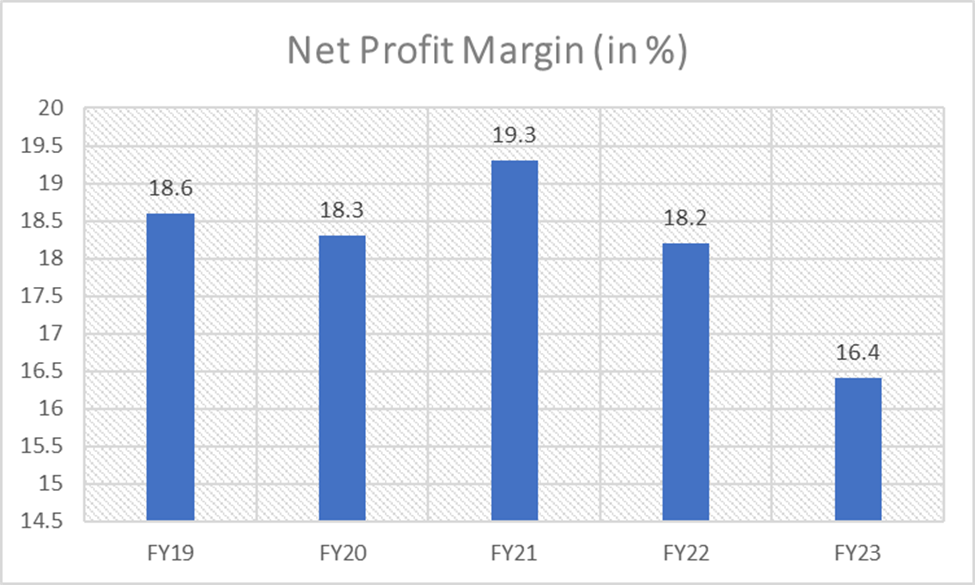

Last 5-year Net Profit Margin

Infosys Key Financial Ratios

Current Ratio: Infosy’s current ratio in FY22 was 2.1 times, declining from 2.7 times in FY21.

Debt-to-equity Ratio: The debt-to-equity ratio is stable at 0.1 in FY22. Debt represents the lease payments.

Return on capital employed: ROCE for FY22 increased to 38.8% from 32.5% in FY21.

Infosys Share Price History

Infosys IPO debuted in the year 1993, and the IPO price of each share is ₹95, and the trading opened at ₹145 per share. Over the years, Infosy’s had done multiple bonus issues and a stock split once.

| Face Value | Ratio | Number of Shares | |

| Pre-bonus and split share | ₹10 | – | 100 |

| Bonus Issue- 30 June 1994 | ₹10 | 1:1 | 200 |

| Bonus Issue- 18 June 1997 | ₹10 | 1:1 | 400 |

| Bonus Issue- 25 January 1999 | ₹10 | 1:1 | 800 |

| Stock Split- 24 January 2000 | ₹5 | 10:5 | 1600 |

| Bonus Issue- 13 April 2004 | ₹5 | 3:1 | 6400 |

| Bonus Issue- 14 April 2006 | ₹5 | 1:1 | 12800 |

| Bonus Issue- 10 October 2014 | ₹5 | 1:1 | 25600 |

| Bonus Issue- 24 April 2015 | ₹5 | 1:1 | 51200 |

| Bonus Issue- 13 July 2018 | ₹5 | 1:1 | 102400 |

At adjusted value, 100 shares at IPO for ₹9500 are now worth over ₹13.8 crores as of 15th April 2023, and this even doesn’t count the dividends.

Infosy’s has a good track record of paying consistent dividends to its shareholders. In the last three calendar years, Infosys paid ₹21.5 in 2020, ₹30 in 2021, and ₹32.50 in 2022 as dividends to shareholders.

Infosys Fundamental Analysis

In recent quarters, Infosys has reported a decline in operating margin due to cost pressures and uncertain macroeconomic conditions in key markets (North America and Europe), where it generates nearly 90% of its revenue.

Infosys continues to be one of the strongest players in the IT industry, with huge cash reserves to battle any uncertainty and a steady deal pipeline. In FY23, Infosys’s free cash flow was ₹20,443 crores, which is 84.8% of the net profit

Deal Momentum Going Strong

In FY23, Infosys signed deals worth $9.8 billion, of which it signed deals worth $2.1 billion in Q4.

More deals are happening in the digital transformation and cloud with a focus on achieving cost efficiency and vendor consolidation. A few mega deals are being actively pursued that will help it to achieve the upper end of the revenue guidance.

Challenges Ahead

Infosys posted lower growth in revenue and net profit in Q4FY23, compared to Q3FY23, mainly on account of the cancellation of a few projects from a major account in the US and weak macroeconomic conditions, impacting revenue growth.

The Financial and Communication segments are experiencing the most impact of challenging macroeconomic conditions in the form of budget deferrals and delayed decisions.

Therefore, Infosys has given lower guidance for revenue growth at 4-7%, which is much lower compared to the guidance of 13-15% in FY23. It achieved 15.4% revenue growth in FY23.

Infosys Share Price Growth Potential

The Financial segment is the cash cow of Infosys, contributing close to 30% to the revenue. The collapse of a few regional banks in the US has affected client spending, and many are opting for vendor consolidation. Therefore, revenue growth is likely to be muted in the medium term until the macro condition improves.

However, a slowdown in the Financial segment is being compensated by other segments to an extent. Manufacturing, Energy, Utilities, and Resources; and Lifescience segments are witnessing strong growth.

The sharp drop in revenue growth guidance in FY24 might keep Infosy’s share price under pressure in the short-to-medium term. Demand for digital transformation services and increased spending in the cloud segments are likely to benefit the overall IT services segment and Infosys.

Infosys Share Price Target

In the long run, stocks in the IT sector outperform the broader index. According to market data, the Nifty IT index has gained 346%, while the Nifty 50 has gained 222% in the last ten years as of 15th April 2023. Despite the global economic turbulence, worldwide IT spending is projected at $4.5 trillion, an increase of 5.5% from 2022, as per the report from Gartner.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

When was Infosys established?

Infosys was established in 1981 by Narayan Murthy with six other colleagues with a meagre initial capital of ₹10,000.

How Infosys share price has performed since its IPO?

Since its IPO in 1993, Infosys had done multiple bonus shares issues and split once. 100 shares bought in IPO is now 1,02,400 shares and is now worth over ₹13.8 crores as of 15th April 2023.

Who is the CEO of Infosys?

Salil Parekh is the CEO and Managing Director of Infosys and was appointed on 2nd January 2018 to the position. He took over from interim CEO U B Pravin Rao.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 5

No votes so far! Be the first to rate this post.