On 8th June 2022, the Reserve Bank of India allowed the integration of credit cards into UPI, marking the beginning of another chapter in the evolution of the UPI-led digital payments ecosystem in India. What makes this inclusion an essential step toward India’s maturing digital payments ecosystem? Let’s understand.

Evolution of Digital Payments Ecosystem in India

Until 11th April 2016, the digital payments ecosystem was driven mainly by payment systems like NEFT, RTGS, and IMPS. Barring IMPS, none of the digital payment systems could process transactions on a real-time basis. And IMPS was expensive for smaller transactions and could not penetrate the digital payment ecosystem. Also, there was a vast urban and rural gap in the adoption and awareness of digital payments.

And this is what the introduction of UPI did really well, plugging the last gap in India’s digital payment ecosystem. It brought seamless fund routing, merchant payments, and peer-to-peer payments under one umbrella. A person can make bank transfers, peer-to-peer transfers, and merchant payments on a real-time basis from a single mobile application.

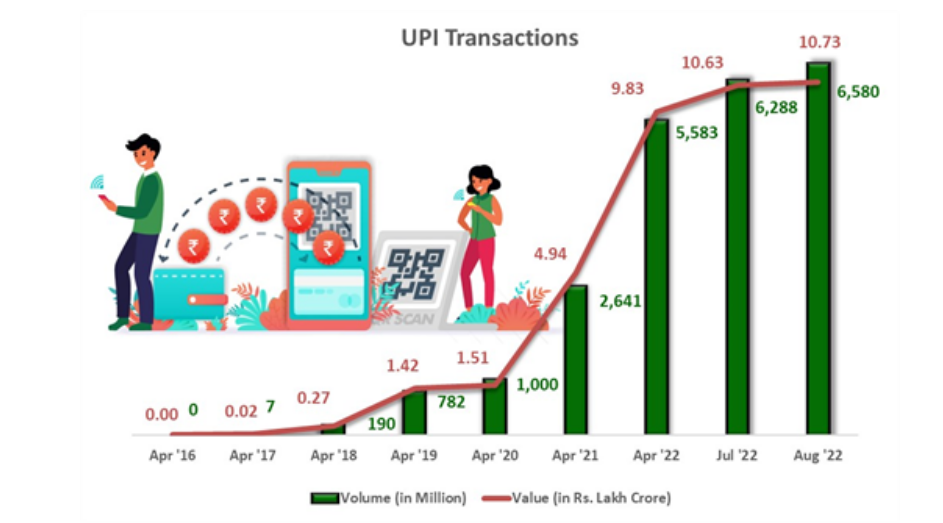

It has come a long way, with only a 2.65 million transaction volume in 2016. In 2022, it processed over 74 billion transactions worth ₹125.94 lakh crores, outpacing the world in digital payments. And this platform has resulted in a behavioral shift towards embracing digital and contactless payments bringing first-time users into the digital fold. In its Payment Vision 2025 document, RBI sees UPI registering average annualized growth of 50% during the period, compared to IMPS/NEFT growth rate of 20%.

So, will the integration of credit cards into UPI be a game-changer, let’s see.

India’s Credit Card Market

India is a largely underpenetrated market, with only 3% of the population having a formal credit card; however, it has shown good growth potential in recent years. The credit card industry has grown at a CAGR of 20% in the last five years, with the number of cards issued having crossed 7.8 crores in July 2022. According to a PWC report, the market is expected to touch 20 crore cards by FY2026.

Along with credit card issuance, the average spending has also increased significantly. In FY22, total spending increased to ₹11.5 lakh crores, up 1.8 times compared to the previous financial year.

Who is driving the growth of the credit card market in India?

According to the RBI data, 65% of credit card issue happens in Tier 1 cities. The rest comes from Tier 2 and Tier 3 cities, with most of the demand coming from professionals and the early jobber (18-25 years age bracket) segment.

Other factors like hyper-personalization for credit cards, co-branded partnership credit cards, and the emergence of Fintech players in the market are helping the growth of credit cards in India.

Will the integration of credit cards into UPI be a game changer?

For credit card holders, integrating their cards into UPI opens access to quick response (QR) – based payments at physical stores. Earlier, the usage of credit cards was limited only to PoS devices at stores. It will allow holders to make small payment transactions to merchants. So, how will it benefit the credit card ecosystem?

Impact on transactional volume

Credit card holders are known for their heavy spending ability. The latest data from RBI shows that credit card users spend 40x more than debit card holders online. And, as per RBI’s March 2022 data, the user spends ₹14,500 per credit card per month, compared to ₹700 per debit card per month.

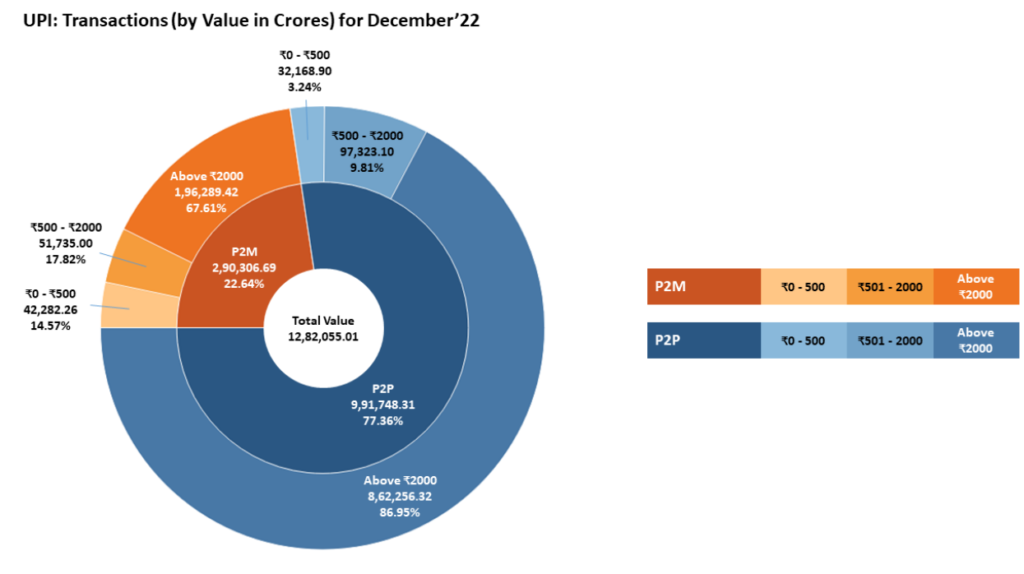

Now coming to the spending pattern on these platforms. Per the December 2022 statistics from NPCI, the peer-to-merchant (P2M) transaction share is 22.64% of the total transactions.

Interestingly, the value of transactions worth over ₹2000 in the P2M segment is more than 67%, which are debited directly from the person’s bank account. Therefore, users will most likely process those transactions through their credit cards after integrating credit cards into UPI rather than debiting the amount from their bank account. It would potentially result in increased credit penetration and expand the scope of digital payments in India.

Merchant Discount Rate – A Revenue Source

The government of India mandated a “zero charge framework,” meaning the platform cannot charge fees on transactions conducted on the platform to increase the penetration of digital payments in India. However, the situation has changed with the integration of credit cards into UPI.

Credit card issuers now have to share a percentage of the Merchant Discount Rate (MDR) with UPI platforms, thus opening up a revenue source.

Goldman Sachs research report titled- India – Payments – Linking Credit Cards To UPI mentioned- “In our base case, we expect credit card transaction volumes in India to grow at a 22 percent FY22-26E CAGR to reach $285 billion. Our sensitivity analysis shows that every five percent of incremental transaction volume in credit cards due to the proposed integration would equate to $38 billion in additional annual credit card volumes or $760 million in additional merchant discount rate (MDR) pool (if MDRs are in line with current credit card MDRs).”

As per the earlier consensus, NPCI and banks have agreed on a 2% MDR for RuPay credit cards on the network, of which 1.5% will be kept by the card issuer, and 0.5% will be distributed to the RuPay network and acquiring entity. Therefore, both credit card issuers and UPI platforms will report increased revenue from higher spending through credit cards on these platforms.

Conclusion

Credit card integration into UPI is a game changer as it will be an incentive for the players in the network and generate a revenue source. For users, it adds to their convenience of not carrying the cards and making payments through QR codes. And, for credit card issuing companies, increased spending would result in higher credit off-take, higher interest income, and income from interchange fees (MDR). So, it’s a win-win situation for every stakeholder in the system.

FAQs

Can credit cards be added to UPI?

Yes, RBI has allowed the integration of credit cards into UPI from June 8th, 2022, thus allowing safe, secure, and contactless payments through QR codes.

Is MDR applicable on credit card transactions on UPI?

Yes, MDR or interchange fee of up to 2% applies on UPI credit card transactions.

How do I pay UPI payments with a credit card?

Making payments with a credit card is similar to using your bank account on the platform. Your existing virtual private address (VPA) acts as an ID to make payments with a credit card.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.