Introduction

When the crisis at IL&FS (Infrastructure Leasing & Financial Services) exploded in September 2018, many saw it as India’s Lehman Brothers moment. As a result, the Centre in October 2018 replaced the entire IL&FS board with a new, six-member board and made Uday Kotak, MD & CEO of Kotak Mahindra Bank, its non-executive chairman.

After three and a half years, when Mr Uday Kotak stepped down, around RS. 55,000 crore of debt had been resolved, representing 90% of the expected resolution, a remarkable achievement. That should tell you something about the man and the owner of the bank he has built and nurtured for the last 35+ years.

Today, Kotak Mahindra Bank is the 3rd largest private-sector bank and has multiplied shareholder’s money by more than 500 times over the last 20 years.

In this Kotak Mahindra Bank share price analysis article, we will review the fundamentals of the company and its growth potential that will help you make an informed investment decision.

Kotak Mahindra Bank Company Overview

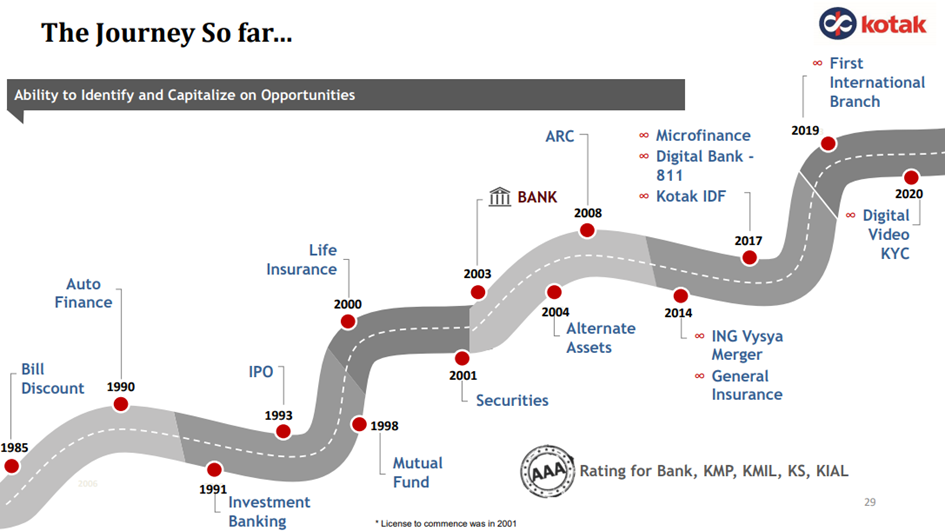

Kotak Mahindra Bank was founded in 1985 by Uday Kotak as a financial services company named Kotak Capital Management Finance Ltd. The company initially focused on bill discounting and commercial paper, but it later diversified into other financial services.

In 2003, Kotak Mahindra Finance Ltd. received a banking license from the Reserve Bank of India (RBI), becoming the first non-banking finance company in India to convert into a bank – Kotak Mahindra Bank Ltd. The bank began its operations focusing on retail banking, corporate banking, and treasury operations. The Kotak Mahindra Share Price has corrected by over 20% and closed at RS. 1868 as on April 13.

Kotak Mahindra Bank Journey

Over the years, the bank has grown significantly and has expanded its product offerings to include investment banking, wealth management, and insurance.

In 2014, the bank acquired ING Vysya Bank, making it the fourth largest private bank with combined assets of RS. 160,012 Cr (replacing Yes Bank). The bank also acquired a 15% stake in the Multi Commodity Exchange of India (MCX) the same year, further expanding its commodity exchange offerings.

Kotak Mahindra Bank has also made strategic acquisitions in digital banking sp ce. For example, in 2016, the bank acquired BSS Microfinance Pvt. Ltd. to enter the microfinance sector.

Today, Kotak Mahindra Bank is one of India’s largest private sector banks with a market capitalization of over Rs. 3.70 lakh crore (as of April 14 2023). The bank has a network of 1,603 branches and 2,569 ATMs across the country, and it has also expanded its presence globally with branches in Dubai, Abu Dhabi, and London.

Kotak Mahindra Bank Management Profile

The top management comprises industry veterans, with the majority having experience of about two decades within the KMB group signalling the establishment of organizational culture and stability.

Mr Uday Kotak is the Managing Director & CEO of the Bank and also its promo er. Under Mr Kotak’s leadership, over the past 35 years, the Kotak Group established a prominent presence in significant areas of financial services, including banking, stock broking, investment banking, car finance, life and general insurance, and asset management.

Mr Deepak Gupta is the Joint Managing Director. He helms numerous functions of the Bank, including Information Technology, Digital Initiatives, Internal Audit, Human Resources, Vigilance, Customer Experience, Marketing & Communications, Environment Social Governance, Corporate Social Responsibility, and Priority Sector Lending.

Ms Shanti Ekambaram is the President of Consumer Banking and Digital Initiatives and has been associated with the bank for over two decades. She has played a pivotal role in developing the bank’s consumer banking business. She has also driven the bank’s digital initiatives, including launching innovative digital banking products and services.

Mr Gaurang Shah is in charge of the Bank’s Credit function and is Chairman of the Bank’s Credit Committee (Level E). In addition, Mr Shah oversees insurance and asset management, including alternate assets and Asset Reconstruction businesses.

Mr KVS Manian has headed Corporate, Institutional & Investment Banking at Kotak Mahindra Bank Ltd since April 2 14. Mr Manian also oversees the firm’s Institutional Equities business.

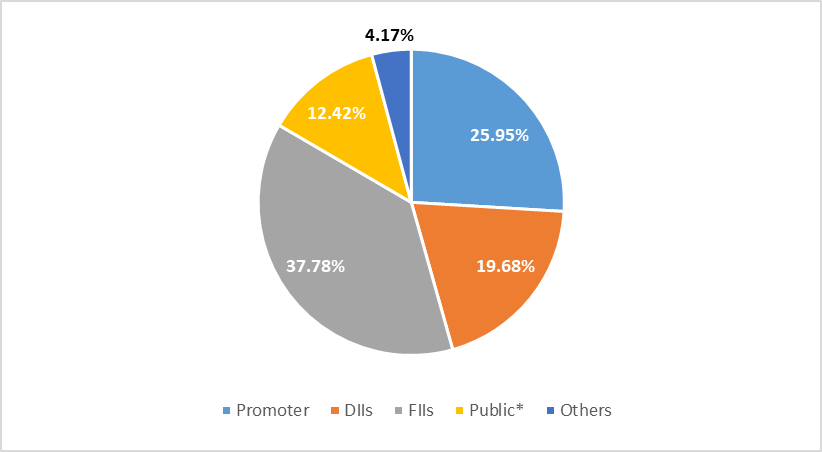

Kotak Mahindra Bank Shareholder Profile

As of December 2022, the promoter’s stake in the bank is 25. 5%. FIIs & DIIs own 37.78% and 19.68% stakes in the business. Public investors hold 12.42%

*Public includes Residential individuals, Non-residential individuals, Clearing members, Foreign companies, Foreign Banks, Qualified institutional buyers,

There has been a longstanding issue between the promoters of KMB and RBI regarding reducing the promoter stake to a maximum of 15% by February 2015. As per the RBI’s revised guidelines for licensing new private banks, issuFebruary 22ary 22, 2013, the promoter group was required to bring down the shareholding to a maximum of 15% within 12 years from the commencement date of the banking business.

However, Mr Uday Kotak resisted the dilution of his holding to 15%. He argued that RBI’s new norms should not be retrospectively applied as he was given the license under RBI’s January 3, 2001 policy which stated that the promoter contribution should be a minimum of 40% of the paid-up capital of the bank at any point in time.

After crossing the 2015 deadline, RBI has repeatedly allowed Mr Uday Kotak an elongated timeline to reduce his stake first to 20% by Dec 2018 and 15% by March 31 2020. That amounted to an extension of 5 years over the original deadline march March 31.

However, in Nov 2021, RBI announced that it raised the stake promoters can hold in their banks to 26% from 15%. So as of today, the promoter’s stake in the bank stands at 25.95%, which is in line with the revised notification issued in November 2021; hence, this issue has been settled now and forever.

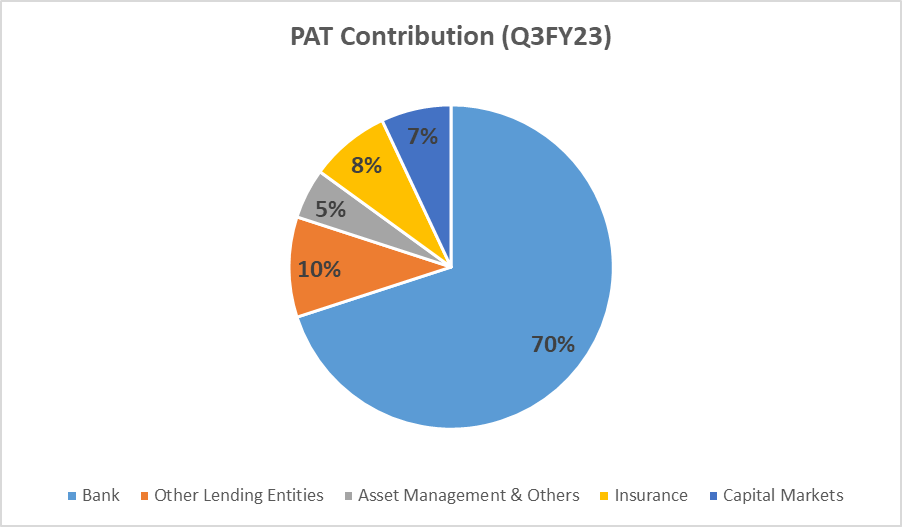

Kotak Mahindra Bank Business Analysis

Over the last 35+ years, Mr Uday Kotak has built a great bank and diversified financial services company. Under his leadership, the Kotak Group expanded into stock broking, investment banking, Life and general insurance, Mutual funds, and other segments.

This can also be validated because 30% of KMB’s PAT currently comes from non-banking operations. Mr Uday Kotak has been very vocal that his vision for KMB was not to build it into a bank but a “financial institution.”

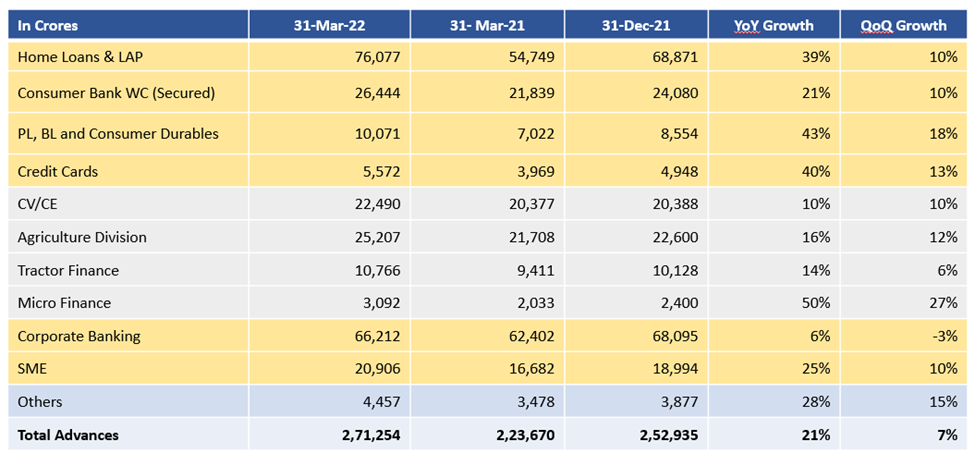

Kotak Mahindra Bank has a diversified asset book across multiple asset classes within the banking business. The table below shows the breakup:

Kotak Mahindra Bank Financials

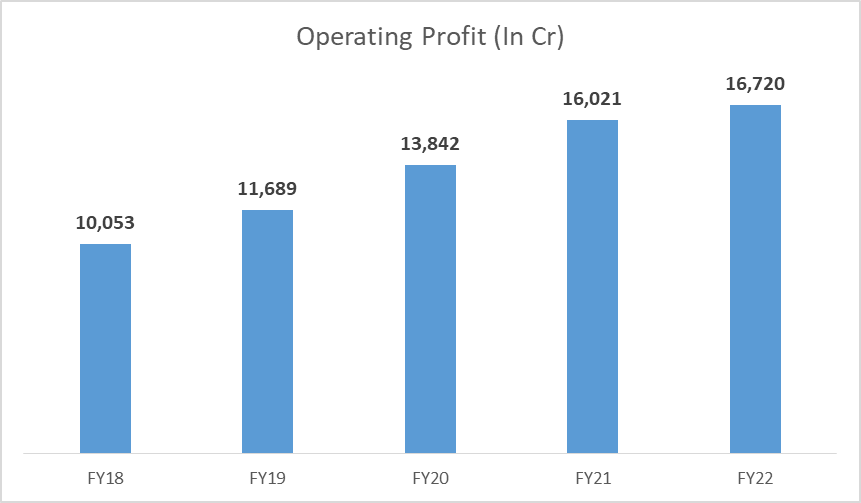

Operating Profit

Operating profit for the quarter ended Dec 2022 was RS. 3,850 Cr, up 43% as against Q3FY22 of last year. Kotak Mahindra Bank’s Operating profit has grown at a CAGR of 14% in the previous 5 years.

Kotak Bank Net Interest Income

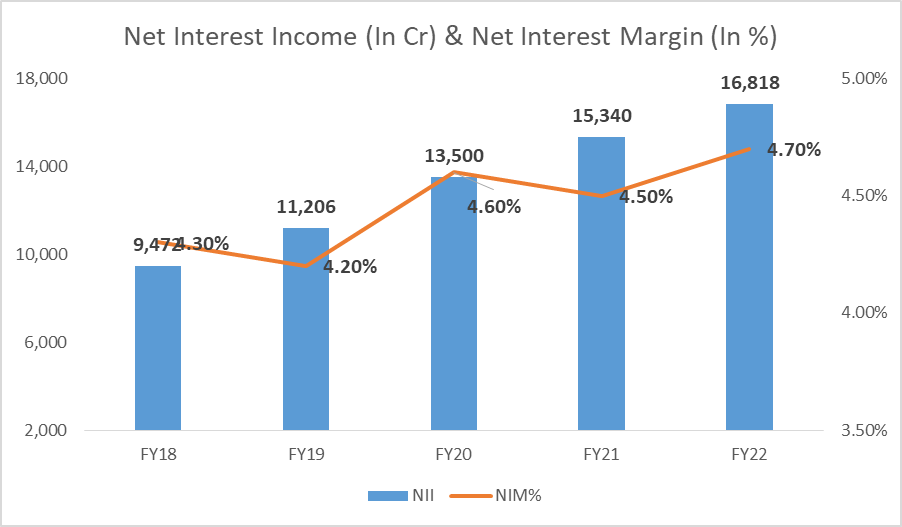

Net Interest Income (NII) represents the difference in the interest earned from a bank’s lending activities to its customers and the interest paid to account holders or depositors.

On the other hand, Net Interest Margins (NIM) are derived by dividing Net Interest Income / by the Average income earned from interest-producing assets such as loans and advances given to borrowers.

NII for Q3FY23 increased to RS. 5,653 Cr, fr m RS. 4,334 Cr in 3FY22, up 30% YoY. NII has grown at a CAGR of more than 15% over the last five years, from FY18 to FY22.

Kotak Bank Net Interest Margin

Net Interest Margin (NIM) was 5.47% for Q3FY23 – one of the highest among large private sector banks. Moreover, NIM has increased consistently from 4.3% odd levels to now at ~5% levels, as seen in the chart below. This tells us a great deal about the bank’s focus on profitability.

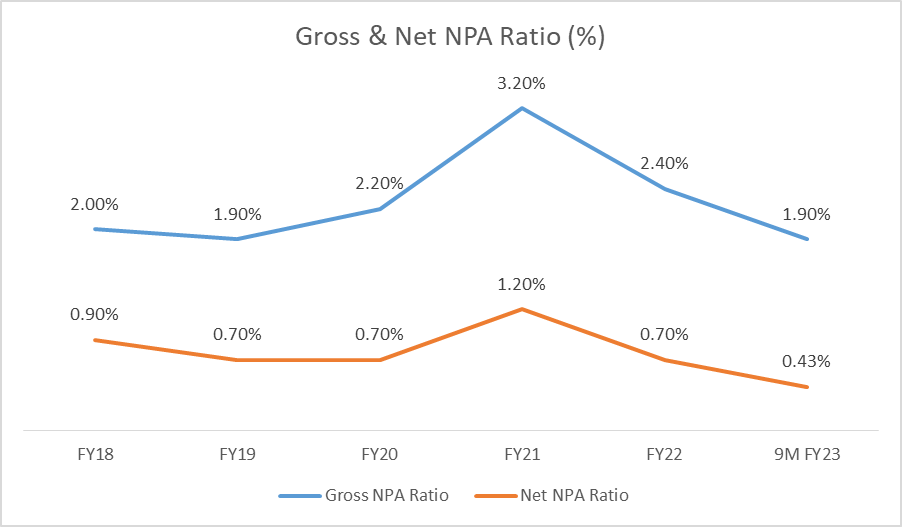

Kotak Bank Asset Quality

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA (GNPA) refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

KMB has kept its Non-Performing Assets (N As) under control. As a result, its NPAs are the 3rd lowest after HDFC and ICICI Bank.

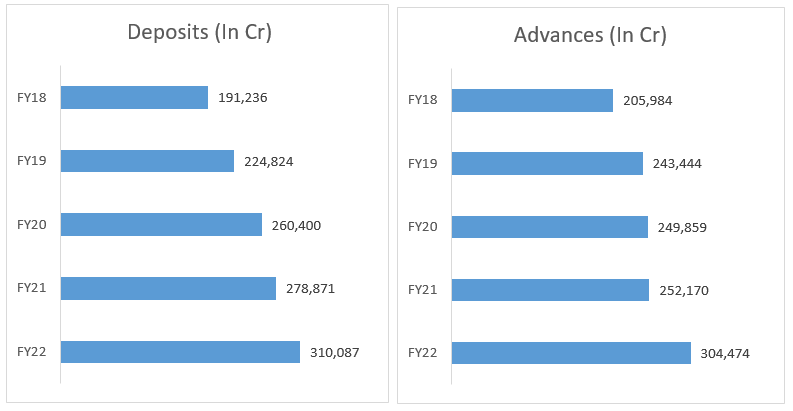

Kotak Mahindra Bank Advances & Deposits

An advance refers to a loan or credit extended by a bank t its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers. Advances increased by over 23% to Rs. 3,10,734 as of December 31, 2022, from Rs. 2,52,935 as of December 31 2021, driven by the home loan segment and increase in the unsecured book.

Deposits have grown at a CAGR of 13%, and Advances have increased at a CAGR of 10% from FY18 to FY22. The bank does not believe in growing the loan book at any cost and is obsessed with profitability. This can also be understood from Mr Uday Kotak’s tweet below after UBS acquired Credit Suisse at a discounted price.

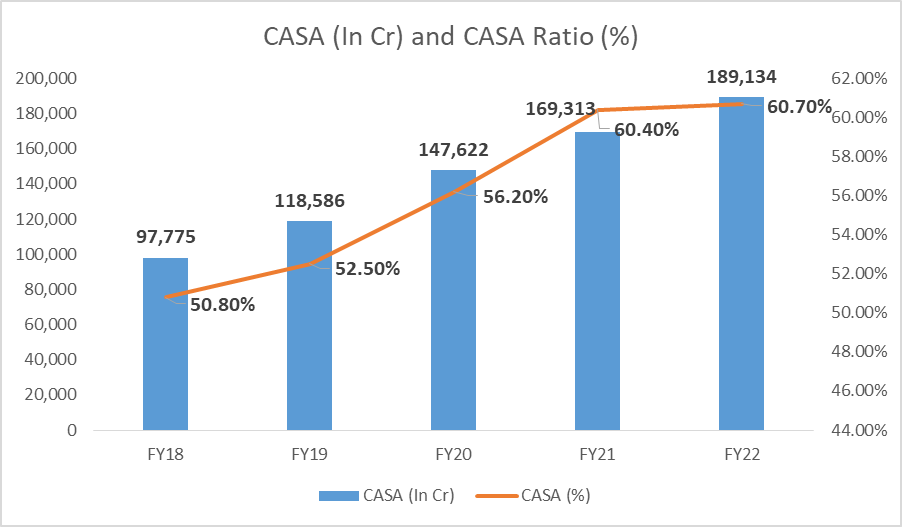

Highest CASA Ratio Among Peers

CASA ratio stands for current and savings account ratio. The CASA ratio of a bank is the ratio of deposits in current and saving accounts to total deposits. Banks typically pay significantly less interest on CASA deposits; hence, it is a relatively cheap source of capital.

KMB has a high CASA ratio, which has significantly contributed to lowering its cost of funds and enabled the engine to grow the ass t book faster. It is also one of the reasons for the relatively high NIM & ROA as well.

CASA Ratio KMB, as of December 31, 2022, stood at 53.3%. The exact ratio was 44% for HDFC Bank & Axis Bank and 45% for ICICI Bank for the same period.

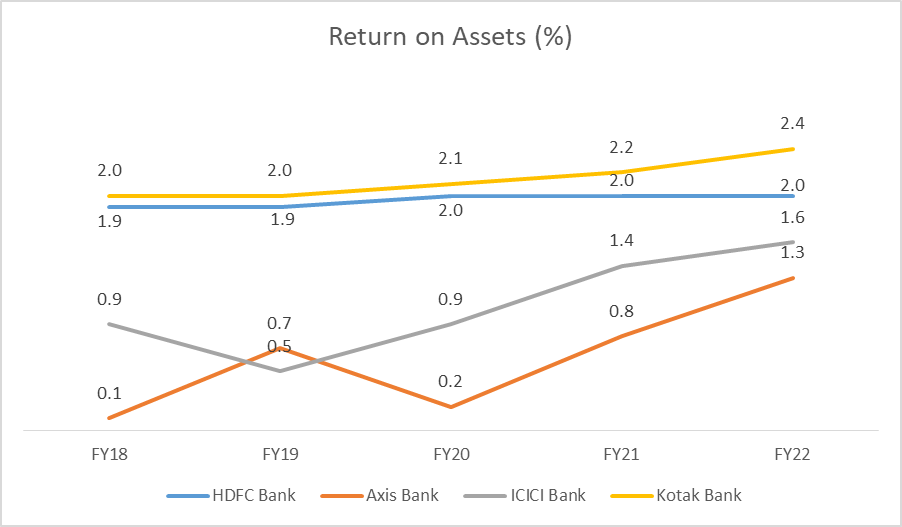

Best-in-class Return Ratios (ROA & ROE)

KMB has the highest ROAs (A higher ROA suggests that a bank is more efficient in generating profits from its assets) among all the large private sector banks. At the consolidated level, the Return on Assets (ROA) (annualized) was 2.76% for Q3FY23 (2.60% for Q3FY22), and the Return on Equity (ROE) (annualized) was 15.04% for Q3FY23 (14.81% for Q3FY22).

Kotak Mahindra Bank Share Price Target Analysis

KMB stock price has grown at a CAGR of 19% over the last ten years. The bank has consistently grown its retail book and improved asset quality, achieving higher ROA/ROE.

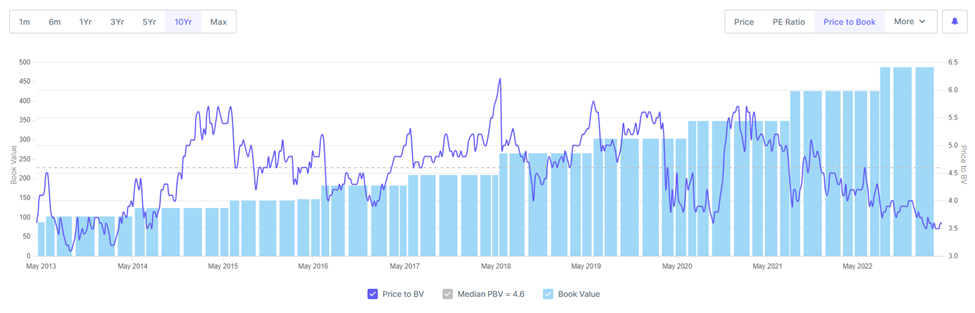

KMB has historically traded at a premium compared to other listed large private-sector banks. However, the stock’s Price to Book (P/B) value has corrected significantly over the last year and is now trading at a P/B value of 3.5x. The average 10-year P/B ratio is ~4.5. It thus continues to be an excellent long-term investment for investors.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

Who is the owner of Kotak Mahindra Bank?

Mr Uday Kotak is the Promoter of Kotak ahindra Bank. He owns a 25.95% stake in KMB as of Dec 2022.

How has Kotak Mahindra Bank performed in the last five years?

KMB bank has delivered a 5-year CAGR of 10%. Stock valuation has corrected significantly in the recent past. KMB is expected to beat the index in the future over the long term, given its strong business performance.

What has been the 52-week high of Kotak Mahindra Bank Ltd stock?

52 Week high of Kotak Mahind a Bank is RS. 2,251. However, the Kotak Mahindra Share Price has corrected by over 20% and closed at RS. 1868 as on April 13.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 2

No votes so far! Be the first to rate this post.