A long-term investment is the only way to create sustainable wealth, and short-term investments are great for momentary profits. But you profit when you sell your investment till then, wealth is notional.

We are sure you have invested money in various assets, including equities and equities-based mutual funds and never paid attention to the long-term capital gains tax.

Today we look at what LTCG is, how to calculate it and more.

Capital Gains

Before you understand the capital gains taxation scheme, let us learn to calculate capital gains. Capital gain is excess between the sale price and cost price of the asset (i.e., profit on the sale of an asset).

To summarize when the selling price is more than the cost, you profit (i.e., capital gains). When the cost price is more than the selling price; you make a loss (i.e., capital loss).

Now, let us understand how to bifurcate between long term and short term. Firstly, the time you hold the assets defines the type of capital gains (whether long term or short term). It is important to differentiate as the government likes to tax the assets differently depending on how long you have held the assets.

When you hold an asset for more than a year, the asset becomes a long-term capital asset attracting long term capital gains tax (LTCG) when you sell it. On the other hand, when you possess an asset for less than a year, it becomes a short-term capital asset. It attracts short term capital gains tax (STCG) when you sell.

Long-term Capital gains (LTCG) & Short-term capital gains (STCG)

The income tax law suggests different taxation rules for short term and long-term capital assets. While short term capital assets are taxed at 15%, long term capital assets are taxed at 10%.

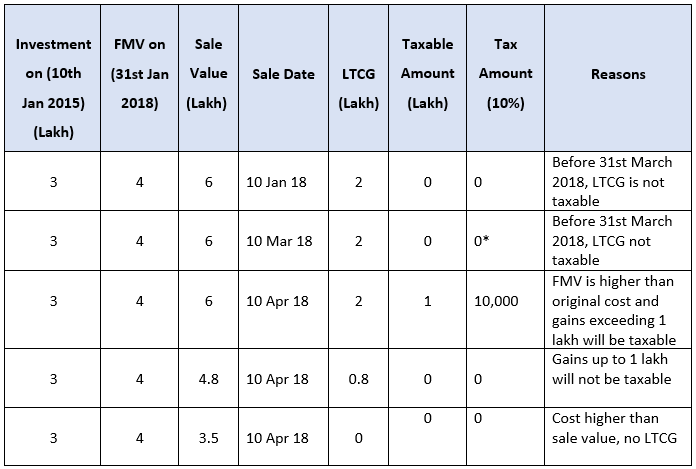

In the Union Budget of 2018, the government announced a tax on LTCG of 10% only if the gains during a fiscal year exceeded Rs. 1,00,000. For example, if you sell some shares and the profit on selling the shares are INR 60,000, then you need not pay LTCG tax for that particular year.

However, to promote long term investments and wealth creation with the help of equities and increase retail participation in the stock markets, there was no tax on long term capital assets until 31st March 2018.

Effects of the new tax regime on long-term investments

Investors could keep the profit they earned till 31st January 2018 based on the grandfathering clause, which exempts LTCG tax on investors’ profit till January 2018.

In this section, let’s understand LTCG (Long Term Capital Gain) calculation according to the new draft.

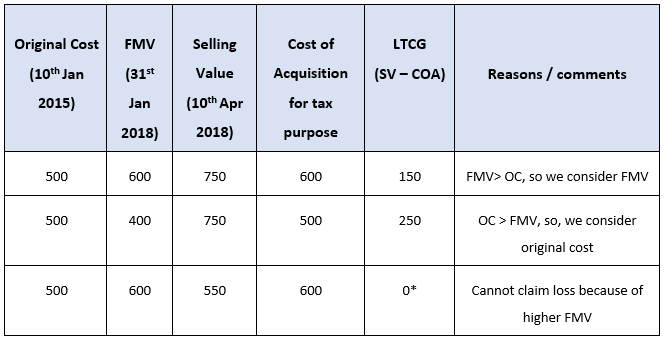

Use this formula to know the acquisition cost of the asset. Consider the “original cost (OC) or Fair Market Value (FMV), whichever is higher to know the LTCG amount. The table below shows the long-term capital gain for various scenarios.

Now that you have seen the calculation of LTCG, let us understand how the new tax regime operates for long-term capital gains.

Impact of LTCG Tax

Everything changed after the introduction of the LTCG Tax in the capital markets. Some developments are:

- FIIs (Foreign Institutional Investors) avoided the capital markets for some time. Even retail investors pulled out of the market. This move led to a reduction in liquidity in the capital markets.

- The Indian indices witnessed a sharp correction when the Sensex fell 2000 points within three days.

- Volatility in the market increased as there was a minimal difference between the STCG Tax and the LTCG Tax. Retail investors considered both the taxes LTCG and STCG the same for a brief period.

- The flourishing world of mutual funds diminished as their profits attracted a tax too.

- The ULIPS (Unit Linked Insurance Plan) gained prominence as they were tax-free.

We hope you now have a better idea of LTCG, its meaning, implications, calculation, and impact on your investments.

But does that mean you do not invest for the long term? No, investing is a need today and not a luxury. The best thing you can do is diversify your portfolio.

What do you think of this article? Let us know on createwealth@researchandranking.com

In the meanwhile, subscribe to 5 in 5 Wealth Creation Strategy and let us help you create.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.