If banks or other NBFCs reject your loan applications due to poor credit scores, then P2P lending may help. Many borrowers unintentionally spoil their credit scores. It could be anything from missed EMIs or credit card bills due to sudden job loss to the discovery of a chronic illness in the family. Not paying on time affects your credit scores, which can hamper loan approvals.

The culture of lending in India dates back to the Vedic periods. People borrow money from financial institutions, friends, and relatives to meet business or personal needs. These loans are based on trust or any collateral security. Lengthy paper requirements, complex credit evaluations, and long turnaround times have hampered potential borrowers. It gave rise to the need for quick and straightforward lending processes such as P2P lending.

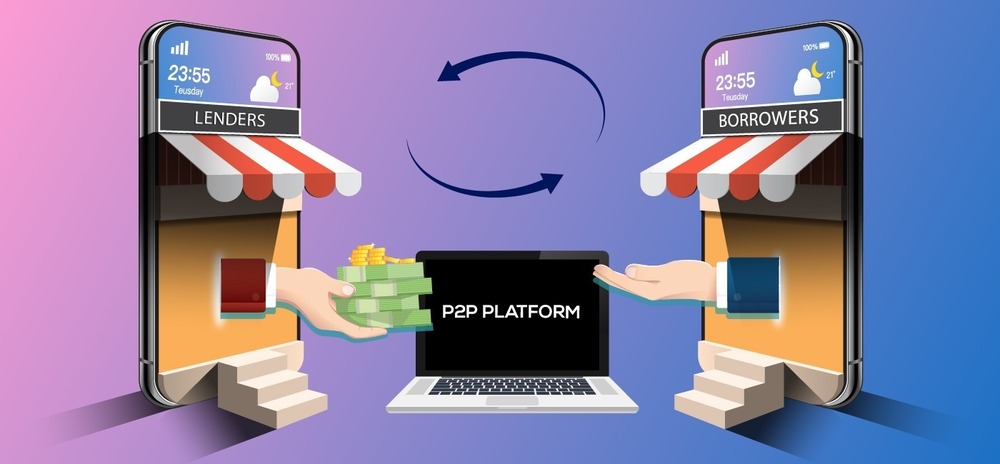

Peer to Peer (or P2P) lending is a cutting-edge digital platform that connects a verified borrower with a suitable investor looking for a good return. Here, no Bank works as a financial intermediary. Instead, the connecting platform is itself the intermediary. As a result, you may be required to pay an origination fee as a percentage of the loan amount, which varies by lender.

In this article, we will learn about the dynamics of the P2P lending industry and how it operates.

What is Peer to Peer (P2P) lending?

When you require a loan for your business, to fund your education, or for debt financing, you typically seek financial assistance from any bank or financial institution. The possibility exists that you may not meet the high eligibility standards for a variety of reasons. However, this does not negate your need for funds.

Your friends and family are your next potential lenders. There may not always be an overwhelming response because they will only invest in your business if they are confident that they will be repaid on time. Here comes into play the concept of P2P lending.

Borrowers who use the P2P lending mechanism gain access to a platform where they can market their business proposition and find interested investors. The process is carried out using user-friendly web-based applications. As a result, borrowers pay interest premiums, while investors earn high investment returns.

How does Peer-to-Peer (P2P) lending Work?

To avail of a P2P lending facility, you must open an account on the website or online application and register as a borrower. Similarly, the investors make an account and register themselves as a lender. Let us analyze the P2P lending process from both the borrower’s and lender’s perspectives-

For Borrowers

When the borrower creates his profile in the application, he is subjected to a soft credit pull. Next, the borrower inputs his P2P lending required, tenure, and desired interest rate. Next, the website employs technology and Machine Learning tools to assess loan eligibility based on social, financial, personal, and professional factors. Finally, the loan grade and risk grade are assigned to the borrower.

For Lenders/Investors

When the lender creates his profile in the application, he enters information such as the loan amount to be covered (both separately and cumulatively), the interest rate on offer, and the expected borrower’s profile. You can also diversify your risk by investing in loans with varying risk levels and P2P lending platforms.

Once the Borrower and Lender have mutually agreed on the above P2P lending parameters, the amounts from the investor’s Escrow accounts are transferred to the Borrower’s Escrow account. The loan amount is then transferred to the borrower’s bank account.

What Are RBI’s Prudential Norms Regarding NBFC facilitating P2P lending?

To safeguard the interests of both Borrowers and Investors, RBI has issued specific guidelines for compliance by P2P lending NBFCs –

- Mandatory disclosure of certain information on the website of the lending NBFCs. Such as investor details, requirements, loan tenure, interest rates, pre-closure charges, other loan processing charges, etc.

- Proper Business Continuity Plans in the event of the NBFC’s untimely closure/winding up.

- The P2P lending platform must submit quarterly reports detailing the number of loans sanctioned and closed, the Escrow balance, complaints received, and the leverage ratio.

- To ensure proper loan agreement execution.

- The maximum loan amount that can be outstanding for any Borrower at any given time is Rs. 10 Lacs.

- A lender’s maximum lending across all P2P lending platforms is Rs. 50 Lacs, with a maximum lending limit of Rs. 50,000 for an individual borrower.

- The maximum repayment period is 36 months.

- A Peer-to-Peer lending platform can maintain a maximum leverage ratio of 2.

- Tax Norms on P2P lending in India

When you invest in traditional instruments like FDs, you are liable to pay tax on the interest earned. Even in P2P lending, you earn interest on your invested amount. Income Tax classifies the interest income earned in P2P lending as “Income from Other Sources” and so gets added to your total taxable income.

You are liable to pay tax according to the income tax bracket applicable to your income. Let us say you fall under the 20 % tax bracket, and you earned Rs. 1 Lac from P2P lending. But you are charging 10 % interest(Rs. 10 K). So, your tax liability comes to Rs. 2000.

But your post-tax returns on investment in the above case will come down to 8%.

Key Takeaways

Traditional investment vehicles only provide a maximum post-tax return of 4-5%. So you have a decent chance of earning a solid return, even 12-15%, which sounds quite appealing. However, P2P lending returns are riskier investments than equity investing.

P2P lending in India is still in its infancy. You can significantly reduce your risk by diversifying your investment across multiple platforms. You can earn monthly interest and even reinvest your earnings to take advantage of the magical power of compounding.

FAQs

Should You Consider Investing in P2P Lending in India?

In Peer-to-peer lending, you do not have market risks like Equity or Mutual Funds, but you have Credit Risk. Therefore, before taking a final call, you must consider risk appetite and the Probability of default.

Will the loan availed under P2P affect my credit score?

Yes, any delay or default in repayment of P2P loans hurts your credit score and reflects in your CIBIL.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 1

No votes so far! Be the first to rate this post.