Introduction

If you have ever invested in an NBFC (Non-Bank Finance Company), you would know it is risky. Only a few NBFCs have survived challenging business environments and consistently generated wealth for their shareholders.

The Poonawalla Group is well-known for its COVID vaccine during the pandemic. The group acquired Magma Fincorp in 2021, renaming it Poonawala Fincorp Limited. Poonawalla’s MD recently mentioned that they wanted to become the lender of choice, offering the users the experience and agility of a Fintech, the customer understanding and practical approach like an NBFC, and a Bank’s fair pricing and transparency.

So, let us understand more about this company and see how it has fared over the years.

Poonawalla Fincorp Overview

Poonawalla Fincorp Limited (earlier known as Magma Fincorp) is a tech-driven NBFC focused on consumer and MSME lending. It is a Rising Sun Holding Pvt. Ltd (RSHPL) subsidiary owned and controlled by Mr Adar Poonawalla.

RSHPL invested INR 3,210 Cr for a 61.5% stake in the erstwhile Magma Fincorp Ltd in Feb’21. Magma Fincorp went into business in 1988. The company has a diversified product offering in consumer and MSME finance, including personal loans, loans to professionals, businesses, and consumers, loans against property, used cars, supply chain finance, machinery, and medical equipment loans.

Since the capital infusion, the company has witnessed the following:

- A change in senior management,

- Re-positioning of their product portfolio,

- Improvement in credit rating, and

- Scale up in digital initiatives.

Poonawalla Fincorp has a strong presence in Tier-II and Tier-III cities in India and is focused on “digital” and “technology” to provide a seamless and hassle-free customer experience. The company is moving from an intermediary-driven sourcing model to a direct sourcing model, thus leading to lower customer acquisition costs, reduced TAT, and greater customer delight.

Poonawalla Fincorp Journey

Here is a timeline of some significant events in the history of Poonawalla Fincorp and Magma Fincorp:

- 1988: Magma Leasing Limited is incorporated in Kolkata by Mayank Poddar and Sanjay Chamria

- 2008: The company re-branded and renamed itself as Magma Fincorp Limited

- 2009: The company inked a joint venture with German insurer HDI Global to enter the general insurance business

- 2011: Global PE firm Kohlberg Kravis Roberts and International Finance Corporation, an arm of the World Bank Group, invested about $100 million in the company

- 2012: Magma Fincorp acquires GE Capital India’s Housing Finance and Home loans business

- 2018: Magma Fincorp raised INR 500 Cr investment through QIP

- 2021: Magma Fincorp changes its name to Poonawalla Fincorp Limited after the acquisition by the Poonawalla Group, one of the world’s largest vaccine makers

Poonawalla Fincorp Management Profile

The company is governed by a board of directors, with Mr Adar Poonawalla being the board’s chairman. The board is supported by a revamped senior management with relevant and significant experience in retail financing, having previously worked at reputed banks and NBFCs (non-bank financial companies). The senior management team is as follows:

Mr Abhay Bhutada is the Managing Director & CEO of Poonawalla Fincorp. He has over 15 years of diversified experience in the commercial and retail lending domains in the NBFCs space.

Mr Sanjay Miranka is the Chief Financial Officer at Poonawalla Fincorp. He has 25+ years of experience in Business Finance and Operations Management, with 18+ years at ABFL.

Mr Rajendra Tathare is the Chief Risk Officer. He has spent 25+ years in BFSI with Fullerton and HDFC Bank in their credit risk and policy functions.

Mr Manish Chaudhari is the President and Chief of Staff at Poonawalla Fincorp. He has 20+ years of experience in lending functions of Credit, Risk, Sales, and Strategy at ICICI Bank, Standard Chartered Bank, GE, Cholamandalam, Reliance, and Magma.

Mr Kandarp Kant is the Chief Technology Officer. He has spent 23+ years with companies such as Sundaram Finance, Polaris Software Labs, Citi, and Oracle.

Mr Vineet Tripathi is the Chief Business Officer at Poonawalla Fincorp. He has 20+ years of experience in the lending industry across a diversified spectrum of Banks and NBFCs with TATA Capital AIG, ING, Citigroup, and Bandhan.

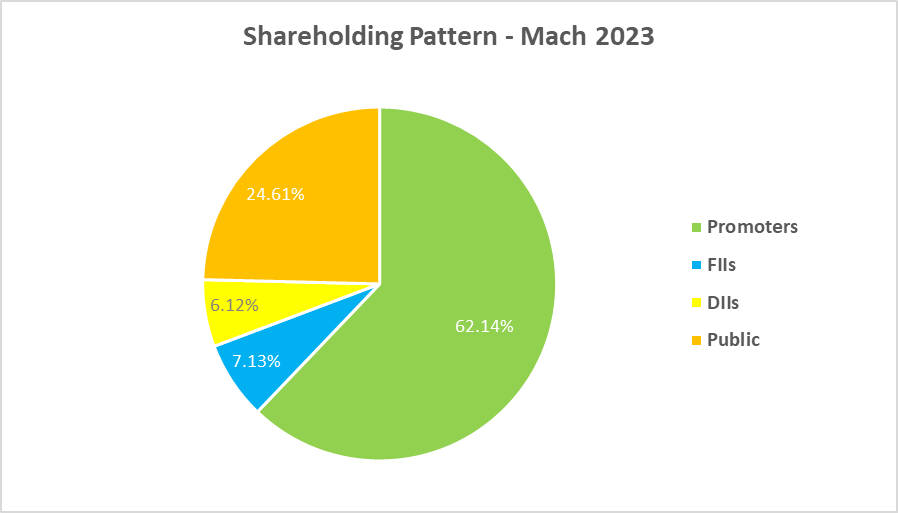

Poonawalla Fincorp Shareholding Pattern

Poonawalla Fincorp Business Segments

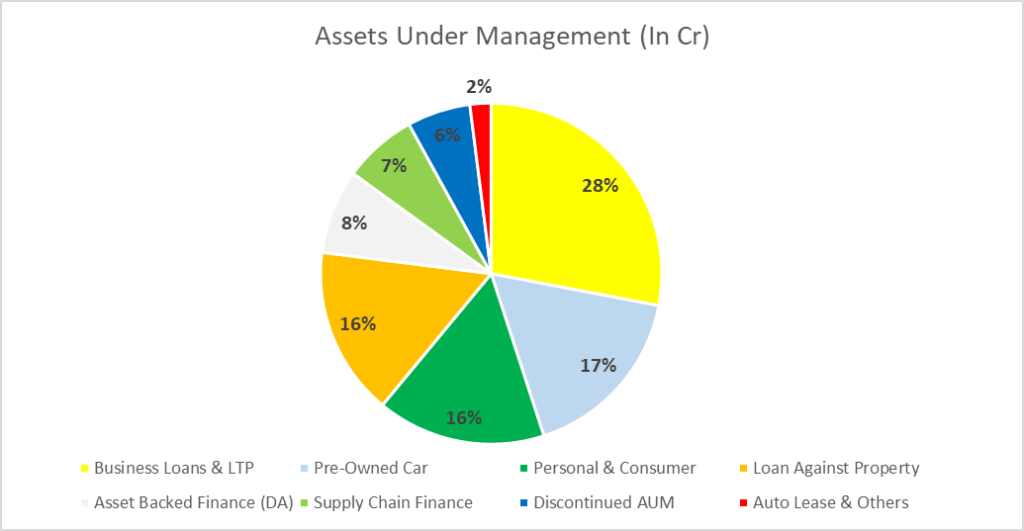

PFL has a pure retail portfolio focusing on the MSME and Consumer segments. The AUM is well-diversified across products, geographies, and sourcing channels.

Poonawalla Fincorp maintains a secured-unsecured ratio of 40% and 60%, respectively. It focuses mainly on the prime customer segment with a Credit Bureau score of 700 plus a credit-tested history.

The erstwhile Magma Group was primarily in vehicle and housing finance with a diversified portfolio across various product segments, such as commercial vehicle finance (CV), construction equipment (CE), car loans, tractor financing, secured MSME loans, and home loans.

Post-acquisition, the new management revised its product strategy, targeting good quality, credit-tested, mass-affluent retail consumers and small businesses in semi-urban/urban locations. Consequently, the company announced its plans to discontinue some loan products in their previous form, like CV, CE, tractors, and new cars segment. The discontinued portfolio constituted around 5.9% of the total AUM as of March 31, 2023, which is expected to run down soon.

Poonawalla Fincorp Financials

Core Operating Profit & Net Profit

PFL’s profitability (both at the Operating and Net Profit levels) has increased consistently over the last few years.

Operating Income refers to the total amount of income banks generate from their operations, which measures the operational success of financial institutions. It is the sum of net interest income and non-interest income.

Operating Income has increased to INR 1,415 Cr in FY23 from INR 1058 Cr in FY22 and INR 1002 Cr in FY21 due to a reduction in Interest expense.

Similarly, the standalone Profit after Tax has increased to INR 585 Cr in FY23 from a loss of INR 578 Cr in FY21. PAT has grown on the back of reversal in provisioning and write-backs and reducing credit costs.

| In INR Cr. | FY19 | FY20 | FY21 | FY22 | FY23 |

| Interest Income | 2,036.5 | 2,022.8 | 1,757.0 | 1,458.60 | 1,816.9 |

| Interest Expense | -1,017.6 | -1,124.0 | -874.6 | -509.3 | -595.3 |

| Net Interest Income | 1,018.9 | 898.8 | 882.4 | 949.3 | 1,221.7 |

| Non-Interest & Other Income | 230.8 | 196.2 | 119.9 | 108.5 | 193.1 |

| Operating Income | 1,249.7 | 1,095.1 | 1,002.3 | 1,057.8 | 1,414.8 |

| Profit After Tax | 275.1 | -10.0 | -578.4 | 293.2 | 584.9 |

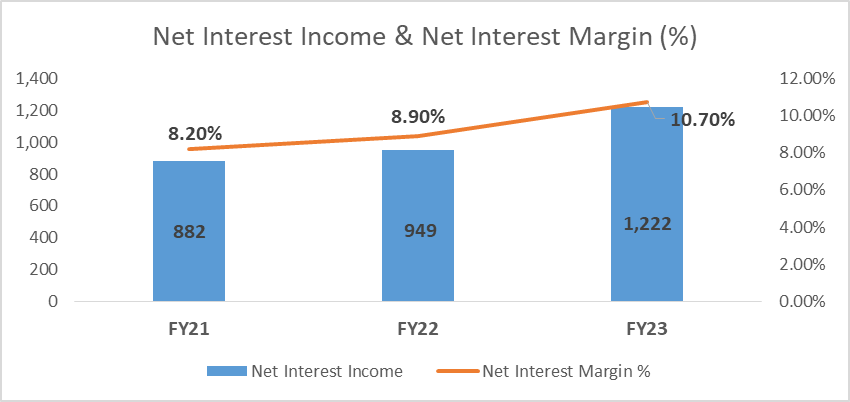

Net Interest Income & Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets.

PFL’s net interest margin has improved to 11.3% during the Q4FY23 quarter, up 87 bps y-o-y and 59 bps q-o-q. NIM is 10.7% for the entire year compared to 8.9% in FY22.

Post the change in ownership to the Cyrus Poonawalla group, the company has enjoyed the benefits of access to a diversified funding mix at lower funding costs, wherein the company has reduced the cost of borrowing substantially. This, coupled with the revised product focus toward consumer and MSME finance, which carries a higher yield, resulted in improved net interest margins (NIMs).

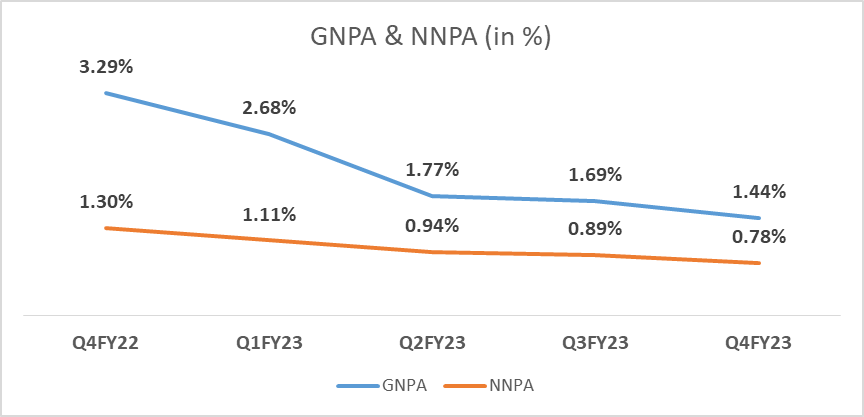

Asset Quality

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

PFL reported gross non-performing assets (GNPA) of 1.44% as of March 31, 2023, compared to 3.3% as of March 31, 2022 (4.3% as of March 31, 2021), showing an improving trend. Similarly, Net non-performing assets (NNPA) came in at 0.78% in March 2023 compared to 1.30% in March 2022.

The reduction in GNPA and NNPA was primarily on account of adopting a more conservative write-off policy as part of the company’s new strategy and partially on account of improvement in the economic activity post the second wave of the pandemic resulting in consistent improvement in collection efficiency, wherein, the company has been reporting consistent collections across months in the range of 96%-100%.

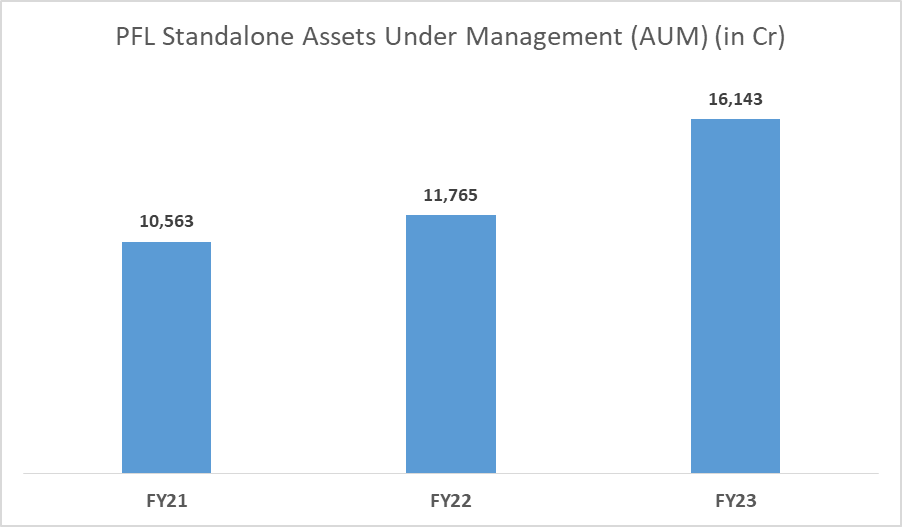

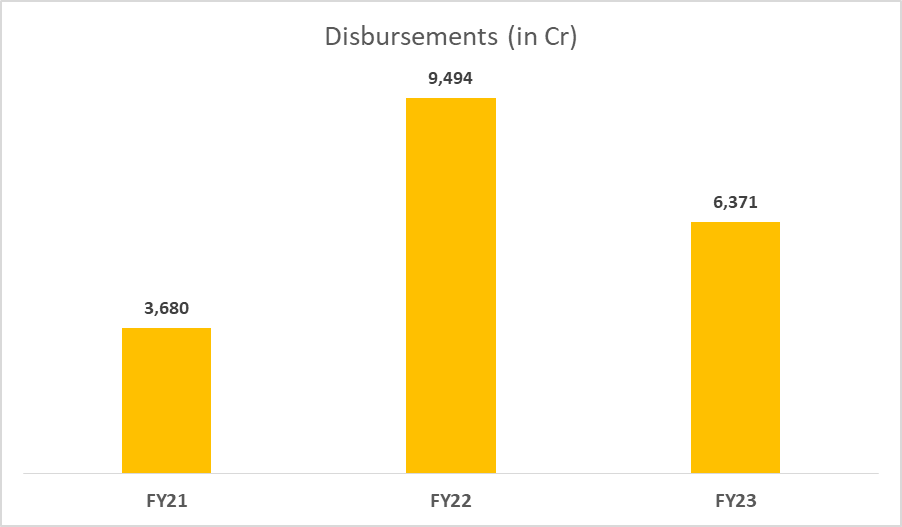

Assets Under Management and Disbursements

The company had an AUM of INR 16,143 crore on March 31, 2023, as against INR 11,765 crore on March 31, 2022, and INR 10,563 crore on March 31, 2021.

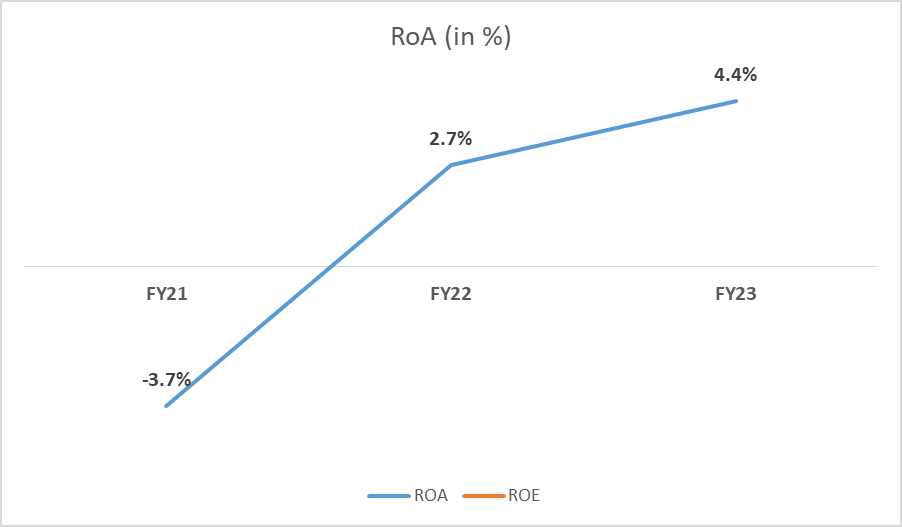

Improving Return Ratios (ROA)

Poonawala Fincorp has been improving its RoA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) over the last few years.

Return on asset was at 5% for Q4FY23, up 178 bps y-o-y. For FY23, ROA was 4.4% as compared to 2.5% for FY22.

Poonawalla Fincorp Share Price Analysis

PFL share price has delivered a CAGR of 180% (from May 10 2020 to May 11 2023) over the last three years, led by a change in ownership and turnaround in the business performance. The NBFC has had good financial performance, with a stable management team and substantial capital provision buffers.

Poonawalla Fincorp Share Price Growth Potential

As per the new business strategy, the company plans to achieve substantial growth by focusing on secured (used car loans and loans against property) and unsecured products (personal loans, business loans, loans to professionals, and consumer loans).

The company has also focused on a direct digital origination strategy, contributing to ~81% of disbursements in Q4FY23 (as compared to ~24% in Q4FY22). In addition, as part of its new strategy for its unsecured segment, the company has moved towards a branch light model.

It is also investing in technology in a big way to make the entire process, from origination to collection, digitally enabled. In addition, the company is looking to rationalize its branches for the secured segment as per the new product strategy. These measures will likely result in a reduction in operational expenses and better yield in the future.

With the change in ownership to the Cyrus Poonawalla group, the company has benefited through access to a diversified funding mix covering capital markets and bank loans at lower funding costs. PFL has been raising money through CPs (commercial paper) regularly.

PFL also raised NCD (non-convertible debentures) from a diversified set of investors, opening access to the bond market. The company has also been able to reprice its existing loans to lower rates, thereby improving gross spreads. Better yield coupled with low cost of funds and lower operational expenses (led by Digital sourcing) could help PFL.

Key Risks:

- The company has made significant efforts to improve its operations, including bringing in new management and investing in technology and processes. However, they could still face challenges in effective strategy execution.

- A highly competitive market could mean maintaining healthy profit margins and sustaining the quality of assets could be difficult.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This Article is for education purpose only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

FAQs

Who is the promoter of Poonawalla Fincorp Ltd?

Poonawalla Fincorp is owned by Rising Sun Holdings Pvt Ltd, a company of Adar Poonawalla (CEO of Serum Institute of India).

What is the market cap of Poonawalla Fincorp Ltd?

The market Cap of Poonawalla Fincorp Ltd. is INR 24,962 Cr as of May 11 2023.

What is the face value of Poonawalla Fincorp Ltd?

The face value of Poonawalla Fincorp is INR 2 per share.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.