The simplicity of investing in index funds draws the attention of millions of investors worldwide. As the famous author Paulo Coelho states, “the core of beauty is simplicity”.

2026 will mark the five decades of the launch of the world’s first index fund. A fund type that has proved its effectiveness in wealth creation over the long term through its low-cost and passive investing strategy. Over the years, the popularity of equity index funds has grown globally. And in India, the situation is no different. With record inflows, Investing in Index funds in India are becoming one of the popular investment options.

According to AMFI’s quarterly report, during the Jan-Mar 2022 quarter, the net asset under management (AUM) has touched a high of Rs 68,675 crore in 93 index funds, an addition of Rs 26,488 crore from the previous quarter. And during the period, 31 new index fund schemes were launched.

An impressive growth rate, right? So, if you are thinking of investing in one, it’s better to know about index funds, how they work, and the things you should consider before investing in them.

What are Index Funds?

In simple words, index funds are a type of mutual fund whose stock portfolio matches or mimics the composition of a particular index. For example, an index fund investing in all Nifty50 stocks in the same proportion and without changing the portfolio composition. So, what benefits do index funds bring in compared to other mutual funds that invest in handpicked stocks and change portfolios per emerging market scenario?

Benefits of Investing in Index Funds

Index funds are known for their passive investing strategy, meaning the fund managers don’t have to spend time researching the stocks and market developments. They just have to follow the index composition blindly. This strategy brings a host of benefits to investors, such as,

Broad market exposure: An index is diversified across multiple sectors and stocks representing different segments of the financial market and the economy. Therefore, you get a fully diversified portfolio of quality stocks through index funds.

Low cost: The cost of managing an index fund is low as fund managers don’t require a team of research analysts to pick the right stocks. Also, changes to the stock portfolio are made only when the index composition changes, which reduces the trading cost.

Eliminates human biases: Every fund manager has some kind of investment bias towards any sector or stock, which can sometimes lead to huge losses. Index funds eliminate human biases in investing decisions.

5 Things to Consider Before Investing in Index Funds in India

Investing in index funds in India makes it easier for you to manage your investments and is also less risky compared to large-cap funds or investing in stocks directly. But, how do you know which index fund is best among the options available?

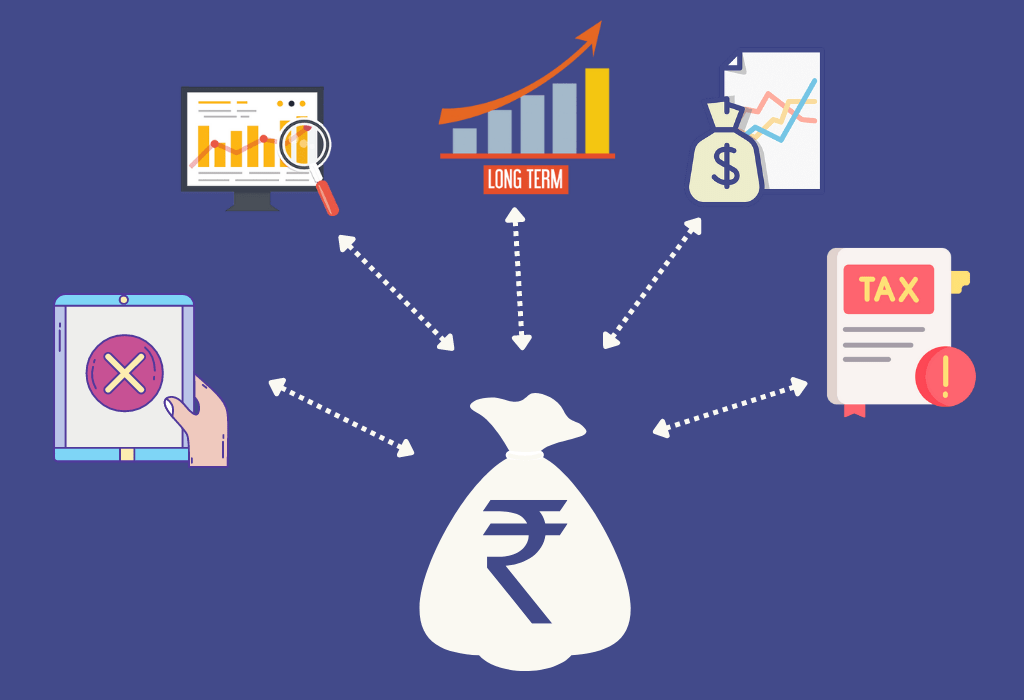

So, here are the 5 things you need to look at in any index funds before investing.

Tracking Error: If you notice closely, the returns of an index fund is always lower compared to the underlying index it tracks. The difference in the return is called tracking error.

Tracking error happens due to delays in making changes to index fund composition with changes in index composition, cash holdings, expense ratio, etc. Therefore, always avoid index funds with a large tracking error.

Index Category: Not all indices are the same, and all have different risk and return relationships. For instance, an index fund with Nifty50 as a tracking index has different risk and return metrics compared to an index fund with Nifty Next 50 as a tracking index. Choose the index fund based on your risk appetite and long-term investment goals.

Investment Horizon: Index funds are not suitable for short-term investment horizons as volatility can impact returns. Therefore, it is prudent to invest in these funds with a long-term investment horizon and benefit from multiple market cycles.

Expense Ratio: It refers to the percentage of a fund’s asset required to manage the index. By design, such index-based funds should have a significantly lower expense ratio than any actively managed funds. Avoid any index fund with a higher expense ratio than its peers, as it will impact returns in the long run.

Taxation: Index funds fall under the category of equity funds. Therefore, it attracts short-term capital gain (STCG) and long-term capital gains (LTCG) on realised gains depending on the holding period. Therefore, always hold the funds for the long term to pay lower taxes.

Conclusion

Lack of reactive ability and no control over holdings by fund managers may be some of the disadvantages of index fund investing, but the benefits outweigh the drawbacks. Investing in such funds is not to beat the market return but to provide returns closer to market returns in a less-risky way. And, historically index fund investing has proved to be a better bet in the long run.

Investing in Index Funds in India should be a part of your overall strategy and not your only wealth creation option. You must take the help of your multibagger stock advisor to create a financial plan that considers your risk appetite and goals.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.