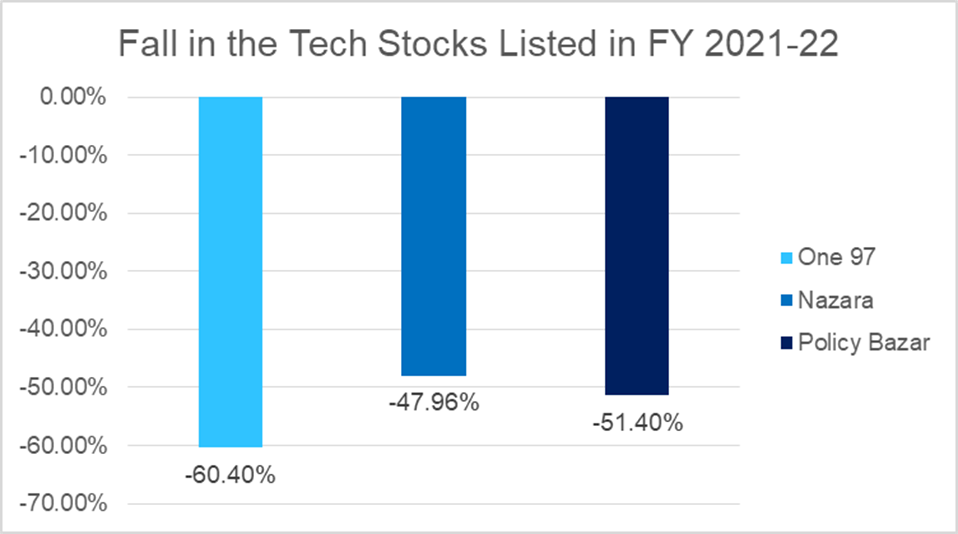

Following the blockbuster tech IPO year of 2021, when the IPO market raised over Rs. 1.2 Lac crores, the year 2022 has been a complete flop in the Indian stock market, with the IPO market raising only Rs. 57000 Crore. On the other hand, 2021 marked the best IPO year in nearly two decades.

Poor post-IPO performance of new-age tech startups instilled fear in investors and tech startups, discouraging them from entering the stock markets. The list of startups deferring their listing plans grew longer as the year passed. With new-age startups continuing to bleed, it would be interesting to see how the investors respond to the upcoming Le Travenues Technology IPO (Ixigo IPO).

A glimpse of the performance of some of the big-ticket size startup IPOs that listed on the Stock Markets

This article will explore the upcoming Le Travenues Technology IPO (Ixigo IPO) 23 in detail, including financial aspects and future viability.

Le Travenues Technology IPO (Ixigo IPO) details

Le Travenues Technology IPO (Ixigo IPO) comprises new shares worth Rs. 750 Crores and an Offer for Sale (OFS) worth Rs. 850 Crores.

| IPO Status | Not Announced |

| IPO Date | Not Announced |

| Total IPO Size | Rs 1600 Cr ( including Fresh issue – Rs. 750 & OFS – Rs. 850 Cr) |

| No. of Shares for IPO | Not Announced |

| Issue Price Band | Not Announced |

| IPO listing at | BSE and NSE |

| Face Value per Equity Share | Rs. 10/- |

| Issue Type | Book Built |

Category-wise Shares Offered

| Category | % Offered |

| Qualified Institutional Investors | Min: 75 % |

| Non-Institutional Investors | Min: 15% |

| Retail Investors | Max: 10% |

About the Company Launching the Le Travenues Technology IPO (Ixigo IPO)

Le Travenues Technology IPO (Ixigo IPO) is a tech-driven company that enables Indian travelers to plan, book, and manage their trips by rail, air, bus, and hotel. It helps travelers make better travel decisions by leveraging AI, machine learning, and data science-driven innovations on its OTA platforms, which include our websites and mobile apps.

The Gurugram-based Travel aggregator launching Le Travenues Technology IPO (Ixigo IPO) was founded in 2007 by Alok Bajpai and Rajnish Kumar. The company has an authorized share capital of Rs. 50 Crores and issued, subscribed, and Paid-up capital of Rs. 36.84 Crores.

Travelers can book train, flight, bus tickets, hotels, and taxis. It also uses its utility tool to provide services such as train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, bus running status, personalized recommendations, instant fare alerts, and automated customer support.

Le Travenues Technology IPO (Ixigo IPO) includes an exit opportunity for early investors like Elevation Cap and Micromax, the Indian smartphone manufacturer, to offload shares to Rs. 550 crores and Rs. 200 crores, respectively.

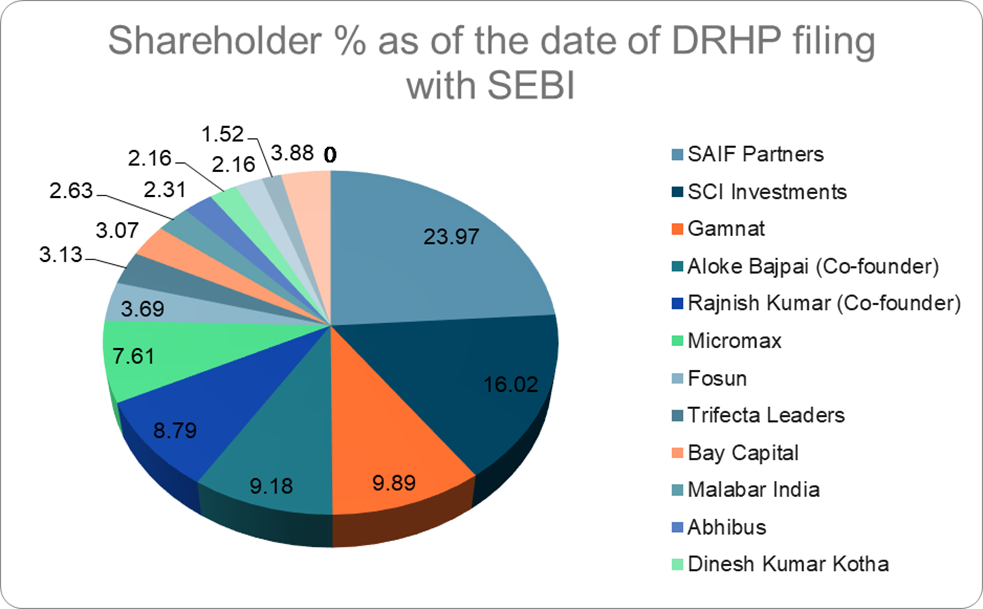

Shareholding Pattern

Le Travenues Technology IPO (Ixigo IPO) is a professionally managed company with no promoters and is entirely owned by the public. The company has 123 equity shareholders and 12 Preference shareholders.

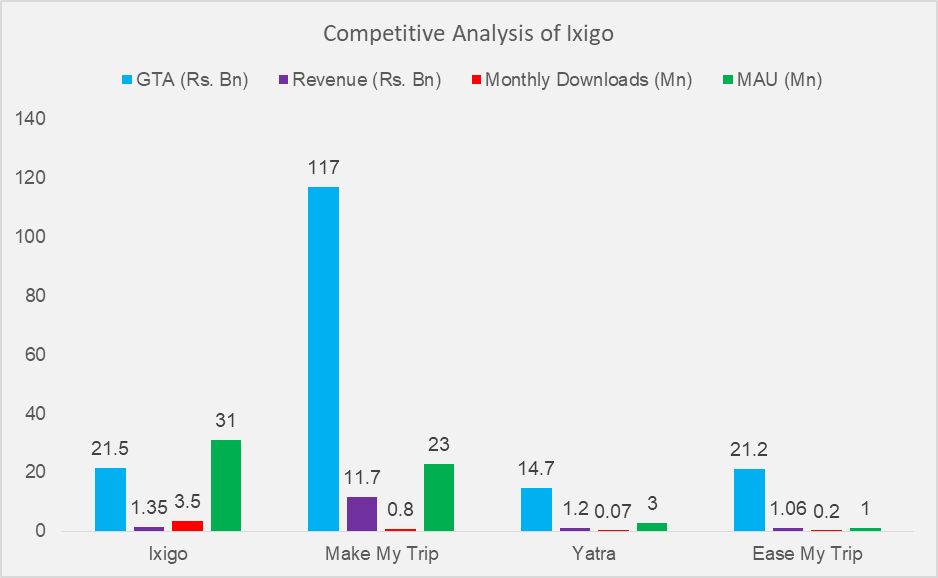

OTA Competitive Analysis of Le Travenues Technology (Ixigo) IPO Company across All Transport Modes

The Indian OTA industry is highly competitive, and any shift in dynamics could impact Le Travenues Technology (Ixigo) IPO. The major competitors in the domestic OTA market include Make MyTrip Ltd, Yatra Online, Clear Trip, and Easy Trip Planners Ltd.

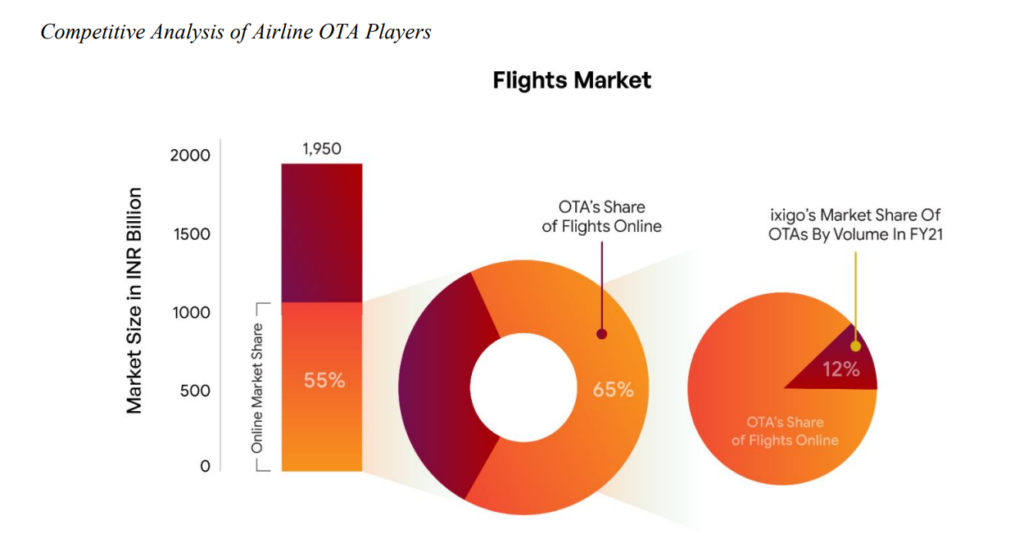

Indian OTA Players’ Key Metrics for FY 2021

The company is India’s third-largest flight OTA, with a 12% market share in online air bookings in FY 21. It maintained a good hold on the air travel market even during the pandemic, witnessing a marginal decrease of 4.7% in the number of air segments sold during FY21. It was because of their quick response time to customer queries, full refund options, and an up-to-date COVID travel guideline help center. Its airline uptake from its catchment area of Tier II/III towns also performed exceptionally well during the pandemic.

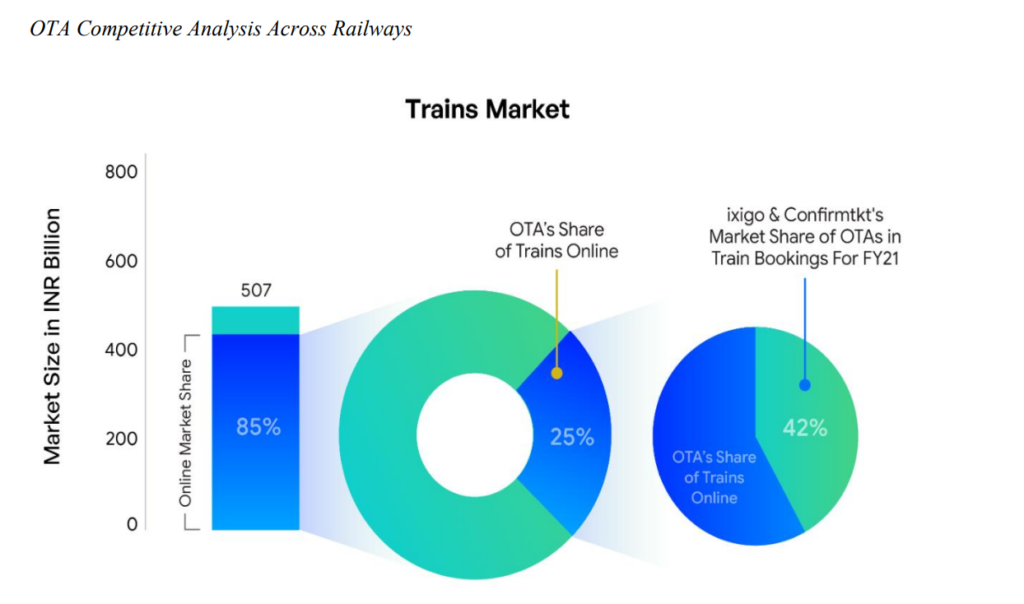

75% of all online reserved rail tickets are booked through the IRCTC directly, with only 25% of tickets being

routed through OTAs, who act as distributors of train tickets for the IRCTC. Though other players in the market do not consider train bookings a source of revenue or profit. However, Ixigo is the exception to the rule. It focused its efforts on the rail segment, which helped it dominate the OTA space in rail ticketing and absorb market shares from other OTAs, especially in Tier II/III cities. Their recent acquisition of ConfirmTkt has strengthened their foothold in the train travel segment.

Today, it is the largest Indian OTA in the online train bookings segment with its train-centric mobile applications- Ixigo trains and ConfirmTkt with a 42% market share among IRCTC’s OTAs and B2C distributors in FY21.

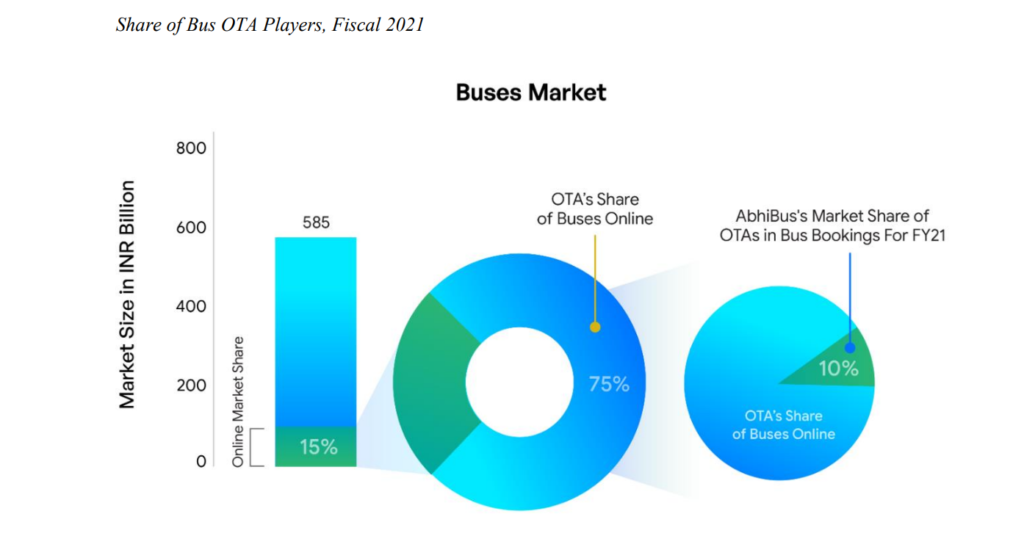

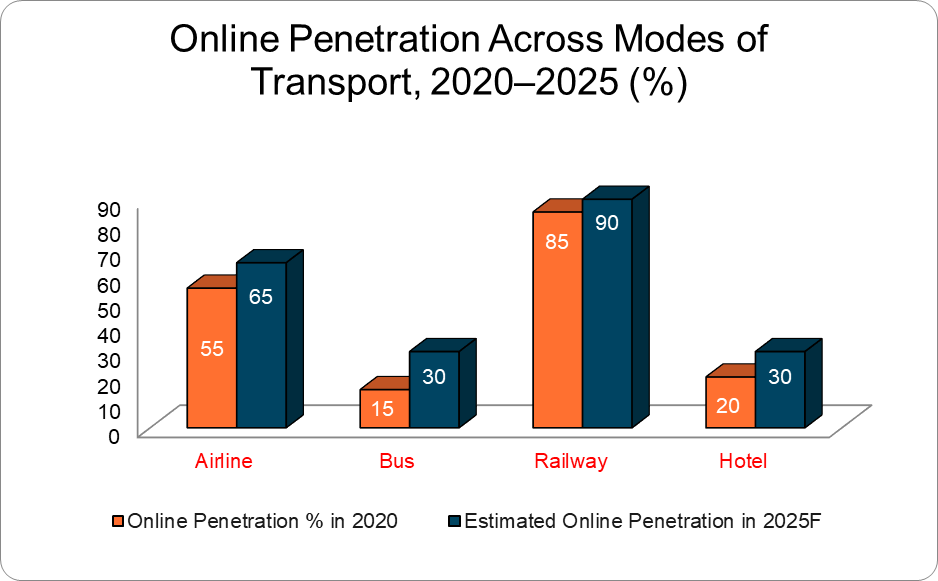

Online bus penetration was only 15% in 2020 pre-pandemic, but after seeing a surge during COVID, the market is expected to increase to 30% by 2024. The market share split of the online bus market between direct SRTCs and private OTAs for online ticket booking stood at 40% and 60%, respectively. Most private OTAs like AbhiBus and RedBus focus on providing value-added services from clean restrooms, blankets, etc., to women’s safety and supporting passengers throughout the journey.

In FY 21, the company’s bus-focused app, AbhiBus, was the second largest bus-ticketing OTA in India, with a 10% market share in online bus ticket bookings.

Subsidiaries

As of the date of filing DRHP, the company planning to float its Le Travenues Technology (Ixigo) IPO has three subsidiaries-

| Name of the Subsidiary | Year of Incorporation | Shareholding |

| Confirm Ticket Online Solutions Private Limited | 17th March 2015 | 83.68% |

| Travenues Innovations Private Limited | 9th November 2018 | 99.99% |

| Ixigo Europe | 28th June 2021 | 100% |

Financial Analysis of Le Travenues Technology (Ixigo) IPO Company

Ixigo’s registered users increased at a CAGR of 75.85% between FY19 and FY21, while their Repeat Transaction Rate was 87.18% in FY21. While the impact of COVID-19 in the first and second quarters of FY21 was significant on Ixigo’s operations, they witnessed a rebound in the subsequent quarters of FY21. In the third and fourth quarters of FY21, their gross transaction value (GTV) grew by 30.93% and 46.32%, year-on-year, compared to the same period in FY20, respectively.

While the overall travel segment has not fully recovered from the impact of COVID-19, the number

of transactions booked through their OTA platforms was 116.61% higher in Q4 FY21 compared to Q4 in FY20. In addition, their Monthly Active Users grew by 19.04% in Q4 FY 21 compared to Q4 FY 20. However, any changes in travel trends and the Indian economy could affect the company’s financial results.

The table below shares a glimpse of their financials for the year ended 31st March 2019, 2020, and 2021

(Amounts in Rs. crores)

| FY 2019 | FY 2020 | FY 2021 | |

| Revenue from operations | 40.37 | 111.60 | 135.57 |

| Other Income | 2.29 | 1.36 | 2.84 |

| Total Expenditure | 100 | 139.57 | 135.70 |

| Net Profit After Tax | -57.33 | -26.44 | 7.58 |

| Assets | 60.38 | 70.13 | 181.34 |

Strengths and Potential Risks to the Performance of the Le Travenues Technology (Ixigo) IPO

Strengths

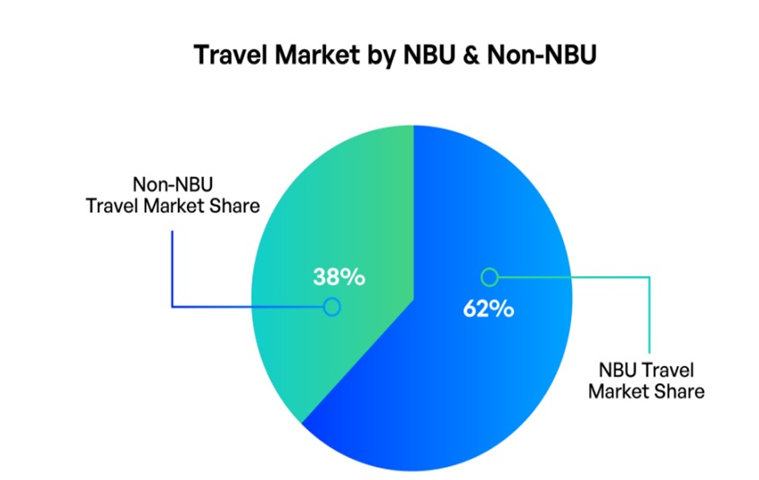

Market leader with deep penetration in the underserved ‘next billion users’ segment

According to the F&S Report, Ixigo is the leading OTA for the next billion users (NBU), with the highest Monthly Active Users (MAU) across OTAs. It is also the second-largest OTA in GTV and revenues in FY21. The number of transactions booked through our OTA platforms has increased at a CAGR of 41.59%, from 4.27 million in FY19 to 8.56 million in FY21.

Low Customer Acquisition Cost

The Customer Acquisition Cost (per customer) of Le Traveneus Technology Ltd (Ixigo) has been consistently reducing and was ₹ 246.69, ₹ 94.95, and ₹ 44.27 in FY 2019, 2020, and 2021. Low Customer acquisition cost implies higher operating margins.

High Operating Leverage and Unstoppable Organic Growth

The company’s advertising and sales promotion contribution in revenue from its operations in FY 19, 20, and 21 have been 82.56%, 15.10%, and 6.36%, respectively. In FY 2021, this company was one of the lowest-spending OTAs in marketing spending for offline (non-digital) media, such as TV, print, and radio.

Improved Customer Experience with AI-driven Operations

Ixigo launched TARA to offer better customer service and COVID advisory during the pandemic. It is an artificial intelligence-driven personal travel assistant supported by deep learning and contextual awareness installed across Ixigo’s OTA platforms. TARA in FY 21 resolved 84% of the total chat queries received end-to-end, bringing in economies of scale.

Risks

- Failure to obtain or renew government approval, licenses, registrations, and permits required to operate the business in a timely or complete manner may harm Le Travenues Technology (Ixigo) IPO performance.

- The travel industry is vulnerable to an outbreak of any contagious disease or health concerns, travel restrictions, natural calamities, poor weather conditions, and much more. These factors can hurt the company’s business, financial condition, operating results, and cash flows.

- The train ticket services, which form a significant portion of its gross revenues, rely on the extension/ renewal of the agreement with IRCTC, valid until 30th April 2023. Any modification or revocation of the agreement with IRCTC could hurt the company’s business and IPO’s future performance.

- Revenue and operating results fluctuate quarterly due to seasonal demand patterns (such as increased demand during holidays or festival seasons) on the company’s OTA platforms.

- Failure to maintain satisfactory performance of our technology infrastructure, including our OTA platforms, particularly those leading to disruptions in our services, could adversely affect Ixigo’s business and reputation. If the technology infrastructure gets damaged or obsolete, it could affect the business.

The Objective of Launching Le Travenues Technology (Ixigo) IPO

The leading travel aggregator company is launching Le Traveneus Technology (Ixigo) IPO with the following significant objectives-

- The company has set aside Rs. 5400 crores from the net proceeds of the IPO for organic and inorganic growth initiatives. This includes a chunk of Rs. 35 crores proposed to be utilized in acquiring the remaining equity capital in Confirm Ticket.

- For general corporate purposes, which will be decided and made official once the Offer Price is determined.

Should You Buy Le Travenues Technology (Ixigo) IPO or let it pass?

The Online travel industry is expected to grow at a CAGR of 7%, and the online segment in the travel industry is expected to grow even higher at 11% by 2024. The rapid recovery of global travel demands due to reducing the impact of the pandemic seems to boost online travel aggregators (OTAs) in recent times.

However, following the recent poor performance of IPOs, investors are wary of riding the current wave. Before you invest, as an investor, you must critically evaluate the company’s past performance, valuations, and market share. Predicting whether the Le Travenues Technology (ixigo) IPO will work is difficult. But you must do your due diligence before you decide.

Disclaimer*: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

When will the IPO of Le Travenues Technology (ixigo) take place?

The IPO dates have yet to be confirmed, but they are expected to occur between the middle and the end of 2023.

What is the Lot size and minimum order quantity for La Travenues Technology (ixigo) IPO?

The company has not yet specified the minimum number of shares (also known as an IPO bid lot). We will also update the information once the company publishes all the details.

Does the allocation probability of La Travenues Technology (ixigo) IPO increase if I bid for more than one lot?

When an issue is oversubscribed, only one application can be submitted for bidding. However, if the investor applies for one lot from multiple accounts, the likelihood of allocation could increase significantly.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 8

No votes so far! Be the first to rate this post.