What are fixed deposits?

Financial instruments known as fixed deposits or FDs are a type of savings option offered by banks that allow investors to park their money while earning a fixed interest on it. Banks provide a variety of fixed deposit products for investment. Some of them are:

- Fixed Deposits for Senior Citizens

- Cumulative Fixed Deposits

- Non-cumulative Fixed Deposits

- Tax-saving Fixed Deposits

- Recurring Deposits (RDs)

- Flexible Fixed Deposits

The interest rates on these Fixed Deposits vary depending on the deposit’s tenure and the bank’s policy in this area. For example, most banks offer senior citizens higher interest rates.

Recently, interest rates have been steadily rising. This news should be pleasant if you intend to invest in fixed deposits.

That is because rising interest rates, in theory, increase FD returns.

However, is it that simple?

Whenever the RBI raises its policy rates, keep in mind that the loan rates offered by banks also rise immediately. But with FD rates, that’s not the case. The banks oversee determining how much cash they require and whether FD interest rates need a rise.

The average interest rate on bank FDs ranges from 2.75% to 6.90% based on tenure. Interest rates on senior citizen FDs would be a little higher. However, recent RBI changes have impacted the bank’s fixed deposit. Refer to the table below for SBI interest rates:

| Tenor | Revised Rates for Public w.e.f. 22.10.2022 | Revised Rates for Senior Citizens w.e.f. 22.10.2022 |

| 7 days to 45 days | 3 | 3.5 |

| 46 days to 179 days | 4.5 | 5 |

| 180 days to 210 days | 5.25 | 5.75 |

| 211 days to less than 1 year | 5.5 | 6 |

| 1 year to less than 2 year | 6.1 | 6.6 |

| 2 years to less than 3 years | 6.25 | 6.75 |

| 3 years to less than 5 years | 6.1 | 6.6 |

| 5 years and up to 10 years | 6.1 | 6.9 |

The Rise In Bank FD Interest Rates

Now let’s observe the causes of the increase in FD interest rates.

The concern about rising inflation is not just for the Indian economy but for economic systems worldwide. As a result, many nations have raised their interest rates to combat rising inflation and stabilize the economy.

From May to September 2022, the central bank raised the repo rates four times following the state of the world economies. Over the last four months, the interest rate has increased by a total of 190 basis points (40 basis points in May and 50 basis points in June, August, and September).

This rise in interest rates has also led to a bank’s fixed deposit rate hike. As a result, the interest rates offered on bank FDs across different tenures have increased at most banks.

Are you thinking of creating a Bank FD for your future, given the recent increase in interest rates?

But is now the right time to invest in Bank FDs?

The best practice is to diversify your investments over the long term. Unfortunately, while the larger banks are currently providing modest FD rates for one to two years, none offer inflation-beating returns.

Economists predict that the nation will experience higher inflation. Therefore, the apex bank will raise interest rates to combat this rising inflation in the upcoming months. This will increase bank FD rates, reaching 7% to 8% in the forthcoming months.

Despite banks increasing FD rates, pre-tax and post-tax returns are still insufficient to outperform inflation.

So, what is an ideal technique to benefit from bank Fixed Deposits?

Choose the Fixed Deposit laddering technique. Then, you can benefit from the current interest rate increases and withdraw your money at the end of the current term to reinvest in bank FDs if interest rates continue to rise.

Let’s understand why equity is the better alternative to Fixed Deposits

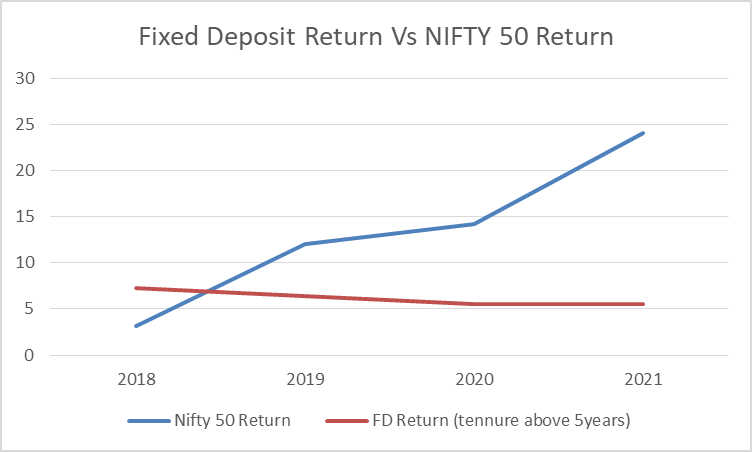

It is always ideal for diversifying your investments over the long term and putting some part of your corpus in Equities. While Bank FDs are practically risk-free, investments in the stock market tend to generate higher returns over the long term. This is because investing in equity for a long time will give you the benefits of compounding. The chart below shows the returns comparison between Bank FDs and NIFTY.

As the above graph shows the progress of Fixed deposits and NIFTY 50, we can see how NIFTY 50 has outperformed in comparison to Fixed Deposits stating equity is a clear alternative.

Final Words

It is encouraging to see that interest rates on bank FDs have increased after a long period. Using the Fixed deposit Laddering method for short-term (1-2 years), you can gain a decent return, but investing in the stock market will yield higher returns for long-term financial goals.

Research & Ranking is here with 5 in 5 Wealth Creation Strategy, a customizable portfolio of the best long-term stocks that will help you diversify, reduce risk, and boost returns. That can help you achieve your long-term financial goals. So, begin now by investing in equity.

FAQs

When repo rates rise, will bank immediately raise their fixed-rate loans?

No. The increase in the repo rate typically occurs before the rise in the interest rate on bank FDs. When repo rates rise, the market is quite liquid, so banks aren’t contending fiercely for customer deposits to immediately respond with interest rate increases on bank FDs.

Are FD returns tax deductible?

Taxes must be paid on interest from fixed deposits. However, there won’t be any TDS charges applied to your interest income if your total income falls below the taxable limit.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.