Inflation, steep interest rate hikes, and fears of an impending recession battered the global economy in 2022- slowing the stock market growth. Moreover, the market-wide sell-off made investors panic worldwide. However, the Indian market held its ground and outperformed its global peers. So, we thought sharing a few inflation-proof sectors to invest in 2023 would help.

Despite foreign portfolio investors (FPIs) offloading worth Rs. 1.32 Lakh crore ($14.73 billion) of Indian equities in 2022, the most significant sell-off since 1993, Sensex and Nifty closed 2022 with approximately 4% gains. But, not all the sectors in the Indian market performed well in 2022. For example, IT/Technology, pharma, real estate, and consumer durables stocks were badly hit by inflation.

So, what’s in store for 2023 for the market? Will it be a repeat of 2022, or will you see an action-packed year like 2021? It’s hard to tell, but investing in inflation-proof or recession-proof sectors to invest in 2023 will help you navigate these challenging times and build a strong portfolio.

Let’s look at the sectors you may consider investing in, in 2023.

3 Biggest Underperformers in 2022

Know the biggest underperformers of 2022 to know which sectors to invest in 2023.

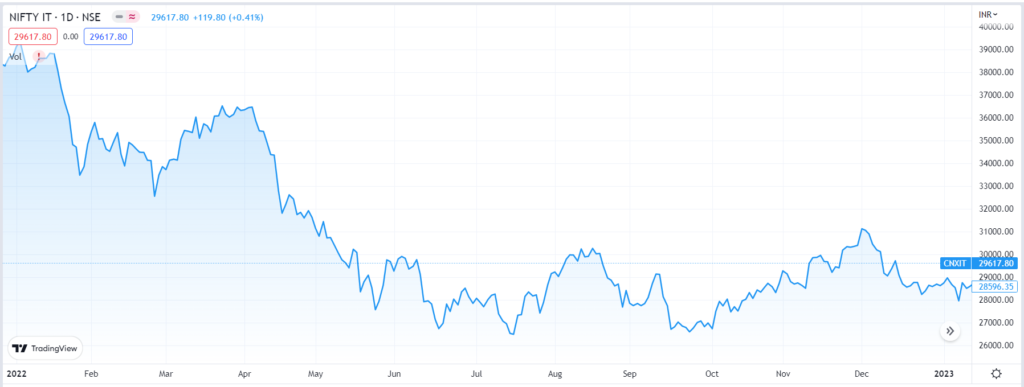

IT and Technology stocks

In 2022, the Nifty IT index cracked -26.04%, the worst since the 2008 global financial crisis, pulling down the overall market. Large-cap IT stocks like Wipro and Tech Mahindra went down by nearly 45% during the year, eroding shareholders’ wealth.

The primary reason for the rout in tech stocks is the slowdown in global growth, raising concerns about the earnings growth of IT companies in the forthcoming quarters due to reduced clients’ spend.

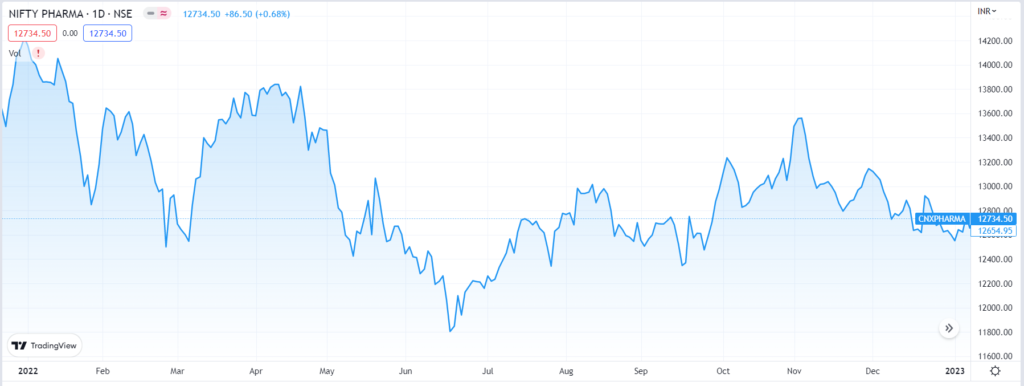

Healthcare/Pharma stocks

In 2022, the Nifty Healthcare index cracked 10.79% after having two good previous years. Stocks like Aurobindo Pharma, Natco Pharma, Divi’s Laboratories, and Laurus Labs were down in a range between 25-40% in 2022.

Pharma stocks are witnessing pressure as peak demand during the pandemic is slowing down, increase in freight cost and pricing pressure in key markets.

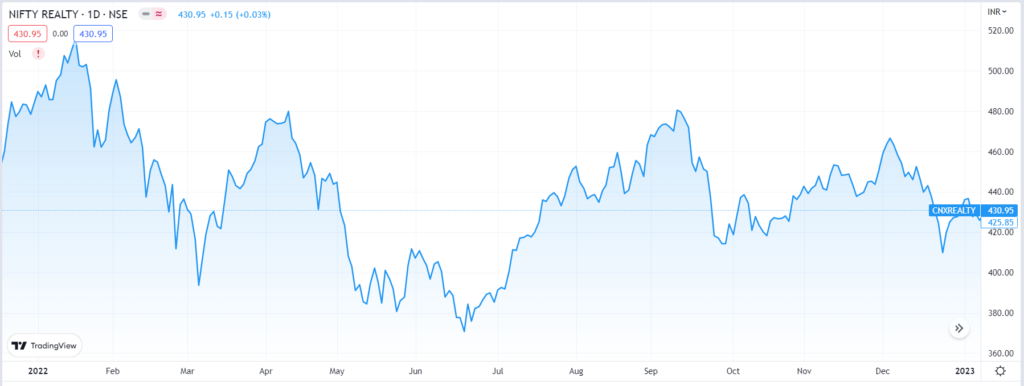

Reality stocks

In 2022, the Nifty Realty index cracked 10.8% as the sector witnessed significant headwinds. The rising price of construction materials, rising interest rates, and growth concerns impacted the industry.

Stocks like Indiabulls Real Estate, Sobha Developers, Godrej Properties, and Sunteck Realty were the worst-performing realty stocks in 2022.

4 inflation-proof sectors to invest in 2023

With no breakthrough in the geopolitical crisis emanating from the Russia-Ukraine war, analysts and market watchers predict inflation to remain persistently elevated in 2023. The silver lining- measures taken by the Indian government and RBI for reducing inflation are showing impact. Retail inflation has eased to an 11-month low of 5.88% in November, well below RBI’s higher limit, giving breathing room to the market.

As the global situation remains fragile, one should continue investing in sectors that are least impacted by inflation over the long term.

Click below to get your personalized portfolio of 20-25 potential multibagger stocks for 2023.

Here are some of the best inflation-proof sectors to invest in 2023.

IT/Technology Stocks

IT and tech stocks were laggards in 2022, but the inflation impact on the sector is the least on the demand and margin side. The thumb rule is the sectors that have the least exposure to commodities and energy as raw materials will have the minimum impact of inflation.

Furthermore, IT and tech stocks have shown an ability to outperform the broader index over the long term and are categorized as high-return stocks. For instance, the 5 years CAGR return of the Nifty IT index is 19.66%, whereas the CAGR return of the Nifty 50 index is 11.45% during the same period.

TCS, the largest IT stock by market capitalization, has given a CAGR return of 18% in the last 10 years, meaning ₹1 lakh invested in TCS stock in 2012 is now worth around ₹6 lakhs.

*The returns are calculated between the periods 1 January 2012 and 31 December 2023

Defense stocks

Defense is one of the sectors to invest in 2023. Defense stocks are popular among investors as they tend to provide consistent returns to investors over the long term and are considered safe bets. In addition, with increasing budgets by governments worldwide to modernize military infrastructure and equipment, the stocks of military equipment manufacturers have benefited.

Revenue for defense equipment manufacturers is more reliable regardless of the economic conditions than any other sector. For instance, despite the rout in the US market and technology stocks in 2022, US defense manufacturers like Lockheed Martin and Northrop Grumman Corporation stocks are up by 34% and 41%, respectively.

Hindustan Aeronautics Limited (HAL), the state-backed military aircraft manufacturer, has seen its share price rise by over 100% in 2022.

Commodity and energy stocks

Inflation is primarily fueled by the rise in oil, gas, and commodities prices. So, it could also be one of the sectors to invest in 2023. Historically, commodity stocks have performed well during periods of high inflation and have better earnings potential due to price advantage. They are considered an inflation hedge as they tend to bear a low correlation with traditional stocks and bonds.

Investing directly in companies with large production capacities with captive mines serves well during periods of high inflation. Over the long term, commodity stocks perform well but are more volatile than other stocks. In 2022, the Nifty Metal index went up by 21.76%, and the 5-year CAGR return was 11.28%.

Bank/NBFC stocks

Inflation is a double-edged sword for financial companies. Banks and NBFCs are considered an inflation-sensitive sector, but rising rates help through increased profit margins. However, high inflation for an extended period kills credit growth for banks, thus affecting profitability.

During periods of high inflation, banks benefit from the spread between what they pay and what they earn. With the rise in interest rates, banks don’t revise interest rates for existing depositors but raise the rates for existing borrowers. Therefore, the net interest margin for banks improves significantly during inflation, thus improving profitability.

Final Words…

Economic conditions tend to change rapidly, and one must modify the portfolio to reduce the impact of inflation or other economic headwinds. For instance, reducing exposure to stocks in consumer discretionary segments, industrials, and materials during periods of high inflation is one of the effective ways to minimize investment losses. And, when inflation cools off, and consumer confidence picks up, these sectors, retailers, travel-related stocks, etc., tend to perform well.

Disclaimer*: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

Which sectors perform best during inflation?

Financials, IT stocks, commodities, and defense companies do well during periods of high inflation.

Which sectors perform poorly during inflation?

Sectors that have the highest exposure to commodity and energy as raw materials are hardest hit by inflation. Consumer discretionary and leisure sectors are also severely affected.

Which sectors to invest in 2023?

IT/tech, defense, consumer stocks, financials, etc., can be considered as sectors to invest in 2023.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.