Introduction

PhonePe has a significant percentage of UPI transactions in India. Ever since demonetization, usage of UPI has increased significantly in India. Transactions on the UPI platform hit a new high of 890 Crore in April 2023. These transactions’ value was at a record high of Rs. 14.07 lac crores.

PhonePe is not listed but is valued at almost double its listed peer Paytm. It has created the largest distribution network through which it intends to sell multiple financial products and eventually become profitable.

Let us try to understand PhonePe in more detail in this article.

Phonepe Overview

It is a digital payments platform in India that lets users make seamless and secure transactions through their mobile phones. Sameer Nigam, Rahul Chari, and Burzin Engineer founded the company in December 2015.

With over 300 million registered users and 50 million monthly active users, PhonePe is one of India’s largest digital payment platforms. It is at the forefront in processing most UPI transactions and has processed 46.71% or 351.9 Cr UPI transactions in February 2023, amounting to INR 6.2 Lakh Cr during the period under review. In terms of percentage, it accounted for 50.18% of the value of UPI transactions.

The platform showcases financial services and has licenses for Account Aggregator, broking, and distribution of insurance products. It has partnered with merchants to help its users make utility payments, recharges, etc. In addition, it allows investments in mutual funds (equity, debt, liquid, etc.) and gold with tie-ups for life/ general insurers such as ICICI Pru Life, ICICI Lombard, Bajaj Allianz, Reliance General, etc., to offer insurance coverage.

The company launched the PhonePe ATM in 2020, allowing neighborhood Kirana stores to dispense cash in real time to customers. It also launched a cross-border payments service to tap international customers, allowing users to pay foreign merchants using UPI. The feature is available in UAE, Singapore, Mauritius, Nepal, and Bhutan.

In December 2020, Flipkart and PhonePe declared a partial split, with Walmart maintaining its majority ownership in the company and the two entities now functioning independently. It also became an India-domiciled company after its hive-off from Flipkart. The company paid INR 8,000 Cr in taxes as it shifted from Singapore to India.

It recently announced fundraising of ~INR 2,900 Cr (USD 350 million) from General Atlantic, an US growth equity firm, at a pre-money valuation of $12 billion. Subsequently, another ~INR 830 Cr (USD 100 million) was attained in primary capital in February 2023 from Ribbit Capital, Tiger Global, and TVS Capital Funds at the same valuation. The company plans to launch its IPO and go public during 2024-2025.

Phonepe Journey

2015:

December: Founded by Sameer Nigam, Rahul Chari, and Burzin Engineer as a mobile payments app in Bengaluru, India.

2016:

April: Launches its UPI (Unified Payments Interface) platform, allowing users to make seamless mobile phone payments.

August: Partners with Yes Bank as its UPI partner, enabling users to link their bank accounts for transactions.

2017:

January: Flipkart, one of India’s leading e-commerce companies, acquires PhonePe.

August: It becomes the first payment app to launch a cashback feature on UPI transactions.

2018:

January: Introduces its Switch platform, offering customers access to various third-party apps and services within the app.

May: The company becomes the first UPI-based app to cross 100 million downloads on the Google Play Store.

2019:

January: Raises $125 million in funding led by Walmart, valuing the company at $1 billion.

September: Launches its IPO (Initial Public Offering) platform, allowing users to invest in mutual funds directly through the app.

2020:

May: Partners with ICICI Bank to launch a digital ATM feature, allowing users to withdraw cash from their bank accounts using UPI.

December: Crosses 250 million registered users and processes over 835 million transactions monthly.

2021:

March: Becomes the first payment app in India to enable UPI-based car and bike insurance premium payments.

June: It expands its international footprint by launching in Nepal, offering digital payment services to Nepalese users.

2022:

February: Introduces “PhonePe Stock Trading” with IndusStox, allowing users to invest directly in stocks and mutual funds from the app.

October: Launches PhonePe Tax Assistant, an AI-based tax-filing feature, to help users file their income tax returns.

December: Shifts its domicile from Singapore to India

2023:

January: Announces raising USD 1 billion in tranches at a pre-money valuation of USD 12 billion from General Atlantic, Walmart, and other investors.

Phonepe Management Profile

Mr. Sameer Nigam is the CEO of PhonePe. He co-founded the company in December 2015 and has played a pivotal role in shaping the company’s vision and strategy. Nigam has extensive experience in the technology and finance sectors, having previously worked at companies like Flipkart, Google, and Amazon.

Mr. Rahul Chari is another co-founder and the Chief Technology Officer. He is responsible for overseeing the technical aspects of the platform and driving innovation. Chari has a background in software engineering and has previously worked at companies like Flipkart, Yahoo, and Symantec.

Mr. Adarsh Nahata is the CFO of Phonepe. He started his career at ITC Ltd. as a Finance Controller and then worked his way up the corporate ladder at Flipkart, becoming a Director in 5 short years. He was Head of Finance at Phonpe before becoming the CFO in June 2021.

Ms. Manmeet Sandhu heads the HR at PhonePe Pvt Ltd. She joined in December 2018 after nine years at Amazon. She has worked in HR for the last 20 years across multiple countries and in compensation, diversity & inclusion, and business partners. Manmeet holds a Bachelor’s degree in Commerce and an MBA in HR from Xavier Institute of Management, Bhubaneswar.

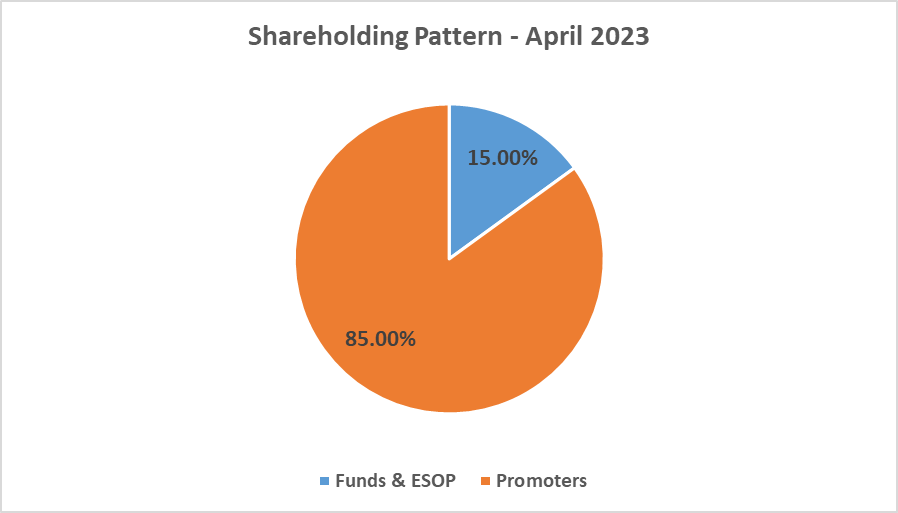

Phonepe Shareholding Pattern

Following is the shareholding of PhonePe as of April 2023.

Phonepe Business Segments

PhonePe makes 99% of its total operating income through processing payment transactions. The remaining 1% comes from commission, processing fees, and other operating income. Going forward, however, PhonePe is looking to grow on the back of significant growth from selling financial products

Revenue breakup is as follows for years FY21 and FY22.

| Business segment | FY21 Revenue (Rs. Cr) | FY22 Revenue (Rs. Cr) |

| Payments and allied services | 686 | 1,630 |

| Commission & Processing fees | 3.78 | 13.61 |

| Other Operating revenue | – | 2.50 |

| Total | 690 | 1,646 |

Phonepe Fundamental Analysis

PhonePe dominates India’s UPI market with a 50.1% market share (as of March 2023). The other two players are Google Pay and Paytm, with a 34.2% and 10.8% market share, respectively.

PhonePe has recorded INR 1,913 crore in revenue in nine months (January to September) of 2022, according to its valuation report through a regulatory filing. It also seems to be on the way to narrowing its losses in FY23 as the firm’s earnings before interest and tax (EBIT) skid to INR -410.4 crore in the same nine-month period, whereas the figure for the same stood at INR -2,061.4 crore during FY22.

Values in Rs. Cr.

| Particulars | FY20 | FY21 | FY22 | 30-Sep-2022 (Jan – Sep 2022) |

| Revenue | 371.8 | 689.6 | 1,646.3 | 1,912.9 |

| Direct Cost | (150.2) | (108.0) | (199.2) | (336.3) |

| Gross Profit | 221.6 | 581.6 | 1447.1 | 1576.6 |

| Gross Profit as % of Revenue | 59.6% | 84.3% | 87.9% | 82.4% |

| Marketing, Referral & Cashback | (1,016.6) | (535.0) | (866.2) | (513.0) |

| Payroll | (480.3) | (1,235.4) | (1,741.0) | (809.4) |

| Other Opex | (468.0) | (442.5) | (697.0) | (458.1) |

| EBITDA | (1743.2) | (1631.2) | (1857.2) | (203.9) |

| EBITDA % | -468.9% | -236.5% | -112.8% | -10.7% |

| Depreciation | (87.0) | (134.2) | (204.2) | (206.5) |

| EBIT | (1,830.2) | (1,765.4) | (2,061.4) | (410.4) |

| EBIT % | -492.3% | -256.0% | -125.2% | -21.5% |

Return ratios like ROE (Return on Equity) and ROCE (Return on Capital Employed) are negative for the company because of negative profitability. However, However, PhonePe has managed to reduce losses significantly over time. As a result, Ebitda has improved from – Rs. 1743.2 cr in FY20 to Rs. 203.9 cr as on 30 Sep 2022.

Phonepe Share Price Analysis

PhonePe is not a listed company, so it is not possible to get the daily share price performance of the company. However, in the most recent funding round, it was valued at USD 12 billion and around USD 5.5 billion in late 2020. Therefore, the company has doubled its valuation in the last two years.

Phonepe Growth Potential

PhonePe seems to be at the forefront of the mobile payments market on UPI, a network built by a coalition of retail banks in India. As a result, UPI has become the most popular way Indians transact online, processing over 8.9 billion monthly transactions. The eight-year-old PhonePe commands about 50% of all these transactions.

Its IPO plans and recent funding round indicate the company’s growth prospects. The Indian digital payments market is expected to grow rapidly in the coming years, driven by the government’s push for a cashless economy, increasing smartphone penetration, and the rise of e-commerce.

PhonePe may be positioned to capitalize on these trends due to its strong brand, extensive user base, and innovative product offerings. In addition, the platform has been expanding its services beyond just payments with the launch of features like PhonePe Switch and PhonePe ATM. These initiatives have helped the platform diversify revenue streams and provide users with a more comprehensive financial services experience.

The company may venture into lending, broking, and asset management as part of its expansion plan. Further, it is looking to invest more in the Insurance business after the recent USD 350 million funding. The company’s goal is to become operationally profitable within the next two years (by 2025) by leveraging the success of its financial businesses.

PhonePe is also looking to launch an Android app store in India. It comes after the company acquired IndusOS, an app store provider. With its massive customer base of over 450 million registered users in India, it sees an opportunity to create an alternate app store more localized in language, discovery, and consumer interests.

Hoping these plans will come through, Management at PhonePe is looking to make an EBITDA profit of INR 1,797 crore in the calendar year 2025, with an EBITDA margin of 19.7 percent.

Key Risks PhonePe May Face:

While PhonePe’s IPO plans may be exciting, the company may face several challenges in the coming years. One of the primary challenges for the platform may be maintaining its market share in the face of increasing competition. The Indian digital payments market is becoming more crowded, with new players like Google Pay and Amazon Pay entering the market.

PhonePe may need to continue innovating and expanding its services to stay ahead of the competition addition. The platform will need to focus on user acquisition and retention, given the high churn rate in the Indian digital payments market. The Indian government has tightened data storage, privacy, and security laws for digital payment platforms, and PhonePe may have to comply with these rules too.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is PhonePe listed in the stock market?

PhonePe is not listed on any Indian stock market exchanges. According to the management, the company is looking to launch its IPO in 2024-2025.

Is PhonePe a profit or loss company?

PhonePe is currently loss-making, but the management believes the company could become profitable by 2025. They expect an EBITDA of INR 1,797 Cr and an EBITDA margin of 19.7% by then.

Who is the largest shareholder of PhonePe?

Walmart has owned owns PhonePe since it acquired Flipkart in 2018.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 6

No votes so far! Be the first to rate this post.