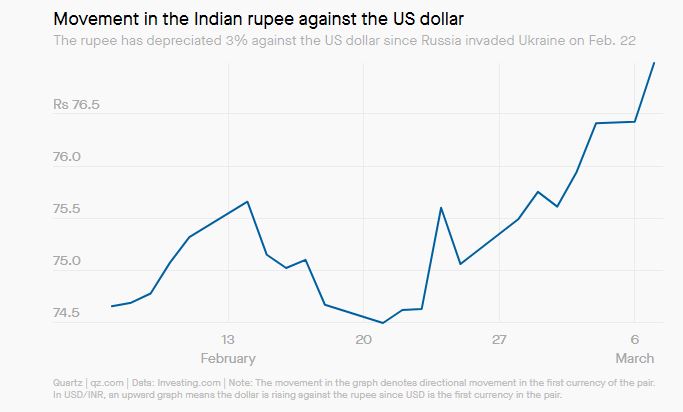

March 7th, 2022, saw the Indian rupee sinking to its lowest-ever against the US dollar as the war between Russia and Ukraine drove up crude prices to multi-year highs globally. The rupee fell to 76.98 per dollar from its previous low of 76.92 to a dollar in 2020.

The Russia-Ukraine War, the rising inflation in consumer prices, omicron cases, widening current account deficit, capital outflows, and the expected Fed tapering were reasons the rupee fell. Several analysts believed the rupee could cross 80 per dollar in 2022.

However, analysts at ICICI Direct Research believe the rupee may not cross 78 per dollar and end on a strong note this year. The rupee may strengthen to 72 a dollar in the next few months as India is better poised to withstand shocks from monetary tightening, and it has the fourth-largest forex reserves. The RBI has built its reserves since April 2020.

Nonetheless, the imports will now be costly adding to the current account deficit. Foreign travel and higher education will also become expensive with the rupee falling. On the other hand, exporters will have higher profits, and international stocks and funds will give investors more returns.

Stocks in the market fell; however, those who invested in US stocks or international ETFs and funds had better returns. One of the chief reasons could be rupee depreciation.

Are you wondering how a fall in the Indian rupee could affect the performance of an international portfolio?

When you invest in US stocks using rupees, your money is converted to the local currency of the country you are buying stocks in. It means the price changes substantially due to currency movements, even if the value of your foreign investment remains unchanged in the country you have invested in.

When the rupee depreciates against the US dollar; a fund or ETFs NAV rises as the investment will be worth more in rupees. However, the opposite holds when the rupee appreciates against the dollar.

That’s an opportunity, isn’t it?

Are you wondering if you should start investing in the US stocks now that the rupee has fallen and a few international stocks and funds have earned in the last few months?

We are sure you may want to invest in international stocks and funds after considering their performance for the last few months.

But the question is SHOULD YOU INVEST IN US STOCKS AND FUNDS JUST BECAUSE THE RUPEE FELL?

Financial experts suggest that currency movements should not motivate you or be the basis for investing in global stocks or funds. Any impact of currency fluctuation on a stock or fund performance is incidental and beyond investors’ control.

There is no guarantee the rupee will depreciate against the dollar all the time. So, investors must not let such short-term performance blind them to the pitfalls of investing in stocks or funds without thorough research.

What should investors really do?

The chief objective of investing in funds or stocks with exposure to international markets is geographical diversification. It helps to improve overall returns for the portfolio as the risk associated with a single investment reduces significantly, especially in times of volatility.

No single market can outperform all the time. There will be times when the market underperforms or remains flat. The only reason to invest in markets outside India should be diversification and a need to make the most of the market growth in developed markets.

We recommend you invest in other markets only after thorough research of the companies, their past performances, prospects, moats, etc. before you invest.

We all want to generate substantial wealth, but remember short-term investments do not help you create wealth; long-term investments do.

So to create wealth by investing in fundamentally sound Indian companies, subscribe to our 5 in 5 Wealth Creation Strategy today.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.