On September 5, 2022, Navi Technologies received SEBI approval for ₹3,350 crore IPO. Founded in 2018, Sachin Bansal’s Navi Technologies has become a major FinTech player in India, offering personal loans, mutual funds, health insurance, and other services.

In this article, we will go over Navi Technologies IPO in-depth and see if there is a compelling reason to subscribe.

Navi Technologies IPO Details

Navi Technologies filed its IPO application or draft red herring prospectus on March 14, 2022, proposing to raise ₹3,350 crores through fresh issuance of equity shares to investors. The company may also consider a pre-IPO allotment of equity shares worth ₹670 crores, according to the draft paper, reducing the total size of the IPO to ₹2,680 crores.

The company has not decided on the IPO launch and distribution of its IPO among different investors category.

| IPO Status | Not Announced |

| IPO Date | Not Announced |

| Total IPO Size | ₹3,350 crores |

| No. of shares of IPO | Not Announced |

| Issue Type | Book Built |

| Issue Price Band | Not Announced |

| IPO listing at | NSE & BSE |

| Face Value | ₹100 |

What Does Navi Technologies Do?

Navi Technologies was incorporated in 2018 in Bengaluru by former Flipkart chairman Sachin Bansal and Ankit Agarwal to provide online financial and investment services to Indian users.

Sachin Bansal is a famous Indian entrepreneur and is known as the co-founder of the e-commerce major Flipkart. He exited the e-commerce platform in 2018 by selling his stake to retail giant Walmart. He is the largest shareholder in Navi Technologies with a 97.77% stake.

Ankit Agarwal is a successful banker with over 10 years of experience in Bank of America and Deutsche Bank and is an IIM and IIT alumni. His holding in the company is 0.98%. To date, the founders have infused over ₹4,000 crores of equity capital in the company.

Navi operates through its two subsidiaries, Navi Finserv Pvt. Ltd and Navi General Insurance Ltd. It has presented itself as a technology-first direct-to-consumer company to grab the opportunities in India’s highly underpenetrated financial services market. It uses artificial intelligence and machine learning (AI/ML) based underwriting processes for its lending products and offers a smooth experience to customers.

Navi uses data analytics to write its lending algorithm to offer better pricing and loan management, giving it an edge in digital and on-field collections. To date, the company disbursed over ₹11,725 crores of loan amount and sold more than 68,000 health insurance policies to millions of its user base.

Watch out for Upcoming IPOs.

How Is Navi Technologies Transforming The Financial Services Sector?

Through its app, Navi Technologies has built a one-stop solution for users to access financial services needs, be it lending, investments, or insurance. By using digital technology, the company is reducing friction points. For instance, the company can do new customer signup in less than 4.5 minutes in the personal loan segment and under 2.5 minutes in the health insurance segment.

As of December 2021, almost 62% of the health insurance products sold on the Navi app were approved without human assistance. Also, Navi allows users to pay health insurance premiums through EMIs, making it affordable for general users.

Navi Technologies Acquisitions

Navi acquired Chaitanya India Fin Credit for ₹739 crores in 2019 to enter the microfinance segment. And in February 2020, it acquired erstwhile DHFL General Insurance Limited for an undisclosed sum.

Navi applied for a universal banking license in 2022 with the Reserve Bank of India, but its application was rejected. It would have allowed Navi to accept customer deposits and use funds for lending purposes.

Navi Technologies Financials

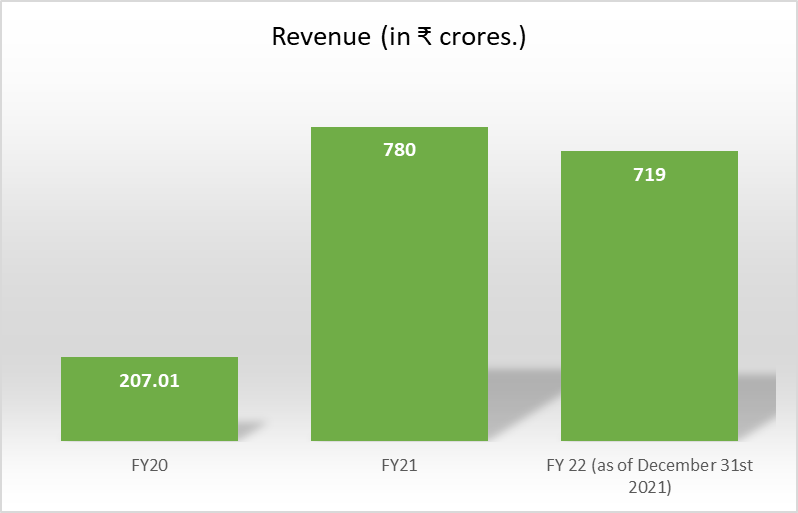

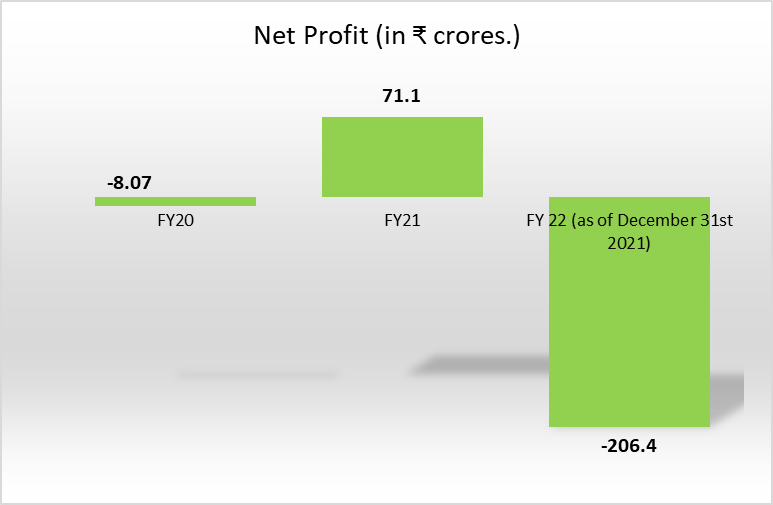

In FY21, the company’s group revenue was ₹780 crores. Navi Technologies reported a profit of ₹71.1 crores. And in the first nine months of FY22, the company reported a revenue of ₹719 crores but reported a loss of ₹206.4 crores. Check out the table below for a more detailed view of the financials.

| Particulars | FY19 (10th December 2018 to 31st March 2019) | FY20 | FY21 | FY22 (as of December 31st, 2021) |

| Revenue (in crores) | ₹16.9 | ₹207 | ₹780 | ₹719.37 |

| Net Profit (in crores) | ₹2.69 | (₹8.07) | ₹71.1 | (₹206.4) |

| EBITDA (in crores) | ₹4.56 | (₹47.7) | ₹234.2 | (₹77.8) |

| Net NPA | – | – | 0.89% | 0.98% |

| Adjusted EPS | ₹7.31 | (₹2.09) | ₹2.47 | (₹7.16) |

Segment-wise Revenue Breakup

| Segment | FY20 (in cr.) | FY21 (in cr.) | FY22 (as of December 31, 2021) (in cr.) |

| Insurance | ₹18.2 | ₹137.04 | ₹97.5 |

| Personal, Housing, and other loans | ₹40.12 | ₹336.68 | ₹316.2 |

| Microfinance | ₹89.6 | ₹233.65 | ₹233.9 |

| Mutual Funds | – | ₹5.74 | ₹5.77 |

| Others | ₹63.29 | ₹86.93 | ₹92.2 |

What Will Navi Technologies Do With IPO Money?

According to the DRHP filed with SEBI, Navi Technologies aims to invest ₹2,370 crores of the IPO money in Navi Finserv Limited (NFL), ₹1,50 crores in Navi General Insurance Limited (NGIL), and the remaining sum will be utilized in general corporate purposes.

Explore our Current IPOs

Should You Subscribe to Navi Technologies IPO?

In the financial services space, India is a highly underserved market with enormous growth opportunities for FinTech companies like Navi Technologies, which are expanding their user base by leveraging India’s high smartphone penetration, high-speed internet usage, and use of AI and ML technologies.

Some of the things that are working for Navi Technologies are:

- The mobile-first approach enables Navi to reach customers directly and achieve the shortest turnaround time (TAT) for retail health insurance policy issuance and lending.

- Full in-house technology stack with AI & ML technologies resulting in innovation and efficient product management and delivery.

- Better cross-selling and up-selling of products. During the nine months ending December 31, 2021, it served over 481000 customers extending Rs. 0.2 crores to them. The retail health insurance segment accounted for ₹. 6.32 crores from the total Gross Written Premium of ₹. 66.77 crores during the same period ending December 31, 2021.

Some of the risks are:

- Multiple FinTech players like Paytm and Policybazaar target the same user segment, which can erode Navi’s market share and impact the bottom line.

- Faces direct competition from established players like Bajaj Finance and other small finance banks.

- Have to continuously invest in technology and improve data science capabilities to make Navi more agile and scalable.

- Higher borrowing costs make Navi less competitive against traditional players with banking licenses who can accept deposits from the public.

Despite the risks, Navi Technologies has strengthened its footprint across India in a very short period. In the 21 months since its inception, Navi’s personal loan business has served customers in over 84% of India’s pin codes, with an average loan ticket size of ₹ 50,990. It shows the strong execution capabilities of the company, where banks and informal lenders dominate.

Looking at the digital lending market in India, it is expected to grow to $1.3 trillion by 2030, up from $270 billion in 2022, at a CAGR of 22%, as per Inc42’s latest report ‘State Of Indian Fintech Ecosystem Q3 2022. Furthermore, other financial products on the Navi app are expected to grow rapidly due to improved cross-selling and increased awareness of the importance of purchasing health insurance and investing.

At first glance, Navi Technologies appears to be a fundamentally strong company with strong growth potential. Still, we must be cautious with IPO investments because a lot of information and disclosures come after the shares are listed.

Explore our Listed IPOs

Disclaimer Note: The stocks and financials mentioned in this article are for education purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any are for illustration only and are not recommendatory.

FAQs

Who founded Navi Technologies?

Navi Technologies was founded by a famous Indian entrepreneur and former founder of Flipkart, Sachin Bansal, in 2018. Pre-IPO Sachin Bansal holds a 97.77% stake in the company.

When Navi Technologies IPO is coming?

Navi Technologies’ ₹3,350 crores IPO got SEBI approval on September 5, 2022, and is expected to launch soon.

Is Navi Technologies a profitable company?

As a recently incorporated company, Navi Technologies has been gyrating between making profits and losses in the past. In FY22, revenue rose to ₹1,061 crores from ₹780 crores in the previous year, but the company reported an overall loss of ₹362 crores on investments made for future business growth.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 10

No votes so far! Be the first to rate this post.