Reliance Industries

Reliance Industries operates on a massive scale. It became India’s first corporate to cross $100 billion in annual revenues. The company alone accounted for nearly 8.4% of India’s merchandise exports in FY22. It also continued to be the largest tax-payer in India. Reliance’s contribution to the national exchequer through various direct and indirect taxes is a massive INR 1,88,012 crore and keeps growing yearly.

It stands at 104th position on the latest Fortune’s Global 500 List 2022, and it has been on the Fortune 500 list for 19 years now.

The company continues to invest in new businesses and aims to double its market value by 2027. First, it brought a revolution in the telecom industry, and now it is on the path to disrupting Indian retail and finance. Reliance is a perfect example of how a company should evolve with changing market conditions. The company has built itself as one of the leaders of digital change in the country. The Reliance Industries Share Price is Rs. 2361.90 as on 26th April 2023.

Let us try and understand what the company is doing and how it will change the business in the future.

Reliance Industries Overview

Reliance Industries is one of the largest private sector companies in India. It is vertically integrated across the oil & gas supply chain, with activities spanning exploration & production, refining and marketing petroleum products, and manufacturing petrochemicals and textiles. Its Jamnagar refining complex, with a capacity of 1.4Mbpd (million barrels per day), is one of the world’s largest and most complex single-location refineries. In addition, Reliance is the world’s largest polyester yarn and fiber producer and among the top 5 to 10 producers in the world in major petrochemical products.

Reliance Industries has evolved from being a textiles and polyester company to an integrated player across energy petrochemicals, textiles, natural resources, retail, and telecommunications and operates world-class manufacturing facilities nationwide. As a result, RIL’s products and services portfolio touches almost all the needs of people daily across economic and social spectrums.

Reliance Industries Journey

Dhirubhai Ambani and his brother, Champaklal Damani, founded a small textile manufacturing unit in 1960. However, the company expanded rapidly under the leadership of Dhirubhai Ambani, who is widely credited for revolutionizing the Indian business landscape.

In the 1970s, RIL diversified into petrochemicals, oil refining, telecommunications, and retail. In 1977, the company went public, and over the years, it has become one of the largest publicly traded companies in India.

Dhirubhai Ambani passed away in 2002, and his sons Mukesh Ambani and Anil Ambani took over the company. However, in 2005, the company was split into two parts, with Mukesh Ambani retaining control of the flagship company, RIL, while Anil Ambani took control of Reliance Communications, Reliance Infrastructure, and other businesses.

Under Mukesh Ambani’s leadership, RIL continued to expand into new sectors and markets. In 2016, the company launched its telecom venture, Reliance Jio Infocomm, which disrupted the Indian telecom market by offering free voice calls and cheap data plans. As a result, reliance Jio soon became the largest telecom company in India by subscriber base.

Following is a timeline of some of the critical years in the company’s history:

- 1960: Reliance Industries is founded by Dhirubhai Ambani and his brother, Champaklal Damani, as a small textile manufacturing unit in Mumbai, India

- 1977: The company goes public with an initial public offering (IPO) that is oversubscribed by seven times

- 1985: Reliance Industries diversifies into petrochemicals and sets up a petrochemicals plant in Hazira, Gujarat

- 1991: The company enters the refining business by acquiring a controlling stake in the Jamnagar Refinery in Gujarat

- 1992: Reliance Industries becomes the first Indian company to raise money in the international markets through a global depository receipt (GDR) issue

- 1995: The company launches Reliance Infocomm, a telecommunications venture that would later be spun off into Reliance Communications

- 2002: Dhirubhai Ambani, the founder of Reliance Industries, passes away

- 2005: The company is split into two parts, with Mukesh Ambani taking control of Reliance Industries and Anil Ambani taking control of Reliance Communications, Reliance Infrastructure, and other businesses

- 2006: Reliance Industries acquires the assets of the Indian Petrochemicals Corporation Limited (IPCL) and becomes the largest producer of petrochemicals in India

- 2010: The company sets up Reliance Jio Infocomm, a broadband and telecommunications venture

- 2016: Reliance Jio launches its services and quickly becomes the largest telecom operator in India by subscriber base

- 2020: Reliance Industries raises over $20 billion in investments from global technology companies, including Facebook, Google, and Qualcomm, for its digital and retail businesses

Reliance Industries Management Profile

Mr Mukesh Ambani is the Chairman & MD of Reliance Industries. He has been on the Board of RIL since 1977. He initiated Reliance’s backward integration journey – from textiles to polyester fiber – to petrochemicals and petroleum refining, then went upstream into oil and gas exploration and production.

Mr Hital Meswani is the Executive Director. His overall responsibility spans the petroleum refining & marketing business, petrochemicals manufacturing, and RIL’s several corporate functions, including HRM, IT, research & technology, and capital projects execution.

Mr Nikhil Meswani is the Executive Director. He is primarily responsible for the petrochemicals division and has significantly contributed to Reliance becoming a global petrochemical leader. Between 1997 and 2005, he handled the company’s refinery business.

Mr PMS Prasad is the Executive Director of the company. He has been with Reliance for about 40 years, holding various senior positions in the company’s fiber, petrochemical, refining & marketing, and exploration & production businesses.

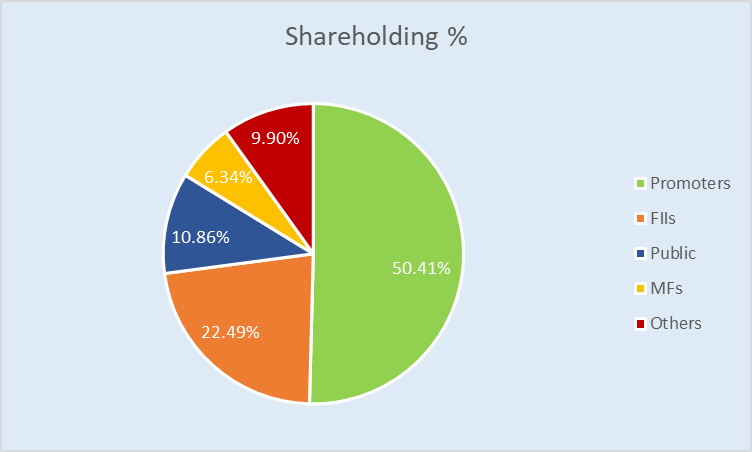

Reliance Industries Shareholding Pattern

Reliance Company Analysis

Reliance has operated in several spaces since its inception, from trading yarn to oil to telecom and now to digital transformation and retail segment. One of the critical aspects of any business is how they adapt to the changing times. Reliance is a perfect example of how a company should evolve with the market in the changing business environment.

Various business segments are:

- Oil to Chemical

- Oil & Gas

- Reliance Retail

- Digital Services

- Others

Revenue Breakup Contribution of Business Segments

| In Percentage | 2019 | 2020 | 2021 | 2022 | 9M FY23 |

| Oil to Chemical (O2C) | 73.3% | 61.5% | 51.5% | 56.8% | 55% |

| Retail | 16.9% | 22.2% | 25.4% | 22.7% | 24.1% |

| Digital Services | 6.3% | 9.5% | 14.5% | 11.4% | 11.1% |

| Oil & Gas | 0.6% | 0.4% | 0.3% | 0.8% | 1.5% |

| Others | 2.9% | 6.4% | 8.2% | 8.3% | 8.4% |

The table shows how the revenue contribution from the refining and petrochemicals segment has been falling. At the same time, digital services and retail have been on a continuous uptrend. Reliance Industries Ltd aims for net-zero carbon emissions by 2035.

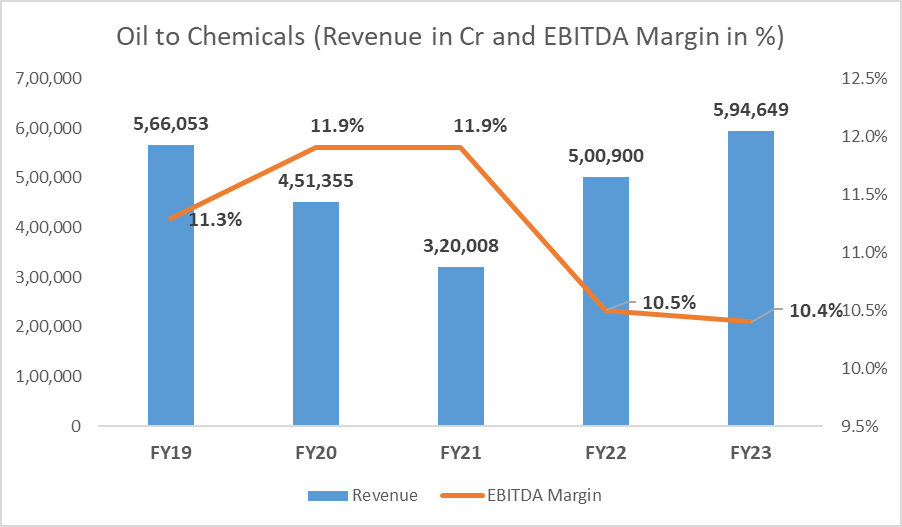

Oil to Chemical Business (O2C):

The oil to chemicals (O2C) business of Reliance Industries Limited (RIL) involves the conversion of crude oil into high-value chemicals, such as olefins, aromatics, and polymers. This business is a significant contributor to RIL’s overall revenue and profitability.

RIL’s O2C business includes refining, petrochemicals, fuel retail, and aviation fuel. The refining segment comprises Jamnagar Refinery, one of the world’s largest single-site refineries with a capacity to process over 1.4 million barrels of crude oil daily. The petrochemicals segment includes the production of chemicals like polyethene, polypropylene, and PVC, among others.

In addition, RIL’s fuel retail business operates a network of over 1,460 petrol pumps across the country. RIL is also involved in producing and selling aviation fuel through its subsidiary Reliance Aviation.

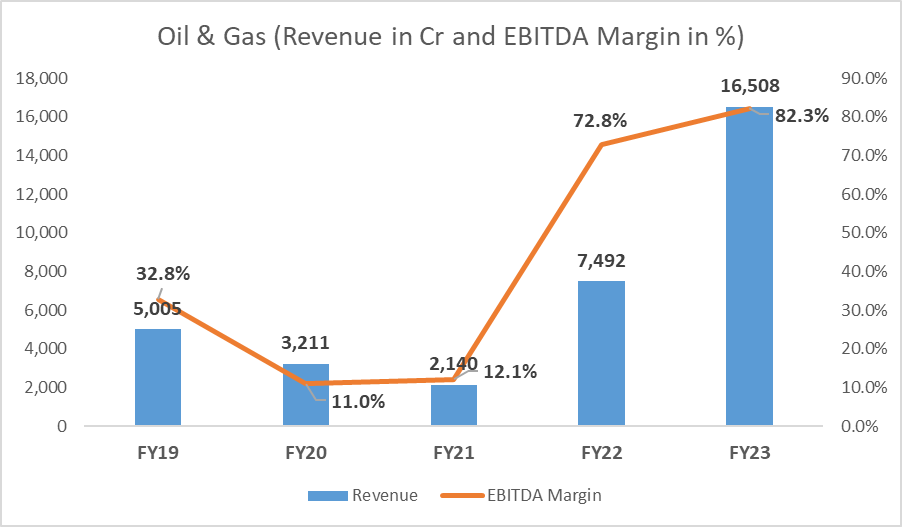

Oil & Gas E&P

Reliance Industries Limited (RIL) is also involved in oil and gas exploration and production (E&P). RIL’s upstream oil and gas operations focus on developing domestic and international assets.

In India, RIL holds a 60% stake in the KG-D6 block, located in the Krishna-Godavari basin off the east coast of India. This is one of the most significant gas discoveries in India and has the potential to produce substantial volumes of oil and gas. RIL also holds stakes in several other oil and gas blocks in India.

Internationally, RIL has exploration and production assets in the United States, Colombia, and Peru. In the United States, RIL’s subsidiary Reliance Eagleford Upstream Holding LP has a significant presence in the Eagle Ford shale play in Texas.

RIL’s E&P business is integral to its overall energy portfolio and complements its downstream refining and petrochemicals business. The E&P business also provides RIL with a source of long-term, stable revenue streams and helps the company to diversify its energy portfolio.

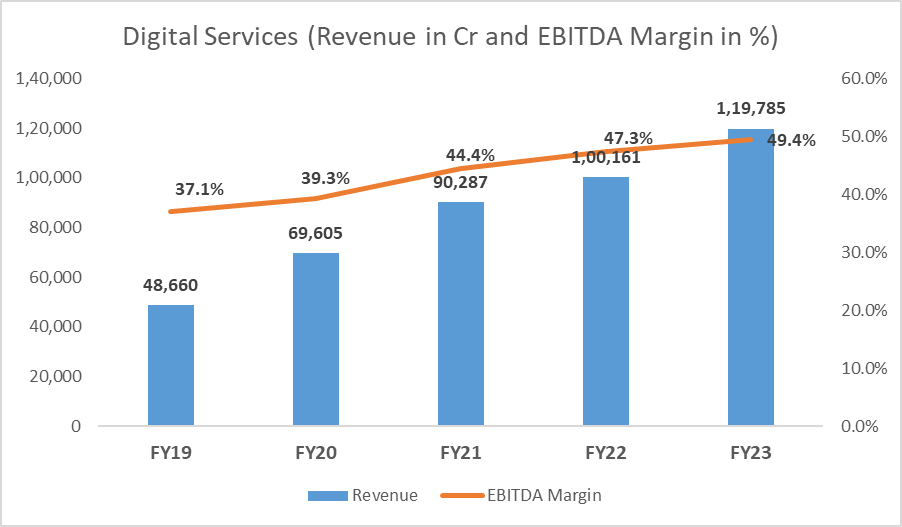

Digital Services:

Reliance Jio Infocomm Limited, commonly known as Jio, is a subsidiary of Reliance Industries Limited (RIL). Jio, India’s largest telecommunications company, offers various digital services, including wireless broadband, mobile data services, digital commerce, media and entertainment, and more.

Jio was launched in 2016 and quickly disrupted the Indian telecom industry with its low-cost data and voice plans. Jio’s 4G network is one of the largest and fastest in the world, with coverage across all 22 telecom circles in India. Jio’s affordable data plans and high-speed internet have helped to bring millions of Indians online and connected.

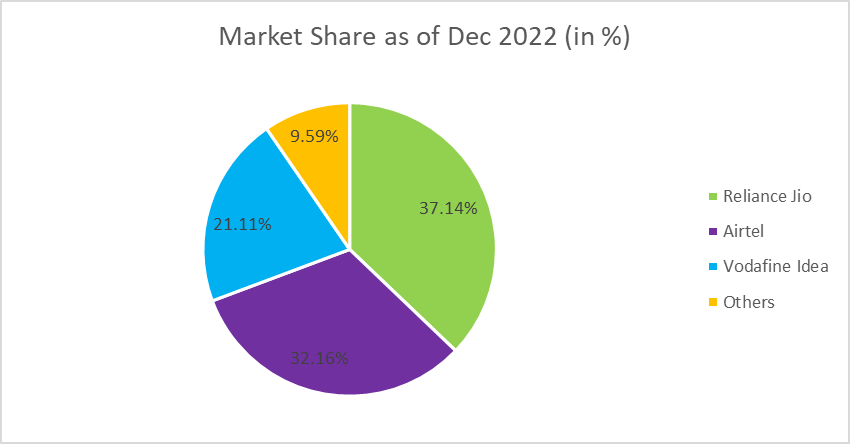

As of Dec 2022, Reliance Jio had the largest market share of 37.14% with 432.9 million subscribers, followed by Bharti Airtel (32.16%) and Vodafone Idea (21.11%).

Digital Services also includes Jio Fiber. 5G rollout and FTTH (Fiber to home) momentum to accelerate market share gains.

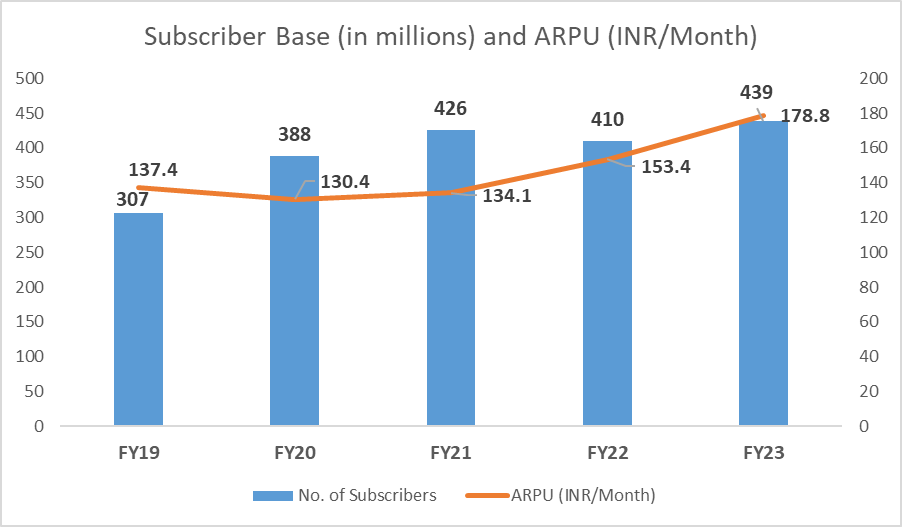

The number of subscribers and Average revenue per user has consistently increased over the last few years, leading to higher revenue and profitability for Reliance Jio.

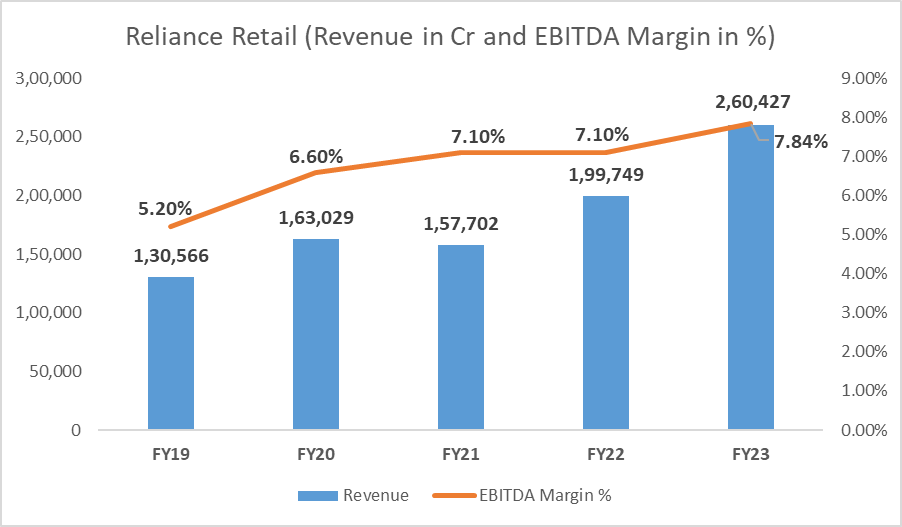

Reliance Retail:

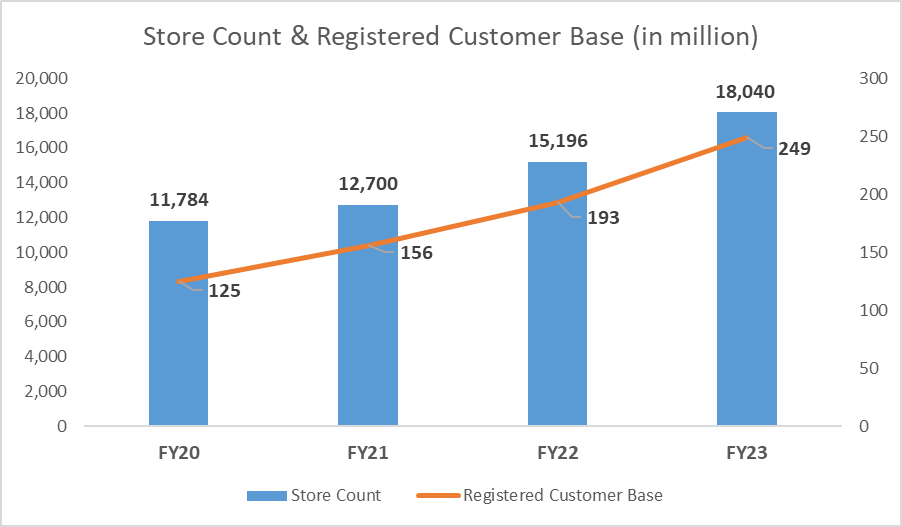

Reliance Retail operates a vast network of retail stores offering various products across categories such as groceries, consumer electronics, fashion and lifestyle, and more.

Reliance Retail’s grocery retail chain, Reliance Fresh, offers a wide range of fresh fruits and vegetables, dairy products, bakery items, and other grocery products. The company also operates supermarkets under Reliance SMART, which offers a wide range of grocery products and home and personal care items.

Reliance Digital is the consumer electronics retail chain of Reliance Retail, offering a wide range of electronics products such as mobile phones, laptops, cameras, and other gadgets. The company also operates fashion and lifestyle retail chains under the brand names Reliance Trends and AJIO, offering a range of clothing and accessories for men, women, and children.

Reliance Retail has also ventured into e-commerce through JioMart, an online platform offering grocery and other household products.

Reliance is also focusing on building its portfolio of private labels by launching its brands and acquisitions. Following is a snapshot of the private labels within various categories. The company also recently launched its indigenous made-for-India consumer packaged foods brand “Independence” in Gujarat. In addition, it also launched Campa (a carbonated drinks brand) in competition with large global brands like Coca-Cola and Pepsi.

Reliance also leverages its merchant network in Jiomart to expand the B2B business. It acquired Metro Cash & Carry for INR 28bn to expand the store network for servicing Kirana stores.

“Other” Business Segment:

These are new emerging business segments within the Reliance Industries Group. The contribution of the “Other” business segment has increased from 2% in 2019 to 7% in 9M FY23. Businesses that are part of this segment include:

Media & Entertainment:

It is India’s largest media house with an omnichannel presence across all genres – news, entertainment, sports, movies, and live entertainment.

It operates in several areas, including:

- Film production & distribution

- Television Production

- Gaming

- Digital Media

In addition to these areas, Reliance Industries has also launched a streaming service called JioCinema, which offers a wide range of movies and TV shows for streaming. It has also invested in various companies in the media and entertainment space, including Balaji Telefilms, Eros International, and Viacom18.

Jio Financial Services:

Jio Financial Services offers a range of digital financial services. The company aims to leverage Jio’s vast customer base and digital infrastructure to provide easy and accessible financial services to millions in India. Some of the Key financial services include:

- Jio Payments Bank

- Jio Money

- Jio POS

- Jio Insure

New Energy business:

Jio New Energy is part of RIL’s larger strategy to transition towards a more sustainable and environmentally responsible business model. The company plans to focus on generating, storing, and selling green hydrogen.

It aims to develop and deploy technology to manufacture fuel cells, electrolyzers, and other equipment to produce green hydrogen at scale. The company has announced more than INR 750 bn CAPEX over the next three years in this new energy business.

Reliance Industries Share Price Analysis

In the past, RIL’s share price has shown strong growth over the years. For example, in January 2003, the company’s share price was around INR 130, and it has steadily grown over the years, reaching its peak in May 2021 of INR 2,856

Reliance Industries stock has given a ten-year CAGR of 20%. It is expected to do well going forward on the back of growth in new emerging businesses like Digital Services, Retail, Financial Services, and New Energy. These businesses are expected to keep the growth momentum going in the future as well.

Reliance Industries Share Price Target

Reliance Industries stock could do well in the future because of the following reasons:

- RIL is expected to start offering its portable 5G device (Jio Airfiber) to ramp up wireless broadband additions and launch its affordable 5G smartphone as it monetizes its pan-India standalone 5G launch by the end of end-2023

- FMCG business can see visible strides due to new brand launches like Independence and Campa Cola

- Three years since the stake sale to PE investors, we see a good chance of a Jio and retail IPO soon, just like the demerger of Jio Financial Services announced two weeks ago. That could lead to further unlocking of value for shareholders.

- Reliance retail is expected to do well, led by robust store additions and deeper online penetration.

- New Energy business is likely going to be a multi-year opportunity. However, this will be a long-term story, with the next two- to three-year focus being on solar and that too for meeting the company’s internal requirements.

Reliance Industries Risks to Future Growth

With all these investments planned, the only significant risk here is execution risk. Completing and commissioning these new projects quickly is crucial for the debt levels to be in check. No increase in tariff hikes may also depress the performance of Reliance Jio and hence remains a risk in the future.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

Can I buy Reliance Industries shares now?

Reliance Industries has given excellent returns over the 5- and ten-year period. Given the new initiatives to keep growing the business, the stock looks like a good investment for the long term. Future de-merger events can further lead to value unlocking. The majority of the brokers are optimistic about the long-term prospects of Reliance Industries.

Is Reliance Industries going to split?

Reliance Industries has kept the face value of the share the same since Jan 1, 2000. However, the company offered 1:1 bonus shares in 2009 and 2017.

What is Reliance Industries Ltd’s 52-week high and low share price on the NSE?

RIL has touched a 52-Week high of INR 2,856 and a 52-Week low of INR 2,180.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 15

No votes so far! Be the first to rate this post.