On December 29th, Honasa Consumer Ltd, the parent company of India’s largest D2C brand Mamaearth, submitted the Draft Red Herring Prospectus (DRHP) to SEBI. This digital-first, sizable, and fast-growing BPC house of brands’ valuations for the upcoming Mamaearth IPO was the talk of the town.

But before we delve into the intricacies of the IPO, let us take a quick look at the performance of IPOs launched over the last two years. The Indian stock exchanges, BSE and NSE, ranked 12th in the world regarding the number of IPOs until the second quarter of 2021. India was even cited as one of the few bright spots amid the bearish market sentiments the global slowdown caused.

Only three of the eleven startups that filed DRHP with SEBI in 2022 proceeded with their IPOs: Delhivery, Tracxn, and DroneAcharya. The remaining eight startups either abandoned their IPO plans, withdrew their DRHP, or their approval is still pending.

Most startups that went public in 2021, like Paytm, Policybazaar, and Nykaa, have declined in the range of 25% to 75% post their listings on the bourses. Delhivery, the largest and the most profitable logistics company in India recorded a sharp correction and fell about 30% from its listing price.

Look at the 2021-22 IPO performance.

| Startup | Listed On | Gain/Loss from Listing Price (in %) |

| Car Trade.com | August 2021 | -66.69 |

| Fino Payments Bank | November 2021 | -60.76 |

| Nazara Technologies | March 2021 | -50.08 |

| One 97 Communications Limited | November 2021 | -71.04 |

| PB Fintech (Policy Bazaar) | November 2021 | -48.67 |

| Delhivery | May 2022 | -28.35 |

| Tracxn Technologies Limited | October 2022 | -4.09 |

With the overall market downturn wreaking havoc on startup IPOs in 2022, investor attention has shifted to the company’s fundamentals and market valuation. Considering these growing concerns and the poor track record of startup IPOs, the Mamaearth IPO could face difficulties.

Mamaearth IPO details

Mamaearth IPO comprises a fresh issue of shares worth Rs. 400 Cr and OFS worth Rs. 4.68 Crores. Promoters and a few investors holding equity shares or NCCCPs are selling their part/entire stake in the company.

| IPO Status | Approved |

| IPO Date | October 31 to November 3 2023 |

| Total IPO Size | Fresh issue – Rs. 365 cr and OFS – Rs. 41,248,162 shares |

| No. of Shares for IPO | 46 shares |

| Issue Price Band | ₹308 to ₹324 per share |

| Issue Type | Book Built Issue |

| Face Value per Equity Share | Rs. 10/- |

| IPO listing at | BSE and NSE |

Category-wise Shares Offered in Mamaearth IPO

| Category | % Offered |

| Qualified Institutional Investors | Min: 75 % |

| Non-Institutional Investors | Min: 15% |

| Retail Investors | Max: 10% |

Details of the Offer For Sale (OFS)

| Name of the Selling Shareholder | Type | Weighted Avg. Cost of Acquisition ( in Rs. per Equity Share) |

| Varun Alagh | Promoter | Negligible (< 0.01) |

| Ghazal Alagh | Promoter | Negligible (< 0.01) |

| Evolvence India Coinvest PCC | Investor | 173.64 |

| Evolvence India Fund III Ltd | Investor | 173.82 |

| Fireside Ventures Ltd | Investor | 7.33 |

| Sofina | Investor | 112.07 |

| Stellaris | Other Shareholder | 7.82 |

| Kunal Bahl | Other Shareholder | 3.21 |

| Rishabh Harsh Mariwala | Other Shareholder | 6.05 |

| Rohit Kumar Bansal | Other Shareholder | 3.21 |

| Shilpa Shetty Kundra | Other Shareholder | 41.86 |

About the BPC floating the Mamaearth IPO

Mamaearth, India’s largest digital-first BPC, witnessed a massive uptick in e-commerce sales during the pandemic. It became the fastest-growing Beauty and Personal Care (BPC) brand, focusing on customer-centric innovation, brand building, and digital-first distribution. Within six years of its launch, it had reached an annual revenue of Rs. 1000 crores.

Varun Alagh and Ghazal Alagh founded Mamaearth in 2016 to produce natural or plant-based beauty and wellness products. Furthermore, the company manufactures baby skincare products that are certified safe for infants.

Mamaearth outsources all product manufacturing to 37 third-party manufacturers via contract-based agreements to sell them across multiple online and offline channels. Aside from an excellent traffic-driven online marketplace, the company has 35 Exclusive Brand Outlets (EBO) across India.

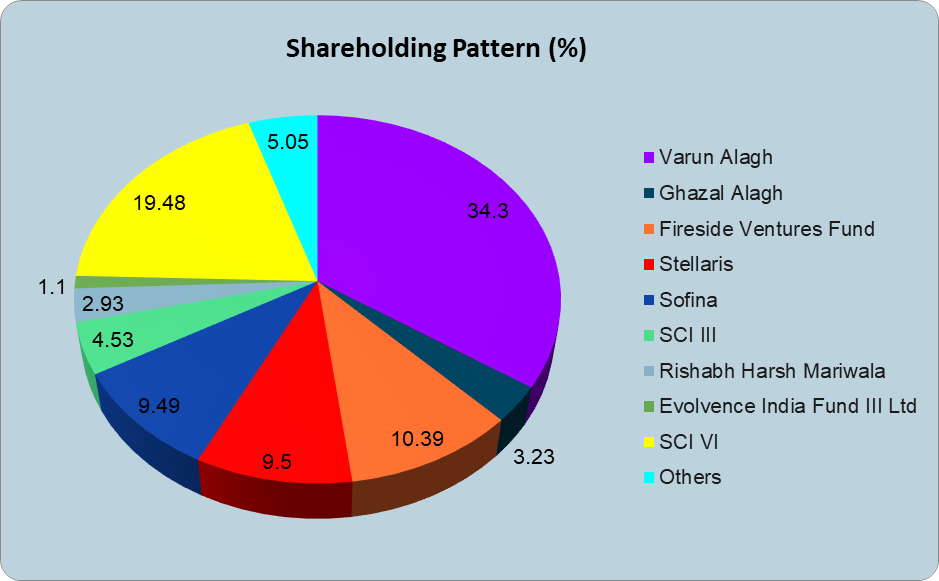

Shareholding Pattern of Mamaearth

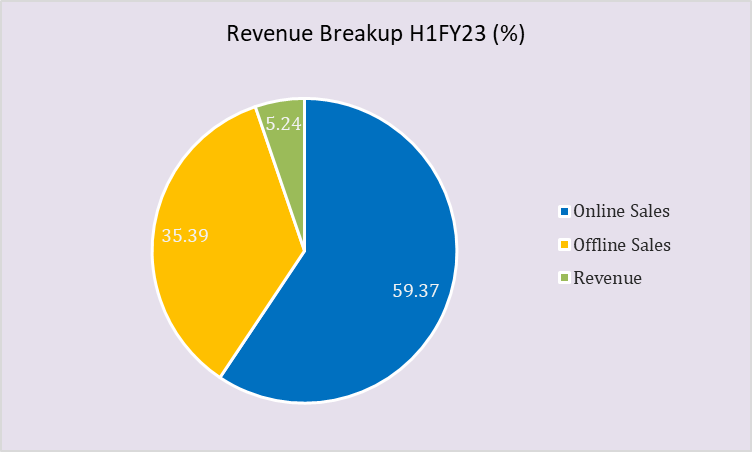

Mamaearth Revenue Break-up

Key Business Offerings of Mamaearth

- Mamaearth offers many toxin-free, natural, dermatologically safe, and convenient beauty products.

- The Derma Co., launched in 202, under the flagship of Mamaearth, provides science-backed skin care products powered with active ingredients.

- Acqualogica, launched by Mamaearth in 2021, provides a specialized skin care product range exclusively designed for Indian skin types.

- The company launched Ayuga in 2021 to make Ayurvedic skin and hair care products in an easy-to-use format.

- It acquired BBlunt, a brand that offers a professional salon-like experience at home, in 2021.

- It acquired Dr. Sheith, a company that offers skin care solutions combining natural and active ingredients, in April 2022.

- Acquired Mompresso in December 2021, a content-led platform that provides mothers with meaningful content to assist them in their journey of womanhood.

Financial Analysis of Mamaearth Company

Mamaearth’s focus on building thoughtfully designed and purpose-driven brands has helped it cultivate trust, brand resonance, and affinity amongst its consumers, helping it to grow its business. According to a RedSeer report, Mamaearth has grown its revenue from operations at a stupendous CAGR of 193.15 % vis-a-vis the industry average of 13% for the same period.

Mamaearth is the BPC company with the highest DTC revenue, accounting for 52.37% of its total revenue for six months ending September 30th. Mamaearth was ranked second among digital-first BPC companies in India in FY 2021 ( 71.15 % for FY 2021) for gross profit margins. Its success was driven by a customer-centric, agile, technology-driven, and differentiated business model.

Mamaearth was one of only two digital-first BPC companies in India with a positive adjusted EBITDA margin (6.82%) in the fiscal year 2021. Its adjusted EBITDA has also increased over previous quarters.

(All figures in Crores)

| FY 2020 | FY 2021 | FY 2022 | |

| Revenue | 109.78 | 459.99 | 943.47 |

| Total Assets | 181.01 | 302.64 | 1035.01 |

| Expenditure | 542.19 | 1796.71 | 941.91 |

| EBITDA | -431.71 | -1334.03 | 11.46 |

| Net Profit | -428.03 | -1332.22 | 19.98 |

The Strengths and Weaknesses of Mamaearth Company

Strengths

- Mamaearth was the most searched Beauty and Personal Care Brand from January 2020 to November 2022.

- The contribution of sales from new SKUs to revenue has increased over the years from 39.75% in FY 21 to 42.17 in FY 22.

- It has brand-building capabilities with expertise in its existing domain and those it wishes to expand into.

- Customer-centric product innovation and House of Brands strategy

- High focus on the Beauty and Personal care category.

Risks

- Failing to identify and effectively respond to changing consumer preferences and spending patterns or changing beauty and personal care trends on time could affect product demand, hurting the business performance.

- Not maintaining brands and their reputation could also affect the business. High marketing spends at ~40% of revenue.

- High Product concentration – The top 10 products contribute 30% of revenue, and the top 2 contribute 13%

- Rapidly scaling offline channel presence.

- Competition with new brands and existing players entering similar categories

The Objective of Mamaearth IPO

Mamaearth IPO is envisaged to bring in a pool of funds to acquire new customers, increase the share of repeat orders, and cross-sell new products to existing customers. Mamaearth proposes to utilize the Mamaearth IPO funds towards the following objectives-

| Purpose | Estimated Amount (in crores) |

| Advertisement to increase Brand visibility | 186 |

| Capital Expenditure toward setting up new Exclusive Brand Outlets (EBOs) | 34.23 |

| Investment in BBlunt to set up new salons | 27.52 |

| Other general purpose and unidentified Inorganic acquisition | Will be determined after finalizing the offer price. |

Should You Buy Mamaearth IPO?

BPC products in India are expected to grow at 12% CAGR to $ 30 million in 2026. Given the potential of this industry, Mamaearth IPO may arouse investor sentiment. Predicting whether the IPO will be successful or not is too difficult. However, you must thoroughly research before you decide.

FAQs

When is Mamaearth IPO expected to be listed on the stock markets?

The Mamaearth listing is expected on the 10th of November, 2023.

What will be the share price of Mamaearth IPO?

The price band for the IPO is ₹308 to ₹324 per share with lot size of 46 shares each.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.