In the recent global stock market rally, metal stocks were in a rage. Stocks like SAIL, Tata Steel, Hindalco, etc., posted substantial gains in the range of 200 to 300% during the period. As a result, the whole metal pack outperformed the broader index and was considered the golden period for the metal sector after years of consolidation. So, the next question is, how much upside is left in metal stocks, or is it the right time to invest in them? Let’s find the answer.

What caused a strong rally in metal stocks?

The strong rally in metal stocks post the onset of the pandemic was surprising given that economies worldwide were closed, impacting demand. However, multiple factors played out in the market that favored the metal stocks. The primary being the rise in the price of industrial metals.

The price increase was broad-based across industrial metals, with the price of iron-ore going up by over 100% in 2021; copper, nickel, and aluminum also witnessed a steep surge in price. While energy commodities like oil, coal, and natural gas were up by only a few percentage points compared to pre-pandemic levels. This helped metal companies to improve their operational efficiencies and profitability.

The rise in the price of industrial metals was due to the following two factors:

- Manufacturing-led economic recovery: Despite the pandemic, manufacturing activities didn’t suffer as estimated earlier and recovered much quicker than the services sector, especially in China. Economies around the world experienced a V-shaped recovery.

- Supply-side factors: Due to Covid-19 led, restrictions and staffing problems led to congestion across significant seaports across the globe, driving up the freight rates for moving bulk products to a 10-year high level. In addition, less availability of raw materials and the rebound in energy prices added to the cost of metals.

Other factors like the expectation of significant infrastructure spending, quicker transition to sustainable energy sources, and more accessible storage of metals than other commodities led to a surge in the price of metals.

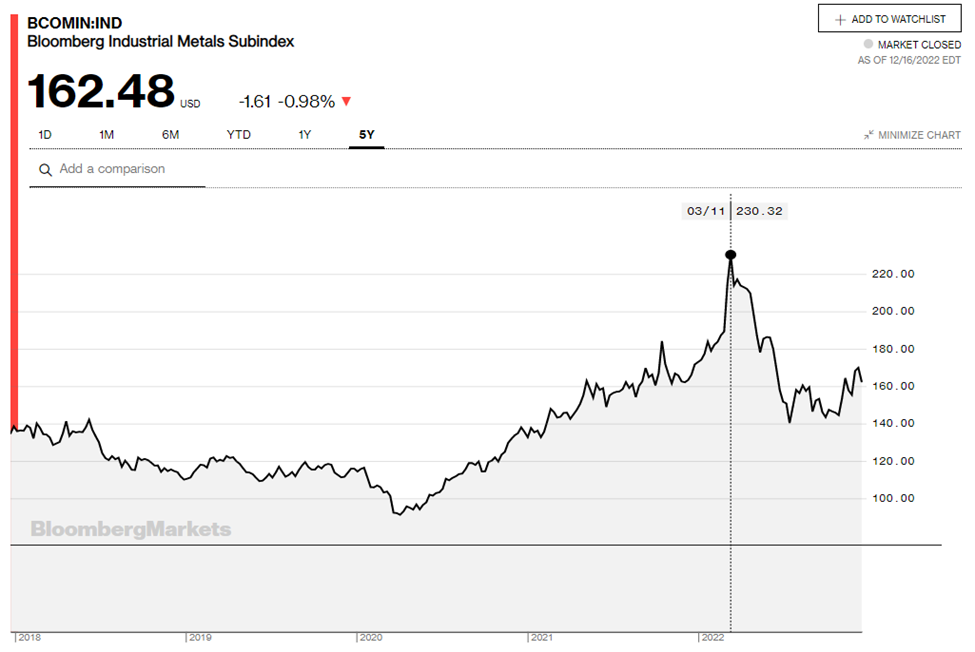

Bloomberg Industrial Metals Subindex tracks the actual price performance of commodities and maintains a broad-based diversification across 27 commodity futures contracts. By the end of 2021, the index was trading at a five-year high and more than doubled after reaching a low of 93.1 in March 2020.

Also, ultra-loose monetary policy by central banks all around the world to support the economy from Covid-19 led disruptions helped companies to scale up their CAPEX plans and operations.

Will Metal Stocks Shine Ahead?

Metal stocks are considered cyclical stocks as the demand for any metal is significantly impacted by the state of the economy. As a result, such stocks perform well during periods of economic recovery or growth and underperform during challenging or slowing economic conditions.

Cyclical stocks are those stocks affected by macroeconomic changes or closely follow the economic cycle of expansion and contraction. Other than metal stocks, auto, consumer, and travel & tourism stocks are considered cyclical. Of late, metal stocks are trading in a range-bound fashion due to multiple headwinds.

Some of the reasons that are leading to drag in the metal index are:

Rising recessionary fears due to the economic slowdown in China: Apart from the worsening geopolitics and inflationary conditions in the western economies that are already impacting demand for industrial metals, signs of economic slowdown in China are further making the situation look bad.

China’s exports and imports fell sharply in November due to Covid-19 leading to disruptions back home and weak trade demand. As a result, exports declined by 8.3% and 0.3% in November and October compared to the previous year. Also, China’s home prices fell for 15 months as sales declined.

Strength in US Greenback: Greenback refers to any piece of US paper money. In July, the Dollar Index soared to a two-decade high level, appreciating against all major currencies. Since commodities are priced and traded in US dollars, the rise in USD directly impacts the price of commodities.

Commodities and the US dollar are inversely correlated. When the USD appreciates, commodity prices measured in other currencies rise. Conversely, it causes a decline in demand and price. As can be seen, the Bloomberg Industrial Metals Subindex dropped by almost 40% as the Fed started an aggressive rate hike cycle, sending the dollar index to a high decadal level.

Sluggish demand for industrial metal: According to worldsteel.org, steel demand in the developed world will decrease by 1.7% in 2022 and recover by 0.2% in 2023. As steel companies ramped up production due to increased demand in 2021, the supply side is still higher than the demand.

Is it the Right Time to Invest in Metal Stocks in India?

As what may look like in the global market, India’s industrial metal demand is likely to maintain a high growth on solid urban consumption and increasing government infrastructure spending. Hence, it provides a positive outlook for many metal stocks in India.

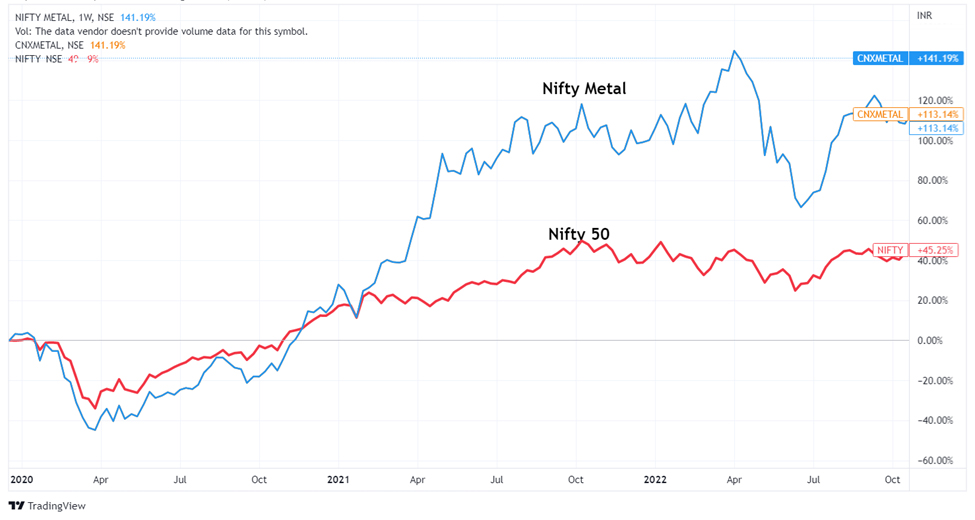

The chart above shows the performance of Nifty Metal and Nifty 50 index in the last two years.

But, there is a problem that every steel company is facing in India. The price of hot rolled (HR) steel in India is higher than the price of HR steel in the global market. For instance, HR steel price in the domestic market is hovering around ₹57,000-58,000 per tonne, whereas, in the global market, it would be around ₹54,000-55,000 per tonne.

Although the price gap between the two markets has reduced, it’s still not attractive for domestic companies to resume exports. It can also be seen in the export numbers of finished steel in the current fiscal, which slumped by 55% y-o-y. Therefore, it’s possible the metal stocks in India may not perform so well in the short-to-medium term until unit economics improve.

In case of recovery in metal prices, companies that have focused on strengthening the financials during the bull run will gain the most. For instance, on the back of improved realization of steel sales, Tata Steel undertook a massive debt reduction exercise, cutting down debt by over ₹50,000 crores in two years. Similarly, Hindalco’s debt-to-equity ratio came down 0.81X from 0.99X a year earlier.

So, suppose you want to invest in metal stocks in India. In that case, we recommend tracking the demand and metal prices in the global market vis-a-vis the Indian market, a thorough research of the company’s financials, moats, and more before you decide.

Disclaimer Note: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

Why are metal stocks called cyclical stocks?

The demand for metals is directly linked to the economic cycle. Therefore, during periods of economic growth, metal stocks tend to rise due to improved demand for metals and vice versa.

What are the top metal stocks in India?

Top metal stocks in India include Tata Steel, JSW Steel, Hindalco, Vedanta, NMDC, SAIL, etc.

Is it a good time to buy metal stocks?

If the demand for the metal is higher than the supply, and prices are rising in the international market, investing in top metal stocks can be considered.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.