We often get asked this question.

A short and straightforward answer to Is Long Term Investing always safe question is – it ultimately depends on the asset(s) you decide to invest in.

Let’s understand what long-term means before explaining why long-term investing may not always be safe. Investing in mutual funds, equity, bank FDs, or real estate for more than 3-5 years is considered a long term investment. While there are different asset classes you can choose to invest in, let us consider equities and understand if it is safe in the long term.

Well, long-term equity investments may not always be safe. We do not want to sound like pessimists, but you must know the truth about equity investments right at the beginning.

Do note that we are saying it’s not ‘Always’ safe, which means it can be safe too. The degree of safety increases with time. The riskier the investment is, the shorter the tenure.

Don’t believe us? Look at the images below:

Nifty 1 Day Chart

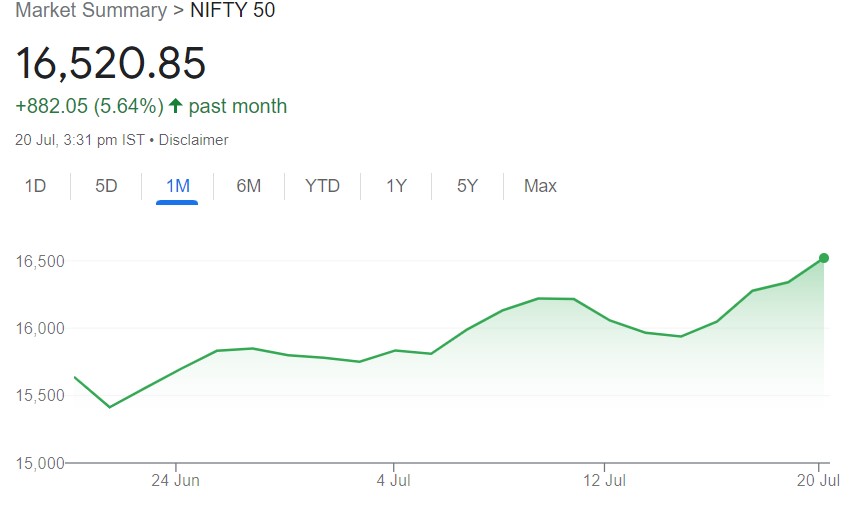

Nifty 1-Month Chart

Nifty 6-Month Chart

Nifty 1-Year Chart

Nifty 5-Year Chart

Nifty Since Inception

If you take note, you will see that the longer you hold your investments, the higher the curve, generating multi-fold returns. So if the charts are green the longer you have the investment, why is it not always safe to invest in equities?

Look at two more illustrations below, and you will see why.

Reliance industries’ share chart since inception

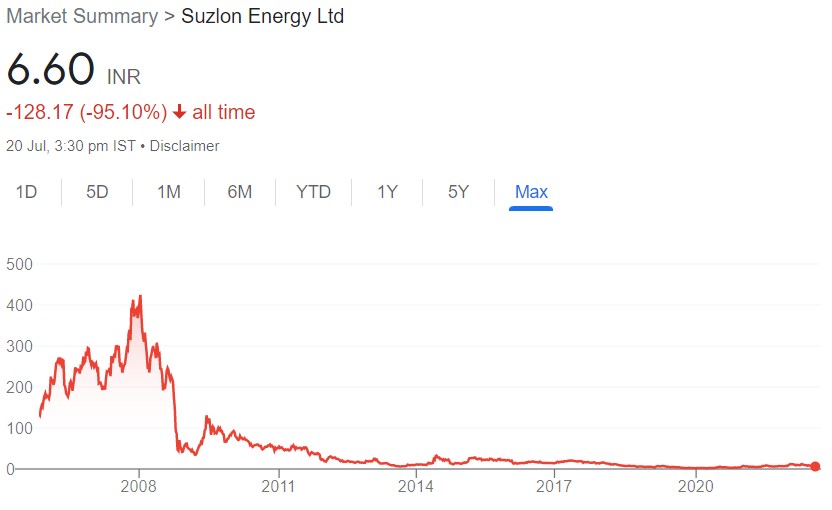

Suzlon Energy’s share chart since its inception

Ah! We can see the wheels turning now.

So, Is Long Term Investing always safe?

Both the companies have existed for years, but Reliance Industries is up over 4,000%, and Suzlon Energy is down over -90%. Of course, there are plenty of businesses like the two mentioned above. However, of the 7000 listed companies in India, only a handful have created substantial wealth for investors.

Whether you create wealth or erode your capital depends on the companies you decide to invest in. So don’t be hasty and invest in bad stocks to create wealth. But how do you know the companies you want to invest in are the best shares to buy for long term investment?

A company must show the characteristics mentioned below for you to invest in it.

• exhibits a solid history of steady growth in revenues and profits

• has a durable product or service portfolio to cater to customer needs

• is a market and industry leader

• has a farsighted management

These are just a few crucial factors that you may consider initially. However, we suggest reviewing the businesses methodically, so you understand the strengths, weaknesses, opportunities, and threats before using your investible surplus to invest in the company.

Benefits of Long Term Investing

1. Exponential Returns

To understand the benefits of long term investing, the charts above speak for us. As you see, the longer you hold on to your fundamentally strong portfolio, you not only enter a safe territory but also earn exponential returns. For instance, the stock market may gain 5-10% in a day, but the sky is the limit when you look at the long-term growth.

2. Short-term bleeps remain irrelevant

The short-term graph of the stock market is full of valleys and mountains. It happens because several events or developments set the course for the markets in the short term. Take elections, for instance; the stock markets are often volatile during election period. Likewise, war or crisis-like situations make the markets jittery. However, these short-term bleeps become irrelevant when you look at long-term growth.

3. Enjoy corporate action Benefits of Long Term investing

Corporate actions comprise dividend, splits, bonuses, buybacks, etc. A company in its lifetime undergoes several developments causing it to buy back shares, announce splits, and bonuses, merge with a different entity, and announce dividends. So, you benefit from corporate actions when you purchase and sit tight on such companies for the long term. To put this into context, Warren Buffett earned $5.6 billion in dividend in 2021.

We have also written a separate blog on the benefits of holding on to equities for the long term.

You can create substantial wealth only if you have the patience and are willing to let your investments grow in the long term instead of keeping an eye for little returns every day.

You may want to check the difference between Short Term and Long Term Investments.

Find this article helpful, share your feedback with us and this article with your friends.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 15

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/