“India is on a 50-year rally.” Since early 2022, seasoned investor Mark Mobius has placed his hopes in the Indian market. Mobius mentioned this in an interview with Bloomberg Television.

Mark Mobius, an investor in emerging markets, told Bloomberg that he is placing significant bets on the Indian market to remedy the declining returns from his Chinese market investments.

Bloomberg reports that the Mobius Emerging Markets Fund allocated 45% of its portfolio to India and Taiwan, with primary market holdings in technology hardware and software. In addition, Mobius has a stake in Persistent Systems, an Indian technology firm, which accounted for 4.2% of the fund at the end of July 2022.

Economic Overview

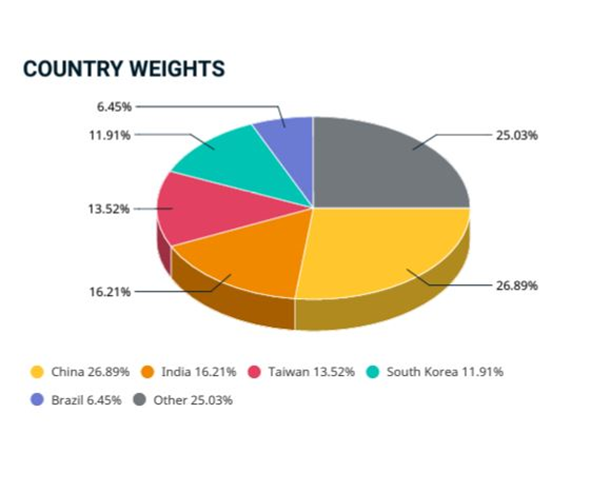

China accounts for 26.89% of the MSCI Emerging Markets Index, making it the most significant country weight. India accounts for 16.21% of the total. India is now in second place, just behind China.

According to Mark Mobius in a conversation with CNBC, the Chinese index is falling as President Xi Jinping secured a third term at the 20th Communist Congress and installed several loyalists on a critical leadership committee. As a result, it will shift more toward a Maoist economy.

This has raised concerns that PM Xi will wield even more power over China’s economy, which has slowed significantly due to lockdown restrictions and his “common prosperity” agenda.

Mark Mobius also noted that China is still recovering from lockdown restrictions, which has led the International Monetary Fund to forecast only a 3.2% increase in the country’s GDP this year. It could cause problems for its markets, especially since the government has withheld vital economic data and delayed other metrics, such as GDP figures. In contrast, India disclosed its GDP growth rate at 8.7% as of FY22.

That’s not a promising sign! But, as Mark Mobius reminded all, that indicates something is boiling beneath the surface of the Chinese market and won’t be good.

“In India, however, the opposite is true. The government is further opening up the market, welcoming foreign investors, and incentivizing people to enter. As a result, we are witnessing a massive change in the world as India and China, the world’s two most populous countries, move into a historical shift towards India.” says Mark Mobius.

Mark Mobius said, “India is possibly where China was a decade ago.” The Indian stock market has recently been on a roll. It will have a positive impact on the Indian Market Index.

Mobius highlighted earnings are closely linked to GDP. Many individual Indian company valuations are still “reasonable” based on forward-looking price-to-earnings and return-on-capital ratios.

Mark believed some Chinese companies would succeed only if they used a selective approach. In the current climate, active management is crucial. He believes investors must not bet on the Chinese index and expect it to succeed; it may not.”

The US-China Technology War Is Heating Up

It is a significant trend occurring for apparent reasons. First, China could face increasing limitations due to the technological competition between the U.S. and China. The COVID lockdown in China is damaging the country’s manufacturers. Therefore, Mobius believes there are many reasons why manufacturers of technological goods will turn their attention to India.

India Can Deal With Its Trade Deficit

Increased local manufacturing in India is needed to address the significant trade deficit with China. India has a demographic advantage over smaller competitors due to its size, making it capable of doing so. And having domestic manufacturing in India is the best way to achieve that. Nations with smaller populations, such as Vietnam, Thailand, and other smaller countries, may find it challenging to increase local manufacturing.

Still, with a billion people, competitive wages, and a young population, India can boost manufacturing and significantly reduce Chinese imports. He believes that because the supply chain still requires imports from China and other countries, the Indian government must not consider accomplishing its goals through input restrictions like higher import taxes.

What the Indian government should do is encourage local manufacturers so that many of the products now imported from China can be manufactured in India at a lower cost.

The long-term strategy for manufacturing companies should be to relocate to India.

Given that it costs a lot of money to establish manufacturing facilities in a nation, Mobius predicted that this manufacturing shift to India would likely last for a long time. But he added that it would mean businesses assume the environment for investments would remain favorable for the long term. Moreover, India’s infrastructure is good, and the government has friendly regulations; manufacturing will stay once it relocates to India.

Additionally, given that foreign investors have continued to pull their money out of Chinese markets, the investor anticipates that India will likely overtake China in manufacturing stocks.

Indian aspirations to become a global hub are being fueled by the booming manufacturing sector.

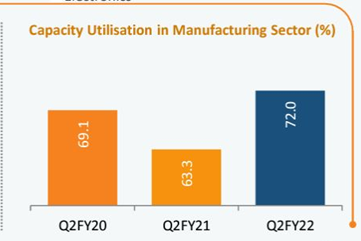

According to the FICCI Quarterly Manufacturing Survey findings, the manufacturing sector’s recent rapid expansion is expected to continue for 6 to 9 months. In addition, manufacturing currently has an average capacity utilization of 72%, which indicates sustained economic activity in the industry.

According to IBEF reports, India can develop into a central manufacturing hub and by 2030 it could contribute more than US$ 500 billion annually to the world economy. According to preliminary estimates of the gross domestic product for the first quarter of 2021–2022, India’s GDP, expressed in current prices, was Rs. 51.23 lakh crore (US$ 694.93 billion) in the first quarter of FY22.

The third quarter of FY22 saw an estimated manufacturing Gross Value Added at current prices of US$ 77.47 billion, according to an IBEF report. In June 2022, the production of coal increased by 31.1%, that of electricity by 15.5%, goods from refineries by 15.1%, fertilizers by 8.2%, cement by 19.4%, and natural gas by 1.2%. Purchasing Managers’ Index (PMI) for Manufacturing in India was 53.9 in June 2022.

The Production-Linked Incentive (PLI) was established with an allocation of Rs. 1.97 lakh crore (US$ 27.02 billion) over the following five years to create global manufacturing champions in 13 sectors beginning FY22.

India’s Government Is Acting Quickly

The progress is patchy because of the federal nature of the country’s political system. Still, Mobius felt the center was moving quickly to increase the ease of business in India. For instance, he suggested speeding up the paperwork so that licenses could be granted more quickly.

The speeding up of processes depends on each state in India. A few state governments in India have done a great job attracting investors. Mobius emphasized that India must prioritize manufacturing from a broad policy perspective even as its services sector experiences robust growth.

As noted in IBEF reports, India’s manufacturing sector has the potential to reach $1 trillion by 2025. Implementing the Goods and Services Tax (GST) has turned India into a common market with a GDP of US$ 2.5 trillion and a population of 1.32 billion, which is enticing investors. In addition, the government has plans to focus on developing industrial corridors and smart cities to ensure the nation’s holistic development.

Indian Governments Initiatives to boost manufacturing industry

Mr. Narendra Modi, the PM of India, launched his “Make in India” campaign not long after taking office in 2014 to make India a global manufacturing center. The campaign aims to ensure the manufacturing sector accounts for 25% of the economy, up from 15% in 2014.

The manufacturing sector has received significant investment

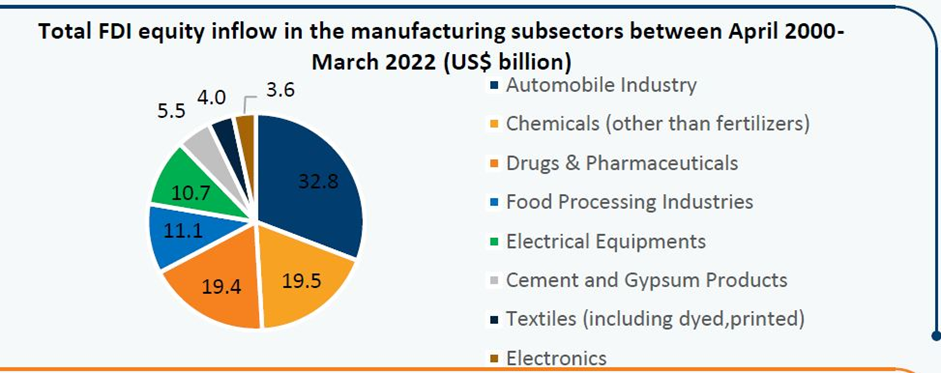

India received a total inflow of US$ 58.77 billion in foreign direct investment (FDI) in FY2021-2022, according to the Department for Promotion of Industry and Internal Trade (DPIIT). For almost two decades, the major industries which received FDI equity inflow are the automobile industry at 32.8%, the chemical industry at 19.5%, and pharma at 19.4%.

The National Manufacturing Policy wants manufacturing to account for 25% of the GDP by 2025. The Union Budget 2022–23 set aside Rs. 2,403 crores (about U.S. $315 million) to promote the production of electronics and IT hardware. The Production-Linked Incentives (PLI) for semiconductor manufacturing are set at Rs. 760 billion (US$ 9.71 billion) to make India one of the world’s major producers of this essential component.

Final Words

Investors should exercise caution when investing Chinese market, Mark Mobius advised. The Indian government has recognized the manufacturing industry’s potential growth and provided incentives and support to change the manufacturing industry.

At the same time, he highlights India’s potential to revolutionize hardware technology and provides a bullish perspective on the Indian market. Remember that due diligence before investing is crucial if you want to invest in China or India. So, thoroughly study the market, the company, its moats, challenges, and future prospects before investing. Long-term investments can help you create wealth.

FAQs

What is the historical gap between the Indian and Chinese Markets?

The $5 trillion collapse in the Chinese market widens the historical gap between Indian stock markets.

Which company relocated its manufacturing facility from China to India earlier in 2022?

Apple Inc. began shifting production from China to India after a flawless production rollout.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.