Mankind Pharma, a company known for its brands Manforce and Prega News, will launch its IPO soon. We have a full review of Mankind Pharma, including what the firm does, the promoters, the company’s financials, and how the company expects to use the money from the public offering. Understanding these facts could help you decide if you should subscribe or pass.

About Mankind Pharma

Mankind Pharma Ltd is a significant player in India’s pharmaceutical industry, coming in fourth for domestic sales and second for sales volume during the 2022 fiscal year. They research, produce, and sell a range of pharmaceuticals and consumer healthcare goods to meet acute and long-term requirements. With a strong emphasis on the local market, the bulk of their income – 97.60% – came from activities in India during the fiscal year 2022, making them one of the most successful firms in this respect among their peers.

Mankind Pharma IPO Details

Mankind Pharma, the biggest pharmaceutical company in India, is planning to launch an initial public offering (IPO) with a 100% offer for sale or book-built issue. The table below contains all the details about the Mankind Pharma IPO.

| Mankind Pharma IPO Details | |

| Mankind IPO Status | Approved |

| Mankind Pharma IPO Date | April 25 - 27 2023 |

| Mankind IPO Size | Rs. 4,326.36 cr |

| Lot Size | 13 shares per lot |

| Mankind IPO Price Band | ₹1026 to ₹1080 per share |

| Issue Type | Book Built Issue |

| Mankind IPO Listing at | BSE & NSE |

| Face Value | Rs. 1/Equity Share |

| Listing Date | May 8 2023 |

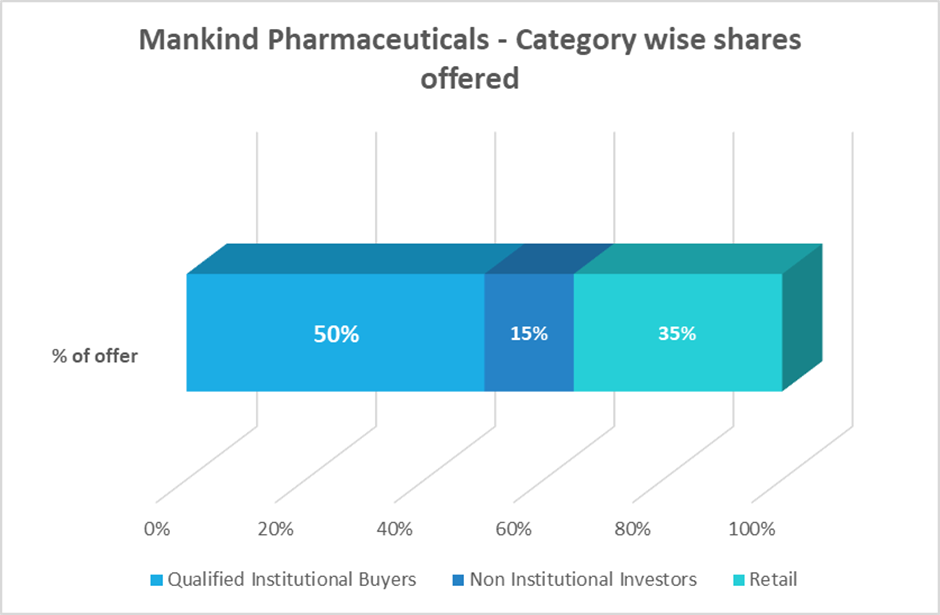

Category-wise Percentage of shares offered.

What is the objective of the Mankind IPO?

The net proceeds from the issue will be used to

• Pay the Selling shareholders their share

• Enjoy the benefits of listing on the Stock Exchanges

Mankind Pharma Business Analysis

Research and development are one of Mankind Pharma primary business sectors. This sector is responsible for researching and developing new pharmaceutical products and enhancing those already on the market. This is an essential business component since it enables them to stay one step ahead of the competition and offer cutting-edge therapies.

Manufacturing is another crucial aspect of business for Mankind Pharma. The company’s medicinal items are produced in this department. The whole manufacturing process is covered, from raw materials to completed goods. Production of both generic and exclusive items is included in this.

Sales and marketing make up Mankind Pharmaceuticals’ third line of operation. The items of the business are promoted and sold in this region. This covers sales, public relations, promotions, and advertising. The marketing and sales team collaborates closely with the research and development team to ensure that the products are efficiently promoted to the appropriate target market.

Furthermore, a distribution network is also present for Mankind Pharmaceuticals. The company’s products are delivered to clients via this department. Hospitals, merchants, and wholesalers are included in this. T dIn addition, this division manages inventory levels, logistics, and shipping for the company’s goods.

Mankind Pharma Primary Products

The business offers a variety of condoms under the Manforce brand. Manforce placed first in the male condom category for domestic sales in the Financial Year 2022, with a market share of around 30.2%.

Prega News is a simple-to-use home pregnancy screening tool that uses urine samples to identify pregnancies. Prega News rated first in the pregnancy test kit category for Domestic Sales in the Financial Year 2022, with a market share of around 80.1% as of March 31, 2022.

Ayurvedic oral antacid powder with many flavors, called Gas-O-Fast, is intended to treat acidity, heartburn, and indigestion symptoms. Gas-O-Fast placed fifth in the molecular category in domestic sales for the Financial Year 2022, with a market share of almost 4.0%.

Unwanted-72 is an emergency contraceptive pill to prevent unwanted pregnancies due to unprotected intercourse or contraceptive failure. To be effective, the medication must be taken within 72 hours following sexual activity.

Unwanted-21 Days, a birth control tablet, is part of this contraceptive line. As a result, unwanted-72 led the emergency contraception market in domestic sales for the Financial Year 2022, with a market share of almost 59.2%.

AcneStar is a clindamycin, nicotinamide-containing anti-inflammatory and anti-bacterial gel used to treat acne. With a market share of around 13.2% in the category of acne preparations for the Financial Year 2022, AcneStar placed second in domestic sales.

The prescription market includes products for high blood pressure (Amlokind), antibiotics (Moxikind-CV), vitamins (Nurokind), and other products.

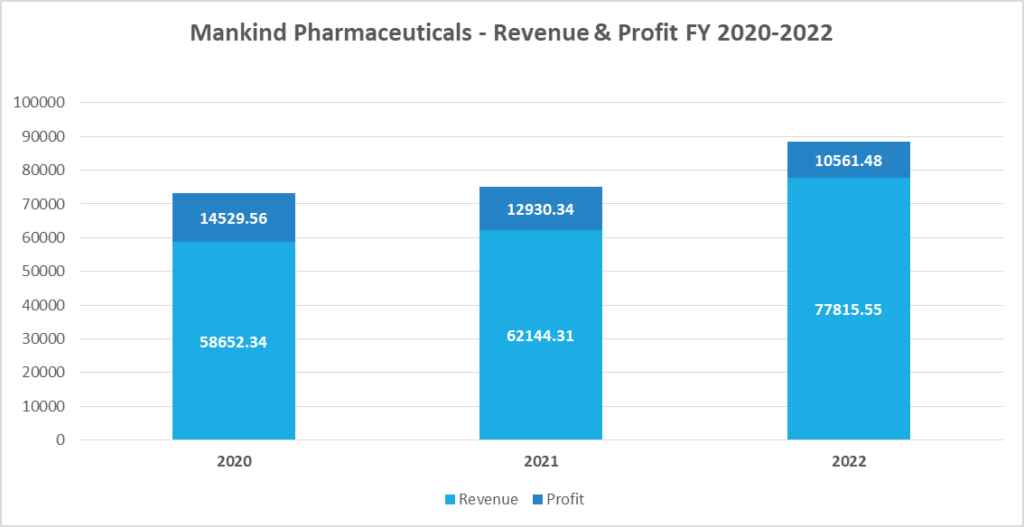

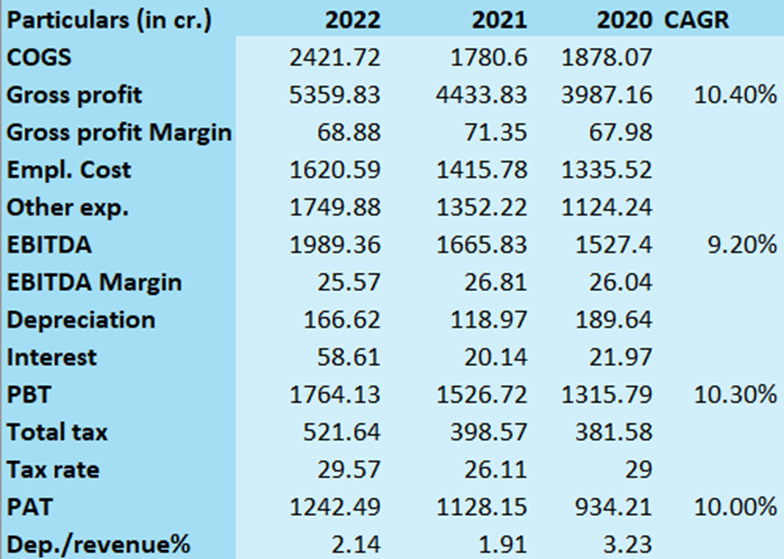

Financial Health – Mankind Pharma IPO

Mankind Pharma Ltd is a domestic-focused pharmaceutical company with significant growth potential. The company’s market share in the Indian pharmaceutical market (IPM) increased by 0.4% between 2020 and 2022, from 4.0% to 4.4%, making it the fastest-growing among the top 10 corporates in the IPM by Domestic Sales.

The Government of India has implemented Production Linked Incentive (PLI) schemes to promote domestic manufacturing of critical key starting materials, drug intermediates, and APIs, which will help to reduce India’s dependence on imports and support the growth of domestic-focused businesses like Mankind Pharma.

Domestic Sales for Mankind Pharma grew at a CAGR of 16% between 2020 and 2022, outperforming the overall IPM growth in domestic sales by 1.5 times. As a result, they aim to continue increasing their presence in the IPM and have a market presence of approximately 64% of the IPM in terms of Domestic Sales for 2022.

Additionally, Mankind Pharma has established several consumer healthcare brands in various categories, such as condoms, pregnancy detection, emergency contraceptives, antacid powders, vitamin and mineral supplements, and anti-acne preparations.

Mankind IPO -The threats

- Quality control or manufacturing issues may harm the company’s reputation, lead to regulatory action, and result in litigation or other liabilities.

- The pharmaceutical and consumer healthcare industries are highly competitive. Therefore, if the company cannot compete effectively, it could lose market share and see a decline in revenues and profits, negatively impacting its business.

- Damage to the company’s brands, product image, or reputation could negatively impact market recognition and trust in its products.

- Identical products in the market could damage the reputation of the brand.

- Disruptions, slowdowns, or shutdowns in the manufacturing or R&D operations could harm the company’s business, financial condition, cash flows, and results of operations.

Should You Subscribe to Mankind Pharma IPO or Not?

IPO investments are subject to market risk research. Please study the company and understand your risk tolerance before investing.

Final Words

In conclusion, Mankind Pharma Limited is a domestic-focused pharmaceutical company with significant growth potential in the Indian Pharmaceutical market as of 2022. The company has several consumer healthcare brands in different categories and is planning to go public by issuing shares to the public through an Initial Public Offering (IPO).

However, like any other investment, there are risks involved, such as intense competition in the pharmaceutical industry, issues with quality control, potential damage to the company’s reputation and brands, and disruptions in manufacturing or R&D operations. It is essential to conduct thorough research and consider these risks before investing in an IPO.

Disclaimer: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

Has Mankind Pharma been publicly traded?

Mankind Pharma will be listed on both the NSE and the BSE.

When is Mankind Pharma IPO going to happen?

The IPO will begin on the 25th and end on the 27th of April 2023.

What is the Mankind IPO’s minimum order quantity?

The minimum lot size is 13 shares for the IPO, and the minimum investment is Rs. 13,338

What is the issue size of the Mankind Pharma IPO?

The IPO is an OFS (offer for sale) of 40.06 million shares with a face value of Rs. 1 per share, totalling to Rs. 4326.36cr.

Who is the registrar of Mankind Pharma IPO?

KFin Technologies Ltd. is the registrar for Mankind Pharma.

What is the price band of the Mankind Pharma IPO?

The price band of the IPO is ₹1026 to ₹1080 per share

What is the allotment date for Mankind Pharma?

The 3rd of May is the allotment date for Mankind IPO

How to apply to the Mankind Pharma IPO?

To apply for the IPO, follow the steps given below

Login to your Demat account and select the issue under the IPO section

Enter the number of lots and price at which you wish to apply for

Enter your UPI ID and click on submit. With this, your bid will be placed with the exchange

You will receive a mandate notification to block funds in your UPI app

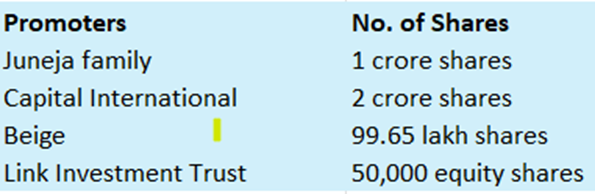

Who are the promoters of Mankind Pharma IPO?

Ramesh Juneja, Rajeev Juneja, Sheetal Arora, Ramesh Juneja Family Trust, Rajeev Juneja Family Trust, and Prem Sheetal Family Trust are promoting the Mankind Pharma IPO.

What is the objective of the Mankind IPO?

The net proceeds from the issue will be used to

• Pay the Selling shareholders their share

• Get the benefits of listing on the Stock Exchanges

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 40

No votes so far! Be the first to rate this post.